1031 Exchange California Rules Investors Should Know

As a real estate investor, you know that selling a property is a big decision. You may be ready to move on from a long-held property or look for a new opportunity in a different area. Whatever the case, a downside to selling an investment property is the capital gains taxes that come with it. […]

1031 Exchange Guidelines for 2025

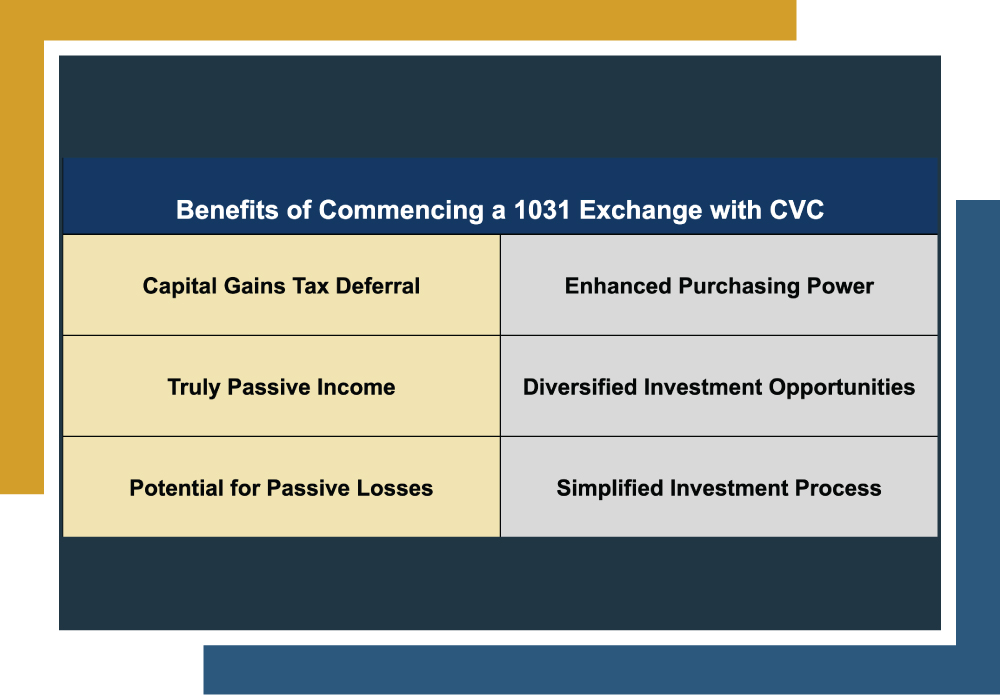

Welcome to the world of 1031 exchanges! If you’re a real estate investor, you may already know the sting of capital gains taxes when selling an investment property. But with a 1031 exchange, you can defer those taxes and keep more capital working for you. In 2025, the guidelines for 1031 exchanges are as strict […]

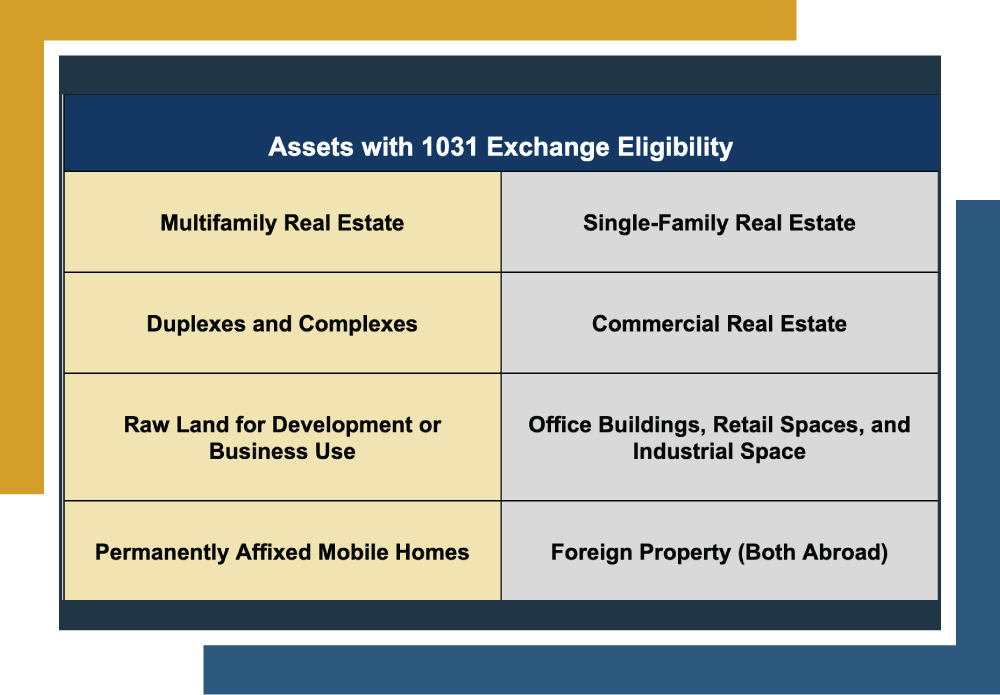

1031 Exchange Eligibility

Many investors know the frustration of selling an investment property at a profit, only to hand over 20% or more of those gains to the IRS in capital gains taxes. The good news? It doesn’t have to be this way. Savvy investors are turning to the 1031 exchange, a powerful tax-deferral tool that allows them […]