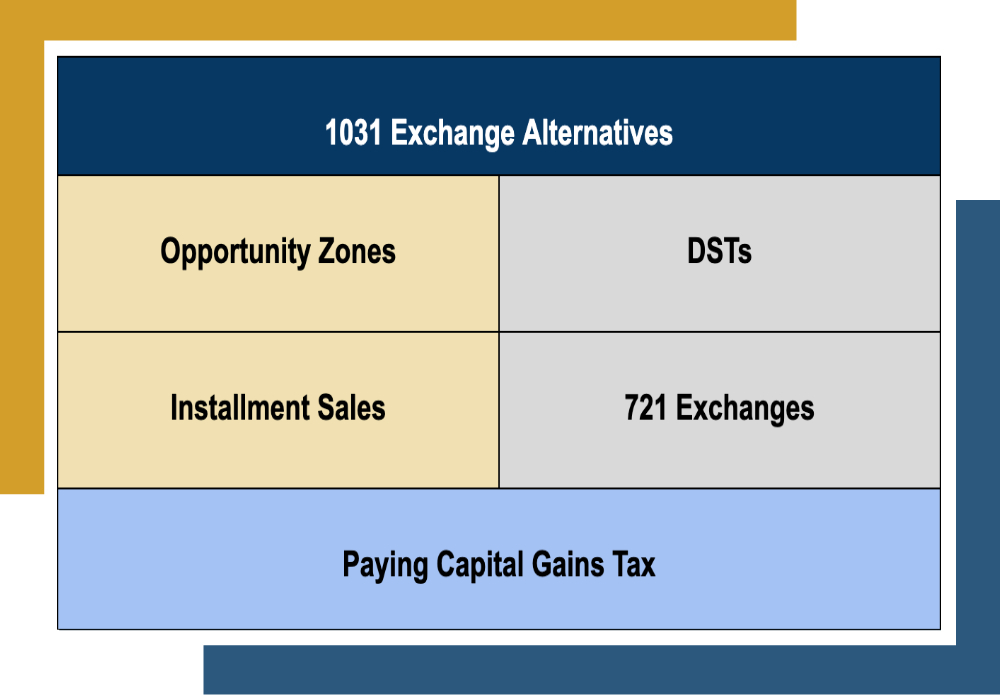

1031 Exchange Alternatives: A Comparison for Investors

Many property managers recognize the benefits of real estate investing, but shifting goals, property upgrades, or liability concerns may lead them to sell. Unfortunately, this often means facing 15-20% in capital gains taxes plus a possible 3.8% surtax for high-income earners. Thankfully, many property owners can turn to 1031 exchanges to defer these taxes and […]