Real estate investors and property managers understand the appeal of passive income and the possibility of long-term wealth accumulation that can come with real estate investments. However, when it’s time to sell an investment property, the burden of capital gains taxes can put a damper on your finances, potentially depriving you of as much as 30% of your profits.

But fear not! Within the realm of real estate tax planning, there exists a powerful tool to protect your money: the 1031 exchange. Embedded in the Internal Revenue Code, this rule acts like a shield, mitigating the impact of capital gains taxes, ensuring more money stays in your pocket, and unlocking a multitude of benefits.

This article ventures into the thorny hedge of tax liabilities that surrounds the sale of investment properties to explore the intricacies of 1031 exchanges. We will reveal how 1031 exchange tax benefits could be the solution you’ve been seeking to help secure your treasure — or optimize your financial gains.

| Discussion Topics |

Liabilities of Selling Investment Property

When selling an investment property, it’s crucial to understand the various tax liabilities involved. Before we discuss 1031 exchange tax benefits, we want to ensure that you have a strong grasp of these tax codes that could have a significant impact on your financial outcomes.

Some of the key tax liabilities you need to know about include:

- Capital Gains Taxes. One of the primary liabilities associated with property sales is capital gains taxes. When you sell property for a profit, you must pay taxes on the capital gains—or the difference between a property’s sale price and its adjusted basis (typically the original purchase price plus any qualified improvements or minus depreciation). Federal Income tax rates for capital gains taxes typically land somewhere between 15-20%, with a 3.8% surcharge added for higher-income individuals, detailed below. That’s a lot of money!

- Depreciation Recapture. If you’ve claimed depreciation deductions on the property in previous years, you may also be liable for depreciation recapture taxes. This refers to the portion of a property’s depreciation that’s subject to ordinary income tax rates rather than the lower capital gains tax rates.

- Net Investment Income Tax (NIIT). Depending on your income level, you might be subject to the Net Investment Income Tax, which is an additional tax of 3.8% on certain types of investment income, including capital gains, for higher income thresholds.

- State and Local Taxes. In addition to federal taxes, you may also be liable for state and local taxes on the sale of investment property. Tax rates and regulations vary by jurisdiction, but can easily surpass 10% in high tax states.This is why it’s essential to consult with a tax professional who’s familiar with the rules specific to your area.

- Mortgage and Loan Liabilities. If you have an outstanding mortgage or loan on the property you’re selling, you’ll need to consider the potential tax implications for the loan payoff as well as any possible mortgage-related fees.

As you can see, while selling an investment property can be lucrative, it also comes with a multitude of caveats that you need to consider. For example, capital gains taxes can add up to a significant amount when you sell for a profit. Below is an example how just how hefty the tax responsibility can be.

Capital gains taxes, illustrated | ||||||

|

|

|

| |||

|

$1M |

| ||||

| 13.3% – CA 23.8% – US |

$92,700 | ||||

It’s important to note that tax laws and regulations can change, so it’s advisable to consult with a qualified tax professional or an accountant who can provide personalized guidance based on your specific situation.

What Is a 1031 Exchange?

Now that you have a better understanding of the various forms of tax liability associated with selling investment property — and the potential impact on your profits — it’s time to explore a powerful strategy to help you retain more of your profits: the 1031 exchange.

Delving deeper into the intricacies of the 1031 exchange can help you unlock valuable insights about effectively mitigating your tax burden and enhancing your financial outcomes. Let’s look at the details of this powerful tool to discover how it could preserve your hard-earned funds during property transactions.

How It Works

Here’s how it works in a nutshell: When you sell an investment property, instead of immediately paying capital gains taxes on the profits, you can reinvest the proceeds into another “like-kind” property without incurring immediate tax liabilities. To qualify as “like-kind,” the property must be of equal or greater value and used for intended investment purposes.

This enables you to defer taxes, in perpetuity, and optimize the power of your own capital to generate potentially higher returns. It’s a savvy move for those seeking to maximize their investment potential.

Rules and Guidelines

Let’s slow down a minute to note some of the crucial rules and regulations you need to follow, in accordance with strict timelines. For instance, within 45 days of the initial sale, you must identify a replacement property and the entire exchange must be completed within 180 days. These timelines run concurrently, making time management essential.

There is also a holding period of about two years that limits how quickly you can perform a 1031 exchange on a property after purchasing it. And, it’s essential that a qualified intermediary holds the proceeds from the original sale, not the seller. Failure to comply with this requirement would void the 1031 exchange.

To summarize, the key points to remember about 1031 exchanges are listed below.

- 1031 exchanges allow investors to defer capital gains taxes on the sale of a property to purchase a “like-kind” property.

- “Like-kind” properties must be of a similar asset type and be used for investment purposes.

- Within 45 days of the initial property sale, you must identify a replacement property.

- The entire 1031 exchange process must be completed within 180 days of the initial sale.

- The 45-day identification period and the 180-day exchange period run concurrently.

- The seller cannot retain any proceeds from the original sale; an intermediary must handle them.

By understanding and complying with these rules, you can access the full potential of a 1031 exchange and enjoy the tax benefits it offers.

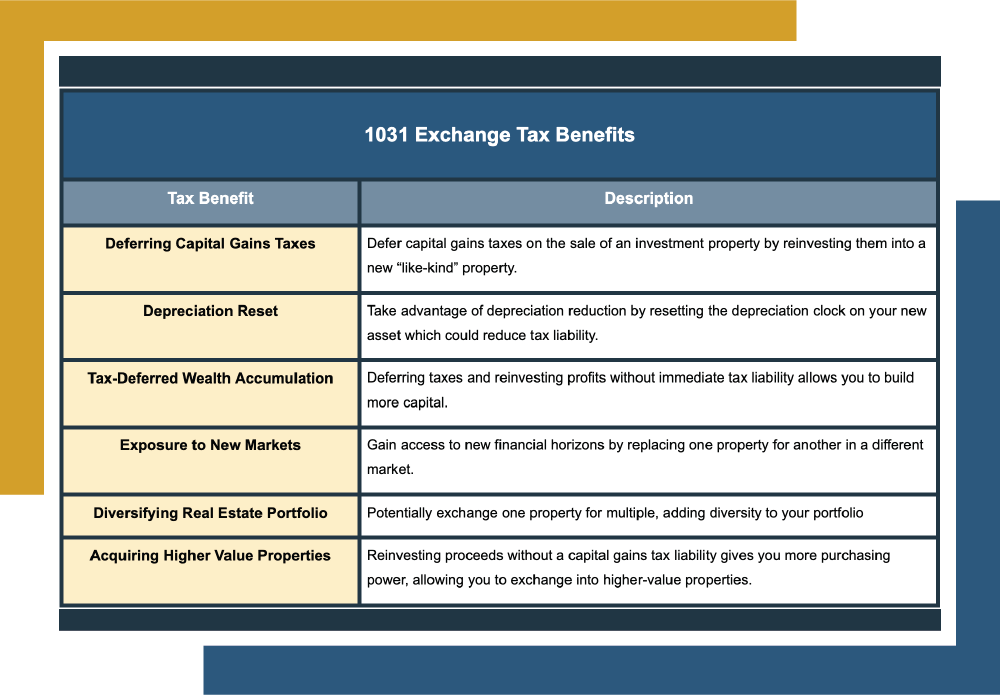

1031 Exchange Tax Benefits You Need to Know

Congratulations on acquiring a solid understanding of tax liabilities and the requirements for the 1031 exchange process! Now, let’s examine the tax benefits more closely to see how they could enhance some financial outcomes for your real estate transactions.

Leveraging the power of a 1031 exchange offers a number of benefits to complement and strengthen your overall financial strategy. Let’s explore these benefits in greater detail and uncover how they might propel your real estate investments to new heights.

- Deferring Capital Gains Taxes. As we mentioned earlier, one of the primary benefits of a 1031 exchange is the deferral of capital gains taxes. By reinvesting the proceeds from the sale of your investment property into a like-kind property, as defined by the IRS, you can defer paying capital gains taxes until a later date. Instead, those funds continue to work for you, potentially bolstering your purchasing power for the replacement property.

- Depreciation Reset. Through a 1031 exchange, you can also reset the depreciation schedule on the new property. When you acquire a replacement property, the depreciation clock starts anew on the additional asset value purchased. This can be advantageous as it allows you to continue taking advantage of depreciation deductions and potentially reduce your overall tax liability in the long run.

- Tax-Deferred Wealth Accumulation. When selling one investment property and acquiring another, using a 1031 exchange allows you to defer taxes continually. This creates a tax-efficient way to grow your real estate portfolio over time because you can reinvest your profits without immediate tax consequences. Tax deferral gives you more available capital for reinvestment.

- Exposure to New Markets. Successful real estate investing often demands adaptability — investors must be able to seize opportunities in emerging markets. By deferring your taxes with a 1031 exchange, you retain more capital, facilitating the transition to new properties in potentially higher-growth markets. It allows you to explore fresh investment horizons and tap into the potential of evolving real estate landscapes.

- Diversifying Your Real Estate Investment Portfolio. Using 1031 exchanges allows you to exchange one property for multiple properties, thanks to the 1031 exchange 200 Rule. This diversification strategy helps spread risk, has the potential to enhance cash flow, and broadens your investment opportunities.

- Acquiring Higher-Value Properties. As your investment goals evolve, upgrading your portfolio with higher-value properties becomes a more achievable goal. Deferring capital gains taxes with a 1031 exchange can help offset the costs associated with acquiring more expensive properties. In turn, these higher-quality assets can increase your potential for greater returns and portfolio growth.

So how do these benefits match up directly with specific liabilities? Below is a chart that explains how each benefit can offset or eliminate a tax liability from the sale of an investment property.

Investment Property Sales Tax Liabilities vs. 1031 Exchange Tax Benefits | ||

Tax Liability | WITHOUT 1031 | WITH 1031 Exchange |

Capital Gains Taxes | Remit payment of capital gains taxes | Defer capital gains taxes to a later date |

Depreciation Recapture | Subject to recapture tax | Reset the depreciation schedule on the new property |

Net Investment Income Tax (NIIT) | Potential NIIT liability | Potential NIIT deferral |

State and Local Taxes | Remit payment for state and local taxes | Potential reduction or deferral of state and local taxes |

Mortgage and Loan Liabilities | Remit payment of outstanding loan(s) | Potential to carry loan over to the replacement property |

When done correctly, a 1031 exchange can limit your capital gains tax liability as well as your responsibility for other taxes. In fact, some strategies that employ successive 1031 exchanges whenever selling property could result in pushing back capital gains taxes indefinitely.

However, while 1031 exchanges offer remarkable tax benefits, they come with complexities and strict requirements. That’s why it’s recommended that even experienced investors consult with a qualified real estate expert or investment professional. That’s where Canyon View Capital comes in.

Canyon View Capital Simplifies 1031 Exchanges

Now that you have a comprehensive understanding of 1031 exchange tax benefits, it’s essential to partner with someone who genuinely understands the intricacies of the process and cares about your success. Canyon View Capital professionals aim to be that reliable companion for your journey.

With a real estate portfolio now valued at an aggregated $1 billion, our team is passionate about sharing our wealth of knowledge to help investors like you fully realize the advantages of a 1031 exchange.

1031 exchanges require precision to navigate their complexities successfully and adhere to their strict guidelines. Our seasoned investment managers will walk you through every step, helping you avoid costly mistakes so you can make the most of incredible tax advantages.

At CVC, our commitment goes beyond facilitating your 1031 exchange. We genuinely care about your understanding and success and are eager to answer any additional questions you may have, providing you with the support and guidance you need throughout the process. Our goal is to empower you with the knowledge and confidence to make informed decisions and achieve your investment objectives to facilitate a bright future.

Still hazy on the details of 1031 exchange tax benefits?

Canyon View Capital can show you the way! We will walk you through your 1031 exchange and our team members will always answer your questions honestly, completely, and promptly. CVC can help you cut through the red tape, no matter how sticky it gets.

For a successful exchange, contact Canyon View Capital.

Verified accreditation status required.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.