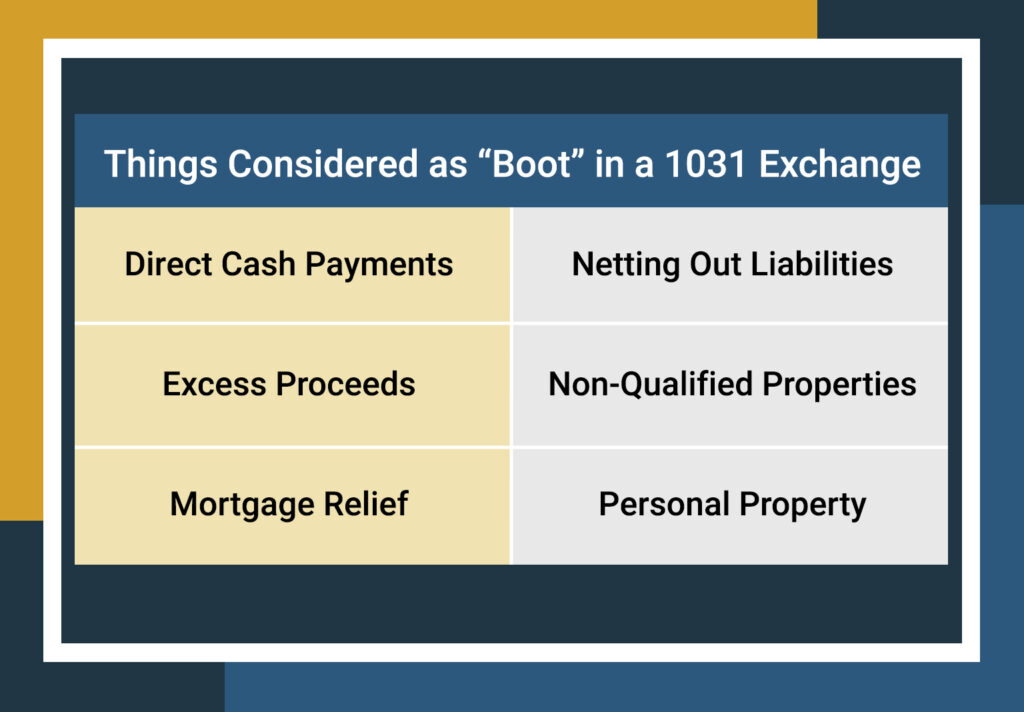

What is a Like-Kind Exchange Boot?

For real estate investors, 1031 exchanges have become a steadfast way to maximize profits and limit their capital gains tax liability. It’s not hard to see the appeal as deferring capital gains taxes on the sale of an investment property increases the investor’s purchasing power. However, 1031 exchanges are complex beasts that the IRS heavily […]