The trusty 401(k) has long been considered a de facto success route for retirement savings. However, recent economic trends and headwinds have caused many investors to seek alternative options. But what if they have a large amount of most of their retirement savings tied in a 401(k) and want to explore an option such as real estate investment?

Some may wonder if a 401(k) withdrawal for real estate investment is possible, given that 401(k)s don’t allow for direct investing in real estate. The answer is yes, but it involves some specific steps.

The Process of a 401(k) Withdrawal for Real Estate Investment

Yes, it is possible to initiate a 401(k) withdrawal for real estate investment. However, the process involves specific steps and considerations and isn’t straightforward.

While a direct withdrawal is technically possible, it involves a complex process that will typically incur penalties and taxes for early withdrawal. However, alternative methods to access these funds without incurring costs exist.

Methods of 401(k) Withdrawal for Real Estate Investment. | |

401(k) Loan | Self-Directed IRA or 401(k) |

One way to use your 401k for real estate investment is by taking a loan from your 401k.

The IRS allows you to borrow up to 50% of your vested account balance or $50,000, whichever is less.

This method avoids early withdrawal penalties and taxes, but you must repay the loan with interest within a specified period, usually five years. | Another option is to roll your 401k funds into a self-directed IRA or 401(k). A self-directed IRA or self-directed 401(k) gives you more control over your investment choices, including real estate.

By doing this, you avoid the penalties and taxes associated with early 401k withdrawal.

However, managing an SDIRA or SD401(k)requires understanding IRS regulations to avoid prohibited transactions. |

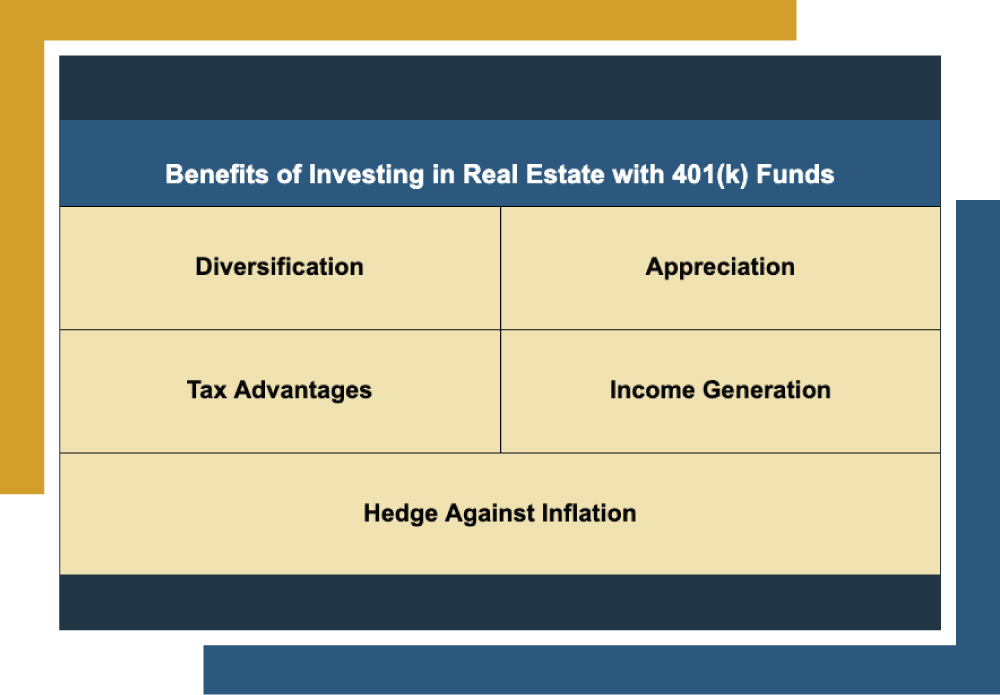

Benefits of Investing in Real Estate with Your 401(k)

Real estate is an investment avenue that offers unique benefits, making it an excellent addition to the portfolios of investors for whom it is a good match. For example, Louis is a 45-year-old investor with a stable career in tech. He has diligently contributed to his 401(k) plan for the past 20 years and has accumulated a solid nest egg.

While he prefers the tax-deferred growth of his 401(k), he is now exploring other investment avenues to diversify his portfolio and generate additional income over long-term growth. He is specifically interested in real estate due to its potential for cash flow and appreciation. If Louis rolls substantial funds from his 401(k) into a self-directed account, he can enjoy these potential benefits:

- Diversification: Real estate can diversify your investment portfolio, reducing overall risk.

- Hedge Against Inflation: Property value and rents usually rise with inflation.

- Appreciation: Over time, real estate can appreciate in value, offering long-term capital gains.

- Tax Advantages: Real estate investments can come with various tax benefits, such as depreciation deductions and 1031 exchanges.

- Income Generation: Real estate investments can provide a steady income stream through rental income.

It’s worth noting that, like any investment, real estate still carries risk and personal responsibility. Always consult your financial advisor or a tax professional before venturing into a new investment.

How Canyon View Capital Can Help

While a 401(k) withdrawal for real estate investment can benefit many investors, there are potential challenges to consider. The stipulations surrounding 401(k) withdrawals can impose limitations, and managing real estate properties requires significant time and effort. For those handling property management themselves, the demands can be burdensome.

However, Canyon View Capital offers a different approach that can provide the same benefits without many of the drawbacks.

When you invest in one of our real estate investment funds with proceeds from your 401(k) loan or self-directed savings account, you will enjoy the following:

- Expert Management and Hassle-Free Investing: We manage a portfolio of multifamily properties on your behalf, handling the heavy lifting while you enjoy truly passive rental income.

- Steady Returns: Our “buy-and-hold” strategy focuses on conservative returns in stable markets, aiming for reliable and consistent returns.

- Compatibility with a 401(k) Loan: The limitations on 401(k) loans make it difficult to purchase real estate. Our threshold means you can still test the waters of real estate while adhering to these limitations.

- Tax Advantages: Our funds are designed to maximize the tax benefits associated with real estate investing.

Partner with CVC and Use Your 401(k) for Real Estate Investing

Now that you understand how to use a 401(k) withdrawal for real estate investment, it’s time to consider your next move. At CVC, we’re passionate about real estate, and our principals have built an extensive multifamily portfolio across the Midsouth and Midwest, now valued at over $1 billion1.

By using savings from your 401(k) to invest in one of our funds, you can enjoy the benefits of rental income through a passive investment vehicle. Our conservative approach ensures that your investment is backed by a robust portfolio, allowing you to reap the tax benefits associated with real estate investing while we handle the complexities for you.

Need more information on a 401(k) withdrawal for real estate investment?

We’re happy to answer your questions! Call CVC today to learn more. Get Started

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.