For some, saving money in a retirement account or investing in traditional assets like stocks and bonds has lost its appeal. For these investors, the benefits of alternative investments, such as real estate, may lure them into diversifying their funds in these unconventional avenues.

But while Individual Retirement Accounts (IRAs) have many advantages, they come with many tradeoffs, such as their strict nature and lack of investment options. Fortunately, you can leverage self-directed IRAs for alternative investments, such as real estate. However, given that IRAs fall under IRS jurisdiction, it’s crucial to be well-informed about the regulations before choosing this route for real estate investment.

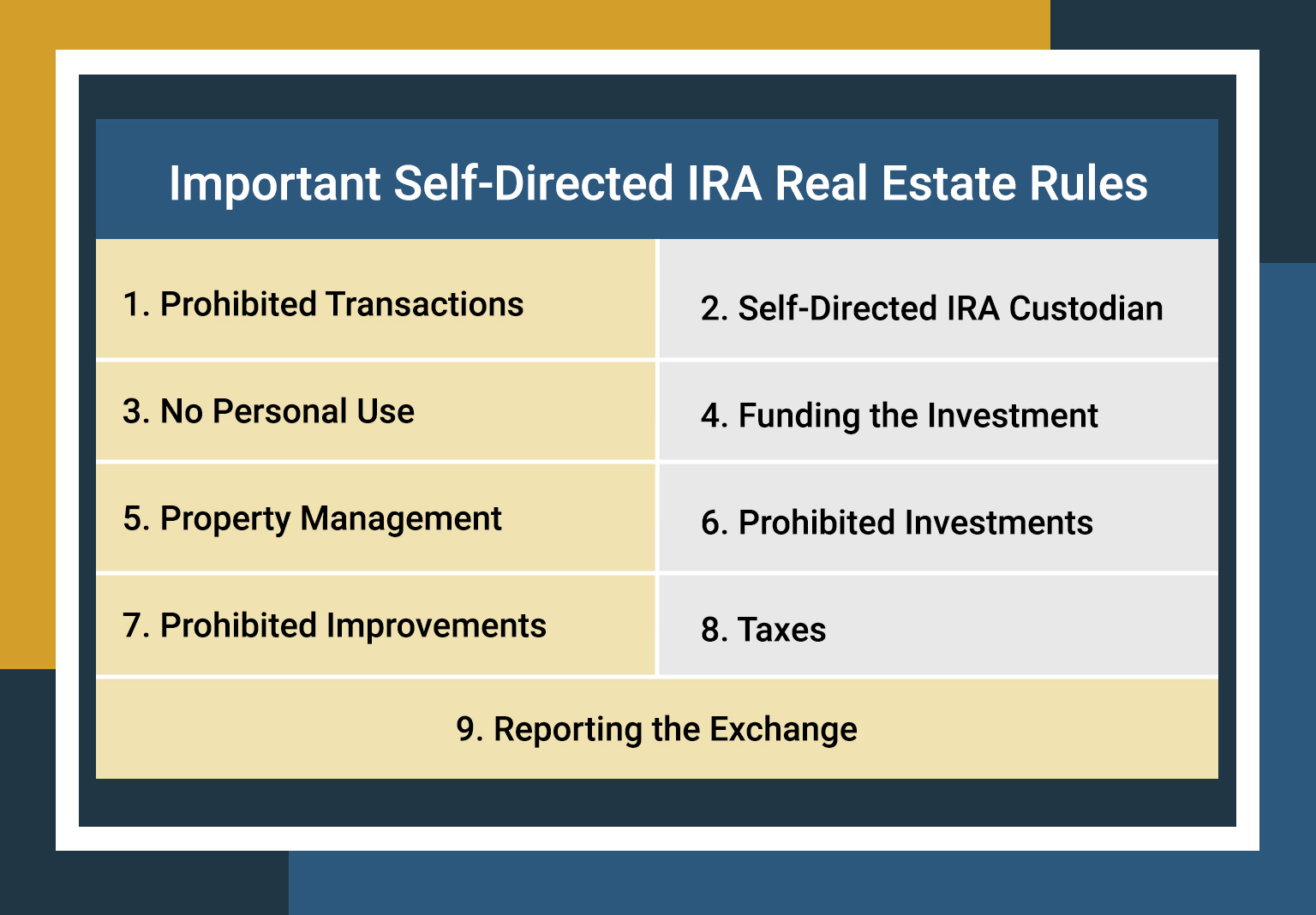

In this blog, we’ll cover the most critical self-directed IRA real estate rules investors need to know.

Self-Directed IRA Real Estate Rules You Need to Know

Self-directed IRAs differ from traditional IRAs, primarily regarding the investment options they allow and how investors manage their portfolios. Traditional IRAs limit your investment choices to conventional assets such as stocks and bonds. In contrast, self-directed IRAs open up a broader range of possibilities, including alternative investments like real estate.

In addition to increasing investor autonomy by providing decision-making power over their assets, self-directed IRAs have a higher level of IRS regulation. These additional regulations are in place to ensure compliance, given the expanded investment choices they offer.

Here are the self-directed IRA real estate rules every investor should consider.

Important Self-Directed IRA Real Estate Rules | |

| The IRS has specific guidelines on what you can and cannot do with self-directed IRAs. For example, you cannot use the property for personal benefit or transactions with disqualified persons such as family members. |

| Self-directed IRAs require a custodian (financial institution or entity responsible for the administration and management of assets) that allows real estate investments. Custodians ensure that your self-directed IRA complies with IRS rules. |

| You are not allowed to personally use or benefit from the real estate investment held in your self-directed IRA. This means you cannot live in it, vacation in it, or rent it to disqualified persons. |

| Your self-directed IRA needs enough funds to purchase and maintain the real estate property, and you can only use personal funds if your self-directed IRA has the funds to buy a property. |

| If the property you’re investing in requires ongoing management, you may have to hire a third party. |

| Some types of real estate may be prohibited from self-directed IRA investments. Such investments involve collectibles, certain forms of debt, and foreign real estate. Check IRS guidelines for the most up-to-date information. |

| You cannot personally make improvements to the property, and any modifications should be financed using funds from your self-directed IRA. |

| Although income and gains from investments in traditional IRAs are tax-deferred, there may be tax implications for real estate in a self-directed IRA. Contact your tax professional for specific information, as it will by region. |

| If you have a traditional self-directed IRA and you’re 72 years old (or 70½ if you reached that age before January 1, 2020), you must take a required minimum distribution (RMD), including the value of any real estate in your IRA. |

These restrictions ensure factors such as the property’s value and use remain consistent with the IRA’s intended purpose of saving for retirement. Using a self-directed IRA for real estate won’t put money directly into your pocket because it all goes back into your IRA for retirement.

Still, diversification has its benefits, such as potentially protecting against inflation, mitigating risk, and increasing sources of income for the account. Regardless, risk is inherent to any investment. Moreover, there are different types of real estate investing strategies, and because of that, always consult with your financial advisor or tax professional.

Canyon View Capital Offers Real Estate Investing Options for Self-Directed IRAs

If you are hesitant to handle property management or need more capital for outright property purchases. Let us help you.

At Canyon View Capital, we have a strong passion for multifamily real estate due to its numerous potential benefits compared to other investment options. We are committed to supporting investors like you.

Our leadership has been working in real estate investment for over 40 years and currently manages a portfolio of multifamily properties in America’s Heartland, now valued at over $1 billion1. We allow investors like you to use funds from a self-directed IRA to invest in one of our funds so you can enjoy the benefits of real estate investing, such as passive income and passive losses, without having to take on the burden of property management or if you lack sufficient capital to purchase a property outright.

Still need more information on IRA Alternative Investments?

12$1B figure is based on aggregate values of all CVC-managed real estate investments as of March 31, 2023.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.