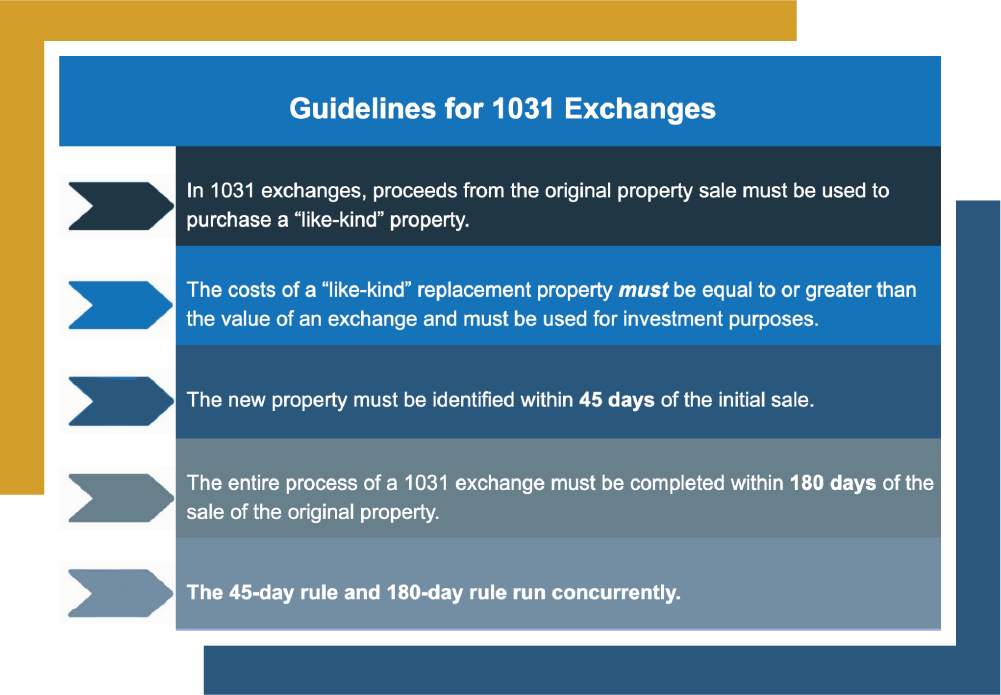

1031 Exchange Holding Period Explained for Investors

So — you’ve decided to seize the opportunity and enjoy the benefits of a 1031 exchange! Or maybe you’re still gathering information before making that leap. After all, why wouldn’t you take advantage of a tax break that lets you defer capital gains taxes, potentially into perpetuity? While 1031 exchanges are a great way to […]

Alternatives to 1031 Exchange: A Comparison for Investors

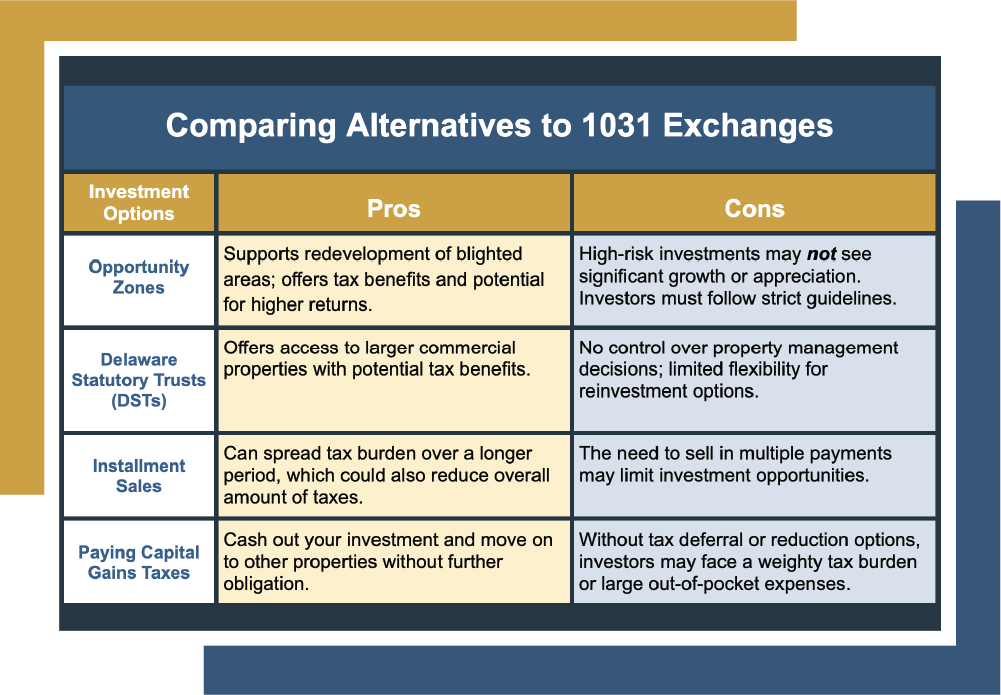

Many property managers who invest in real estate have come to realize the numerous benefits it offers. However, certain circumstances, like shifting investment goals, property upgrades, or a need to limit liability may prompt them to sell their property. Regardless of the reason, this decision is often accompanied by the daunting realization they have to […]

1031 Exchange Benefits: Comparing Alternatives

When it comes to real estate investing, navigating a path to financial growth requires a broad understanding of the diverse tools and strategies at your disposal. Among these, the 1031 exchange stands out as a game-changing tax deferment strategy that could amplify your profitability when selling an investment property. Imagine this: you’re considering selling an […]