Real estate investing is a compelling alternative for investors looking to diversify beyond the traditional stock market and bonds. Among the various avenues within real estate, Real Estate Investment Trusts (REITs) stand out for their unique advantages.

In this article, we will highlight the benefits of a REIT and compare them to our real estate investment options.

By understanding these benefits, you can make a more informed decision and enhance your investment strategy, potentially leading to greater financial growth and stability.

| Discussion Topics |

Benefits of a REIT

What is a REIT?

A REIT is a company that owns, operates, or finances income-producing real estate across various sectors.

Imagine you and your friends pooling money to buy an orchard, forming a company, and hiring experts to manage it. Profits from fruit sales are then distributed as dividends to shareholders. Similarly, REITs allow investors to pool money to buy real estate, with a company managing the properties and distributing profits from rent or sales as dividends.

The benefits of a REIT include steady income, diversification, liquidity, professional management, and accessibility. They combine some of the advantages of real estate investing with the ease of publicly traded stocks.

Understanding the benefits of a REIT is crucial for your investment strategy.

Benefits of a REIT | |

| Like receiving profits from fruit sales, REITs pay out regular dividends, providing a reliable income stream. |

| REITs typically invest in various property types, reducing risk by spreading investments across different sectors, such as commercial real estate. |

| Shares in REITs can be easily bought and sold on stock exchanges, making them more liquid than direct property investments. |

| Experienced managers handle the properties for you, ensuring efficient operation and little hands-on involvement from you. |

| REITs allow individuals to invest in large-scale real estate with smaller amounts of money, making it easier to diversify an investment portfolio with a lower upfront cost. |

Disadvantages of a REIT

Real estate offers various investment options, including REITs, each with unique benefits and risks. While some benefits of a REIT are shared with other real estate investments, REITs also come with distinct risks. Understanding both the benefits of a REIT and the potential risks is crucial for making informed investment decisions.

Risks of a REIT | |

| REITs are traded on stock exchanges, making them susceptible to market fluctuations in addition to real estate market risks. Economic downturns, interest rate changes, and market sentiment can all impact REIT prices. |

| REITs often rely on borrowed capital for property acquisitions and operations. Rising interest rates can increase borrowing costs and reduce profitability, negatively affecting REIT dividends and share prices. |

| The value of the underlying properties can fluctuate due to changes in real estate market conditions, impacting the overall value of the REIT. |

| A REIT’s performance largely depends on the expertise and decisions of its management team. Poor management can lead to suboptimal property acquisitions, maintenance issues, and lower rental incomes. |

| Many REITs use leverage to finance property acquisitions. High debt levels can increase the risk of financial distress, especially in a rising interest rate environment or during economic downturns. |

| REIT dividends are typically taxed as ordinary income, which might be higher than the capital gains tax rate, potentially reducing investors’ net return. |

REITs vs. Other Options

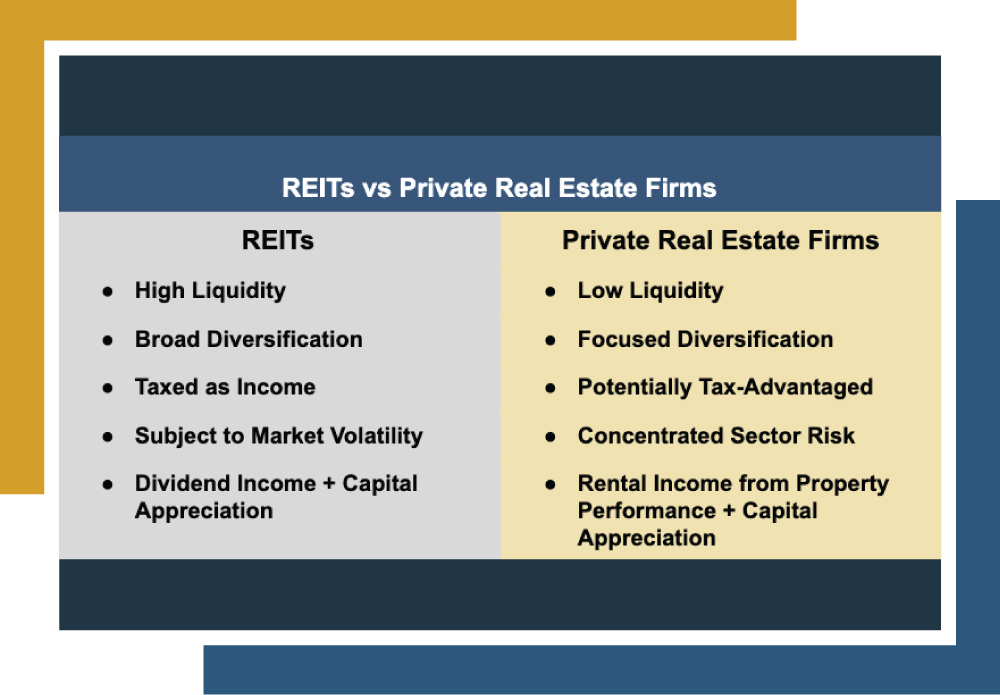

While REITs offer the combined benefits of real estate investing and public stock trading, they also carry many of the same risks. Despite their attractive advantages, these risks might make them less suitable for some investors.

At Canyon View Capital, we provide an investment vehicle that shares several benefits with REITs, such as a hands-off investment approach and access to larger real estate operations with lower upfront investment requirements. However, our multifamily real estate investment options avoid many of the disadvantages associated with REITs, potentially making them a better fit for some investors.

We are a private real estate investment firm that offers hands-off investment in large real estate operations with lower upfront costs, similar to REITs but without many of their disadvantages. We specialize in multifamily real estate, acquiring and managing large apartment complexes in the Midwest and Midsouth regions.

Here’s how we stack up to an average REIT.

CVC vs REITs | ||

Feature | CVC | REITs |

Hands-off investment approach | ✔️ | ✔️ |

Lower upfront investment requirements | ✔️ | ✔️ |

Access to large real estate operations | ✔️ | ✔️ |

High liquidity | ❌ | ✔️ |

Professional property management | ✔️ | ✔️ |

Regular dividend income | ❌ | ✔️ |

Regular rental income | ✔️ | ❌ |

Potential tax advantages (e.g., 1031 exchange, passive losses) | ✔️ | ❌ |

Traded on stock exchanges | ❌ | ✔️ |

Direct partnership opportunities | ✔️ | ❌ |

High regulatory oversight | ❌ | ✔️ |

Personalized investment strategy | ✔️ | ❌ |

Less market volatility | ✔️ | ❌ |

To explain it further, there are many unique advantages to investing with CVC as opposed to a REIT.

- Potential Tax Advantages:

- 1031 exchanges for deferring capital gains taxes

- Passive losses that can reduce taxable income

- Lower Market Volatility:

- Not publicly traded, providing more stable returns

- Personalized Investment Approach:

- Direct partnership opportunities

- Customized strategies based on individual investor needs

- Focused Management and Targeted Strategy:

- Potentially higher returns due to specialized investment in multifamily properties

- Hands-on management by experienced professionals

- Expertise:

- Decades of experience in the multifamily real estate sector as well as regional expertise.

- Lower Liquidity but Potentially Higher Returns:

- Although less liquid than REITs, this can lead to more stable, long-term investments

Partnering with CVC Could Be the Right Move For You

Now that you understand the benefits of a REIT and some of its caveats, you’ll likely be considering your next steps.

At CVC, we’re passionate about multifamily real estate investing. With decades of experience, our principals have built a portfolio valued at over $1 billion1.

We want to share that passion by helping accredited investors like you step into multifamily real estate and enjoy its benefits without the headaches. We manage properties across the Midsouth and Midwest on your behalf, allowing you to enjoy truly passive rental income without any hassle.

Need more information on the benefits of a REIT?

We’re happy to help! Call CVC today to learn more. Get Started

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.