Welcome to the world of 1031 exchanges! If you’re a real estate investor, you may already know the sting of capital gains taxes when selling an investment property. But with a 1031 exchange, you can defer those taxes and keep more capital working for you. In 2025, the guidelines for 1031 exchanges are as strict as ever, so understanding how they work is critical to reaping the full benefits.

This guide explains 1031 exchange guidelines, offers insights into the 2025 1031 exchange process, and shows how Canyon View Capital can help ease the strain of 1031 exchanges and get the most from your exchange.

The Complete 1031 Exchange 2025 Guide

What is a 1031 Exchange?

A 1031 exchange, outlined in Section 1031 of the Internal Revenue Code, is a powerful tax-deferral strategy for real estate investors. By reinvesting proceeds from a property sale into a new “like-kind” property, you defer capital gains taxes that would otherwise be owed on the sale. These guidelines make it possible to build wealth faster and keep more capital in play.

A 1031 exchange allows you to:

- Increase your purchasing power: Use the full proceeds from your sale to buy a higher-value property.

- Defer capital gains taxes: You retain more capital to reinvest in future properties by deferring taxes.

- Potentially defer taxes indefinitely: By continuing to roll over properties, you may defer taxes as long as you keep reinvesting according to 1031 exchange guidelines.

Key 1031 Exchange Guidelines for 2025

A 1031 exchange offers significant advantages, but you must strictly adhere to IRS guidelines for the exchange to be valid. Here’s what you need to know for 2025:

Like-Kind Property Requirement

Both the “relinquished” property (the one you’re selling) and the “replacement” property (the one you’re buying) must be investment properties, not personal residences. The “like-kind” rule doesn’t mean properties have to be identical; they’re just similar in nature or purpose. So, you can exchange a commercial property for a residential investment but not a personal vacation home.

45-Day and 180-Day Deadlines

These time-sensitive guidelines are crucial:

- 45-Day Identification Period: You have 45 days from the sale of your property to identify potential replacement properties. This list must be submitted in writing to your Qualified Intermediary (QI).

- 180-Day Completion Period: You must complete the purchase of the replacement property within 180 days of the original sale.

The two periods run concurrently, so prompt action is essential to avoid disqualification.

QI Requirement

The IRS requires the use of a Qualified Intermediary to facilitate the exchange. You cannot access the sale proceeds directly—only your QI can hold and distribute these funds to ensure compliance with 1031 exchange guidelines.

How 1031 Exchange Guidelines Affect Capital Gains Taxes

The properties involved in the exchange need to be “like-kind.” For real estate, this means both the property you’re selling and the one you’re buying must be for business or investment purposes. The good news? The real estate types can vary, so you could swap an apartment building for raw land if it has similar purposes.

The main advantage of a 1031 exchange is that it defers capital gains taxes, allowing you to keep more capital invested in property. Here’s a quick look at how much you can save with a 1031 exchange:

Here’s an example:

Selling a Property with a 1031 Exchange vs. Without a 1031 Exchange | ||

|---|---|---|

| Details | With 1031 Exchange | Without 1031 Exchange |

| Original Purchase Price | $500,000 | $500,000 |

| Selling Price | $750,000 | $750,000 |

| Capital Gain | $250,000 | $250,000 |

| Capital Gains Tax Rate | 0% (Deferred) | 20% |

| Capital Gains Tax Owed | $0 | $50,000 |

| Proceeds Available for Reinvestment | $750,000 | $700,000 |

Without a 1031 exchange, you’d pay 20% on $250,000, leaving you with a tax bill of $50,000. By using a 1031 exchange, you defer this tax, leaving that $50,000 to reinvest in a higher-value property, creating a “snowball” effect as your investments grow.

The Step-by-Step 1031 Exchange Process for 2025

To benefit fully from a 1031 exchange, here’s a step-by-step overview of the process according to the latest 2025 guidelines:

- Consult with a Tax Advisor: To confirm eligibility and strategize, consult with a tax advisor who understands 1031 exchange guidelines for 2025.

- Engage a Qualified Intermediary: Choose a reputable QI to oversee your transaction and hold the proceeds from your sale in escrow.

- Sell Your Property: The 45-day and 180-day clocks start ticking once your sale closes.

- Identify Replacement Properties (45-Day Rule): Within 45 days, submit your list of up to three replacement properties to your QI. This list is binding and essential for IRS compliance.

- Complete the Purchase (180-Day Rule): Close on the replacement property within 180 days of selling the relinquished property.

- Report the Exchange on Your Tax Return: File Form 8824 with the IRS to report your 1031 exchange.

- Maintain Records: Keep detailed documentation of all transaction steps to verify compliance with 1031 exchange guidelines if needed.

Why 1031 Exchanges Offer Unique Tax Benefits for Investors

In addition to deferring capital gains taxes, 1031 exchanges offer several potential tax perks:

- Depreciation Reset: With each new property, you can start a fresh depreciation schedule, maximizing tax deductions.

- Tax-Deferred Wealth Accumulation: Keeping capital gains in play allows for faster portfolio growth.

- Flexible Portfolio Diversification: You can exchange one property for multiple properties, using the 200% rule to spread risk and boost cash flow.

Overcoming 1031 Exchange Challenges with Canyon View Capital

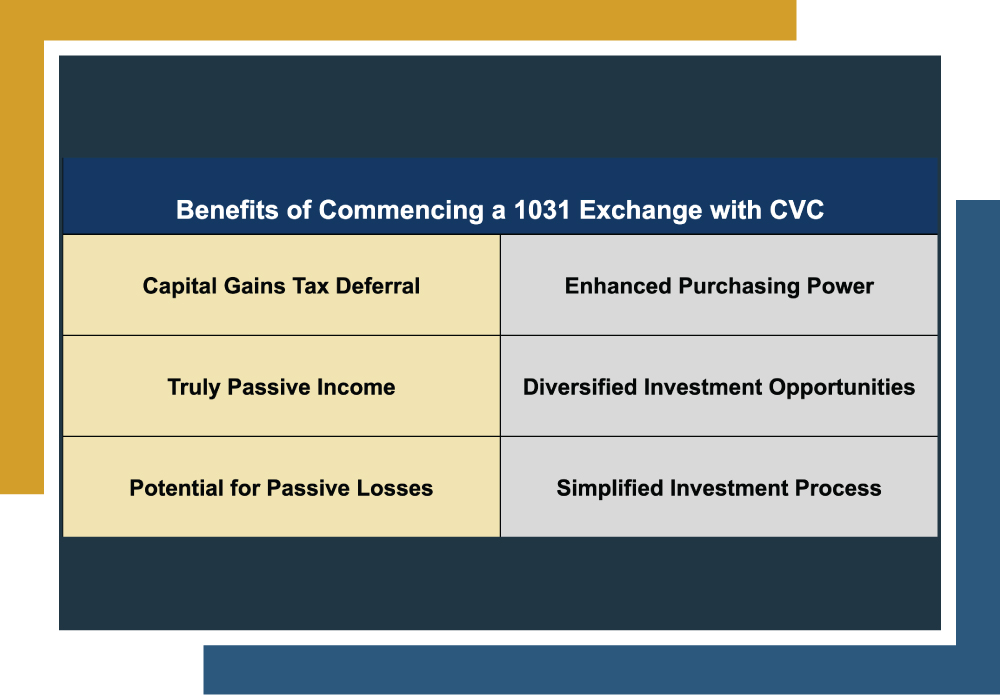

1031 exchanges are fantastic tools for deferring taxes, helping you keep more wealth within your portfolio and reinvest more significantly into new investment properties. But they’re not always easy–as the best things in life rarely are–these exchanges come with precise rules and tight deadlines. That’s where CVC comes in to make things simpler. CVC offers quality multifamily properties that make identifying properties suitable for 1031 exchanges and completing 1031 exchanges less stressful. Partnering with us also comes with a host of other potential benefits.

As an accredited investor and CVC partner, you’ll unlock these benefits:

- Simplify Identification and Closing: CVC offers pre-qualified properties for quick identification, saving time, and potentially minimizing risk.

- Access Tenants in Common (TIC) Options: Exchange into CVC’s multifamily properties as a Tenant in Common, allowing you to benefit from passive real estate income without managing the property.

- Ensure IRS Compliance: CVC’s team guides you through each step, ensuring strict adherence to 1031 exchange guidelines and helping you avoid disqualification.

- Enjoy Comprehensive Property Management: CVC’s team handles all aspects of property management, allowing you to earn income and claim passive losses without the day-to-day hassle.

An Important Note

Before diving into a 1031 exchange, consulting with a trusted financial advisor or tax professional is essential. While 1031 exchanges are powerful tax-deferral tools, like any investment strategy, they come with their level of risk.

A financial advisor or tax professional can help you weigh the benefits, navigate potential pitfalls, and ensure the strategy aligns with your financial goals. At CVC, we’re here to simplify the process and take the load of property management off your shoulders, but a personalized professional perspective is always a smart first step.

Canyon View Capital Offers Unique 1031 Exchange Opportunities

Now that you’re familiar with the essential 1031 exchange guidelines for 2025, you might be wondering about the next steps. If a 1031 exchange sounds like the right move, CVC is here to support you every step of the way.

With a portfolio valued at over $1 billion1 across the Midsouth and Midwest, CVC is passionate about real estate and committed to helping accredited investors simplify their investments.

We offer the unique opportunity to exchange into one or more of our multifamily properties as Tenants in Common, giving you the advantages of traditional real estate investing—without the hassle of property management. It’s a passive investment option that still provides real estate’s benefits and growth potential.

For over 40 years, the principals at Canyon View Capital have worked in real estate, with a portfolio currently valued at over $1B1. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

Need more information on exchange eligibility and how to become a partner?

We’re happy to answer your questions! Call CVC today to learn more. Get Started

Gary Rauscher, President of Canyon View Capital

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.