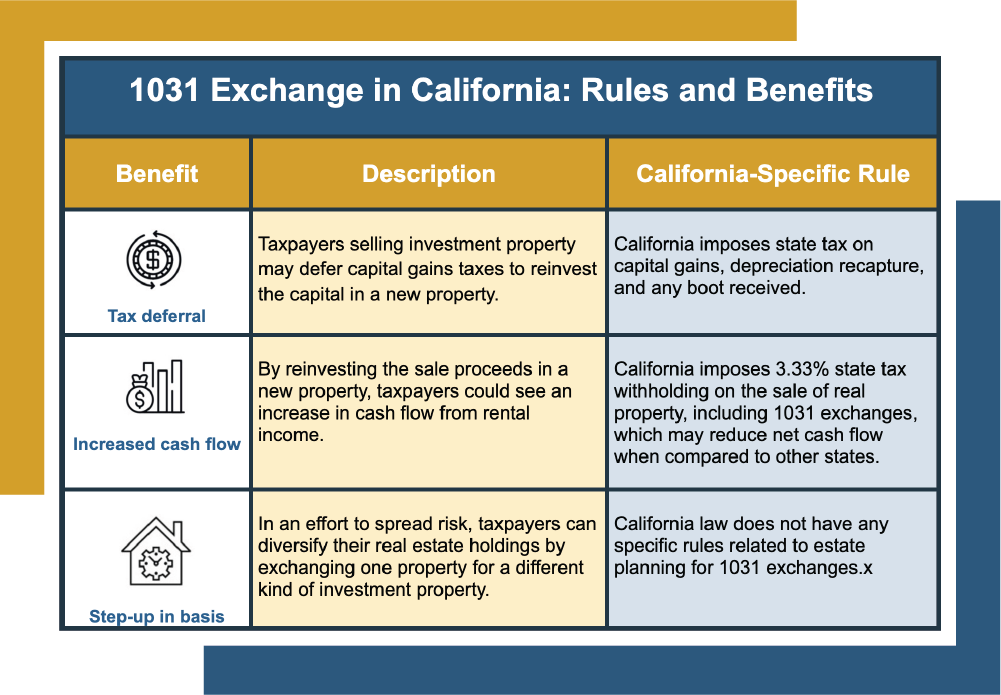

1031 Exchange California Rules Investors Should Know

As a real estate investor, you know that selling a property is a big decision. You may be ready to move on from a long-held property or look for a new opportunity in a different area. Whatever the case, a downside to selling an investment property is the capital gains taxes that come with it. […]

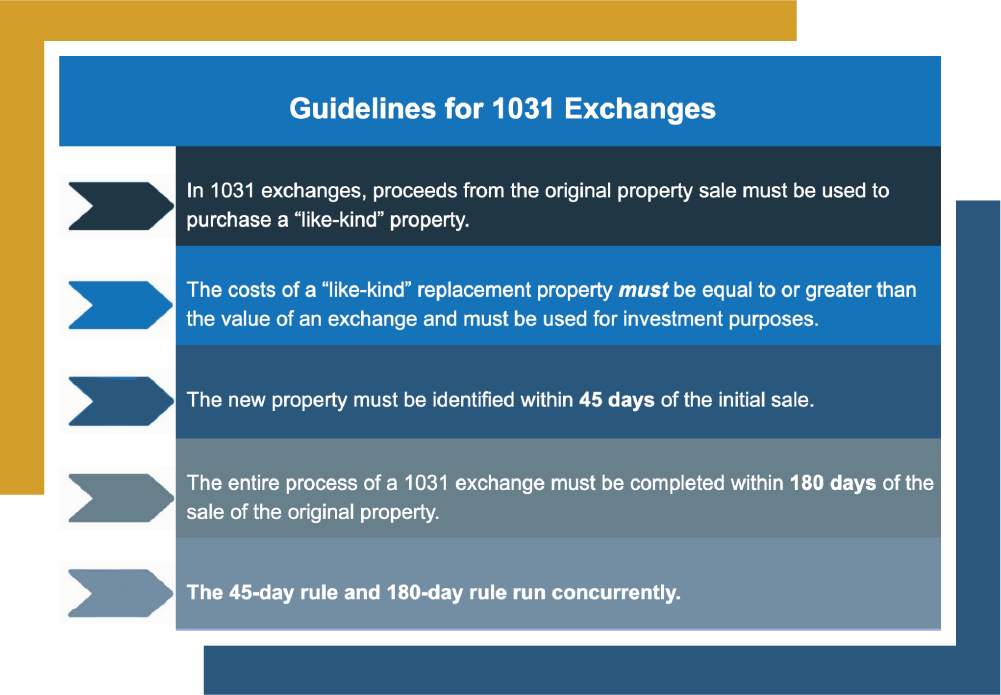

1031 Exchange Guidelines for 2025

Welcome to the world of 1031 exchanges! If you’re a real estate investor, you may already know the sting of capital gains taxes when selling an investment property. But with a 1031 exchange, you can defer those taxes and keep more capital working for you. In 2025, the guidelines for 1031 exchanges are as strict […]

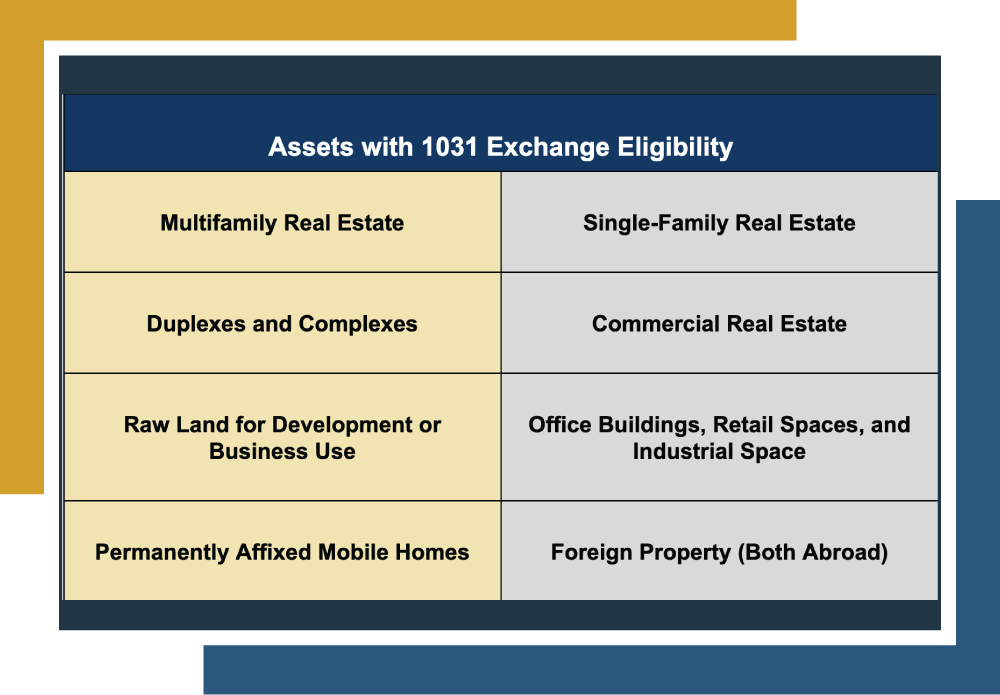

1031 Exchange Eligibility

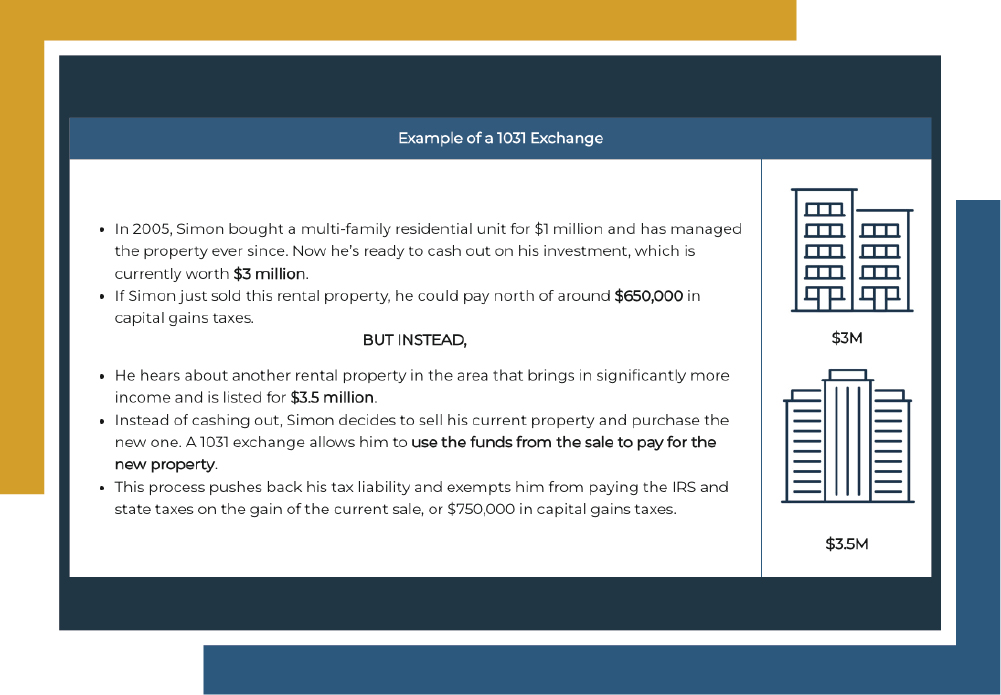

Many investors know the frustration of selling an investment property at a profit, only to hand over 20% or more of those gains to the IRS in capital gains taxes. The good news? It doesn’t have to be this way. Savvy investors are turning to the 1031 exchange, a powerful tax-deferral tool that allows them […]

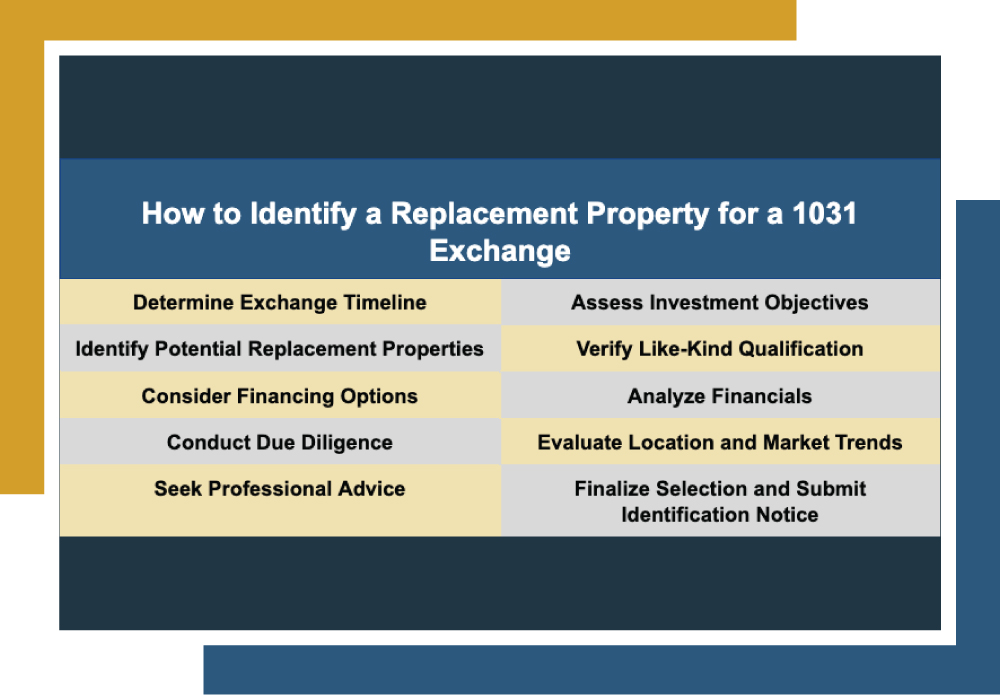

How to Identify a Replacement Property for a 1031 Exchange

1031 exchanges offer real estate investors a valuable opportunity to defer capital gains taxes when selling and replacing properties. By retaining the full proceeds from property sales, investors can maintain their portfolio and net worth intact. This helps sustain a robust real estate market by keeping funds within the industry rather than surrendering them to […]

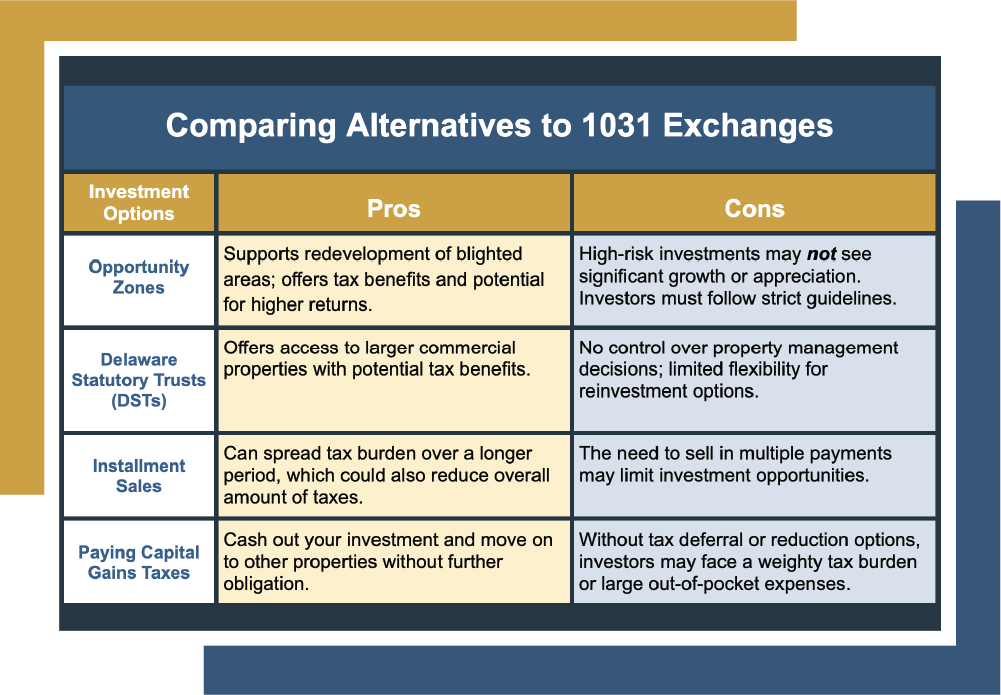

Alternatives to 1031 Exchange: A Comparison for Investors

Many property managers who invest in real estate have come to realize the numerous benefits it offers. However, certain circumstances, like shifting investment goals, property upgrades, or a need to limit liability may prompt them to sell their property. Regardless of the reason, this decision is often accompanied by the daunting realization they have to […]

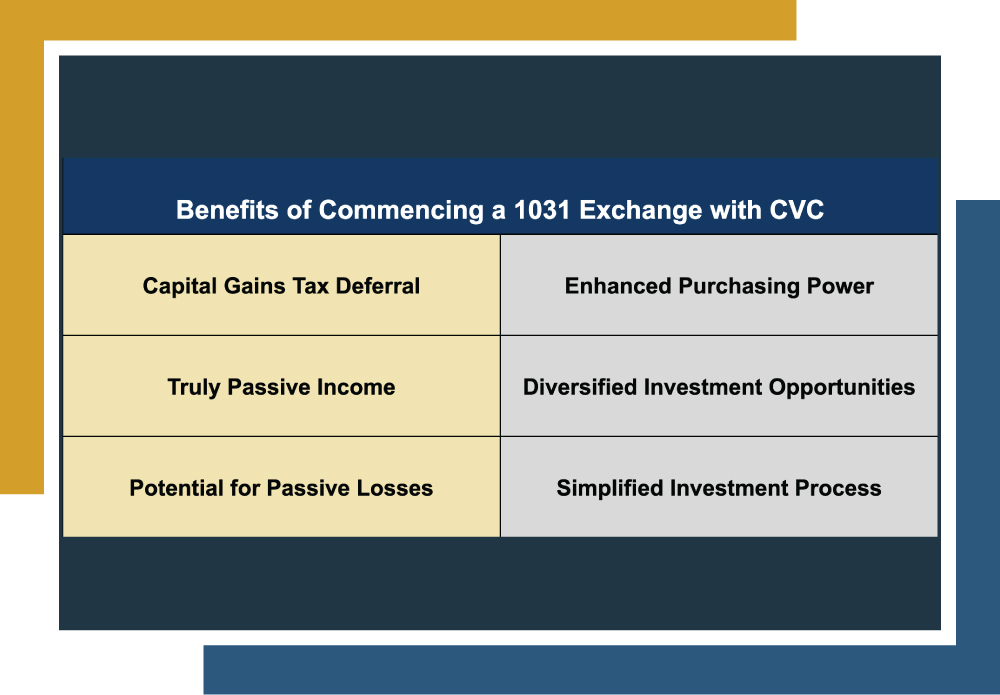

1031 Exchange Benefits: Comparing Alternatives

When it comes to real estate investing, navigating a path to financial growth requires a broad understanding of the diverse tools and strategies at your disposal. Among these, the 1031 exchange stands out as a game-changing tax deferment strategy that could amplify your profitability when selling an investment property. Imagine this: you’re considering selling an […]

1031 Exchange From California to Another State: How It Works

While investing can be a rewarding experience, venturing into new financial waters can bring on feelings of anxiety. Despite the learning curve, most investors still want some kind of reassurance that they’re making the best moves — especially when you have so many options. Another concern of financial ventures is the fact that at some […]

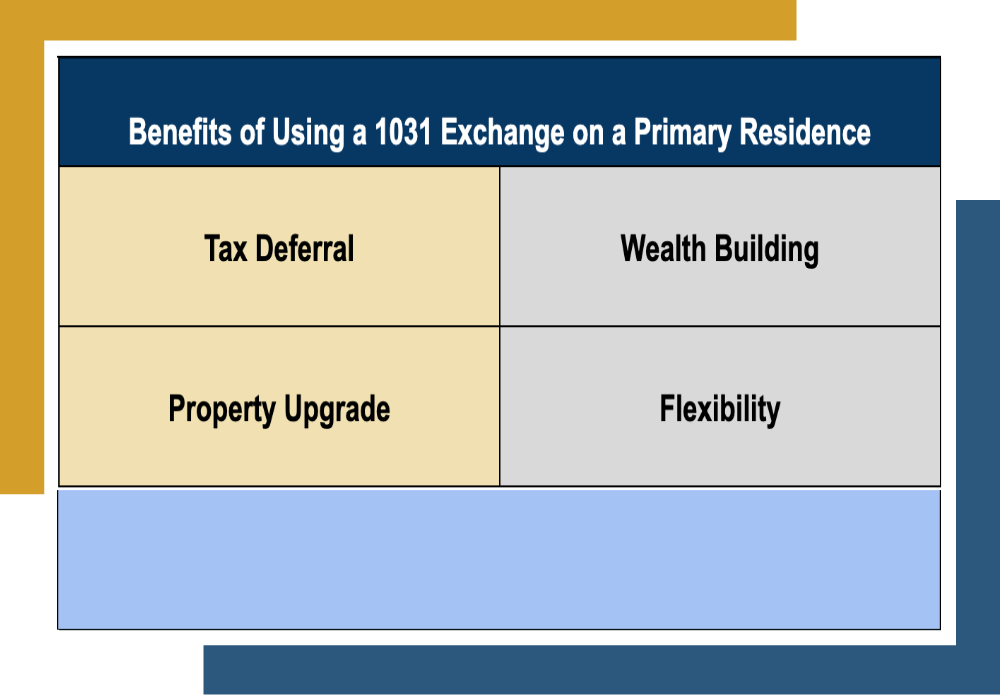

Using a 1031 Exchange on a Primary Residence, Simplified

Anyone who has managed or sold real estate properties is keenly aware of at least one of life’s few guarantees: taxes. Whether you make a record-breaking return or a modest profit, the Internal Revenue Service inevitably appears to collect the government’s cut. Some savvy property owners use a 1031 exchange to delay capital gains taxes, […]