Investing in Real Estate vs 401k: Considering Your Options

Investors are always looking for ways to strengthen their investment portfolios, whether by diversifying into new investment vehicles or fortifying their current holdings. The overarching aim of investing is to bolster the financial reserves earmarked for the future. While 401(k)s have traditionally served as a tax-advantaged retirement savings option, some investors may find that relying […]

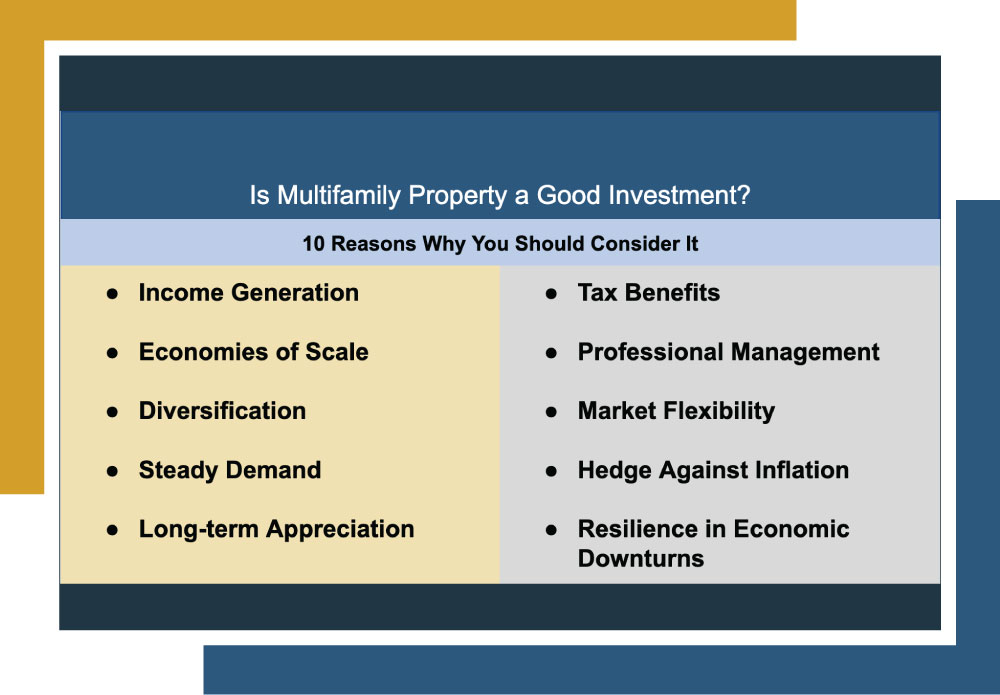

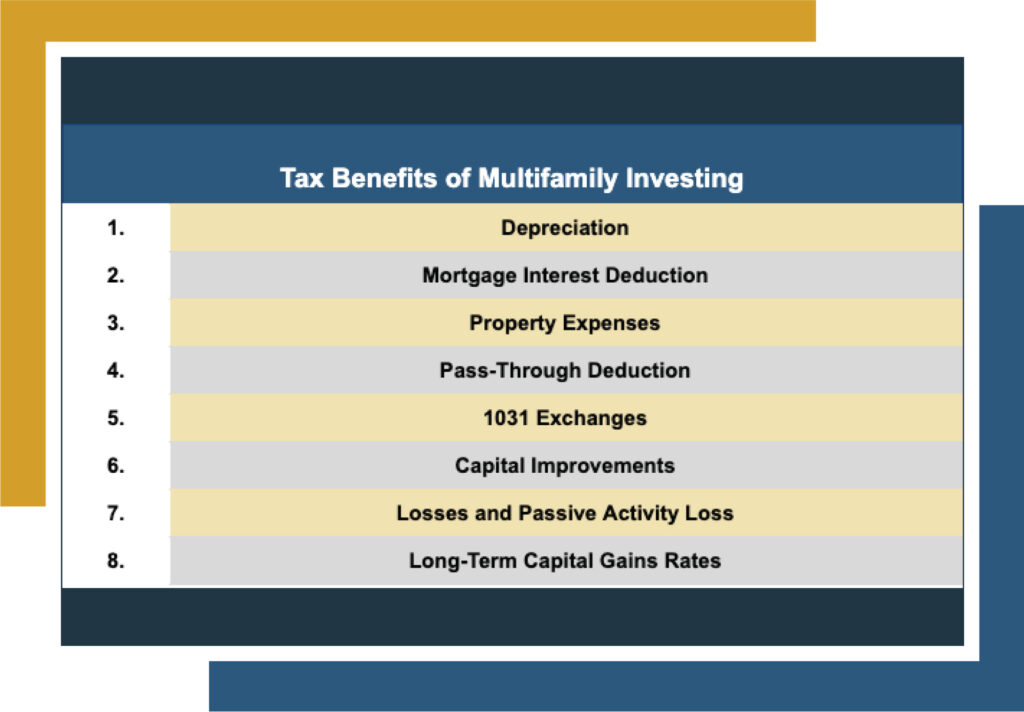

Is Multifamily Property a Good Investment?: 10 Reasons Why You Should Consider It

Real estate is an alternative investment avenue that some investors have turned to for various reasons. Whether it’s property appreciation, a source of consistent cash flow, hedging against inflation, tax advantages, or portfolio diversification, real estate offers many potential benefits for investors of all experience levels. In this article, we’ll discuss multifamily real estate investing, […]

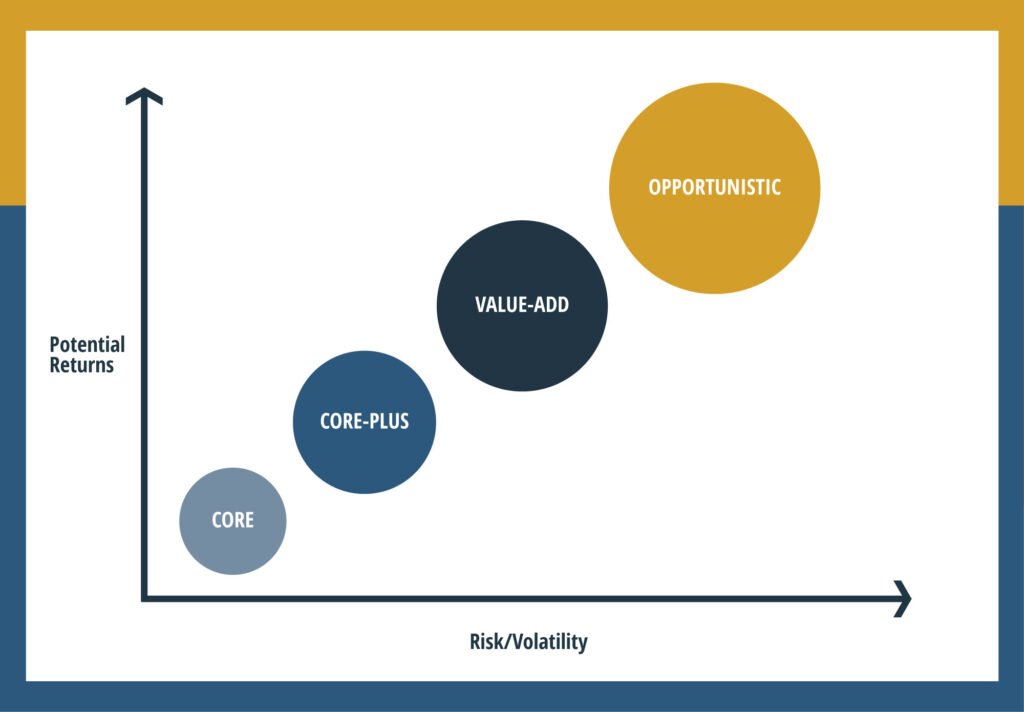

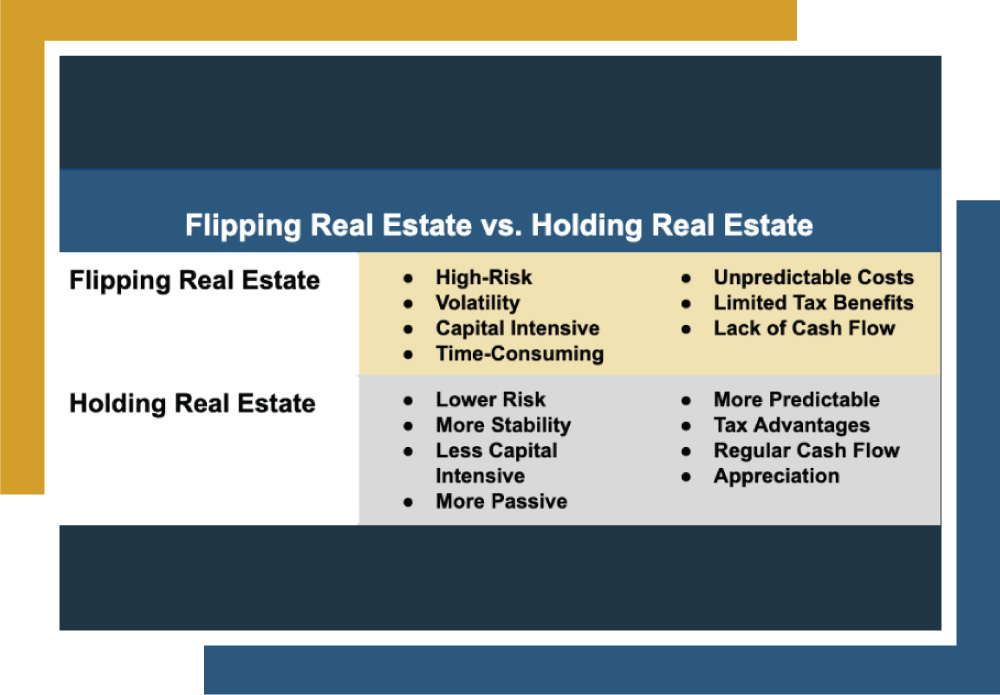

Different Types of Real Estate Investing Strategies

Many savvy investors have become privy to the idea of utilizing real estate as an investment vehicle in their portfolio. Like any investment, it is an ever-evolving landscape of opportunities that requires a nuanced understanding of the various strategies and approaches to investing. In this article, I will delve into the different types of real […]

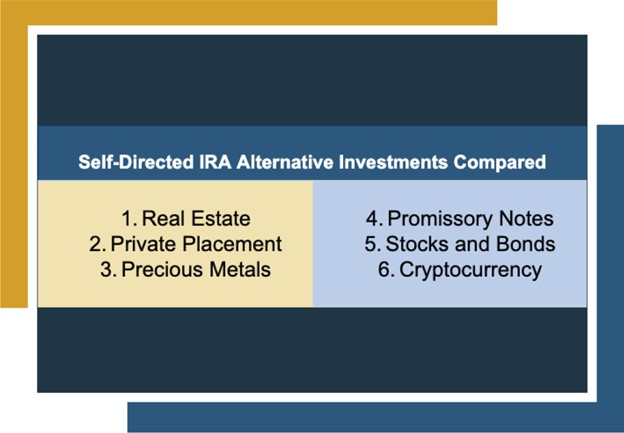

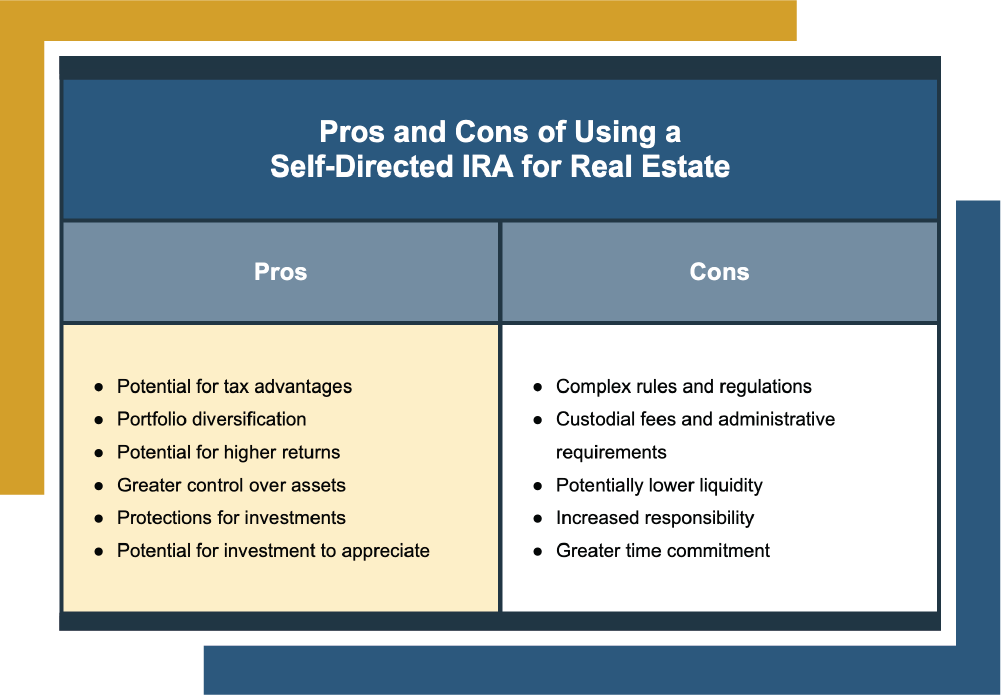

Self-Directed IRA Alternative Investments: Information for Investors

Investors seeking more agency over where their money is invested often turn to self-directed IRAs. These IRAs offer significantly more investment control and diverse investment vehicles than other IRA types, benefiting individuals who want a more comprehensive array of investment options. Broadly speaking, self-directed IRAs have many factors that set them apart from other IRA […]

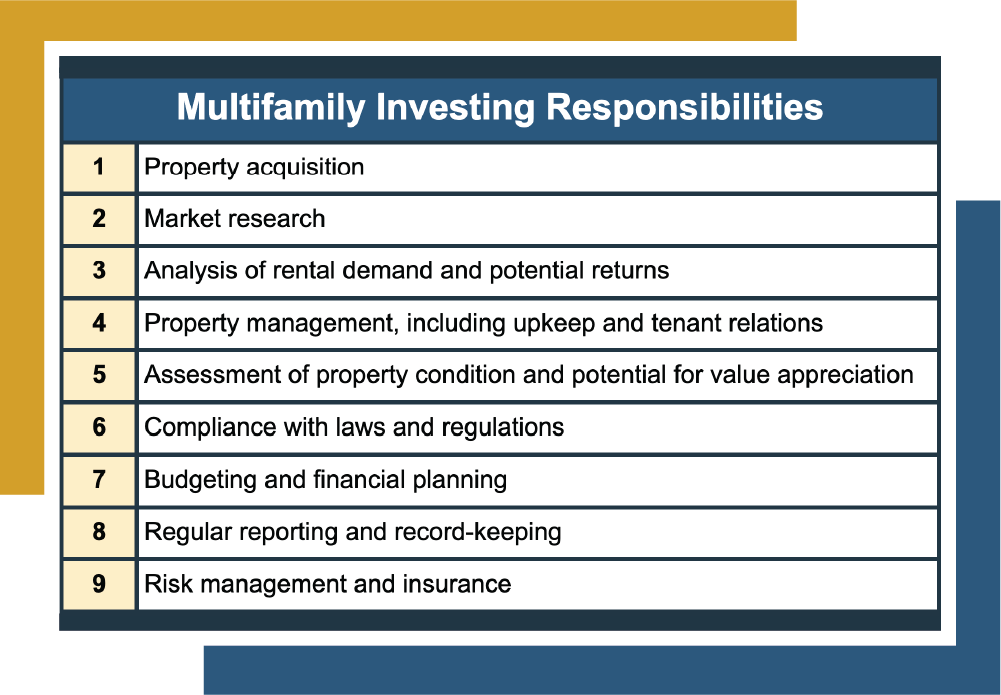

Multifamily Investing Criteria for Investors

![A table that positions the largest real estate regions [Midsouth, Midwest, East Coast, and West Coast] next to various criteria to consider when investing in real estate in said regions such as weather and environment, economic factors, cost of living, job market, and rental demand.](https://www.canyonviewcapital.com/wp-content/uploads/2023/09/Multi-family-investing-criteria-1024x712.jpg)

Multifamily investing has become an increasingly popular real estate investment option for investors over the last few years. From Jan. to Sep. 2022, multifamily investing accounted for $64.2 billion in investment volume1. Despite a ~30% decline in 2023, multifamily investing remains the largest recipient of capital in the real estate market, and some experts project […]

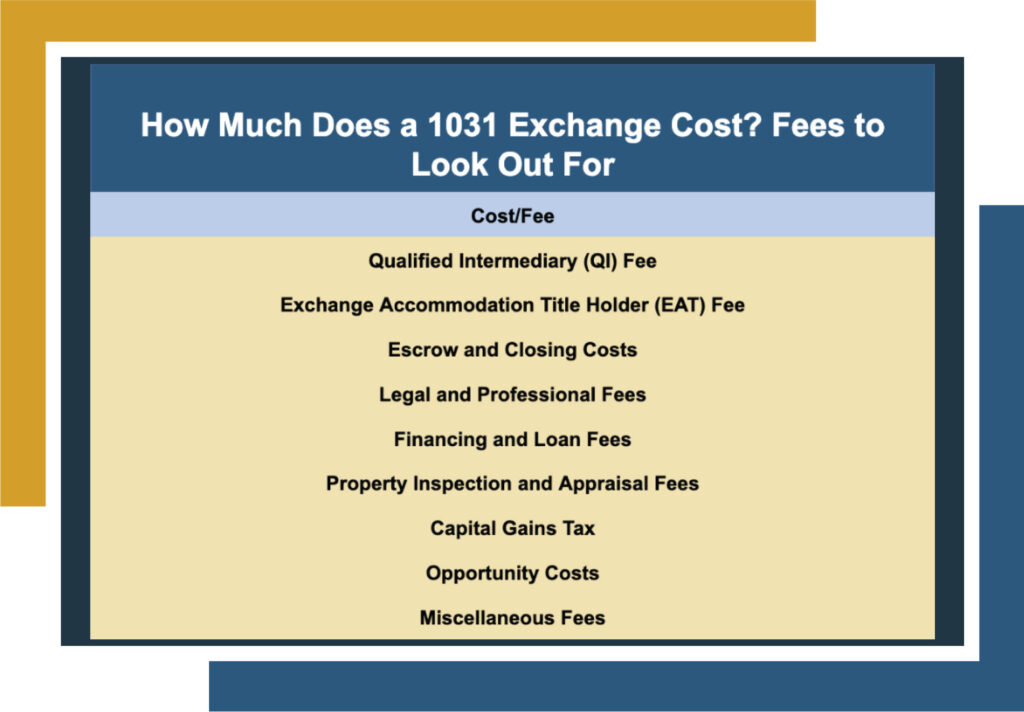

Best 1031 Exchange Investments for Investors: Pros and Cons of Each

At some point in their real estate journey, investors often contemplate a change from their current property. It could be due to the desire to reinvest in more promising areas, deal with troublesome property issues, or simply seek relief from the burdens of property management. Amidst the prospect of paying capital gains taxes upon selling […]

Self-Directed IRA for Flipping Real Estate: Is It a Good Idea?

In recent years, a common investment strategy called “house flipping” has captured the public eye. House flipping involves buying a cheap property that requires improvements, making those improvements to add value, and then selling the house at a higher price for profit. It may sound great on paper; however, if it were this simple to […]

Passive Multifamily Investing: Unlocking Truly Passive Cash Flow

Whether you’re a seasoned investor or just getting started, the idea of having a source of income that doesn’t require a significant time investment may be enticing. While real estate can be a hugely beneficial investment option, it often involves a lot of hands-on management that can be quite time-consuming. While multifamily investing is no […]

Self-Directed IRA Real Estate Pros and Cons for Investors

Individual retirement accounts (IRAs) have long been popular among investors seeking a straightforward approach to saving for retirement or investing in conventional assets like stocks and bonds. Yet, traditional IRAs have restrictions that can limit your investment options and narrow your financial ambitions. But there’s also a particular type of IRA that gives investors even […]

How Much Does a 1031 Exchange Cost?

Many investors decide to venture into real estate, as it can be very profitable. However, whatever the reason, sometimes you need to move on from a specific property. Unfortunately, you can expect to owe capital gains taxes when you sell an investment property. Many savvy investors realize that 1031 exchanges can be a massive boon […]