Many property managers recognize the benefits of real estate investing, but shifting goals, property upgrades, or liability concerns may lead them to sell. Unfortunately, this often means facing 15-20% in capital gains taxes plus a possible 3.8% surtax for high-income earners.

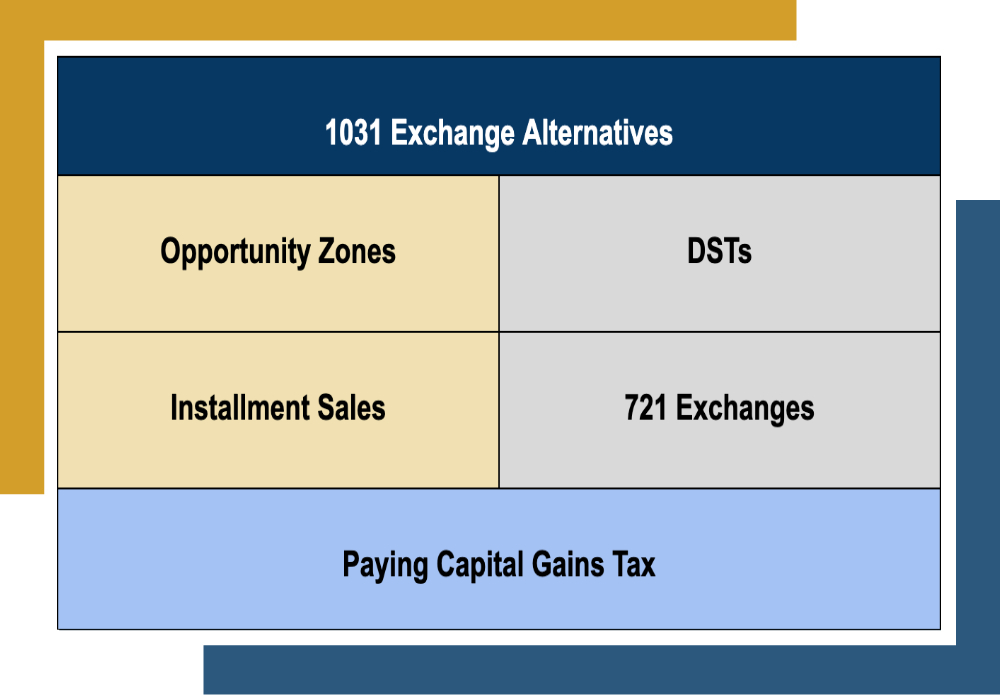

Thankfully, many property owners can turn to 1031 exchanges to defer these taxes and lower their tax liability. While a 1031 exchange is a popular option, other alternatives are worth considering.

In this article, I’ll break down 1031 exchange alternatives to help you make the decision that makes the most sense for your financial strategy.

What are 1031 Exchange Alternatives?

While a 1031 exchange is a popular option for deferring capital gains on the sale of real estate, it’s not the only option available. Here are a few 1031 exchange alternatives worth considering:

- Opportunity Zones. Opportunity Zones are designated as economically distressed areas where investors can receive tax benefits for real estate investments. By investing in these areas, investors can potentially defer or eliminate capital gains taxes on their profits.

- Delaware Statutory Trusts (DSTs). A DST is a type of trust that allows multiple investors to pool their funds and invest in a larger commercial property. This strategy can provide investors access to properties they might not be able to afford while offering potential tax benefits.

- Installment Sales. An installment sale is when a property owner sells their property using multiple payments over time rather than one lump sum. This can help spread the tax burden over a longer period, potentially reducing the overall amount of taxes due from the owner.

- Paying Capital Gains Taxes. While it may not be the most attractive option, simply paying capital gains taxes on selling a property remains a viable alternative. This may be a good option for investors who want to cash out of their investment entirely and move on to other opportunities.

- 721 Exchanges. In a 721 exchange, the property owner contributes their property to a partnership with a Real Estate Investment Trust (REIT) and, in return, receives operating partnership units (OP units) in the REIT. These OP units can be exchanged for REIT shares later, allowing the property owner to defer capital gains taxes until the shares are sold.

Pros and Cons of 1031 Exchange Alternatives

Comparing Alternatives to 1031 Exchanges |

||

|---|---|---|

|

Investment Option |

Pros |

Cons |

|

Opportunity Zones |

Supports redevelopment of blighted areas; offers tax benefits and potential for higher returns. |

High-risk investments may not see significant growth or appreciation. Investors must follow strict guidelines. |

|

Delaware Statutory Trusts (DSTs) |

Offers access to larger commercial properties with potential tax benefits. |

No control over property management decisions; limited flexibility for reinvestment options. |

|

Installment Sales |

Spread the tax burden over a longer period could also reduce the overall taxes. |

The need to sell in multiple payments may limit investment opportunities. |

|

Paying Capital |

Cash out your investment and move on to other properties without further obligation. |

Investors may face a weighty tax burden or significant out-of-pocket expenses without tax deferral or reduction options. |

|

1031 Exchanges |

Defer taxes on the sale of real estate to invest in other properties. Untethers the investor from the property and allows them to enhance their portfolio. |

Strict guidelines for reinvestment; potential for delayed closings or increased costs if guidelines are not closely followed. |

|

721 Exchanges |

Allows investors to exchange shares in a REIT without incurring capital gains taxes. |

Extremely limited options for REIT investments. Potential risks include changing interest rates, economic downturns, and volatile real estate markets. |

It’s impossible to overemphasize every transaction’s distinctive nature, which parallels every investor’s individual concerns regarding goals, risk tolerance, and time constraints. Although 1031 exchanges are excellent tools for tax deferral, they aren’t your only option.

It’s crucial to contact an experienced tax professional or financial advisor for assistance when exploring 1031 exchange alternatives. They can help narrow down investment options that align with your goals and ensure that you adhere to regulations.

Canyon View Capital Makes Your 1031 Exchange Simpler

At Canyon View Capital, we understand that while a 1031 exchange can be an excellent tool for deferring taxes, it’s essential to explore all options available, including some 1031 exchange alternatives.

Our team comprises principles with over four decades of experience managing real estate that has amassed over $1B1 in aggregated value. We’re eager to share our expertise and help you explore the world of real estate investing.

A 1031 exchange offers excellent benefits but has tight timelines and strict requirements. At CVC, we simplify the process by letting you exchange into our available properties as Tenants in Common, avoiding stressful deadlines while enjoying passive income and additional potential tax benefits.

Need more information on 1031 exchange alternatives?

We’re happy to answer your questions! Call CVC today to learn more. Get Started

Gary Rauscher, President of Canyon View Capital

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.