As an investor, it’s natural to worry about what might happen to your assets over time. While familiar options, like stocks, bonds, and 401(k)s are popular choices for investing in the future, many people ignore the potential of real estate investments because they assume they don’t have the available funds to get started.

If this sounds familiar, one avenue you might consider exploring is using a self-directed IRA to invest in real estate. For funds in a self-directed IRA, investors usually have more flexibility in deciding how to invest their savings when compared to traditional 401(k)s, which can include options like real estate. This approach can help diversify your portfolio, offer a hedge against inflation via rental income1, and spread your risk to protect your nest egg2 from volatile market forces.

In this article, I’m going to delve into the benefits of using a self-directed IRA for real estate investing to help both new and experienced investors learn to build diversified portfolios in the hopes of to getting you closer to your financial goals. You can use the links below to skip ahead to different topics in the article.

| Discussion Topics | |

What is a Self-Directed IRA?

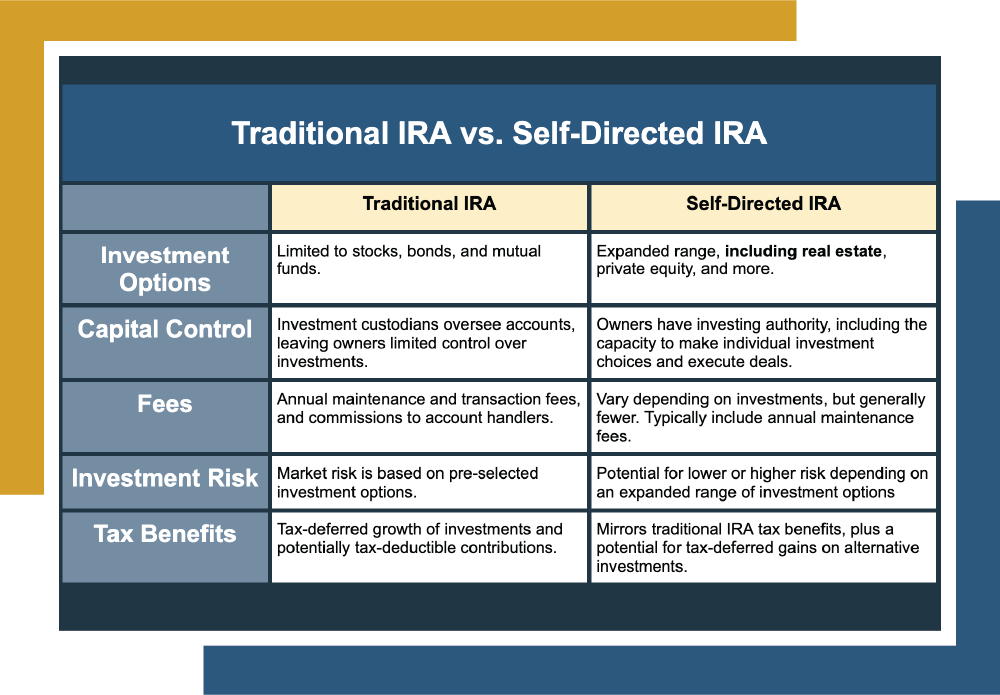

Before we get into the nitty-gritty of using a self-directed IRA for real estate investing, we’ll want to make sure you have a baseline understanding of how self-directed IRAs work vs. other financial savings vehicles, like traditional IRAs.

Traditional IRA

An IRA refers to an Individual Retirement Account, hence the acronym. These accounts allow people to contribute pre-tax income toward retirement savings, up to a specified annual amount.

These funds grow tax-deferred in your account until you withdraw them in retirement. Your IRA contributions are typically invested but are usually limited to stocks, bonds, and mutual funds. These investment decisions are normally made by the custodian or trustee of the account, usually a bank, brokerage firm, or another financial institution.

Self-Directed IRAs

When it comes to IRAs, many people think of traditional IRAs as the go-to option. However, another type called a self-directed IRA, offers investors more control over their investment choices. Unlike traditional IRAs, self-directed IRAs do not require that decisions on investing capital go through third-party custodians, which gives account holders greater flexibility.

Self-directed IRAs allow investors to invest in a wider range of assets than traditional IRAs, including real estate, precious metals, and private equity. This article focuses on real estate investing with funds from a self-directed IRA.

To open a self-directed IRA, investors need to select a custodian or trustee that specializes in self-directed accounts. Unlike traditional IRAs, custodians of self-directed IRAs are not responsible for deciding where funds are invested. Instead, they hold and manage the assets in the account and ensure that all transactions comply with IRS rules and regulations.

Some custodians also offer investment management services, such as financial planning and portfolio analysis, for investors who want to make use of them.

Traditional IRA vs. Self-Directed IRA | ||

Traditional IRA | Self-Directed IRA | |

Investment Options | Limited to stocks, bonds, and mutual funds. | Expanded range, including real estate, private equity, and more. |

Capital Control | Investment custodians oversee accounts, leaving owners limited control over investments. | Owners have investing authority, including the capacity to make individual investment choices and execute deals. |

Fees | Annual maintenance and transaction fees, and commissions to account handlers. | Vary depending on investments, but generally fewer. Typically include annual maintenance fees. |

Investment Risk | Market risk is based on pre-selected investment options. | Potential for lower or higher risk depending on an expanded range of investment options |

Tax Benefits | Tax-deferred growth of investments and potentially tax-deductible contributions. | Mirrors traditional IRA tax benefits, plus a potential for tax-deferred gains on alternative investments. |

Using a Self-Directed IRA for Real Estate Investing

Now that you understand the difference between traditional IRAs and self-directed IRAs, we can get into the details of using a self-directed IRA for real estate investing. “But Eric,” you ask, “why would I want to invest specifically in real estate, instead of all the other options available out there for self-directed IRAs?” Great question!

It’s impossible to overemphasize how distinctly each investment behaves, even though all share a potential for extremely variable performance, depending on conditions. And while piloting the realm of investment property requires careful consideration of all available options, the CVC team believes real estate can offer a few benefits to supplement your investment portfolio, depending on your financial objectives. Some of them include:

Diversification. Adding real estate to your portfolio can help spread your risk. When you put your money in multiple investment avenues, it can have the effect of minimizing risk. In other words, you’re making sure your eggs aren’t all in the same basket.

Diversification. Adding real estate to your portfolio can help spread your risk. When you put your money in multiple investment avenues, it can have the effect of minimizing risk. In other words, you’re making sure your eggs aren’t all in the same basket.- Potential for long-term growth. Historically, real estate has proven to be an avenue where investors can find value appreciation over time because real estate values move slowly. Thus, as home prices rise over time2, the value of your investment may also increase.

- Income generation. Investing in real estate can provide an investor with passive income via rent payments.

- Tangible asset. Unlike many other investment options, real estate is a physical asset you can see and touch, which may offer a sense of security to some investors.

- Inflation hedge. Real estate can help protect your portfolio from inflation, as property values and the rents you collect tend to increase alongside inflation3.

How to Use a Self-Directed IRA for Direct Real Estate Investment

So how do you actually use a self-directed IRA for real estate? There are a few IRS rules and regulations you must follow to avoid penalties or potential account disqualifications.

But broadly, the process follows these steps:

| |

|

|

|

|

| |

|

|

As you can see, using funds from a self-directed IRA to invest in real estate comes with plenty of benefits that could make it an exciting opportunity for investors of all experience levels. However, as with all major investment decisions, investing in real estate requires due diligence and a discussion with your advisors to ensure the risk and return is appropriate for you.

Direct investment in real estate comes with the responsibility of ensuring all transactions comply with IRS regulations, in addition to the physical effort required to manage the property itself. Newer investors might find these daily tasks demand a level of patience, stamina, and expertise that they may not yet have acquired.

That’s where we come in. Canyon View Capital’s investment offerings can help you enjoy some of the potential benefits of real estate investing without the responsibilities of property management.

Canyon View Capital Can Help You Start Your Real Estate Journey

Are you interested in using your self-directed IRA for real estate investing? Canyon View Capital has the know-how you need to get started, and we’re eager to share it with you. Our team can guide you through the intricacies of real estate investing to make the process as easy as possible.

CVC takes on the heavy lifting of property management so you can enjoy the benefits of real estate investing without the daily hassles. Our professionals are here to help you invest in real estate and support your financial goals.

Ready to get started on Your Real Estate Journey?

For over 40 years, principals at CVC have managed, owned, and operated real estate now valued at over $1B3. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

New to real estate, but want to learn more about using a self-directed IRA for real estate investing?

Citations

1Grimes, Patrick. “Why Income-Generating Real Estate Is the Best Hedge Against Inflation,” Forbes.com, April 14, 2022. Accessed May 19, 2023.

2Case-Shiller U.S. National Home Price Index. Federal Reserve of Economic Data of St. Louis. FRED.stlouisfed.org. Accessed April 28, 2023.

3Real Estate Can Be a Haven From Market Volatility,” RealtyMogul.com. Accessed May 22, 2023.

4Which Asset Classes Provide Inflation Hedges? National Bureau of Economic Research. NBER.org. Accessed April 29, 2023.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.