Many investors know the frustration of selling an investment property at a profit, only to hand over 20% or more of those gains to the IRS in capital gains taxes. The good news? It doesn’t have to be this way.

Savvy investors are turning to the 1031 exchange, a powerful tax-deferral tool that allows them to reinvest the proceeds from a property sale directly into a new investment property without triggering capital gains tax. However, to reap these benefits, you’ll need to understand 1031 exchange eligibility—because not all assets qualify.

To help you navigate the ins and outs of 1031 exchange eligibility, we’ve created this quick guide to answer common questions and clarify which assets meet the criteria.

1031 Exchange Eligibility: Which Assets Qualify?

Understanding eligibility is critical to maximizing the tax-saving potential of a 1031 exchange. Not every asset makes the cut, and knowing the ins and outs of 1031 exchange eligibility can mean the difference between maximizing your investment and leaving tax benefits on the table.

To help you stay ahead, here’s a breakdown of common questions on eligibility, starting with foreign real estate purchases.

Understanding the “Like-Kind” Requirement for 1031 Exchanges

One of the big rules when it comes to 1031 exchange eligibility is the “like-kind” requirement. This rule means that both the property you’re selling and the one you’re buying need to be similar in nature—but don’t worry, they don’t have to be identical twins.

While there is no formally outlined definition for what constitutes a “like-kind” property, it’s generally accepted that both must be held and used for investment or business purposes.

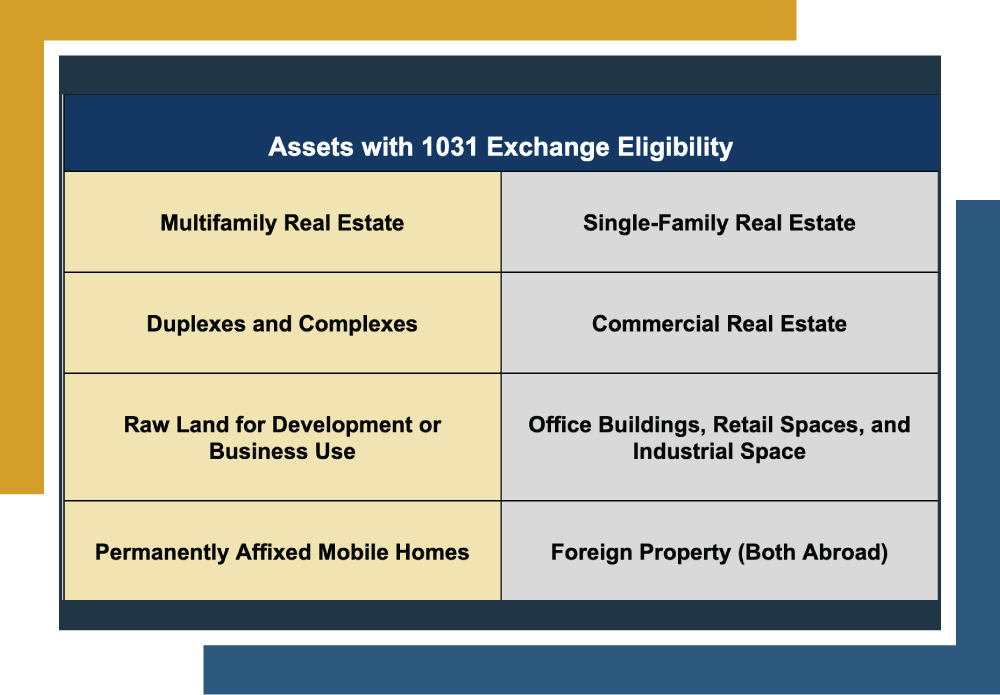

Here are a few examples of what fits under 1031 exchange eligibility:

- Residential Investment Properties: Single-family rentals and multifamily properties such as condominiums, complexes, or duplexes.

- Commercial Properties: Office buildings, retail spaces, and industrial facilities.

- Raw Land: Land held for investment or future development.

When planning a 1031 exchange, remember it’s all about real property investments used for business or held for investment. This keeps the focus on building up your real estate portfolio.

So, as long as both properties check that “like-kind” box, you should be on track for a successful 1031 exchange.

Are Mobile Homes Eligible for a 1031 Exchange?

Mobile homes fall into a bit of a gray area regarding 1031 exchanges because their eligibility depends on their classification. Generally, mobile homes are considered personal property, which makes them ineligible. However, if the mobile home is permanently attached to the land and classified as real property, it might qualify.

Here’s a quick breakdown to clarify:

Mobile Home 1031 Exchange Eligibility | ||

|---|---|---|

Classification | Eligibility | Explanation |

Mobile Home (Not Affixed) | Not Eligible | Classified as personal property because it can be moved with the owner. |

Mobile Home (Permanently Fixed) | Potentially Eligible | Likely eligible if considered real property and part of an investment property |

If you’re considering exchanging a property with a mobile home, double-check its classification with a tax professional. That classification ultimately determines whether it meets the IRS’s “like-kind” requirement.

Are Foreign Real Estate Purchases Eligible for a 1031 Exchange?

Another common question is whether foreign real estate purchases—cross-border properties–qualify for a 1031 exchange.

The answer? Yes—if both the property you’re selling and the one you’re buying are located outside the U.S., you can make it work under 1031 rules. But here’s the catch: both properties must be like-kind and based outside the U.S.

Selling a Property with a 1031 Exchange vs. Without a 1031 Exchange | ||

|---|---|---|

Details | Eligibility | Explanation |

Foreign Real Estate | Eligible | Eligible only if both the relinquished and acquired property are “like-kind” properties not located on U.S. soil. |

U.S.-Based Investment Property | Eligible | Must be “like-kind” real estate property. |

So, while you can’t do a cross-border exchange (meaning you can’t swap a U.S.-based property for an international one or vice versa), you’re good to go if both properties are foreign and are “like-kind.” This setup keeps the tax-deferral benefits within each region, allowing you to reinvest internationally while deferring those capital gains.

Are Stocks Eligible for a 1031 Exchange?

Stocks, bonds, and similar securities aren’t eligible for a 1031 exchange. The IRS keeps 1031 exchanges strictly limited to real property used for investment or business, so if you’re hoping to swap stock investments, 1031 isn’t the tool for you.

The whole idea is to keep capital gains working within the real estate world and not shift into other asset classes.

Quick Recap

Here’s a quick overview of what doesn’t have 1031 exchange eligibility:

- Mobile homes (unless they are permanently affixed and qualify as investment properties).

- Foreign real estate (unless both parties are located abroad and are “like-kind”)

- Stocks, bonds, or securities.

- Primary residences.

While 1031 exchanges can bring substantial potential benefits, as you can see, they also come with their fair share of complications and strict requirements.

That’s where CVC steps in to make things easier—especially for investors ready to skip the property management headaches. With us, you get a smoother 1031 exchange process and the freedom to enjoy passive real estate income without all the hassle.

Turn to CVC for Your Next 1031 Exchange

Now that you’ve got a handle on the basics of 1031 exchange eligibility, you might wonder what’s next. If a 1031 exchange seems the right path, CVC is here to help you make it happen smoothly.

With a $1 billion1 portfolio spread across the Midsouth and Midwest, CVC is about multifamily real estate and helping accredited investors simplify their 1031 exchange processes.

We offer the chance to exchange into one or more of our multifamily properties as Tenants in Common, giving you all the potential benefits of traditional real estate investing—without any property management headaches. It’s a truly passive way to invest in real estate, allowing you to capture the growth potential and income benefits without the hands-on hassle.

For over 40 years, the principals at Canyon View Capital have worked in real estate, with a portfolio currently valued at over $1B1. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

Gary Rauscher, President of Canyon View Capital

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.