Savvy investors understand the importance of diversifying their portfolios, exploring new investment avenues to increase their income potentially, and spreading risk across multiple sectors.

One popular investment sector is real estate. However, like any investment, there are various paths investors can take, each with its advantages and disadvantages.

Real estate funds are a favored option for those looking to reap the benefits of real estate investing without extensive hands-on involvement and personal responsibility. But are real estate funds a good investment? Let’s explore this avenue to help you determine if it’s worth considering.

Are Real Estate Funds a Good Investment?

Real estate funds offer a mix of benefits and challenges, making them a valuable investment depending on your circumstances. Factors such as your risk tolerance, financial goals, investment horizon, and preference for hands-on property management will influence whether real estate funds are the right choice for you.

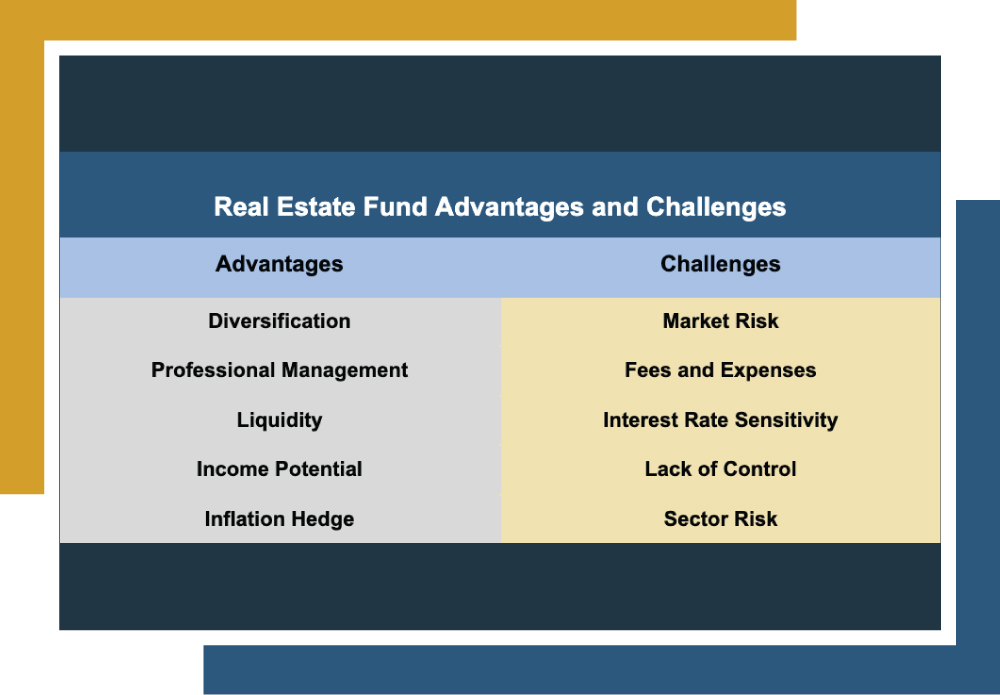

Advantages and Challenges of Real Estate Funds | |

Advantages | Challenges |

Diversification | Market Risk |

Reduces risk by spreading investments across various properties. | Subject to economic downturns and fluctuations in property values. |

Professional Management | Fees and Expenses |

Managed by experts with real estate knowledge and experience. | Potential management fees and other costs can erode returns. |

Liquidity | Interest Rate Sensitivity |

Easier to buy and sell compared to direct property investments. | Sensitive to changes in interest rates, which can impact borrowing costs and property values. |

Income Potential | Lack of Control |

Potential for regular dividend payments from rental income. | Limited control over specific property investments and management decisions. |

Inflation Hedge | Sector Risk |

Property values and rental income generally rise with inflation. | Concentration in specific real estate sectors can increase vulnerability to sector-specific downturns. |

So, are real estate funds a good investment? They can certainly be an excellent choice for investors whose interests align with their benefits.

Who are Real Estate Investment Funds a Good Fit For?

Consider Emily, a 50-year-old professional with a stable income who aims to diversify her investment portfolio. With a moderate risk tolerance, Emily prefers not to handle property management herself due to her busy schedule.

However, she seeks a steady income stream for her approaching retirement. Unlike direct property investments, real estate funds perfectly fit her, offering professional management and the liquidity to buy and sell shares quickly. This approach allows Emily to achieve her financial goals without the hassle of hands-on property management.

It’s also important to understand that real estate investment funds differ by the fund itself, each having unique characteristics such as the type of real estate invested in and the specific investment strategy employed. For instance, CVC offers the Balanced Fund and the Income Fund, each with a distinct focus and benefits.

Let CVC Be Your Real Estate Investment Partner

Are real estate funds a good investment? They can be, depending on your financial goals and risk tolerance. If you think they might be a good fit for your portfolio, consider the expertise of Canyon View Capital. We’re passionate about real estate and manage a portfolio of multifamily properties valued at over $1 billion1.

Partnering with CVC means you benefit from a real estate investment fund with significant tax advantages and income potential. Our fund is fully managed for you and backed by a buy-and-hold strategy that targets conservative returns in stable markets.

If you’re an accredited investor, reach out today to see if Canyon View Capital is the right fit for your investment needs.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.