Like other investment options, real estate provides various opportunities for those seeking financial freedom. While many investors choose the traditional route of rental properties, it’s important to consider alternatives like Real Estate Investment Trusts (REITs), which have gained significant popularity. But how do real estate investments, particularly REITs, compare to traditional investment vehicles like the Standard & Poor (S&P) 500 stock market?

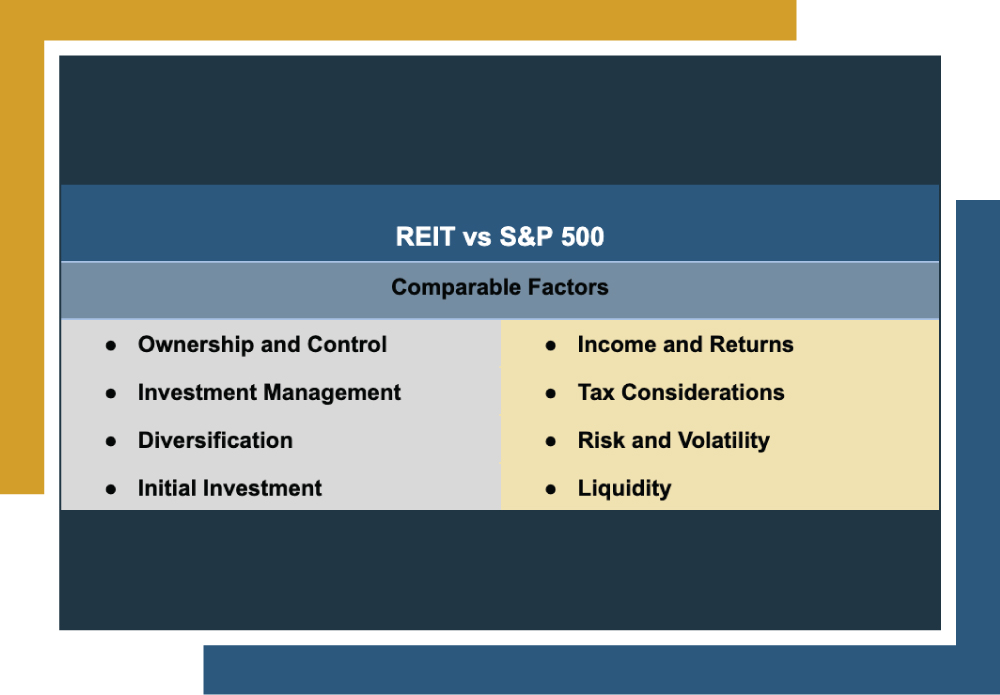

This analysis will explore the differences between REITs and stock markets like the S&P 500 and other real estate investing options. By comparing the benefits and challenges of REITs vs. S&P 500, we aim to offer a comprehensive understanding to help you determine which option best aligns with your financial strategy.

| Discussion Topics |

REIT vs. S&P 500

When examining REIT vs. S&P 500 investments, comparing and contrasting them is essential. While REITs and the S&P 500 may appear vastly different at first glance—one being rooted in real estate and the other in stocks—they share more similarities than you might think.

Although REITs are technically real estate investments, they function quite similarly to stocks. This functional difference is because REIT investments operate on principles akin to those of the stock market, offering liquidity, dividend income, and potential for capital appreciation.

Understanding REITs

Although REITs involve real estate investments, they differ significantly from directly investing in rental properties. When you invest in a REIT, you are not buying the property itself. Instead, you purchase shares in a trust that owns and manages the real estate. In this setup, the REIT is the actual owner of the properties.

As a shareholder, you have minimal control over the properties within the REIT. Your investment functions similarly to owning stock in a company; you receive dividends based on the profitability and appreciation of the REIT’s properties. This way, your investment in a REIT becomes an asset, much like owning company shares.

The S&P 500

The S&P 500 is an index of 500 large, publicly traded U.S. companies in various industries, such as technology, healthcare, and consumer goods.

Unlike buying individual stocks, investing in the S&P 500 means purchasing shares in an index fund that holds a portfolio of these companies. This factor provides broad market exposure and diversification.

Much like a REIT, you don’t have direct control over the individual companies. Your returns depend on the overall performance of the 500 companies, offering a balanced investment strategy.

REIT vs S&P 500 | ||

REITs | S&P 500 | |

| Indirect ownership through shares, no direct control over properties. | Indirect ownership through shares means there is no direct control over companies. |

| Professionally managed, passive investment. | Professionally managed, relatively little active management. |

| Built-in diversification across various properties and locations. | Diversification across 500 large companies in multiple industries. |

| Lower initial investment, shares can be bought at low prices. | Lower initial investment, shares can be purchased at low prices. |

| Regular dividend income, the potential for share price appreciation. | Potential for capital appreciation and dividends. |

| Dividends are taxed as ordinary income; some may qualify for deductions. | Qualified dividends are taxed at capital gains rates; ordinary dividends are taxed as income |

| Subject to real estate market, stock market volatility, and interest rate fluctuations. | Subject to market volatility, influenced by economic and company-specific factors |

| Highly liquid, shares can often be easily traded on stock exchanges. | Highly liquid, shares can be easily traded on stock exchanges. |

Exploring Other Options

Both REITs and the S&P 500 offer investment options that require less active management compared to other methods, but they may not be ideal for every investor. Investing in the S&P 500 can be challenging due to its market volatility. Similarly, although real estate investments can provide a hedge against stock market fluctuations, REITs are affected by volatility in both the stock and real estate markets.

CVC presents an innovative approach to real estate investment for investors seeking alternative options that address some of the drawbacks associated with REITs and the S&P 500. CVC specializes in multifamily real estate and offers access to professionally managed investment funds designed to provide stable, passive rental income along with potential tax advantages.

Key Benefits of investing with CVC:

- Passive Income: CVC’s investment funds enable investors to earn passive rental income from multifamily properties.

- No Landlord Responsibilities: Investors can enjoy the benefits of real estate investing without the burdens of property management.

- Tax Advantages: CVC’s funds are structured to maximize tax efficiency, allowing investors to benefit from passive losses and utilize tax deferral strategies that REITs cannot, such as 1031 exchanges.

- Reduced Stock Market Volatility: Unlike REITs, CVC’s multifamily real estate investments are not publicly traded, providing a more stable and predictable income stream.

Investing with CVC Could Be a Great Fit for You

Now that we’ve shed a little light on the differences between REITs and the S&P 500, you may be considering your next steps.

Consider partnering with Canyon View Capital (CVC) for a unique and truly passive real estate investment opportunity. At CVC, we specialize in multifamily real estate investing, leveraging decades of experience to build a portfolio valued at over $1 billion1.

We invite accredited investors like you to benefit from our expertise and gain access to the multifamily real estate market without the typical stresses of property management. Our dedicated team manages properties across the Midsouth and Midwest, ensuring you receive a hassle-free, passive rental income.

Let CVC guide you to stable returns and the rewards of real estate investing with confidence and ease.

Need more information on REIT vs S&P 500?

We’re happy to help! Call CVC today to learn more. Get Started

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.