How to Convert 401k to a Real Estate Investment

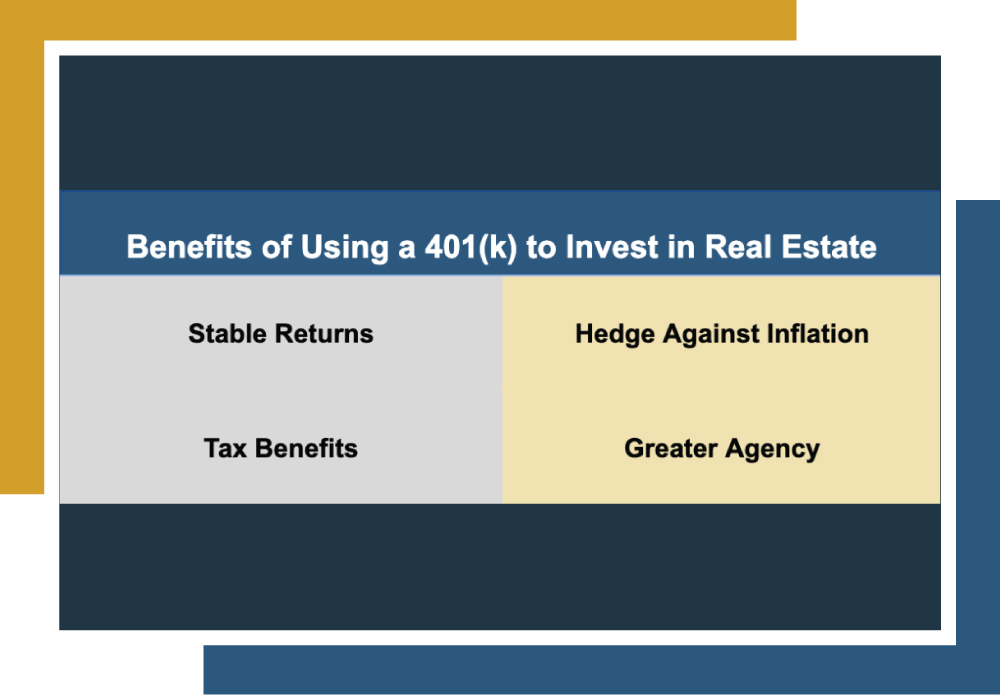

Employer-sponsored 401(k) plans have long been a popular retirement savings method. However, their appeal has waned due to factors like market volatility1, high fees and management costs2, changing employment patterns3, and their restrictive nature. As a result, many with funds tied up in 401(k)s are seeking alternative retirement savings options with greater flexibility and growth […]

Benefits of a Reit

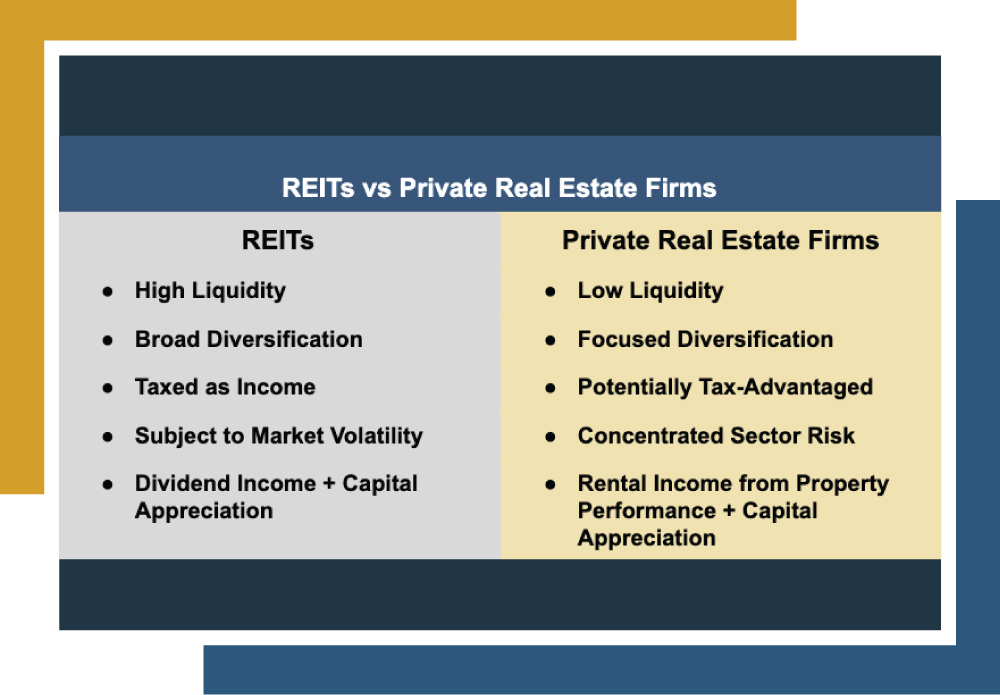

Real estate investing is a compelling alternative for investors looking to diversify beyond the traditional stock market and bonds. Among the various avenues within real estate, Real Estate Investment Trusts (REITs) stand out for their unique advantages. In this article, we will highlight the benefits of a REIT and compare them to our real estate […]

How to Use a 401k to Invest in Real Estate

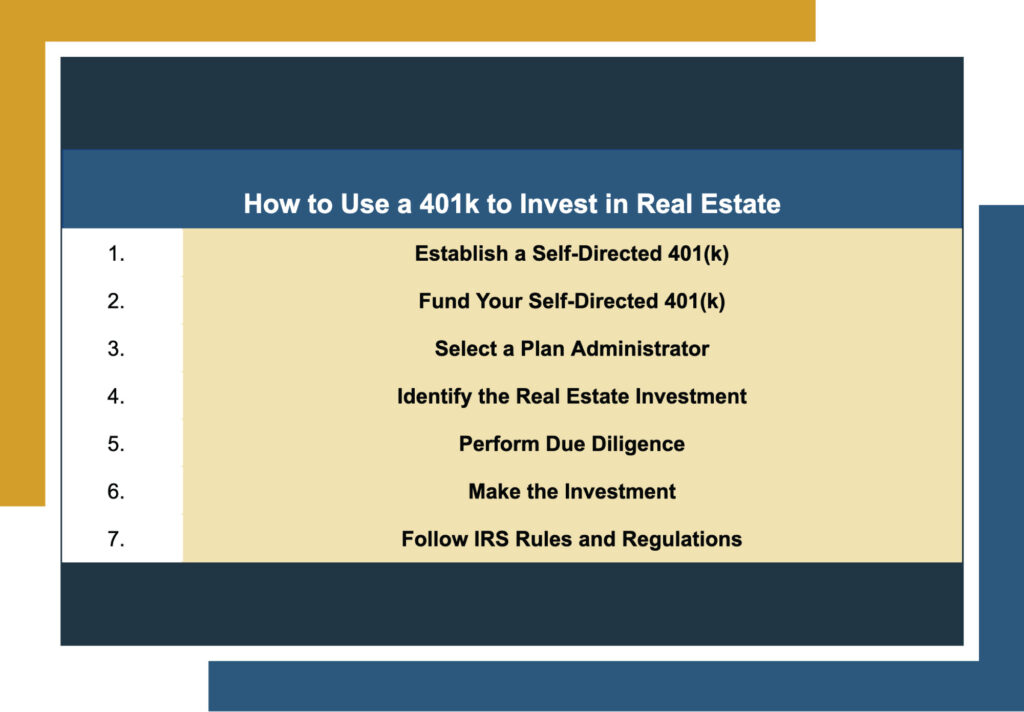

Real estate is a popular investment choice, but many investors have money locked in their 401(k) accounts, which don’t give much control over investments. The good news is that it’s doable, but you need a specific type of account. If you’re wondering how to use a 401k to invest in real estate, our handy guide […]

Are 1031 Real Estate Investment Trusts Possible?

Astute investors increasingly leverage a powerful tax deferral strategy known as the 1031 exchange. This provision, found in section 1031 of the Internal Revenue Code, enables real estate investors to defer their capital gains taxes when selling an investment property as long as they reinvest the proceeds into a like-kind replacement property. Yet, many investors […]

Multifamily Investing 2024: What Investors Need to Know

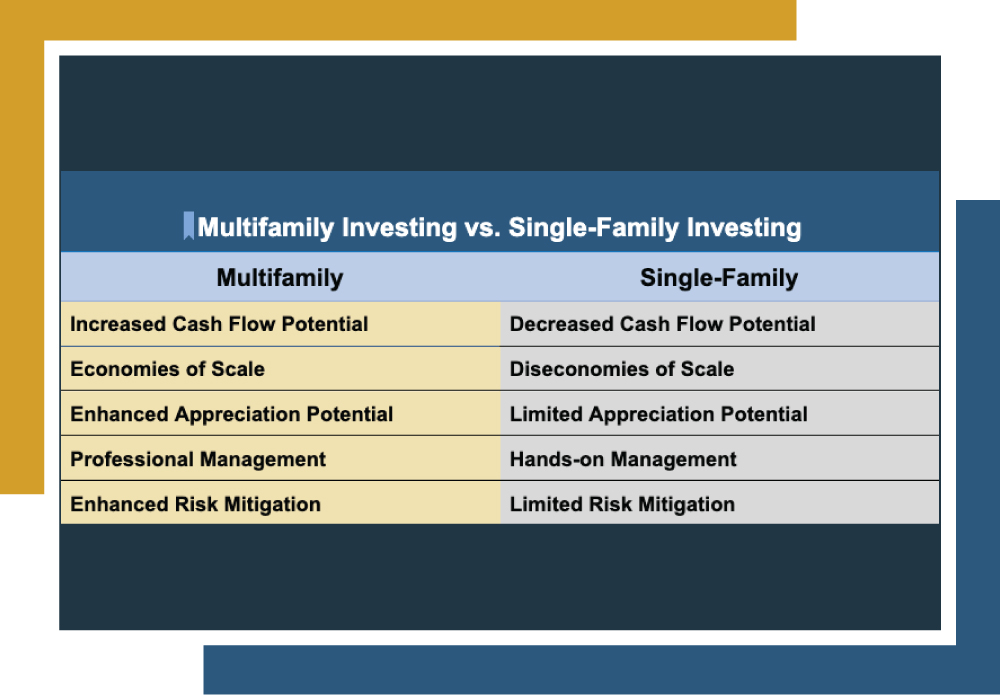

Whether you’re a seasoned investor or a newcomer testing the waters, you’re probably already aware of some of the benefits the real estate market can offer. It’s not uncommon for real estate investors to start with single-family properties. But what about another option? Multifamily real estate offers an exciting opportunity for investors of all backgrounds […]

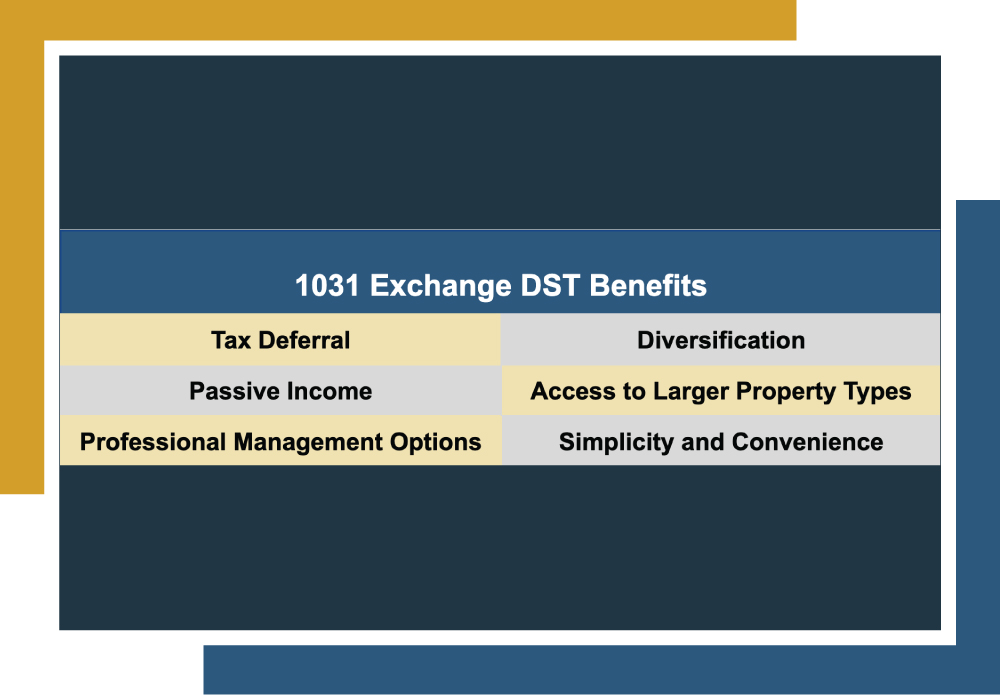

1031 Exchange DST Investments

1031 exchanges are unique tax deferral tools increasingly used by investors to maintain capital within their real estate portfolios. Instead of paying capital gains taxes on the sale of an investment property, investors can defer their tax burden and use the proceeds to acquire a replacement property. Navigating 1031 exchanges poses a challenge, particularly in […]

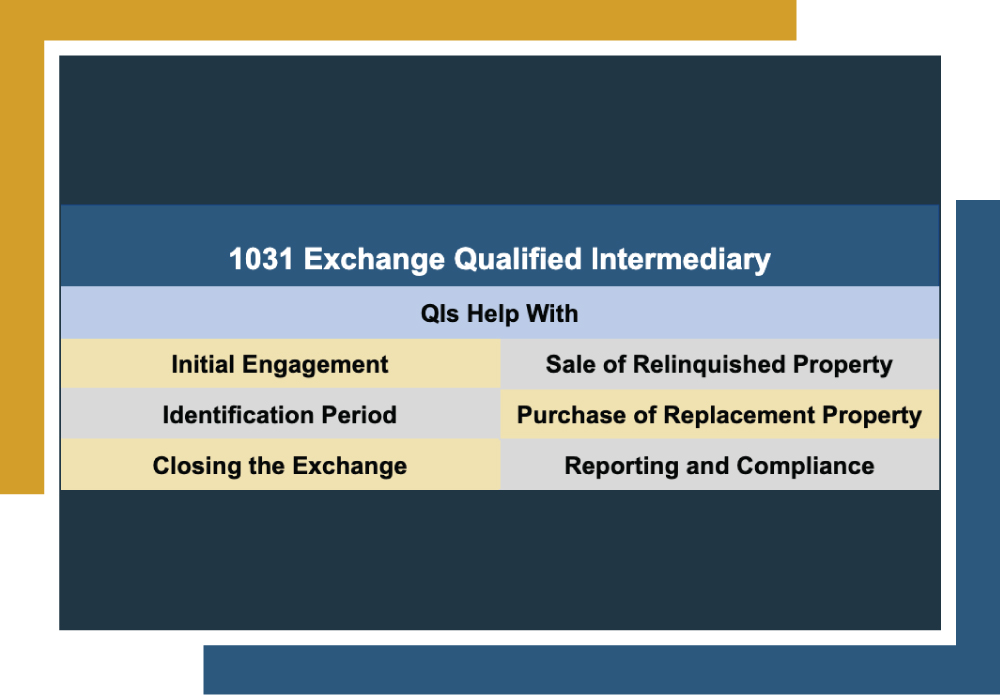

1031 Exchange Qualified Intermediary: What You Need to Know

A 1031 Exchange, as outlined by the IRS, is a unique tool that savvy investors can use to retain the full proceeds from selling an investment property within their portfolio. This is achieved by deferring their capital gains tax burden and exchanging into a replacement property. However, 1031 exchanges have strict rules and guidelines that […]

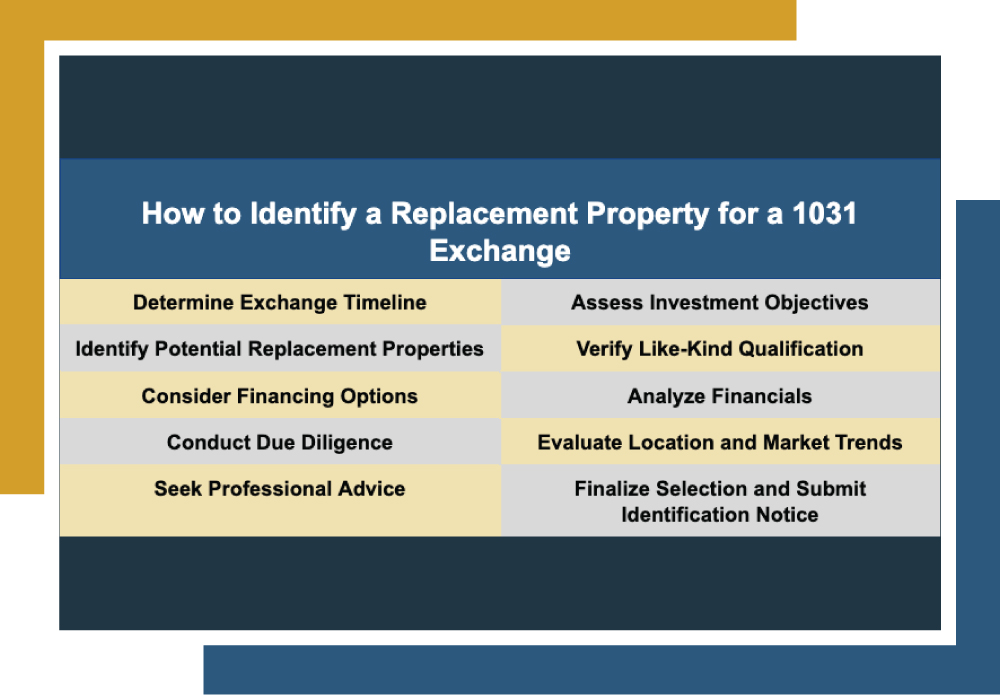

How to Identify a Replacement Property for a 1031 Exchange

1031 exchanges offer real estate investors a valuable opportunity to defer capital gains taxes when selling and replacing properties. By retaining the full proceeds from property sales, investors can maintain their portfolio and net worth intact. This helps sustain a robust real estate market by keeping funds within the industry rather than surrendering them to […]

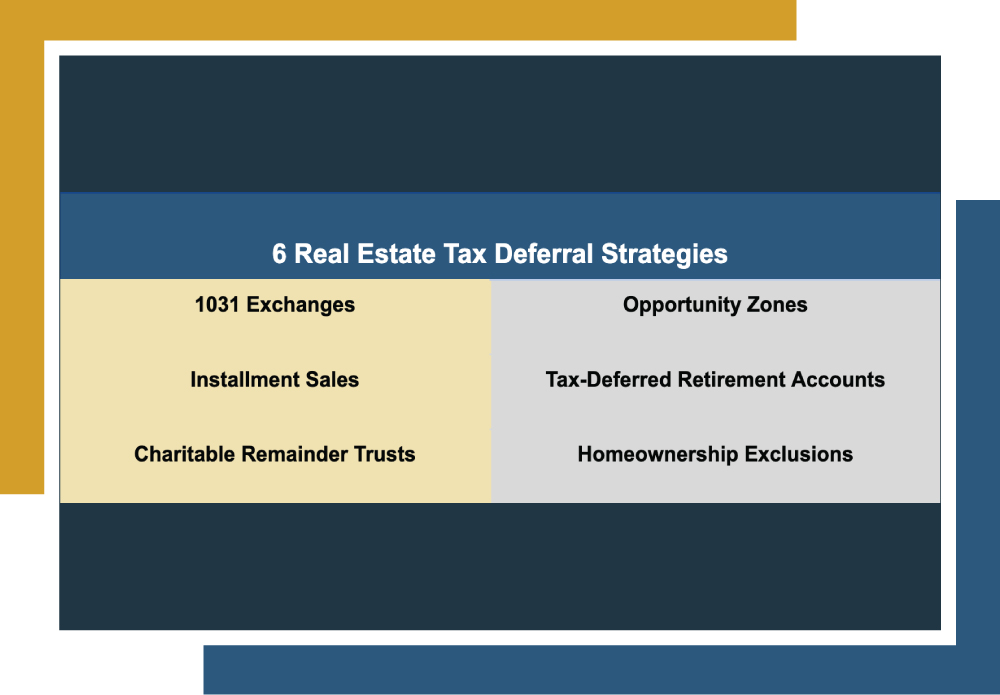

6 Real Estate Tax Deferral Strategies

In the realm of investing, individuals constantly seek methods to enhance their portfolios and safeguard their capital. However, a common obstacle to this goal comes in the form of taxes, as the IRS typically claims a portion of all transactions. Real estate is no different. However, savvy investors know how to utilize various methods that […]

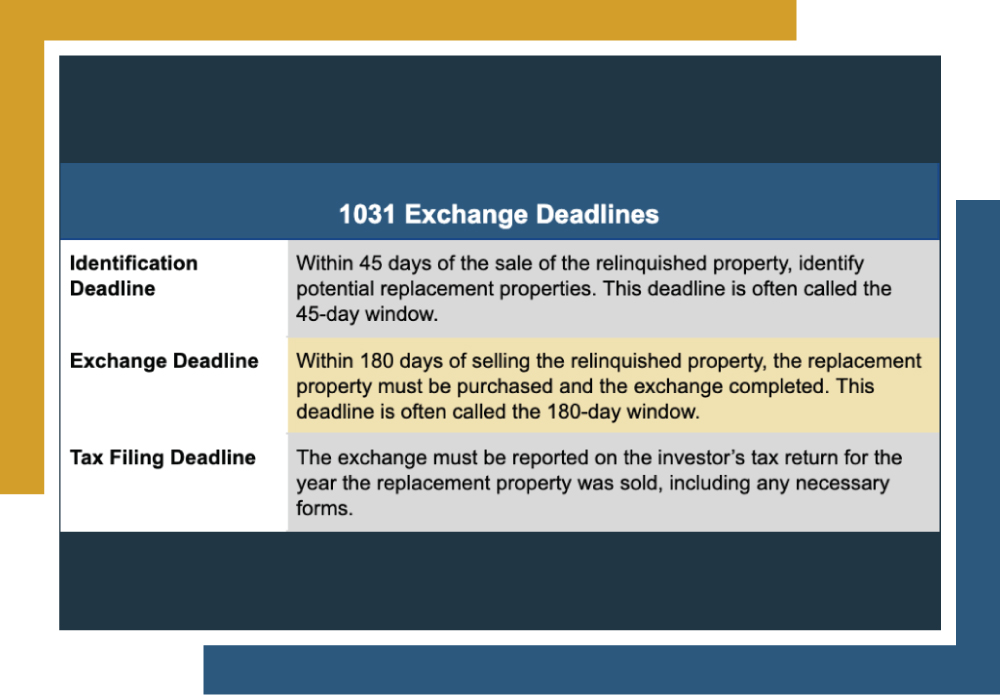

1031 Exchange Deadlines

When it comes to real estate investing, astute investors often seek ways to amplify profits while reducing tax liabilities. When contemplating selling properties to venture into fresh opportunities or alleviate managerial responsibilities, the 1031 exchange is a popular option. This IRS-code section allows the deferral of capital gains taxes, enabling investors to transfer tax basis […]