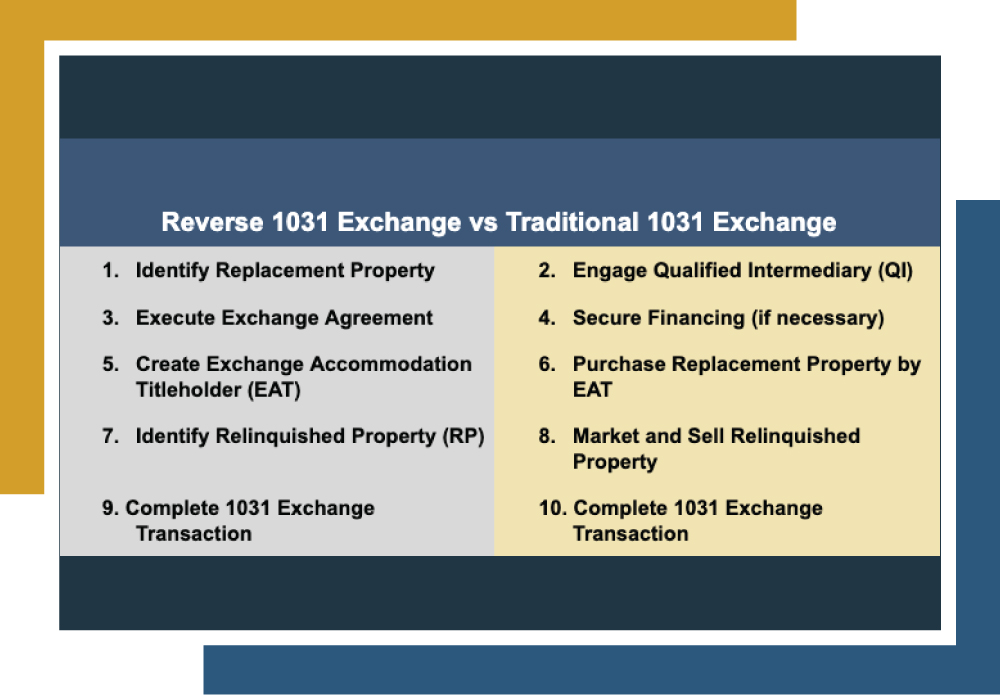

Reverse 1031 Exchange Timeline

1031 exchanges are powerful tax deferral tools that allow investors to negate their capital gains tax liability, letting them keep all the proceeds from the sale of an investment property in their investment portfolio. The rigidity and strict timelines of traditional 1031 exchanges to ensure their validity can pose challenges. However, the reverse 1031 exchange […]

Reverse 1031 Exchange Rules

The old axiom that nothing in life is guaranteed other than “death and taxes” typically rings true. Nevertheless, a growing number of real estate investors are discovering that the certainty of taxes on specific transactions may not be as guaranteed as previously believed. Utilizing the 1031 exchange, investors can defer taxes on investment property sales […]

1031 Exchange TIC: An Overview

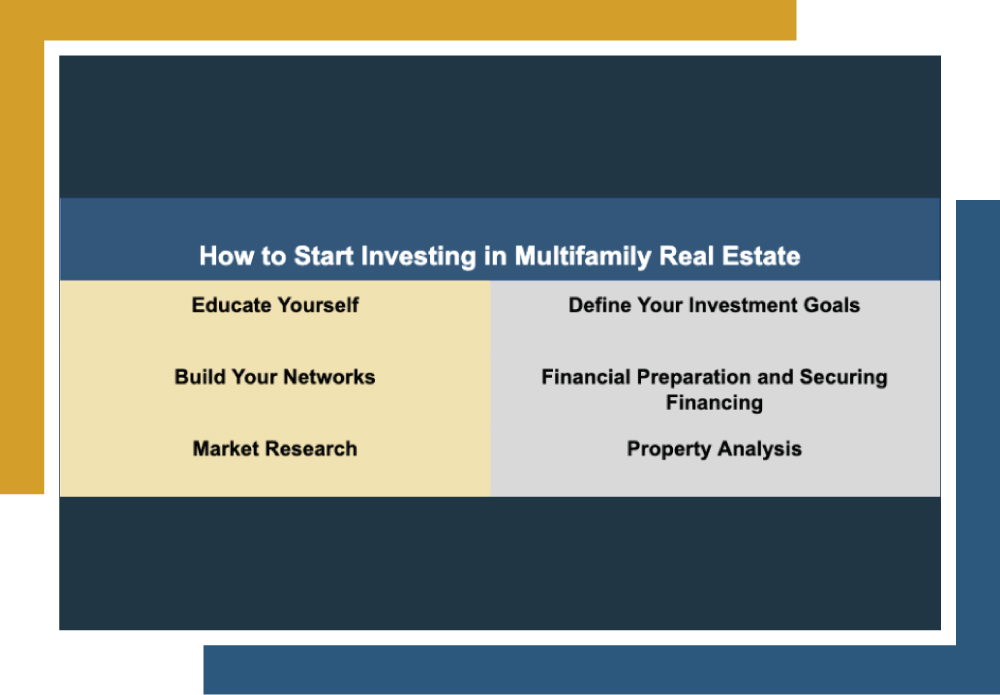

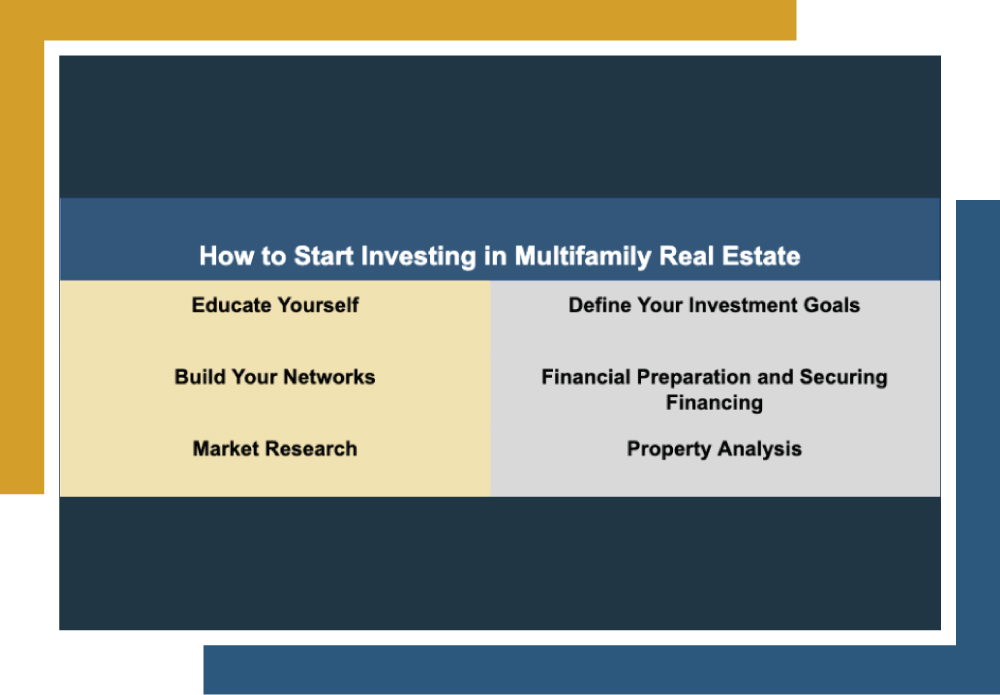

In real estate investing, savvy investors seek strategies to maximize returns and minimize taxes. When considering selling properties to explore new opportunities or lighten management burdens, the 1031 exchange stands out. This IRS-code section allows the deferral of capital gains taxes, enabling investors to transfer tax basis and defer gains from one property into another. […]

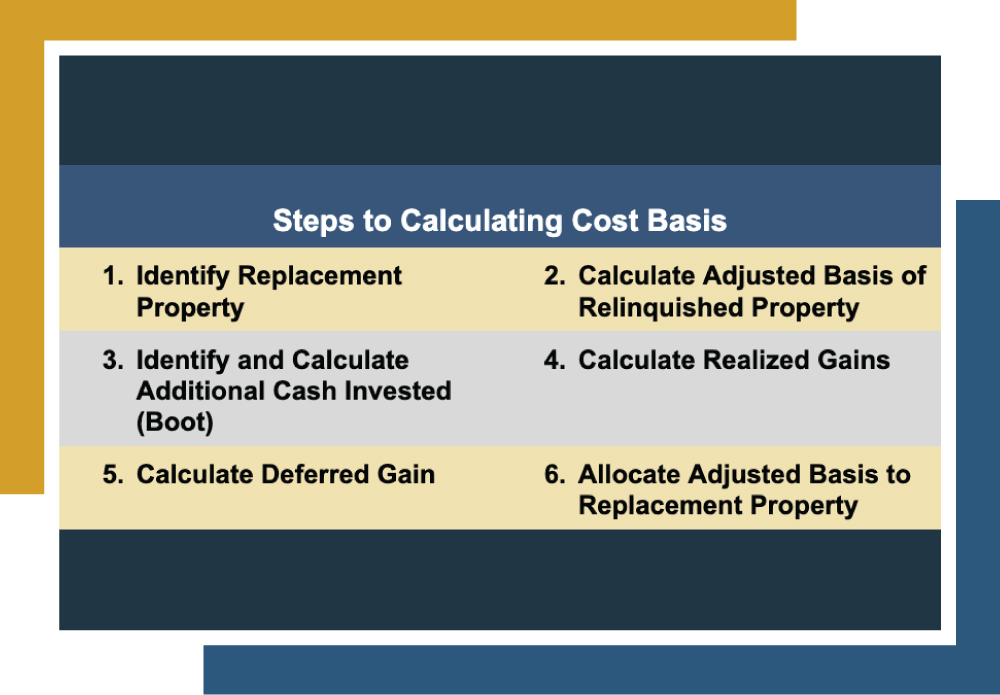

How to Calculate Cost Basis After a 1031 Exchange

Imagine you’ve been overseeing an investment property for a specific duration. Perhaps the property has experienced appreciation, prompting you to consider selling for a profit. Or maybe you’re contemplating a shift to a different investment opportunity for many reasons. Either way, when you sell an investment property, you will typically expect to owe capital gains […]

How to Become an Accredited Investor

When it comes to investing, access to investment opportunities is not a uniform experience. There are a variety of investments that require investors to be “accredited investors.” This is due to the U.S. Securities and Exchange Commission (SEC)’s restrictions. Some of the investment options that many investors may find enticing, such as private real estate […]

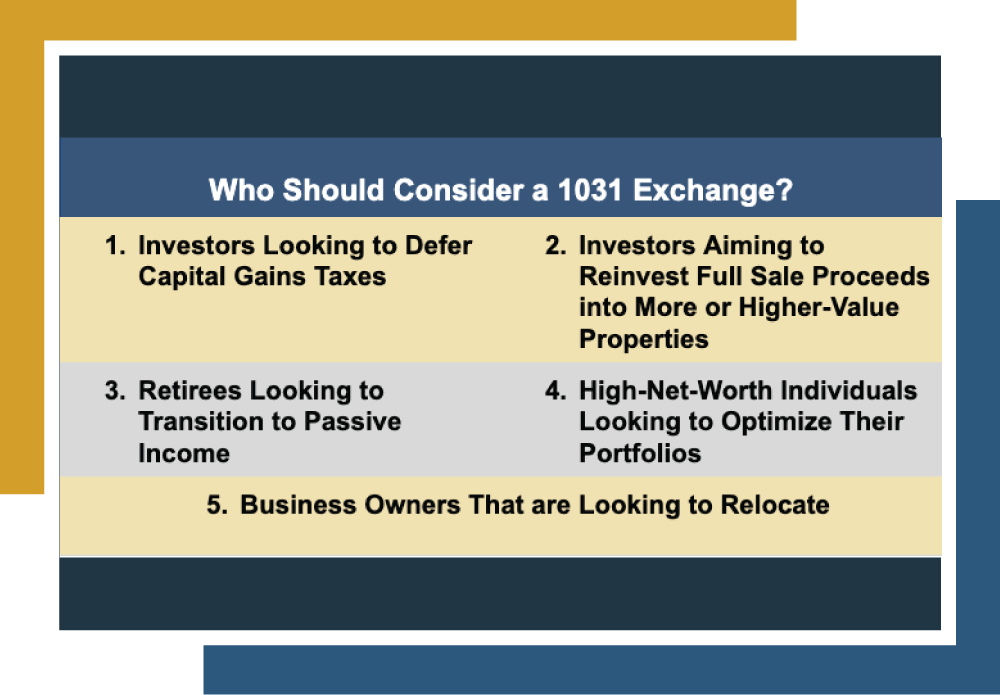

Is a 1031 Exchange Worth It?

If you’ve owned or sold real estate properties, chances are you’re aware of the inevitable capital gains tax liability that awaits you at the end of a transaction. But consider this: What if there were a way to avoid parting with significant funds in the form of capital gains taxes payable to the IRS? That’s […]

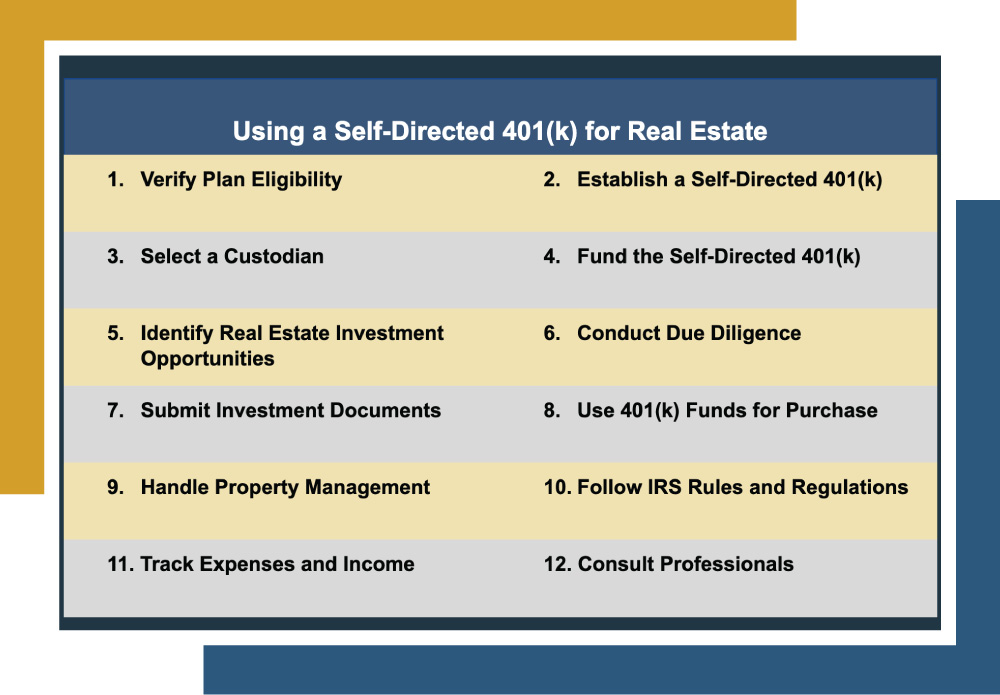

Can I Use 401k to Invest in Real Estate

Many Americans have traditionally leaned on personal retirement savings accounts such as 401(k)s as an investment in their future. However, some concerns are associated with them compared to other investment options, such as: Limited investment control Fees and expenses Market volatility Others are enjoying some of the potential benefits of real estate, such as: Appreciation […]

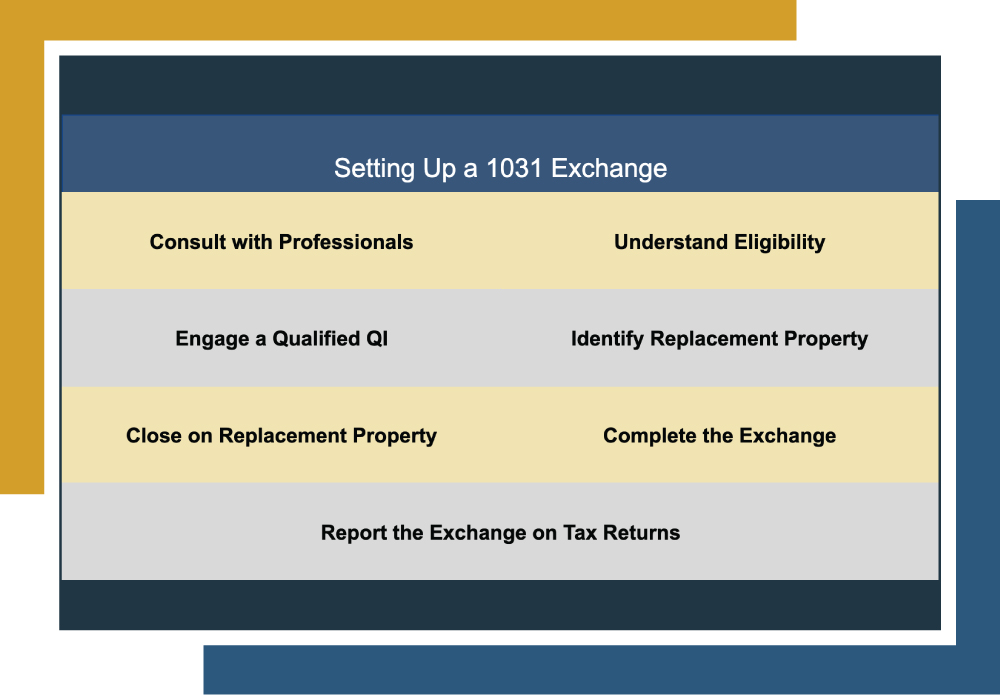

How to Set Up a 1031 Exchange

It’s probably not a controversial statement to say that many investors enjoy having real estate properties in their investment portfolio due to the many potential benefits of this asset class. However, just like any investment vehicle, there are caveats. One of the potential hangups with real estate investing is its potential tax burdens, such as […]

Self-Directed Ira Real Estate Rental Income

Investors have traditionally leaned on personal savings accounts such as 401(k)s and IRAs to save for the future. However, some concerns are associated with them compared to other investment options, such as limited investment control, fees and expenses, and market volatility. That’s why many investors are turning to alternative investment options like real estate to […]

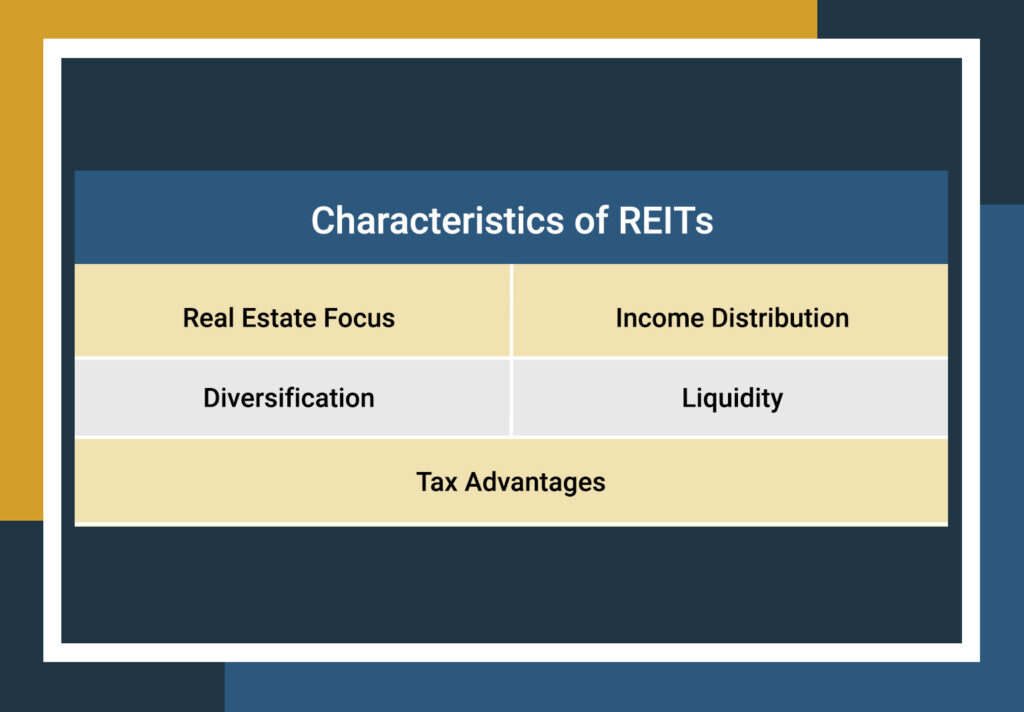

Do REITs Qualify for a 1031 Exchange?

Investors often include real estate in their portfolios for its potential benefits. Real Estate Investment Trusts (REITs) are popular among various real estate investment options. Whether investors choose direct real estate or REITs, many consider using 1031 exchanges to defer capital gains taxes when selling investment properties. Are you considering a 1031 exchange and wondering, […]