1031 Exchange Guidelines for 2025

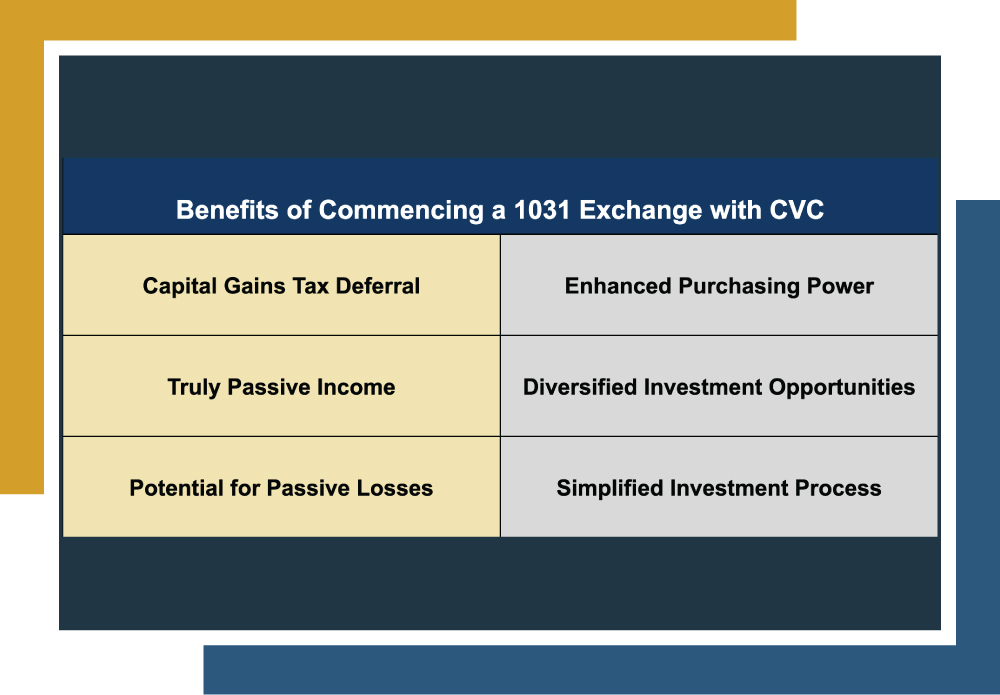

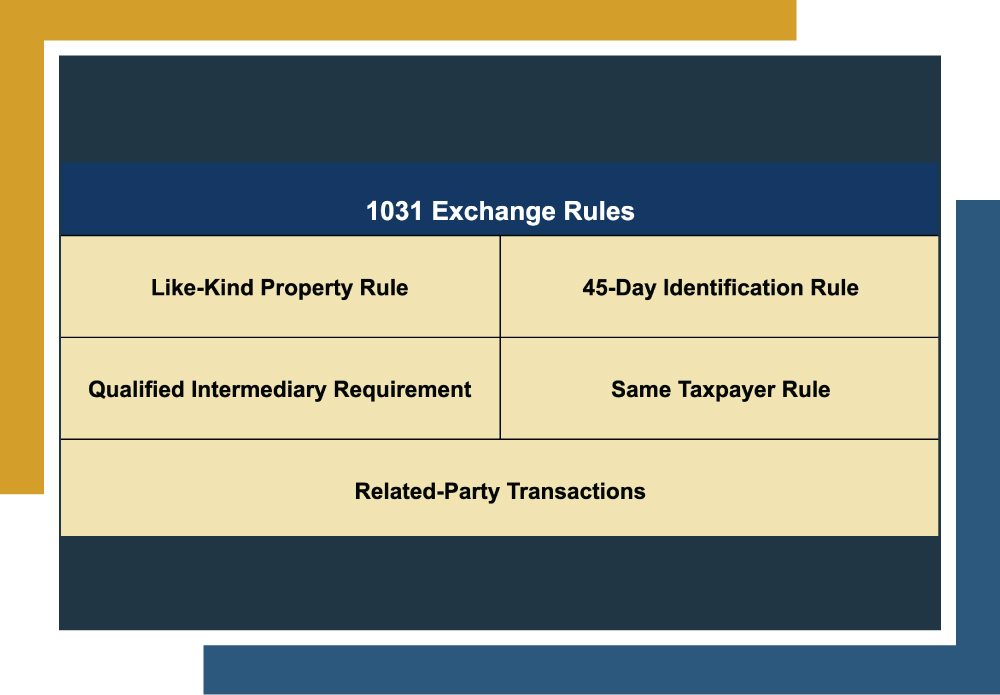

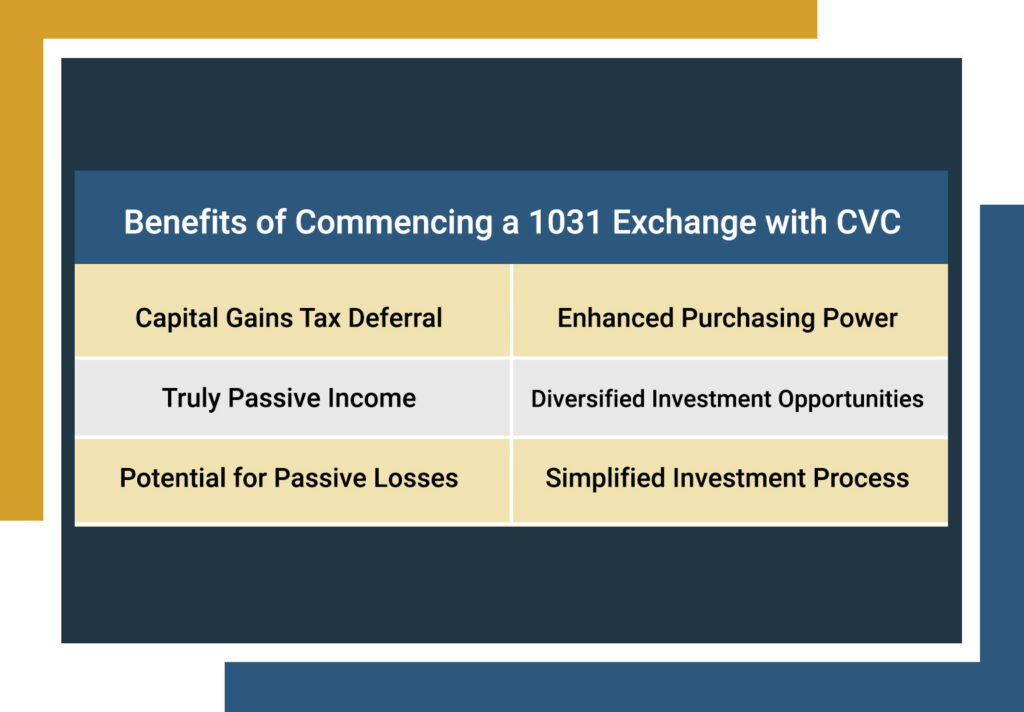

Welcome to the world of 1031 exchanges! If you’re a real estate investor, you may already know the sting of capital gains taxes when selling an investment property. But with a 1031 exchange, you can defer those taxes and keep more capital working for you. In 2025, the guidelines for 1031 exchanges are as strict […]

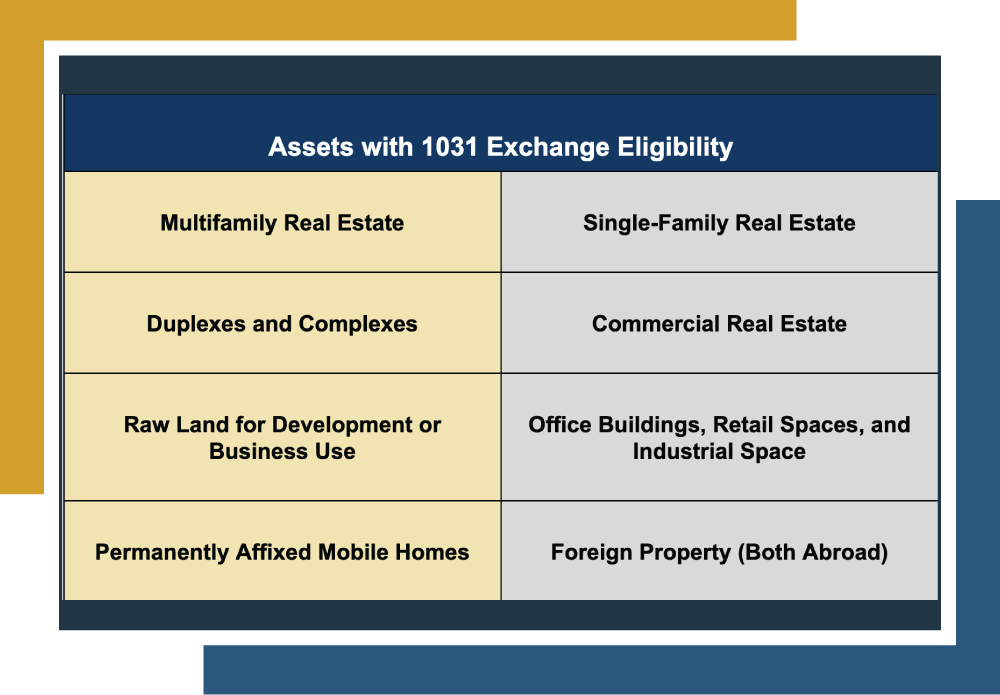

1031 Exchange Eligibility

Many investors know the frustration of selling an investment property at a profit, only to hand over 20% or more of those gains to the IRS in capital gains taxes. The good news? It doesn’t have to be this way. Savvy investors are turning to the 1031 exchange, a powerful tax-deferral tool that allows them […]

1031 Exchange 5-Year Rule

Taxes are one of life’s few certainties, and capital gains taxes, especially on real estate sales, can be among the most burdensome. Fortunately, many savvy investors turn to a popular tax-deferral tool: the 1031 exchange. This strategy allows investors to defer capital gains taxes on investment property sales, making it a valuable option in real […]

1031 Exchange Guidelines for 2025 – Canyon View Capital

Welcome to the world of 1031 exchanges! If you’re a real estate investor, you may already know the sting of capital gains taxes when selling an investment property. But with a 1031 exchange, you can defer those taxes and keep more capital working for you. In 2025, the guidelines for 1031 exchanges are as strict […]

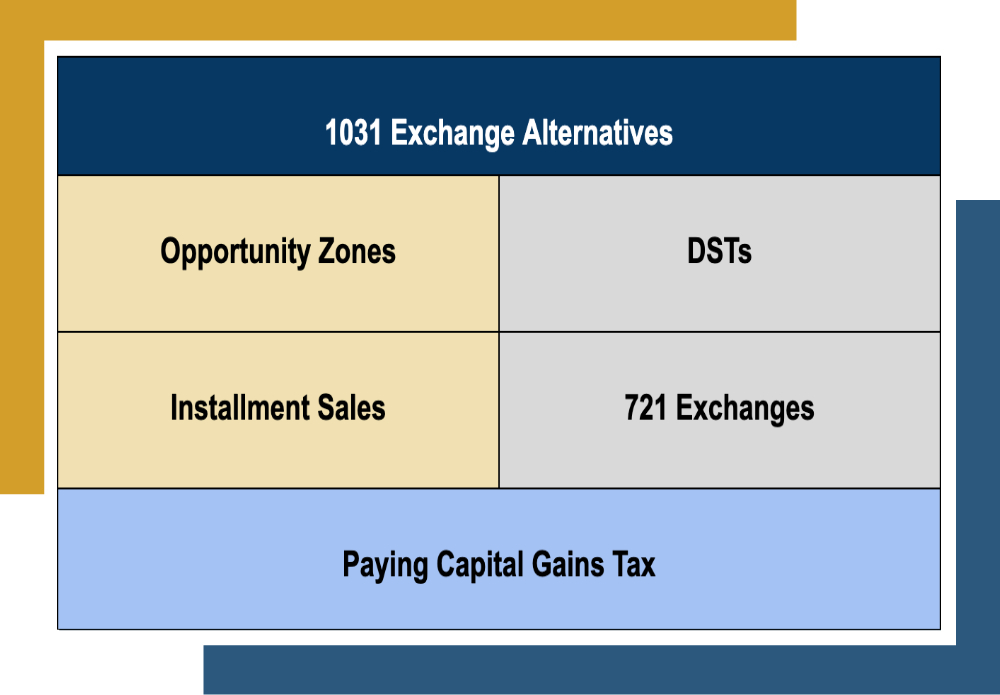

1031 Exchange Alternatives: A Comparison for Investors

Many property managers recognize the benefits of real estate investing, but shifting goals, property upgrades, or liability concerns may lead them to sell. Unfortunately, this often means facing 15-20% in capital gains taxes plus a possible 3.8% surtax for high-income earners. Thankfully, many property owners can turn to 1031 exchanges to defer these taxes and […]

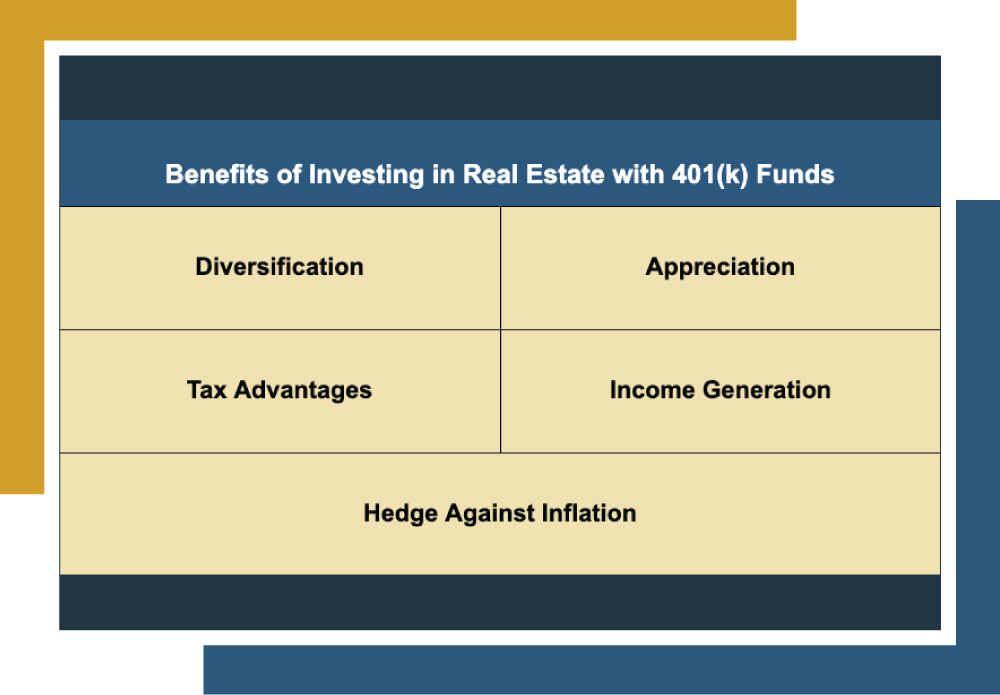

401k Withdrawal for Real Estate Investment

The trusty 401(k) has long been considered a de facto success route for retirement savings. However, recent economic trends and headwinds have caused many investors to seek alternative options. But what if they have a large amount of most of their retirement savings tied in a 401(k) and want to explore an option such as […]

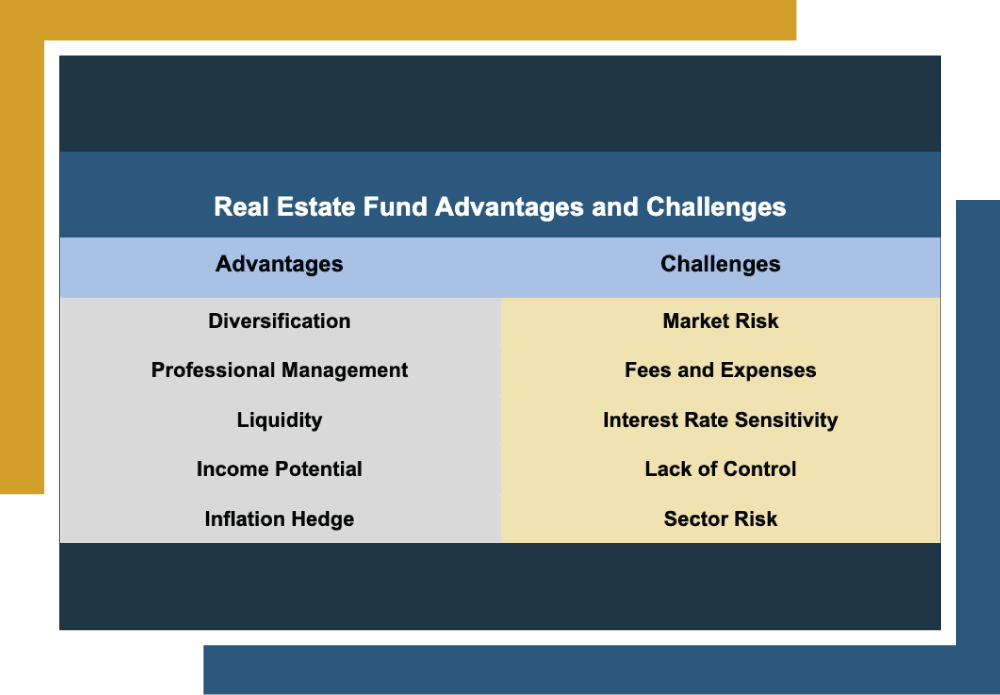

Are Real Estate Funds a Good Investment?

Savvy investors understand the importance of diversifying their portfolios, exploring new investment avenues to increase their income potentially, and spreading risk across multiple sectors. One popular investment sector is real estate. However, like any investment, there are various paths investors can take, each with its advantages and disadvantages. Real estate funds are a favored option […]

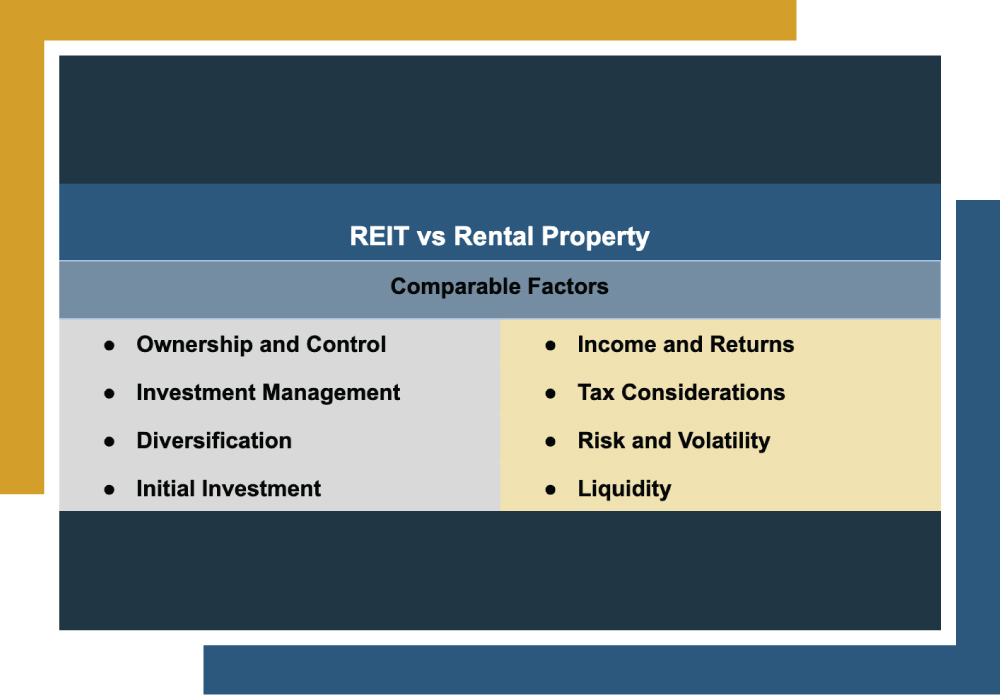

REIT Vs Rental Property

Much like other investment avenues, real estate investing offers diverse opportunities for investors seeking financial freedom. While many opt for the traditional approach of rental properties, it’s essential to be aware of alternative options, such as Real Estate Investment Trusts (REITs), which have gained popularity. This analysis will delve into the distinctions and commonalities between […]

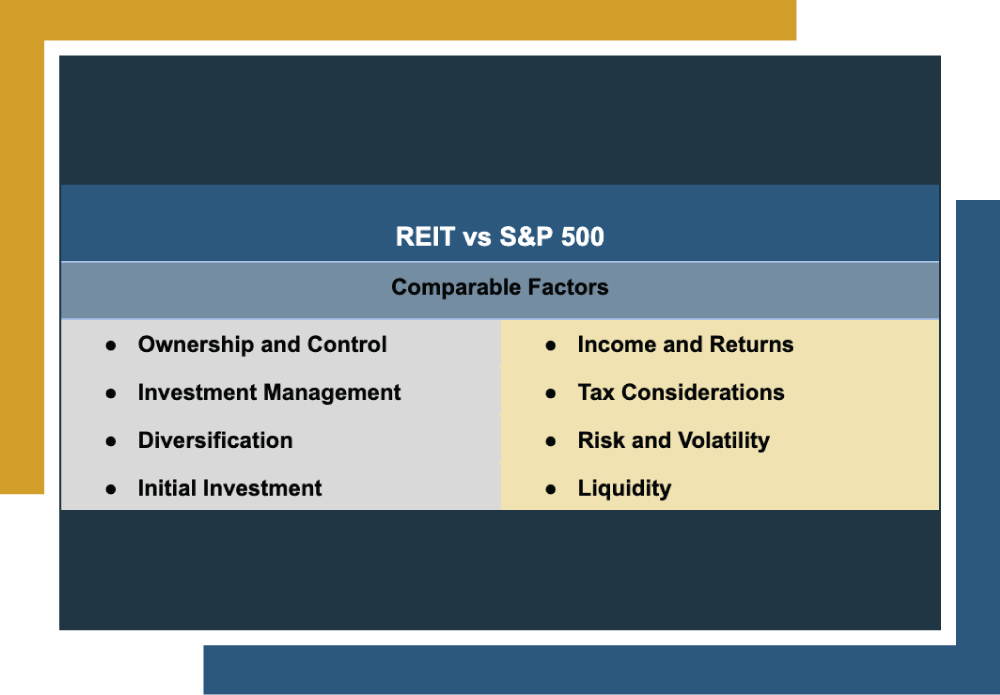

REIT Vs S&P 500

Like other investment options, real estate provides various opportunities for those seeking financial freedom. While many investors choose the traditional route of rental properties, it’s important to consider alternatives like Real Estate Investment Trusts (REITs), which have gained significant popularity. But how do real estate investments, particularly REITs, compare to traditional investment vehicles like the […]

How to Analyze Multifamily Investment Opportunities

Real estate investing can be a powerful tool for building wealth, with multifamily properties such as apartment buildings, condominiums, or duplexes offering many unique advantages. To make informed decisions and maximize your investment potential, it’s essential to understand how to analyze multifamily investment opportunities effectively. This guide outlines the critical steps in analyzing multifamily investment […]