If you plan on selling an investment property but are concerned about paying up to 30% of your sales proceeds as capital gains tax, a 1031 exchange may be the best solution. A 1031 exchange is a tool savvy investors use to defer the capital gains taxes on selling their investment properties. By taking the sales proceeds and using them towards purchasing a “like-kind” property, you can push your capital gains tax liability back to the sale of the newly acquired property.

However, 1031 exchanges are complex and require adherence to strict rules and guidelines.

If you fail to follow these steps, your 1031 exchange will be voided, and you will be responsible for paying your capital gains taxes.

In this guide, I detail what is required for a 1031 exchange to be valid by IRS standards

| Discussion Topics |

What Is Required for a 1031 Exchange to Be Valid?

The rules required for a 1031 exchange to be valid can be overwhelming, especially if it’s your first time engaging in this tax deferral tool. Outlined in section 1031 of the Internal Revenue Code, 1031 exchanges allow investors to sell an investment property and use those proceeds to purchase a replacement property.

When done correctly, the taxes are deferred—potentially indefinitely—substantially increasing your purchasing power when buying a new property or moving on from a problematic one.

Be aware of these crucial rules when following the 1031 exchange timeline:

- The replacement property must be a “like-kind” property. The IRS does not clearly define “like-kind” properties but states that they must be of the exact nature or character, meaning the replacement property must also be an investment property. For example, you can exchange a duplex for a condominium or farmland for a residential property.

- The quality of the property does not have any bearing on the validity of the 1031 exchange (i.e., an unimproved property can be exchanged for an improved property because the improvements are not a grade of character).

- Investors can exchange more than one property by utilizing the 200% rule, which allows investors to identify an indefinite amount of replacement properties as long as their cumulative value does not exceed 200% of the fair market value of the relinquished property.

- There must be a clear intent to exchange properties from the beginning of the sale of the original property, and you must include explicit language in the sales agreement for the relinquished property.

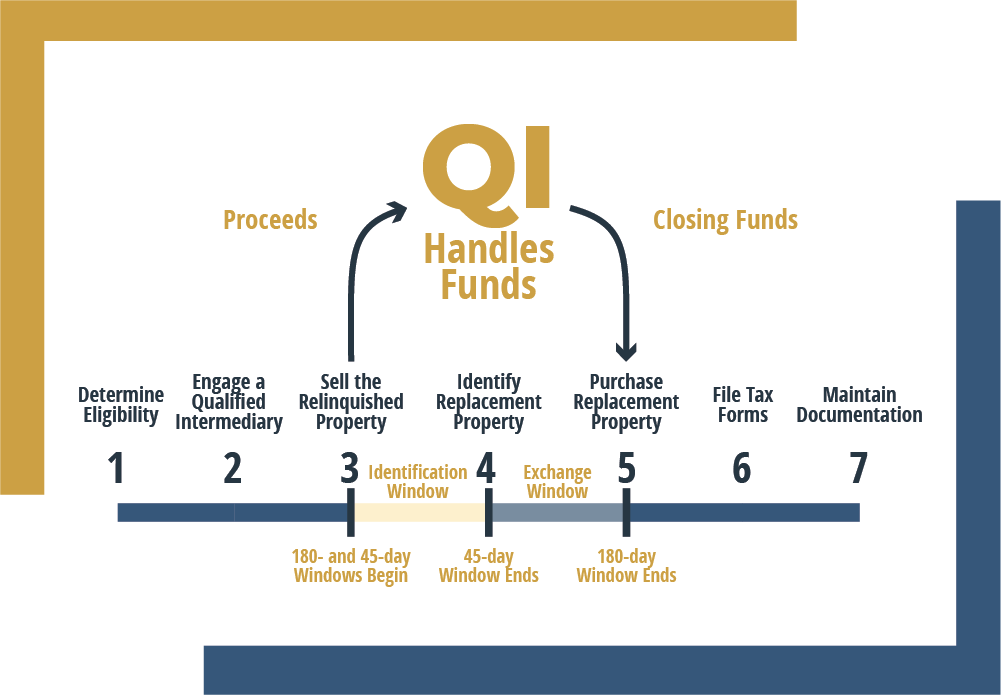

- Investors must use a qualified intermediary (QI), an independent third party who holds the funds from the sale of the relinquished property and uses them to acquire the replacement property on behalf of the investor. The investor is not allowed to have direct access to these funds.

- Investors must adhere to a strict timeline involving a 180-day window and a 45-day window. From the day the relinquished property sells, a 180-day window to complete the exchange process begins, and the investor also has 45 days to identify the replacement property. These two windows run concurrently, and outside of rare exceptions, extensions are not available for the 1031 exchange process.

- Investors must reinvest all net proceeds from the sale of the relinquished property into the purchase of the replacement property. Any cash or property received outside the 1031 exchange is considered “boot” and subject to taxes.

- Investors must report the exchange on their tax return using IRS Form 8824, which provides the exchange details, including the identity of the relinquished property and replacement property(s), the exchange’s timeline, and the exchange’s financial aspects.

Failure to adhere to these rules may nullify a 1031 exchange and open investors to capital gains tax liability. Now, let’s explore the steps of a 1031 exchange.

Steps of a 1031 Exchange | |

1 | Determine Eligibility: Ensure all properties involved are eligible for a 1031 exchange. The IRS does not state specifics, but generally, real estate properties held for investment purposes will qualify as a “like-kind” property, while primary or secondary residences will not. |

2 | Engage a Qualified Intermediary: Hire a QI to facilitate the exchange. Investors are not allowed to hold onto the sale proceeds during the exchange process; a qualified intermediary who helps with documentation and compliance must hold the proceeds. |

3 | Relinquish Current Property: You will “relinquish”, rather than “sell” your existing property, which means a QI will be involved to hold the funds while you find and close on a replacement property. You must also ensure the contract includes language indicating intent to complete a 1031 exchange. This will begin the 180-day and 45-day windows. You must identify the replacement property(s) within 45 days of this date and complete the 1031 exchange within 180 days from this date. |

4 | Identify Replacement Property: Within 45 days of the sale of the relinquished property, you must identify the replacement property(s) by formally documenting its legal description and street address in writing to the QI. |

5 | Purchase Replacement Property: Within 180 days of the sale of the relinquished property, acquire the replacement property using the proceeds from the original property held by the QI. |

6 | File Tax Forms: Report the exchange on your tax return by filing Form 8824 and consult a tax professional to ensure compliance with the reporting requirements. |

7 | Maintain Documentation: Keep a thorough record of all 1031 exchange transaction-related documents, including, but not limited to, sale agreements, closing statements, identification notices, and any correspondence with the QI. Maintaining these records is crucial to substantiating the exchange to the IRS in the future. |

While 1031 exchanges can be incredible tools for investors, they are also complex and can be difficult for even the wisest investors to manage. On top of the myriad of rules and regulations, investors must complete the exchange within extremely tight windows.

That’s why consulting with a qualified professional experienced in 1031 exchanges is essential to ensure compliance with requirements and address any specificities regarding an exchange.

Canyon View Capital Guides You Through Your 1031 Exchange

At Canyon View Capital, we know how incredible 1031 exchanges can be for investors. They allow investors to defer taxes, increase their buying power, diversify their portfolios, and provide enhanced flexibility when reconfiguring their investment strategy.

We help simplify part of the process by allowing investors to defer the capital gains taxes on the sale of their investment property and roll the proceeds into one of our many multifamily properties as a Tenant in Common. Investors can enjoy a truly passive real estate income without worrying about property management responsibilities.

Still need more information on what it takes for a 1031 exchange to be valid?

At Canyon View Capital, we will walk you through every step of your investment when using your 1031 exchange as a vehicle, and our staff will always answer your questions honestly, completely, and promptly. For more on investing using a 1031 exchange, contact Canyon View Capital.

1“Like-Kind Exchanges Under IRC Section 1031.,” Internal Revenue Service. Feb. 8, 2008, IRS.gov. Accessed July 5, 2023.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.