How to Start Investing in Multifamily Real Estate

Investing in real estate is a widely favored choice among many Americans as a means of long-term investment1. It’s not hard to see why, as it offers many potential benefits, such as:

- Capital Appreciation

- Stream of Income

- Diversification

- Various Tax Advantages

- Hedge Against Inflation

- Tangible Asset

- More Passive Income Than Some Other Options

However, real estate investment is a diverse concept, encompassing various subsets similar to any other investment option. Like any investment vehicle, being aware of your options is essential.

One popular option is multifamily investing, which has advantages and potential shortcomings. If you’re looking for the next addition to your investment portfolio, it’s crucial that you understand how to start investing in multifamily real estate. In this comprehensive introduction to investing in multifamily real estate, I’ll ensure that you have the knowledge necessary to start your journey on the right foot.

Discussion Topics

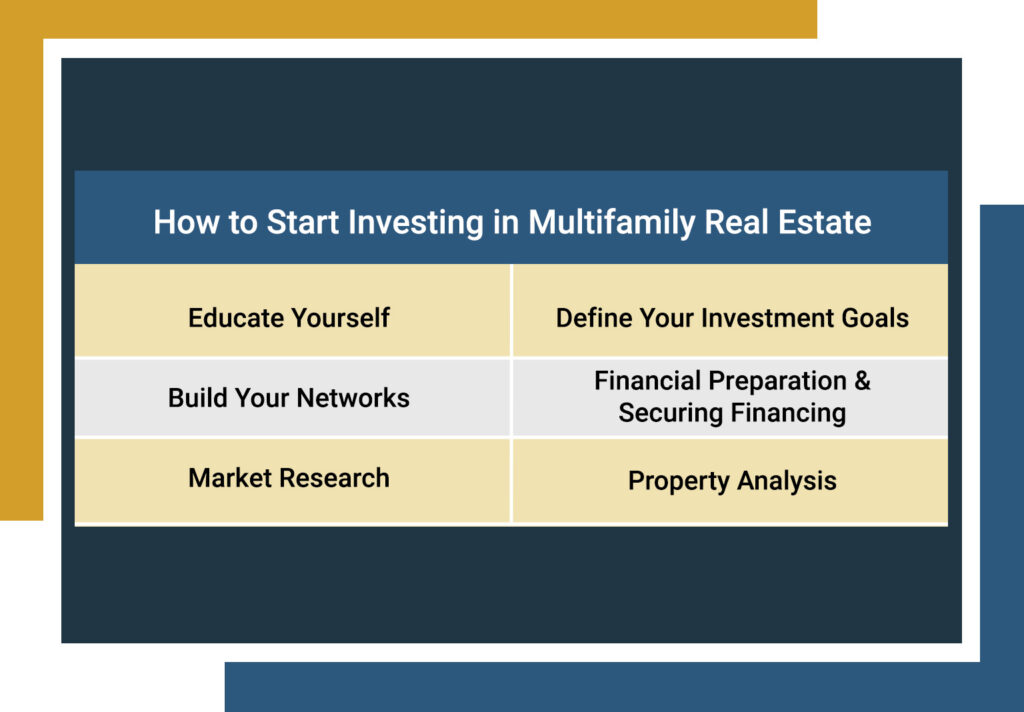

How to Start Investing in Multifamily Real Estate

If you’ve decided to test the waters of multifamily real estate, you’ll be joining a plethora of Americans who have found that the benefits of multifamily investing align with their investment strategy.

If you’re wondering, “How to start investing in multifamily real estate?” This comprehensive guide is designed to set you on the path to kickstarting your multifamily real estate journey.

| How to Get Started with Investing in Multifamily Real Estate | |

| The initial stage of investing in multifamily real estate involves ensuring that you know what is necessary to succeed. You’ll need to learn about:

|

| Clarify your financial objectives. Understanding your goals will shape your investment strategy, whether you’re aiming for passive income, long-term wealth, or portfolio diversification. |

| Connect with experienced investors, real estate professionals, and like-minded individuals. Networking opens doors to valuable insights, potential partnerships, and a supportive community. |

| Assess your financial readiness. Understand your budget, evaluate financing options, and explore potential funding sources to set your multifamily real estate journey on the right foot. Since multifamily investing typically comes with higher purchase prices, you’ll want to make sure you have the cash to purchase or to make a down payment, which could be around 25% of the property’s purchase price. You’ll also want to ensure that your debt-to-income ratio (DTI) meets the requirements for any loans you may take, such as conventional, FHA, or VA. |

| Conduct thorough market research to identify high-potential locations. Analyze demographics, economic indicators, and local trends to pinpoint areas with growth potential. |

| Develop the skills to analyze multifamily properties. Explore factors such as cap rates, cash-on-cash returns, and potential appreciation to make informed investment decisions. |

| Before you acquire the property, you’ll need to know how to thoroughly inspect it, review financial records, keep up with important tax information, identify potential risks, and manage the property and tenant relations effectively. |

What is Multifamily Real Estate?

Multifamily real estate investing is a specific subset of real estate investing that involves what the name implies: homes for multiple families. This asset class spans a large spectrum of residential properties designed to accommodate many tenants, from a few to hundreds or even thousands.

These self-contained living spaces comprise a larger property with kitchens, bathrooms, and bedrooms in each unit.

Common multifamily properties include:

- Duplexes, Triplexes, Fourplexes

- Condominiums

- Townhouses

- Apartments

What are the Benefits of Investing in Multifamily Real Estate?

- Passive Income: Investing in multifamily real estate offers a passive cash flow through rent payments. After the initial setup, you can enjoy income without constant upkeep. Hiring property managers can ease the workload, though responsibilities still exist, albeit potentially fewer than some other investment options.

- Economies of Scale: Consolidating units under one roof leverages economies of scale, reducing operating and maintenance costs like insurance, repairs, and supplies. This efficiency arises from utilizing resources on a single property, leading to significant cost savings.

- Portfolio Diversification: Diversification is critical in investing in lowering risk and maximizing income streams. Multifamily real estate adds to this strategy, offering further portfolio diversification and risk management, even if you’re already invested in other property types.

- Appreciation: Multifamily properties offer rental income and potential appreciation driven by market demand, location, and property enhancements. As the property appreciates, equity builds, opening avenues for refinancing at favorable rates or selling for potential substantial profits in the future.

- Potentially Lower Risk: Multifamily investing is often deemed a secure choice, especially compared to other real estate types. Even in economic downturns, the enduring need for housing contributes to its stability. Additionally, the presence of multiple income streams within a single property lessens the impact of vacancies or tenant non-payments, enhancing the resilience of multifamily investments.

- Ability to Leverage: Repayment of the loan is funded through the income generated from the property or other assets in the IRA itself.

- Diverse Property Types: Self-directed IRAs face stringent IRS regulations that are often more rigorous and detailed than traditional IRAs. Investors must stay vigilant about prohibited transactions and other rules to guarantee compliance with these regulations.

- Tax Benefits: Multifamily properties can be structured as tax-advantaged investment vehicles, offering various benefits. Investing in these properties allows for deductions on mortgage interest, leverages depreciation, and utilizes tax deferral tools like 1031 exchanges to optimize financial outcomes and retain more money in your pocket.

- Tenant Stability and Occupancy Rates: Because multifamily properties involve housing many tenants as opposed to a single family, tenant stability is much higher, which lowers the impact of vacancies or non-payments.

Moreover, multifamily properties tend to have high occupancy rates, with multifamily occupancy being around 96%2.

What are the Potential Concerns of Multifamily Investing?

- Market Volatility: Real estate markets can be sensitive to economic changes, and multifamily properties are not immune to market fluctuations. Economic downturns may impact rental demand and property values.

- Property Management Challenges: Managing multiple units requires effective property management. Issues such as tenant turnover, maintenance, and dealing with various tenant personalities can be time-consuming and challenging.

- Financing Risks: Multifamily properties often require significant upfront investment. Securing financing and managing mortgage payments can be a concern, especially if economic conditions or interest rates change.

- Regulatory Changes: Changes in local or federal regulations can impact the profitability and feasibility of multifamily investments. Stay informed about zoning laws, rent control measures, and other regulatory factors.

- Tenant Issues: Dealing with tenant-related challenges, such as non-payments, disputes, or evictions, can be a part of multifamily property ownership. Screening tenants thoroughly and having effective lease agreements can help mitigate these risks.

- Market Saturation: In some areas, there may be high competition and market saturation for multifamily properties. This can affect rental prices and occupancy rates, potentially impacting the profitability of investments.

- Interest Rate Risks: Changes in interest rates can affect mortgage costs and, consequently, the profitability of your investment. Understanding and planning for potential interest rate fluctuations is crucial.

- Dependence on Local Economy: Like its single-family counterpart, multifamily property performance is often tied to the local economy. Economic downturns or industry-specific challenges in the area can impact tenant demand and property values.

It’s important to remember that all investment opportunities carry some level of risk. Even with its promising benefits, multifamily real estate is no different. Always consult with a financial advisor or tax professional to ensure that any new investment strategy aligns with your risk tolerance and financial goals.

What Drives Demand for Multifamily Properties?

Understanding the dynamics of rental properties requires insight into the diverse factors influencing the housing market and rental demand. In real estate, individuals fall into two categories: homeowners and renters. Each group is propelled by distinct factors that guide their choice between ownership and renting.

- Population Growth and Urbanization: While the national population growth rate is declining3, numerous cities are experiencing an uptick in population, creating a demand for multifamily real estate. The trend is particularly evident in urban areas, where living spaces are efficiently consolidated to meet this growing demand.

- Demographics: Shifts in demographics, such as millennials delaying home ownership, an aging population seeking downsizing options, and others, contribute to an increased demand for rental properties such as multifamily real estate.

- Affordability: In many regions, purchasing a single-family home may be more expensive than renting, especially with current trends in the housing market that are driving up prices and keeping interest rates high. Homeownership is expected to continue being a challenge for many families5, and multifamily properties offer a more affordable way for them to live.

- Job Growth: cities with robust job markets often attract individuals seeking new employment opportunities. This influx of potential tenants drives the demand for rental housing, with multifamily properties being popular.

- Temporary or Transitional Housing Needs: Multifamily properties serve individuals or families with temporary or transitional housing needs, such as students, young professionals, or those relocating for work.

Canyon View Capital Has Investment Opportunities for Accredited Investors

Whether you’re a novice testing the waters of real estate investing or a real estate journeyman looking to add multifamily real estate to your portfolio, knowing how to start investing in multifamily real estate is an essential first step.

At Canyon View Capital, we manage an extensive multifamily real estate portfolio across the Midsouth and Midwest, using value investing as a pillar of our investment approach. We want to help investors like you enjoy the benefits of multifamily real estate while avoiding potential pitfalls.

When you invest with us, you maintain many of the benefits of multifamily real estate investing without having to worry about managing properties, staying up-to-date on the latest market trends, or purchasing property with a long-term mortgage commitment.

Let us see if we can do the heavy lifting for you while you enjoy passive rental income and a bevy of tax benefits.

For over 40 years, Canyon View Capital has managed, owned, and operated real estate currently valued at over $1B6. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

To learn more about how to start investing in multifamily real estate, reach out today!

1. James Royal, Ph.D., “Survey: Real estate and cash top Americans’ list of preferred investments over next 10 years,” for Bankrate, June 23, 2023, bankrate.com, Accessed Feb. 2, 2024.

2. Jay Parsons, “Demand for Apartments in 2021 Smashes Previous Record High by 66%” for Realpage, Jan. 6, 2022, realpage.com, Accessed Feb. 1, 2024.

3. “U.S. Population Projected to Begin Declining in Second Half of Century,” US Census Bureau, Nov. 9, 2023, census.gov, Accessed Feb. 1, 2024.

4. “Large Southern Cities Lead Nation in Population Growth,” US Census Bureau, May 18, 2023, census.gov, Accessed Feb. 1, 2024.

5. Bernadette Joy, “The Case To Keep Renting Versus Buying In 2024,” for Forbes, Dec. 27, 2023, forbes.com, Accessed Feb. 1, 2024.

6. $1B figure based on aggregate value of all CVC-managed real estate investments valued as of March 31, 2023.