Taxes are one of life’s few certainties, and capital gains taxes, especially on real estate sales, can be among the most burdensome. Fortunately, many savvy investors turn to a popular tax-deferral tool: the 1031 exchange. This strategy allows investors to defer capital gains taxes on investment property sales, making it a valuable option in real estate.

However, like most things that offer significant benefits, the 1031 exchange comes with strict rules and regulations set by the IRS. One common question is whether there’s a “1031 exchange 5-year rule.” Thankfully, this is a case of mistaken identity. While no such rule exists, investors should know that the 1031 exchange process is still complex and governed by precise timelines and guidelines that must be followed carefully.

Is There a 1031 Exchange 5-Year Rule?

While there are several rules and regulations, investors can rest easy knowing there’s no such thing as a “1031 exchange 5-year rule.” This confusion likely stems from the five-year requirement for capital gains exclusions on primary residences unrelated to 1031 exchanges. However, many investors follow a standard guideline to hold a property for at least one to two years. While it’s not an official rule, this timeframe helps show the IRS that you’re not “flipping” the property and that it was meant for long-term investment, which is critical to qualifying for a 1031 exchange. That said, investors must still be mindful of the many rules governing 1031 exchanges. Despite the significant tax-deferral benefits, it’s essential to understand the process thoroughly before diving in. These exchanges come with strict guidelines, and following them is crucial for taking full advantage of this powerful tax tool.What 1031 Exchange Rules Are There?

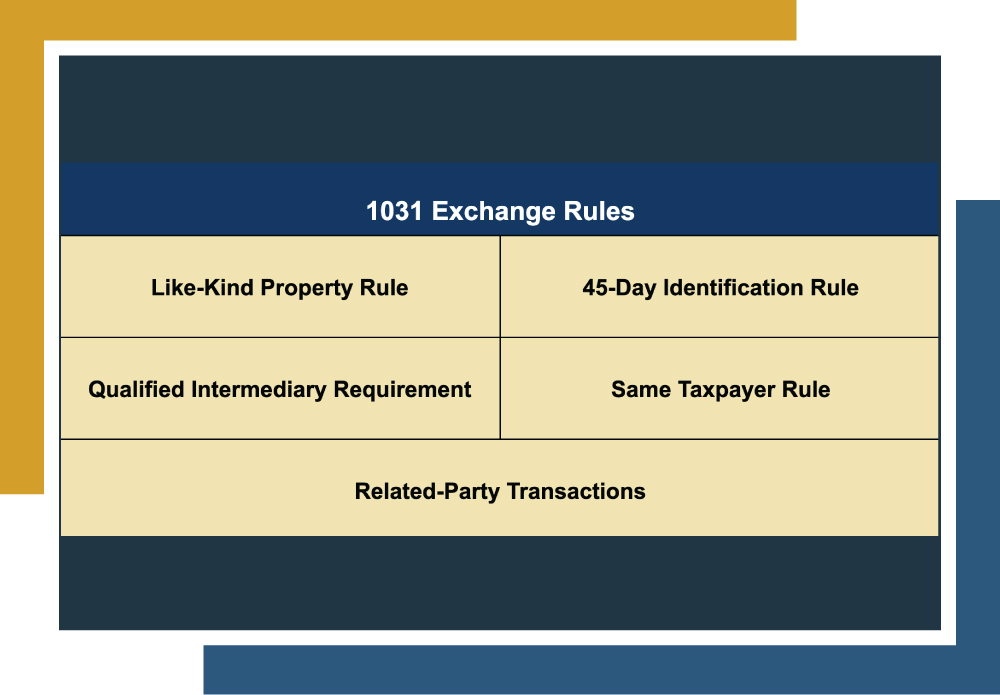

While there is no 5-year rule in a 1031 exchange, several important rules and regulations must be followed to ensure you qualify for the tax deferral. These rules are designed to keep the exchange compliant with IRS requirements. Here are the key rules:Like-Kind Property Rule

The properties involved in the exchange need to be “like-kind.” For real estate, this means both the property you’re selling and the one you’re buying must be for business or investment purposes. The good news? The real estate types can vary, so you could swap an apartment building for raw land if it has similar purposes.45-Day Identification Rule

After selling your property, you have 45 days to identify potential replacement properties. Just submit this list in writing to a qualified intermediary, and you can list up to three properties (or more, depending on certain conditions). This keeps the process moving smoothly.180-Day Exchange Rule

You have 180 days from the sale of your original property to finalize the purchase of your replacement. This includes the 45-day identification period, so the clock starts ticking right after your sale. It’s helpful to keep this timeline in mind as you plan.Qualified Intermediary Requirement

A 1031 exchange requires the help of a third-party intermediary to handle the transaction. You won’t touch the proceeds from your sale; instead, the intermediary holds them safely until you’re ready to purchase your new property. This keeps everything above board with the IRS.Same Taxpayer Rule

The person or entity selling the original property has to be the same one buying the replacement property. This ensures that you’re the one deferring your capital gains tax.Related-Party Transactions

The IRS has stricter rules if you’re exchanging properties with a related party (like family members or a business partner). For example, both parties must hold onto their properties for at least two years. If either party sells within that time, the exchange might not qualify, and taxes could come due. Sticking to these rules will keep your 1031 exchange on track and avoid any hassles later. While many requirements exist, the process doesn’t have to be stressful. Canyon View Capital could help make the whole thing smoother for you, taking some of the worry out of the equation!Canyon View Capital Makes 1031 Exchanges Easy

While there isn’t a 1031 exchange 5-year rule, you now know that there are many requirements that you need to adhere to and consider before taking on a 1031 exchange. These requirements can make 1031 exchanges challenging, especially given the tight identification windows. At CVC, we’re passionate about real estate, and that dedication has helped us build an extensive portfolio of multifamily properties across the Midsouth and Midwest. For accredited investors, we offer an easier path through the 1031 exchange process by allowing you to exchange into one of our available properties as Tenants in Common. This means you can worry less about those strict identification and closing windows. In addition, you’ll enjoy the benefits of passive real estate investing as we handle the property management for you—no effort is needed on your part! For over 40 years, the principals at Canyon View Capital have worked in real estate, with a portfolio currently valued at over $1B1. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.11$1B figure based on the aggregate value of all CVC-managed real estate investments as valued on March 31, 2023.

Gary Rauscher, President of Canyon View Capital

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.