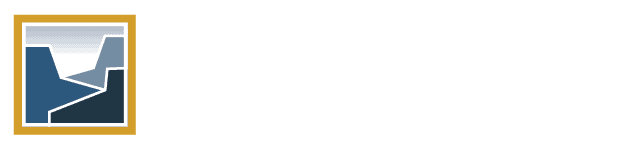

What Is Required for a 1031 Exchange to Be Valid? A Guide for Investors

If you plan on selling an investment property but are concerned about paying up to 30% of your sales proceeds as capital gains tax, a 1031 exchange may be the best solution. A 1031 exchange is a tool savvy investors use to defer the capital gains taxes on selling their investment properties. By taking the […]

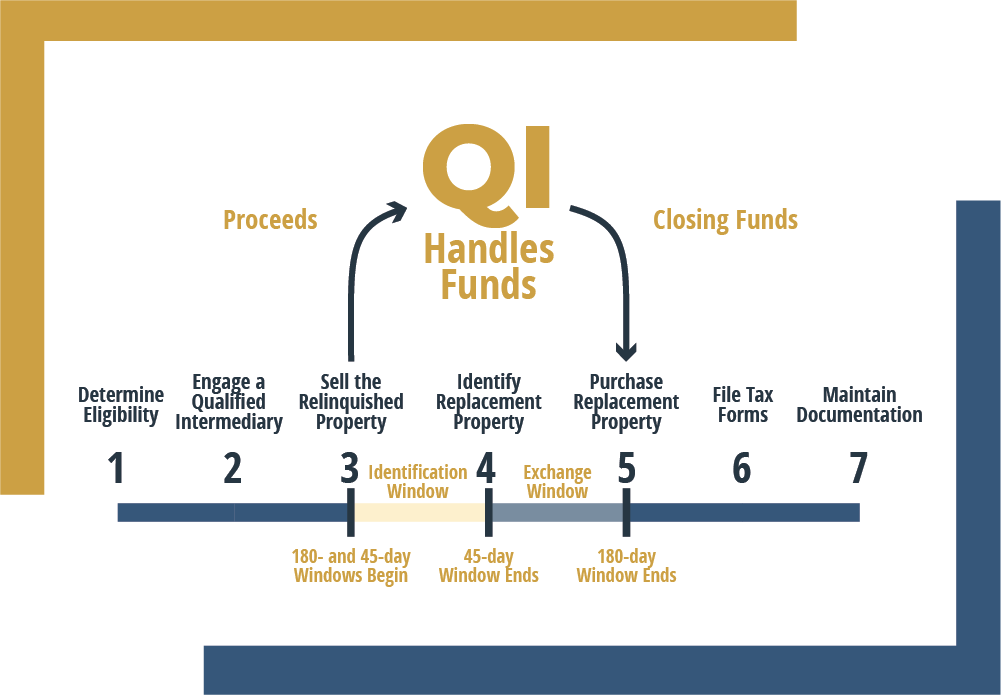

Self-Directed IRA for Real Estate Investment: Why Investors Should Consider It

While many investors may know that retirement savings accounts such as individual retirement accounts (IRAs) can be hugely beneficial for accumulating funds for the future, they may not be aware that there is a world of other investment options available to them. In this article, I will explain how investors like you can utilize sources […]

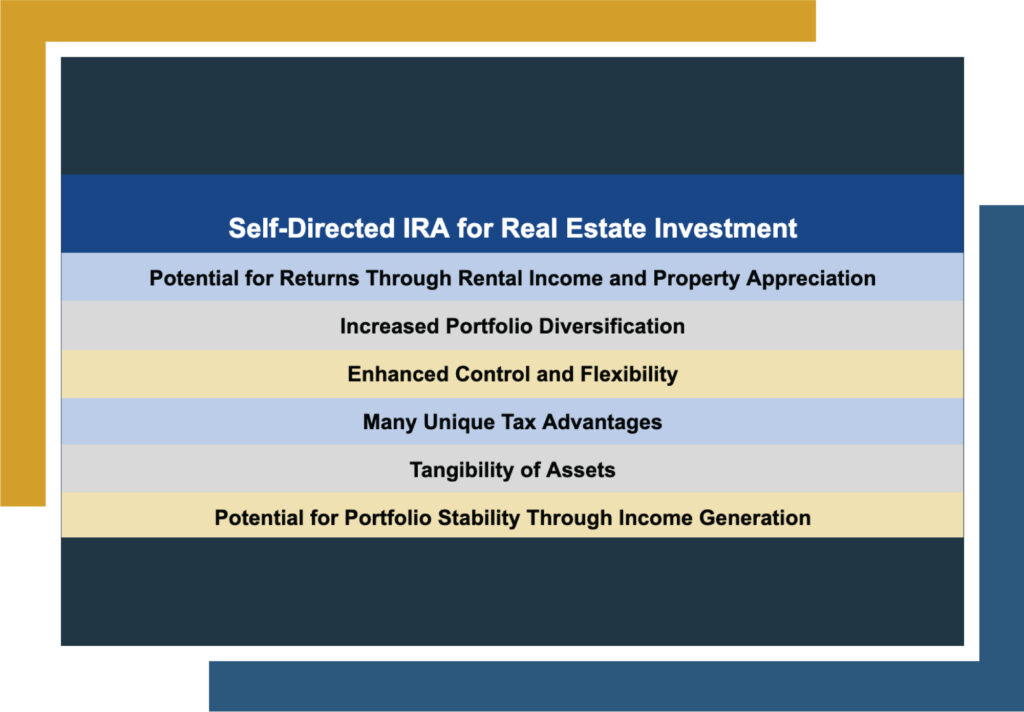

Multifamily Investing Passive Income: What Investors Need to Know

American investors have many options to expand their investments and increase their cash flow, with many investment vehicles at their disposal. The abundance of options can sometimes make it challenging to determine the most suitable choice for their next investment venture. In this article, I will focus on one such option—multifamily investing, a type of […]

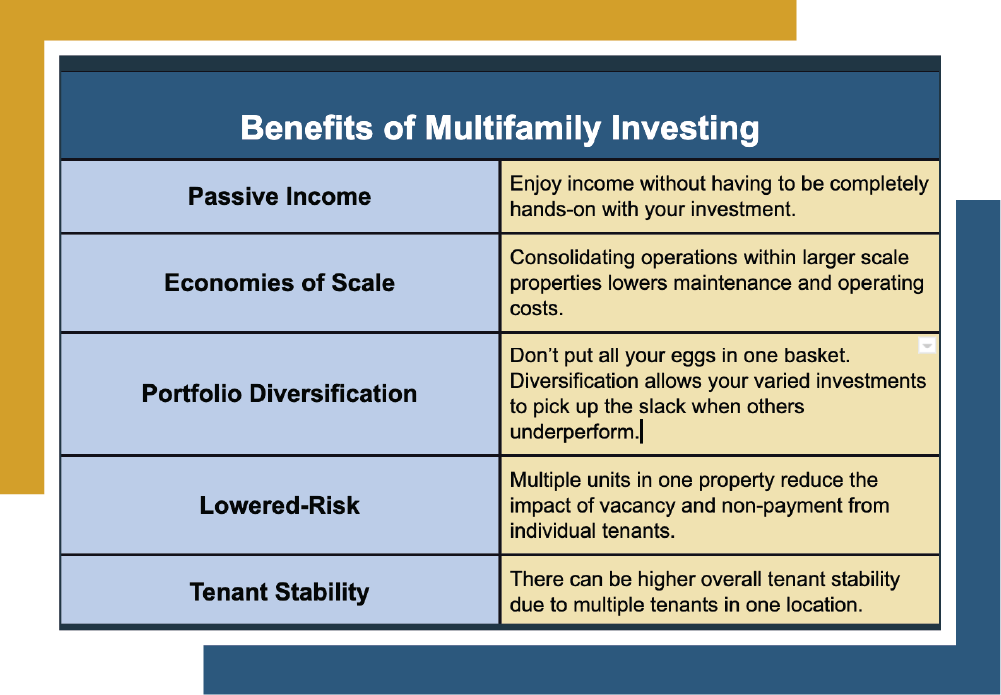

Benefits of Multifamily Investing: A Guide for Investors

In recent years, many investors have realized that real estate could be an excellent addition to their investment portfolio. It makes sense—real estate increases your cash flow, tax breaks, and hedges against inflation1 while giving you access to an asset that doesn’t need to be constantly monitored like others. However, there are multiple types of […]

The 1031 Exchange 200 Rule: A Guide for Investors

Like other investment avenues, real estate is a sector where investors constantly seek new strategies and opportunities to enhance their investments. One such tactic that has gained traction is the 1031 exchange, a robust tax deferral tool. Whether to upgrade and diversify their portfolios or simply because they wish to wash their hands of a […]