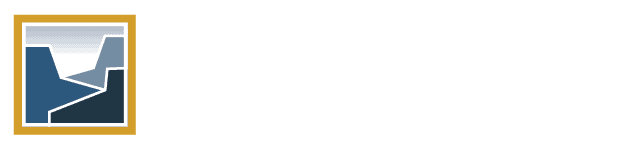

Capital Gains 1031 Exchange

Investors who manage investment real estate know just how much of a nuisance capital gains taxes can be. Should you part ways with an investment property and proceed with its sale, be prepared to owe the IRS a substantial portion, often upwards of 28% of the sale profits—an exorbitant figure by any measure. While you […]

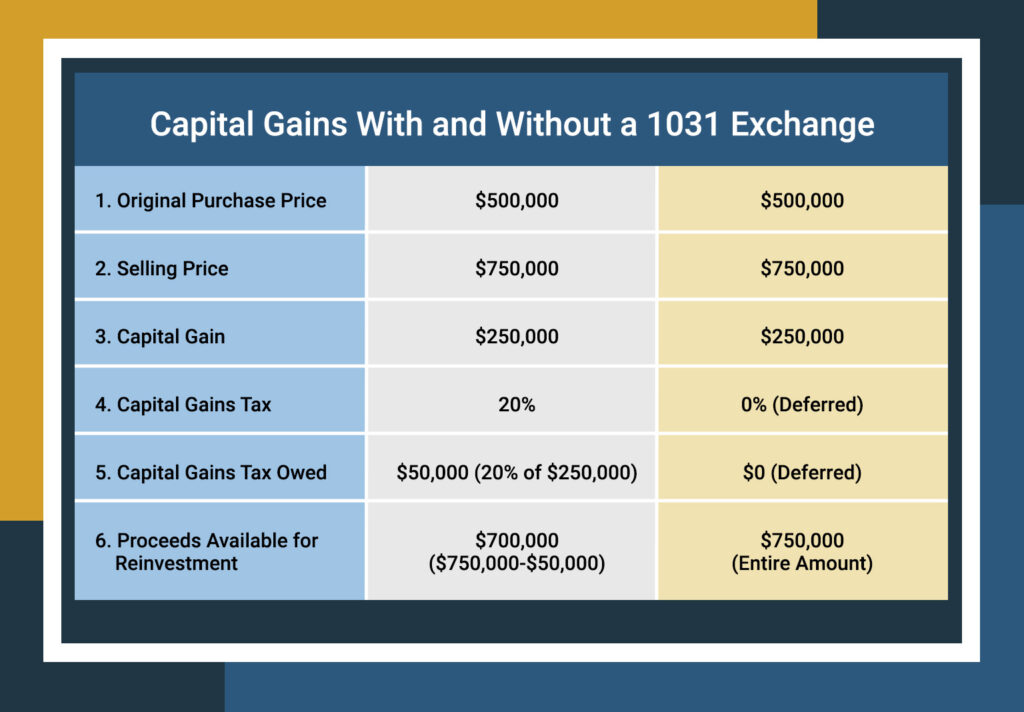

Self-Directed IRA Real Estate Rules

For some, saving money in a retirement account or investing in traditional assets like stocks and bonds has lost its appeal. For these investors, the benefits of alternative investments, such as real estate, may lure them into diversifying their funds in these unconventional avenues. But while Individual Retirement Accounts (IRAs) have many advantages, they come […]

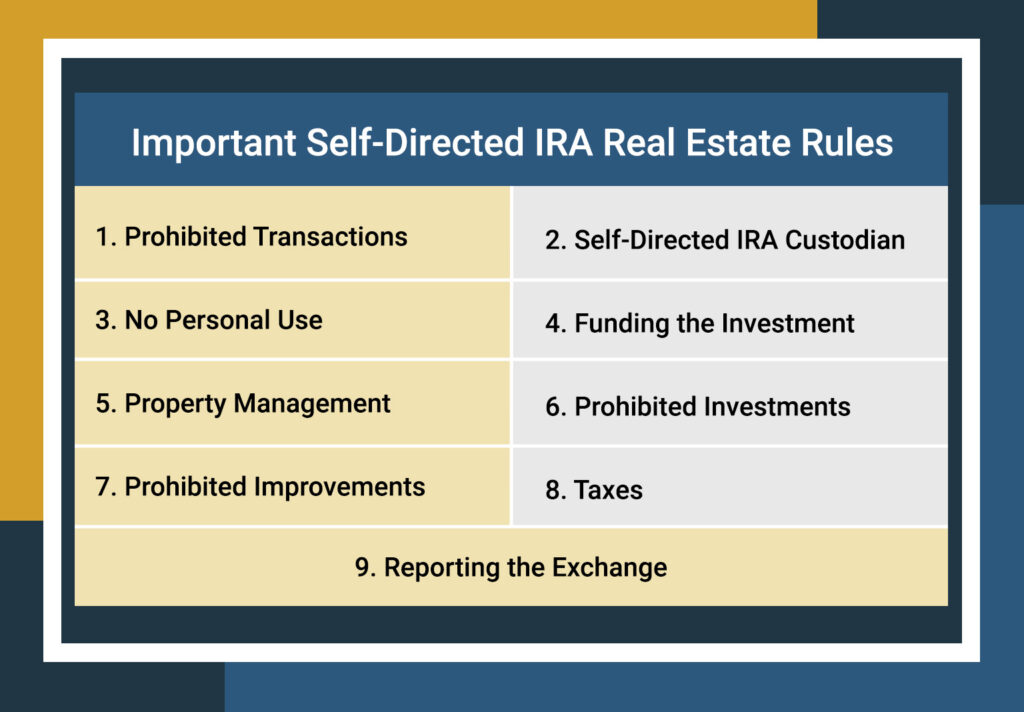

What Are the 1031 Exchange Rules for Commercial Property?

Are you an investor who is considering the sale of a commercial property and seeking strategies to optimize your returns? The 1031 exchange, also known as a like-kind exchange, might be the ideal solution. This tax-deferral tool allows investors to exchange one investment property for another, or even multiple properties, and reinvest the proceeds without […]

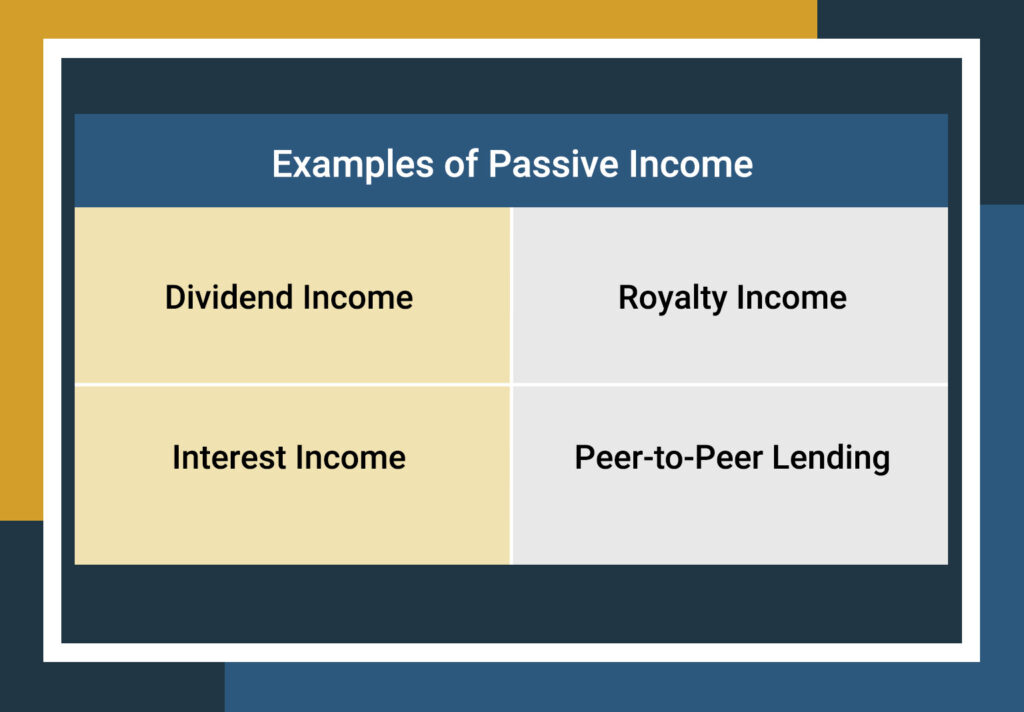

Do You Have to Pay Taxes on Passive Income?

Active investment avenues demand vigilant monitoring, and not everyone has the time or skills for this level of involvement. Investors are keen to diversify their portfolios with real estate, and it is easy to see why: passive income. Learn more about passive income, taxes on passive income, and deductions so that you can choose your […]

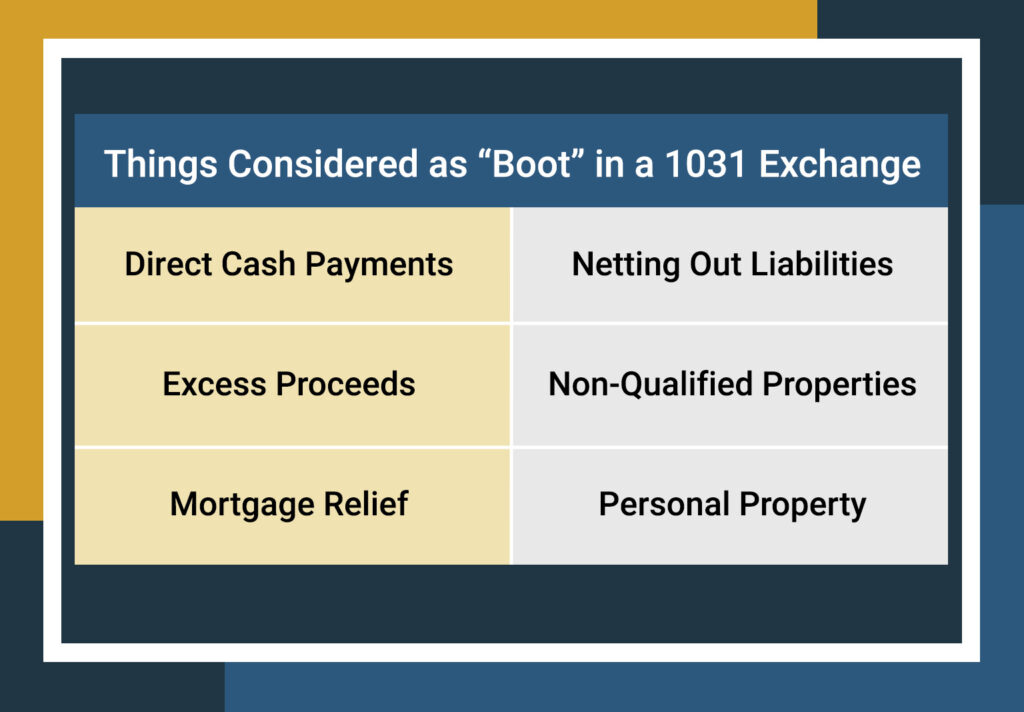

What is a Like-Kind Exchange Boot?

For real estate investors, 1031 exchanges have become a steadfast way to maximize profits and limit their capital gains tax liability. It’s not hard to see the appeal as deferring capital gains taxes on the sale of an investment property increases the investor’s purchasing power. However, 1031 exchanges are complex beasts that the IRS heavily […]

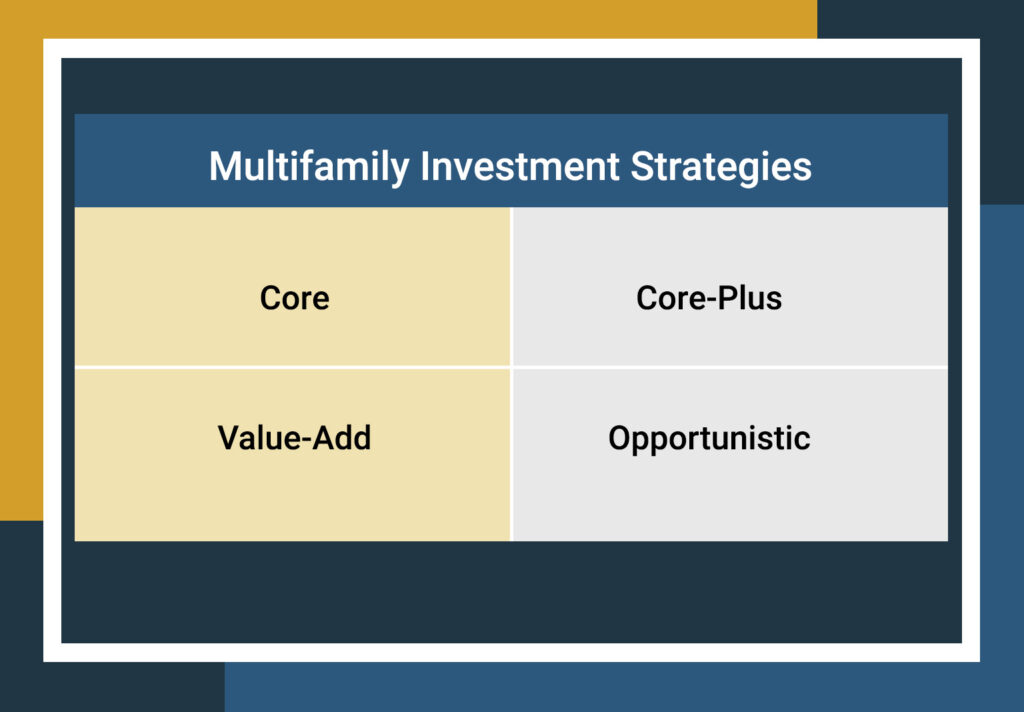

What Is a Good Multifamily Investment Strategy?

Investors are always on the lookout for the next game-changing addition to enhance their investment strategy. On this quest, many explore alternative investment avenues, with real estate often standing out as a compelling choice. Like in any investment landscape, real estate features distinctive sectors, such as multifamily investing, which possess inherent advantages that consistently captivate […]

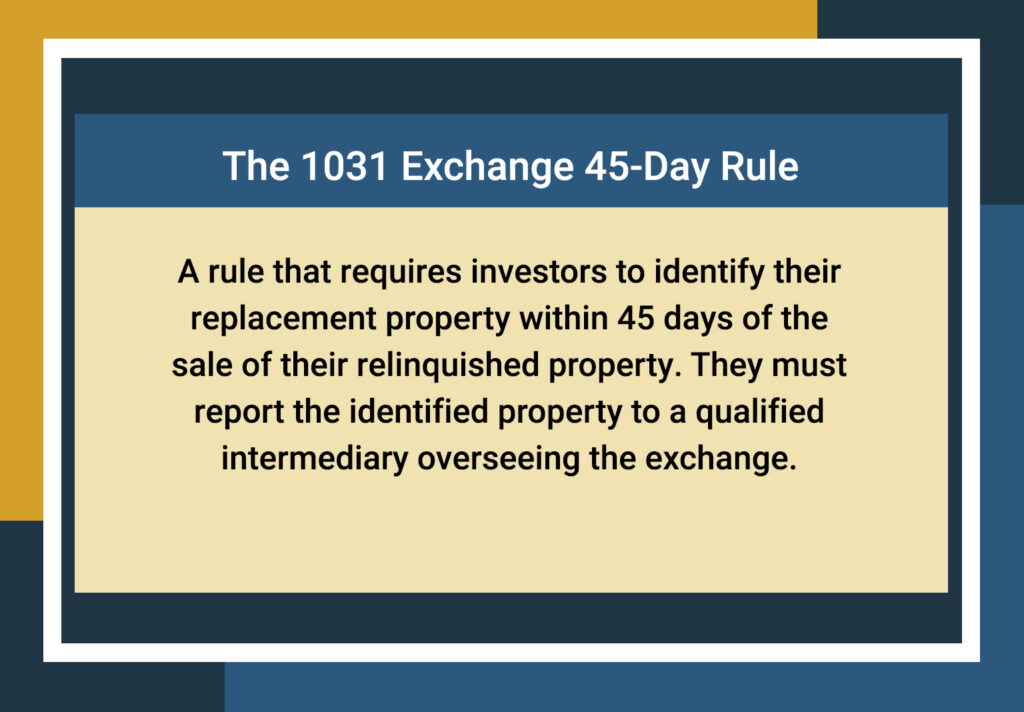

The 1031 Exchange 45-Day Rule Extension

Real estate investors are increasingly leveraging the advantages of 1031 exchanges. A 1031 exchange is a potent tax-deferral strategy that enables investors to postpone capital gains tax obligations following the sale of an investment property by swapping their relinquished asset for a new one. Often, adhering to strict timeframes is challenging during a 1031 exchange. […]

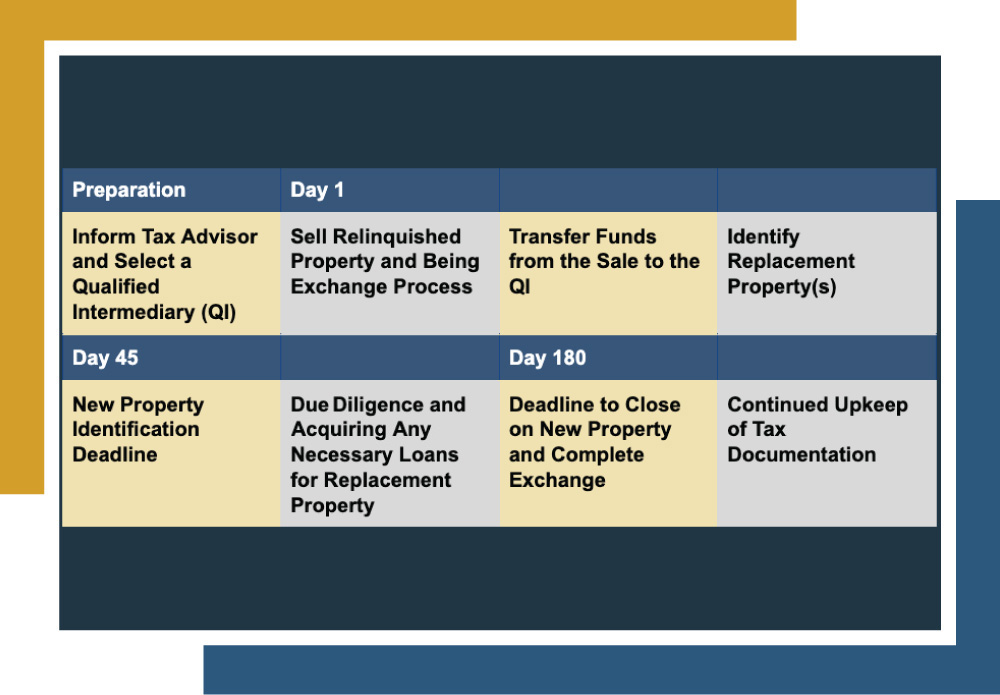

The 1031 Exchange Timeline: A Roadmap for Investors

Real estate investors often contemplate property sales for various reasons, including relocation, upgrading, or divesting underperforming assets while grappling with tax complexities. Investors increasingly recognize the value of 1031 exchanges, a tax-deferral tool. These exchanges enable the sale of investment properties without the burden of capital gains taxes, potentially saving up to 30% of the […]

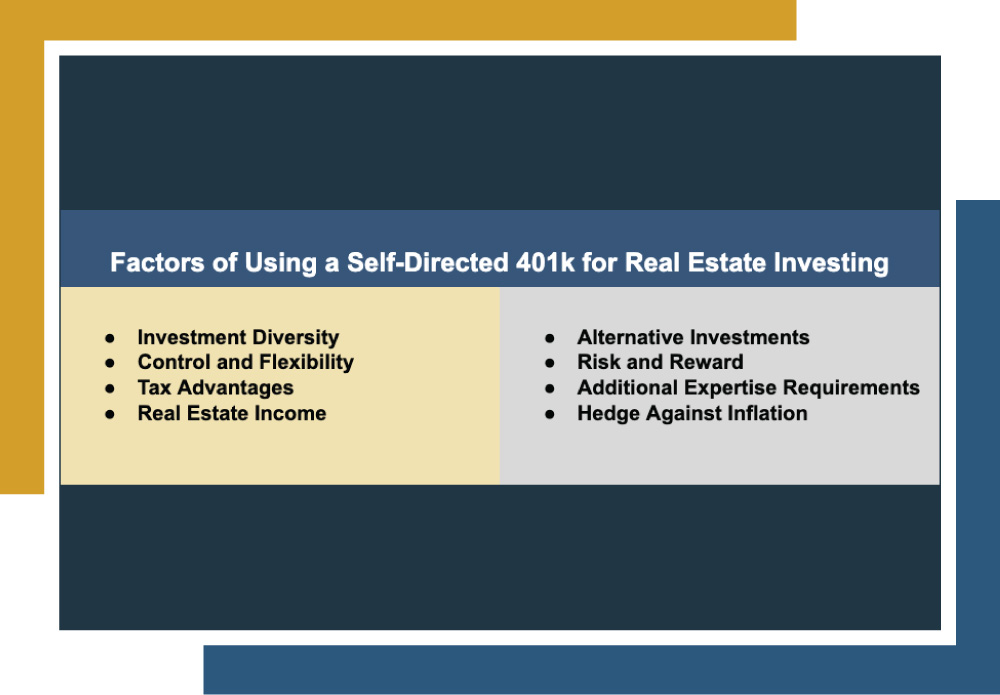

Self-Directed 401k Real Estate: Benefits of Going Solo

401(k)s have been historically popular options for investors seeking to save for the future. These employer-sponsored retirement plans offer many advantages that have solidified their position as an investment vehicle. However, a potential downside of 401(k)s is their restrictive nature regarding specific investment options. In recent years, some investors have sought alternative investment strategies, such […]

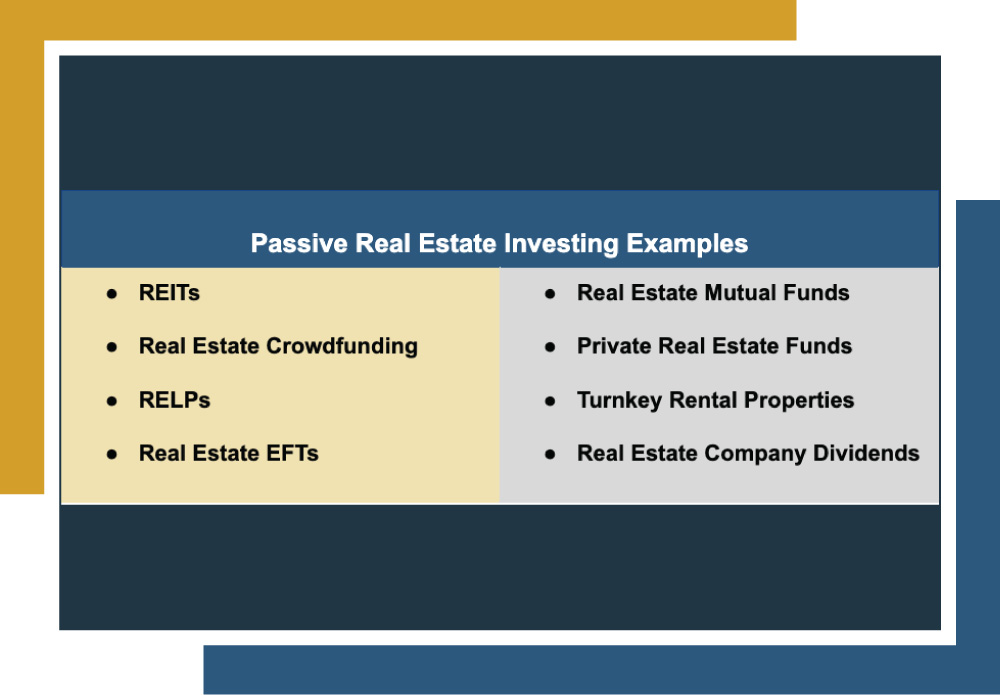

Passive Real Estate Investing Examples: Getting Started

In the ever-evolving landscape of investing, savvy investors constantly look for ways to grow their portfolios while minimizing their hands-on involvement. One path that many investors have become enticed by is real estate investing. However, like any investment, real estate often requires significant hands-on time, and there are many investing strategies to choose from. Also, […]