As a real estate investor, you know that selling a property is a big decision. Maybe you’re ready to move on from a long-held property or looking for a new opportunity in a different area. Whatever the case, a downside to selling an investment property is the capital gains taxes that come with it. But what if I told you that you don’t have to pay them?

That’s right – using a tax strategy called a 1031 exchange allows you to defer those taxes and reinvest in new properties. However, as a California investor, you may be wondering about any rules and regulations specific to California you need to follow.

In this article, we’ll give you the scoop on 1031 exchanges, 1031 exchange California rules, and explain why you’ll want an expert at your side to help ensure all the details for your 1031 exchange are in order. So, if you’re a real estate investor looking to defer capital gains taxes and reinvest in new properties, keep reading to learn how 1031 exchange rules can work for you in California.

| Discussion Topics |

What Is a 1031 Exchange?

If you’re a real estate investor looking to defer taxes when moving on to more promising opportunities, then listen up! A 1031 exchange, named for Section 1031 of the Internal Revenue Code (IRC), is a tax strategy that could help you do just that.

Here’s how it works: when you sell an investment property, instead of paying capital gains taxes on the sale, you can reinvest the proceeds into another “like-kind” property without paying taxes. To be considered “like-kind,” the property must be of equal or greater value and must be used for investment purposes.

This provides a path for deferring taxes until later—possibly in perpetuity—and offers a smart strategy so your money works for you to make increased returns a real possibility.

But wait, there’s more! The rules and regulations surrounding a 1031 exchange can be complex, and you must follow strict timelines. For example, you’ll need to identify a replacement property within 45 days of your initial sale and complete the exchange within 180 days. Also, these two time periods run simultaneously.

1031 exchanges also require that proceeds from the sale of the original property be held by an intermediary, not the seller, otherwise, the exchange may be voided.

To summarize, here are a few baseline rules for 1031 exchanges:

- 1031 exchanges allow investors to sell one property and exchange it for another “like-kind” property to defer capital gains taxes.

- “Like-kind” properties must be of equal or greater value and be used for investment purposes.

- The replacement property in a 1031 exchange must be identified within 45 days of the initial property sale.

- The entire 1031 exchange process must be completed within 180 days of the initial property sale.

- The 45-day rule and 180-day rule run synchronously.

- To qualify for a 1031 exchange, the seller may not hold any proceeds from the sale of the original property. These must be handled by an intermediary.

.

Still interested? It’s important to note that, technically, a 1031 exchange is not a way to avoid paying taxes altogether. Eventually, if you sell the new property without executing another 1031 exchange, the capital gains taxes will still be due. However, with careful planning, a 1031 exchange can be a powerful tool real estate investors use to defer those taxes and can be performed in perpetuity.

Why Do a 1031 Exchange in California?

For investors and property managers in California, a 1031 exchange can be a lucrative proposition because, as you probably already know, California is one of the states with the highest capital gains taxes in the country, sometimes reaching 13.3%. That’s the kind of tax rate that can take a substantial bite out of your profits when selling investment property.

When using a 1031 exchange, California investors can defer paying both state and federal capital gains taxes on the sale of their investment property, which can be a serious amount of money. Using this particular tax code allows you to reinvest your full sale proceeds into a new property, which could open the door to a higher-value property.

1031 Exchange California Rules Investors Should Know

You may be wondering about any specific 1031 exchange California rules, as tax laws often vary by state. While California does recognize Section 1031 of the IRC and does not have any laws directly related to 1031 exchanges, there are a few state rules that apply to selling and buying property in the state or exchanging property in California for one in another state.

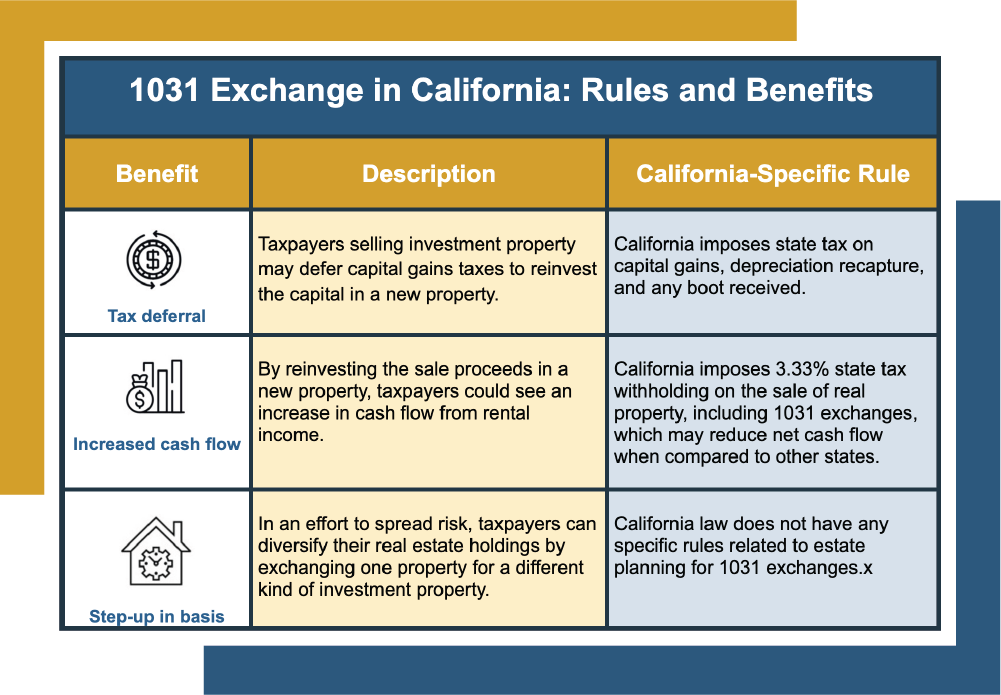

1031 Exchange in California: Rules and Benefits | ||

| Benefit | Description | California-Specific Rule |

Tax deferral

| Taxpayers selling investment property may defer capital gains taxes to reinvest the capital in a new property. | California imposes state tax on capital gains, depreciation recapture, and any boot received. |

Increased

| By reinvesting the sale proceeds in a new property, taxpayers could see an increase in cash flow from rental income. | California imposes 3.33% state tax withholding on the sale of real property, including 1031 exchanges, which may reduce net cash flow when compared to other states. |

Diversification

| In an effort to spread risk, taxpayers can diversify their real estate holdings by exchanging one property for a different kind of investment property. | California has a “clawback” provision: if you exchange a California property for one in another state, when you sell the new property you may be subject to California state tax and the state of the final sale. |

Step-up in basis

| If a taxpayer holds a replacement property until death, the heirs receive a step-up in basis, which could potentially eliminate their capital gains tax liability. | California law does not have any specific rules related to estate planning for 1031 exchanges. |

Depreciation benefits

| Allows for continued depreciation benefits on the replacement property. | California does not conform to federal depreciation recapture rules. You must recapture any depreciation claimed on the property as income on your CA state tax return. |

Initiating 1031 exchanges in California is usually just as simple as it would be in any other state. However, you’ve probably noticed that California aggressively tracks replacement properties purchased in other states. That means that if you exchange your California property for one in Arkansas, for example, California will want to recoup the capital gains tax when you decide to sell your Arkansas property.

As you can see, the benefits of a 1031 exchange are clear: you defer capital gains taxes and use them to increase your income potential with a new investment. But the devil is in the details, and a misstep in the process can cost you big bucks. That’s why it’s crucial to work with an experienced partner that can help you navigate the rules and regulations surrounding 1031 exchanges, including California-specific requirements.

Let CVC Help Guide Your 1031 Exchange

Now that you have a better understanding of 1031 exchange California rules, you’ll need a partner who truly understands the nuances of the process. At Canyon View Capital, we know 1031 exchanges like the backs of our hands. For the better part of four decades, our professional team members have owned and managed multifamily real estate that is now valued at over $1 billion1. We want to share our wealth of experience to help investors like you realize the benefits of a 1031 exchange.

Think of it like hiring a tour guide to show you the hidden gems in a new place. They know the language, the customs, and the best sites to see. In the same way, an experienced investment manager speaks the language specific to 1031 exchanges and can guide you through the ins and outs so you avoid costly mistakes.

At CVC, we are committed not only to assisting your 1031 exchange but also to helping you understand the process by answering any additional questions. We can’t wait to share our experience with you.

Still hazy on the details of 1031 exchange California rules?

Canyon View Capital can show you the way! We will walk you through every step of your 1031 exchange to help you cut through the red tape, no matter how sticky it gets. Contact Canyon View Capital.

Verified accreditation status required.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.