Are 1031 Real Estate Investment Trusts Possible?

Astute investors increasingly leverage a powerful tax deferral strategy known as the 1031 exchange. This provision, found in section 1031 of the Internal Revenue Code, enables real estate investors to defer their capital gains taxes when selling an investment property as long as they reinvest the proceeds into a like-kind replacement property. Yet, many investors […]

Multifamily Investing 2024: What Investors Need to Know

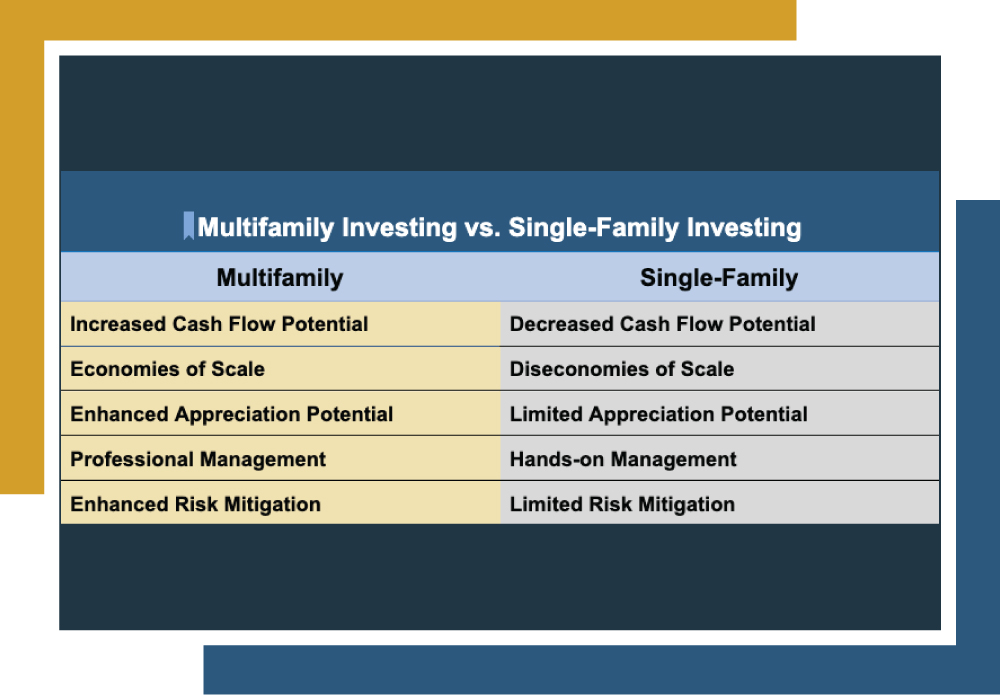

Whether you’re a seasoned investor or a newcomer testing the waters, you’re probably already aware of some of the benefits the real estate market can offer. It’s not uncommon for real estate investors to start with single-family properties. But what about another option? Multifamily real estate offers an exciting opportunity for investors of all backgrounds […]