At some point in their real estate journey, investors often contemplate a change from their current property. It could be due to the desire to reinvest in more promising areas, deal with troublesome property issues, or simply seek relief from the burdens of property management.

Amidst the prospect of paying capital gains taxes upon selling an investment property, astute investors have unlocked the advantages of the 1031 exchange—a robust tax deferral tool outlined in section 1031 of the Internal Revenue Code1.

The 1031 exchange empowers investors to leverage the proceeds from a property sale and use them to purchase a different property or properties categorized as “like-kind.” Nevertheless, some investors face a dilemma as the IRS doesn’t precisely define what qualifies as “like-kind,” leaving a plethora of options open for consideration and making the decision process challenging.

In this blog, I will help investors like you learn about the possibilities available when using a 1031 exchange and explore the best 1031 exchange investments.

| Discussion Topics |

The Best 1031 Exchange Investments

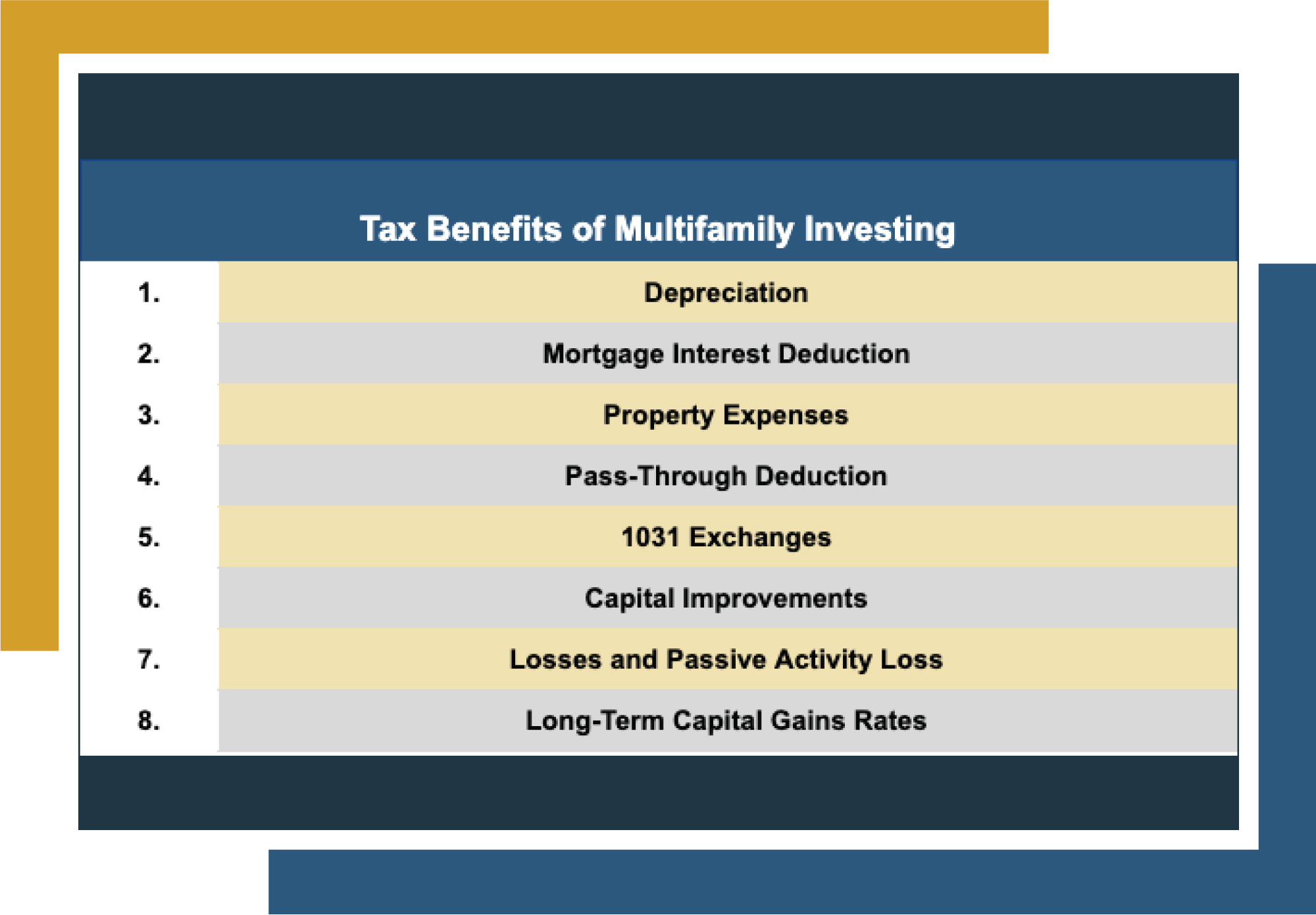

Investors choose to use 1031 exchanges because they present a unique opportunity to defer capital gains taxes. This can be a significant boon for many investment strategies due to increasing the capital for the purchase of new investment opportunities instead of paying upwards of tens of thousands of dollars in capital gains taxes.

When it comes to finding the best 1031 exchange investments, there are quite a few options available. The IRS does not stipulate what is accepted as a like-kind property in a 1031 exchange, opening the door for options such as:

- Multifamily Properties: Residential properties containing multiple housing units inside a single building or complex designed to house more than one family unit, such as apartments, condominiums, duplexes, and townhouses, rented out to tenants for rental income

- Single-Family Properties: Standalone residential properties designed to house one-family units rented out to tenants for rental income

- Commercial Properties: Business properties, including office buildings, retail shopping centers, warehouses, and industrial properties, rented out to businesses for rental income

- Agricultural Properties: Farms, orchards, ranches, and other land held for investment purposes

- Development Projects: Such as raw land

- Real Estate Investment Trusts (REITs): Companies or trusts that operate or finance income-generating real estate on behalf of investors who pool their money together to invest in a portfolio of real estate assets without directly owning or controlling the properties

- Delaware Statutory Trusts (DSTs): DSTs allow investors to cooperatively own and manage large properties such as multifamily or commercial properties

Pros and Cons of the Best 1031 Exchange Investments | ||

1031 Exchange Investment | Pros | Cons |

Multifamily Properties |

|

|

Single-Family Properties |

|

|

Commercial Properties |

|

|

Agricultural Properties |

|

|

Development Projects |

|

|

REITs |

|

|

DSTs |

|

|

While each potential 1031 exchange has a bevy of benefits that would make them enticing propositions, they also have their shortcomings. Like any investment option, there are always advantages and disadvantages that will make some options fit into one investor’s investment strategy better than another’s.

These advantages and disadvantages can vary depending on the specific property, location, and market conditions, so it is crucial for investors to consult their financial advisor and/or tax experts to help them decide which 1031 exchange investments are best for them.

Some investors may find the idea of DSTs alluring as it offers them an entry point into larger-scale properties that they may not otherwise have had the individual capital to purchase without worrying about personal property management. Other investors may be drawn to the benefits of multifamily investing but deterred by the prospect of individually managing properties and keeping up with various laws and regulations. Luckily for investors like this, Canyon View Capital has investment products that may be the perfect solution.

Exchange Your Property Into One of Canyon View Capital’s Multifamily Properties

The ideal 1031 exchange investment varies from invedstor to investor and depends on your goals. At Canyon View Capital, we offer investment vehicles that allow investors to enjoy the many benefits of multifamily investing without some downsides, such as worrying about property management or needing to keep up with complex laws and regulations.

For over 40 years, our principals have managed real estate that is now valued at over $1B in aggregate2, and we allow investors a path to using a 1031 exchange to roll the proceeds into one of our many multifamily properties located in America’s Heartland as Tenants in Common, allowing them to defer their capital gains taxes. Investors not only get to defer capital gains taxes but also enjoy the potential for passive income while relieving them of management responsibilities.

Still need more information on the best 1031 exchange investments?

At Canyon View Capital, we will walk you through every step of your investment when using your 1031 exchange as a vehicle, and our staff will always answer your questions honestly, completely, and promptly. For more on investing using a 1031 exchange, contact Canyon View Capital.

Verified accreditation status required.

1Like-Kind Exchanges Under IRC Section 1031.,” Internal Revenue Service. Feb. 8, 2008, IRS.gov. Accessed July 27, 2023.

2$1B figure based on the aggregate value of all CVC-managed real estate investments as valued on March 31, 2023.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.