Multifamily Investing 2024: What Investors Need to Know

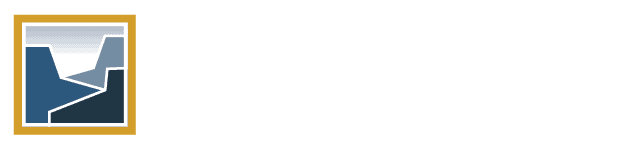

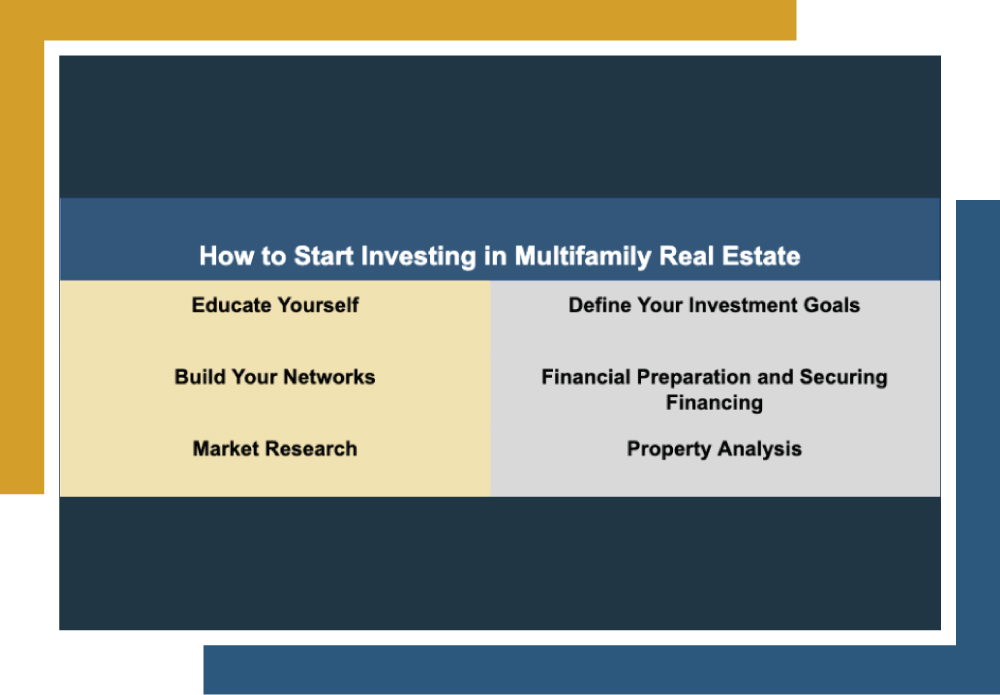

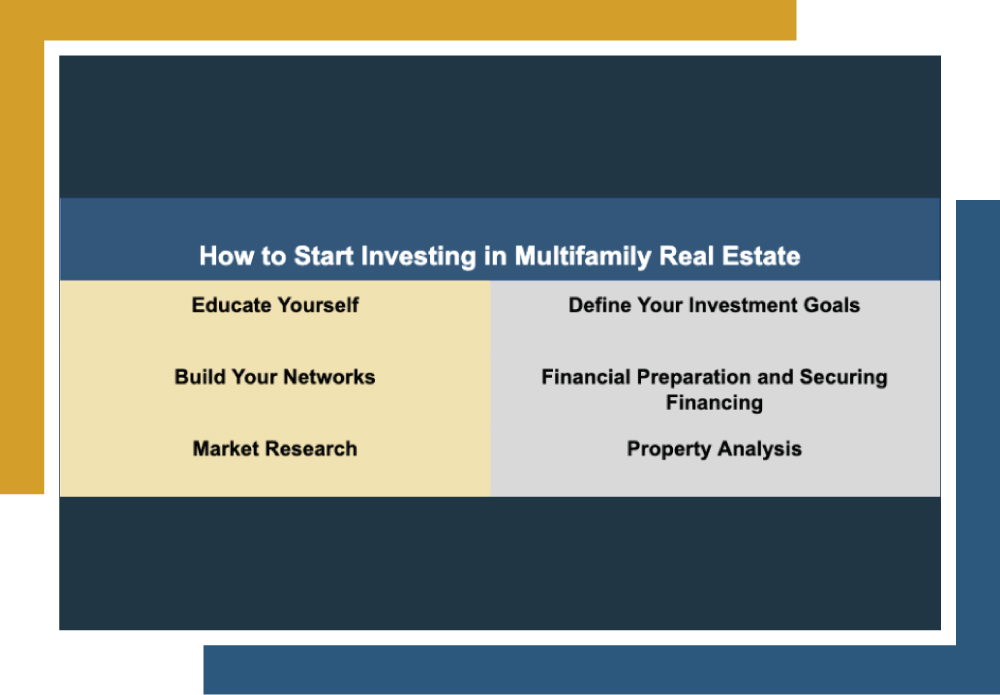

Whether you’re a seasoned investor or a newcomer testing the waters, you’re probably already aware of some of the benefits the real estate market can offer. It’s not uncommon for real estate investors to start with single-family properties. But what about another option? Multifamily real estate offers an exciting opportunity for investors of all backgrounds […]

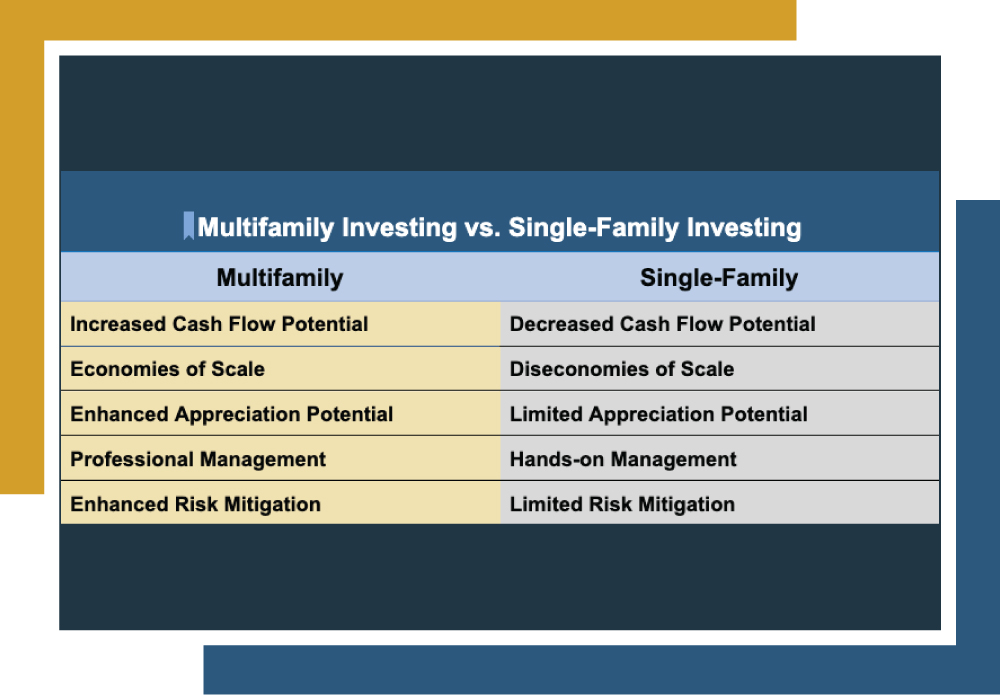

1031 Exchange DST Investments

1031 exchanges are unique tax deferral tools increasingly used by investors to maintain capital within their real estate portfolios. Instead of paying capital gains taxes on the sale of an investment property, investors can defer their tax burden and use the proceeds to acquire a replacement property. Navigating 1031 exchanges poses a challenge, particularly in […]

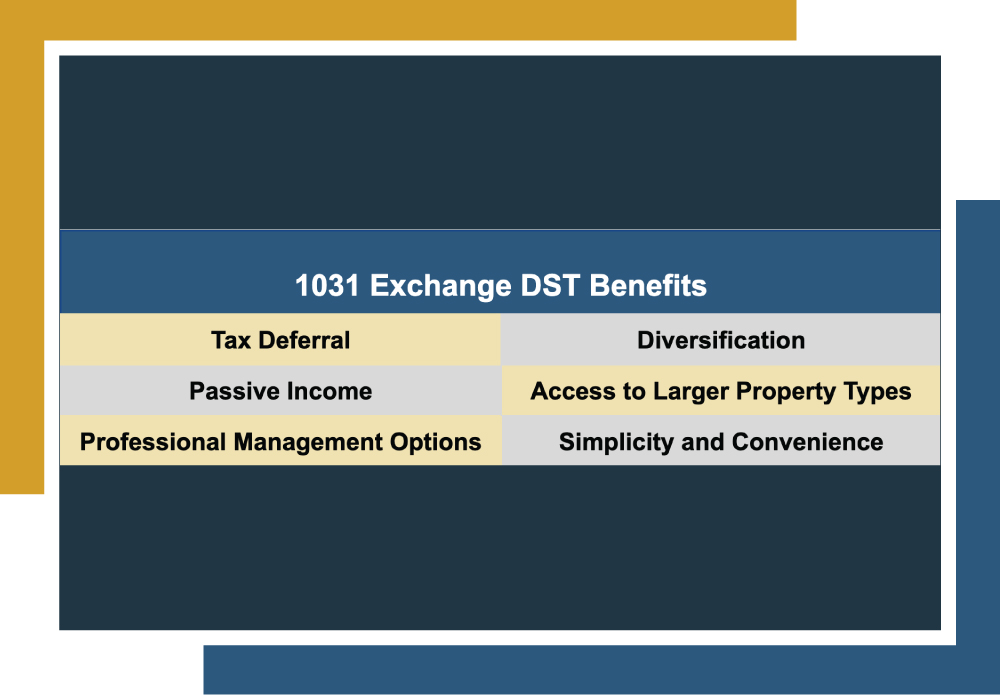

1031 Exchange Qualified Intermediary: What You Need to Know

A 1031 Exchange, as outlined by the IRS, is a unique tool that savvy investors can use to retain the full proceeds from selling an investment property within their portfolio. This is achieved by deferring their capital gains tax burden and exchanging into a replacement property. However, 1031 exchanges have strict rules and guidelines that […]

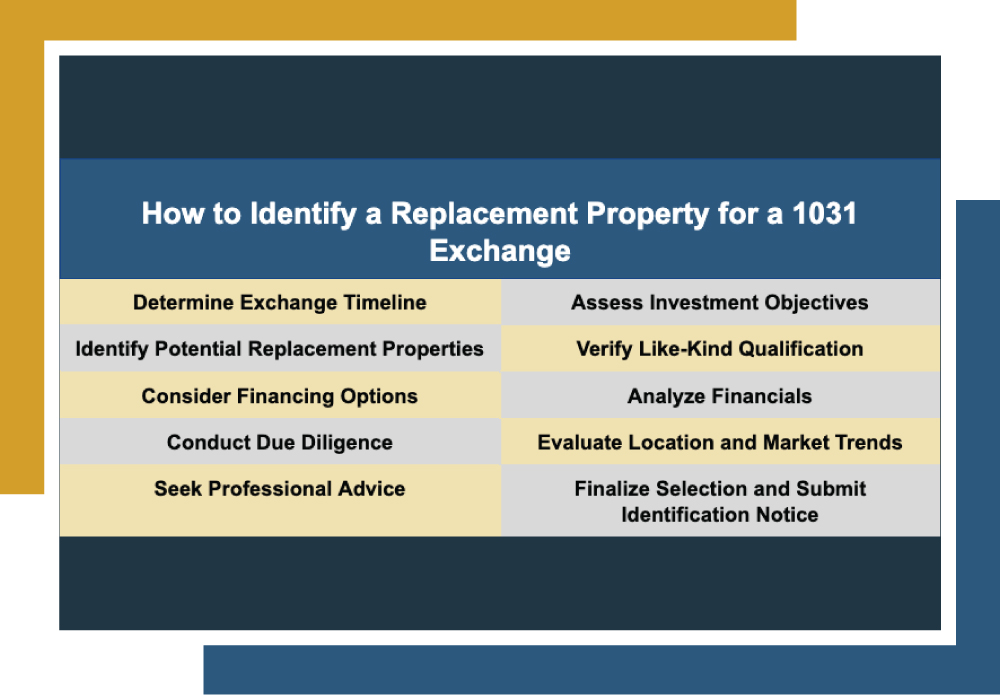

How to Identify a Replacement Property for a 1031 Exchange

1031 exchanges offer real estate investors a valuable opportunity to defer capital gains taxes when selling and replacing properties. By retaining the full proceeds from property sales, investors can maintain their portfolio and net worth intact. This helps sustain a robust real estate market by keeping funds within the industry rather than surrendering them to […]

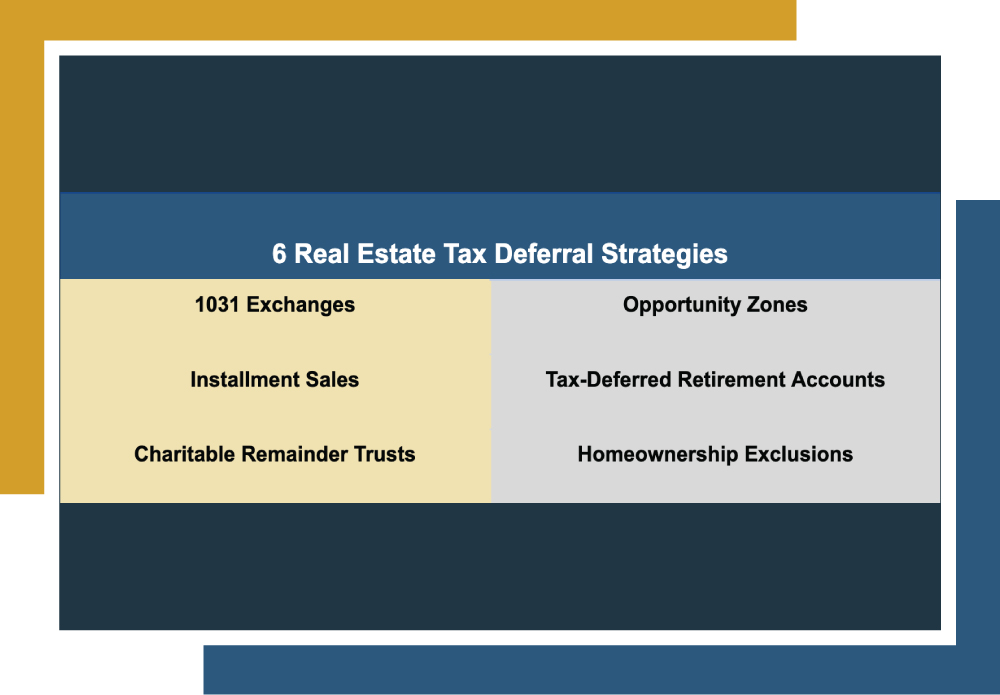

6 Real Estate Tax Deferral Strategies

In the realm of investing, individuals constantly seek methods to enhance their portfolios and safeguard their capital. However, a common obstacle to this goal comes in the form of taxes, as the IRS typically claims a portion of all transactions. Real estate is no different. However, savvy investors know how to utilize various methods that […]

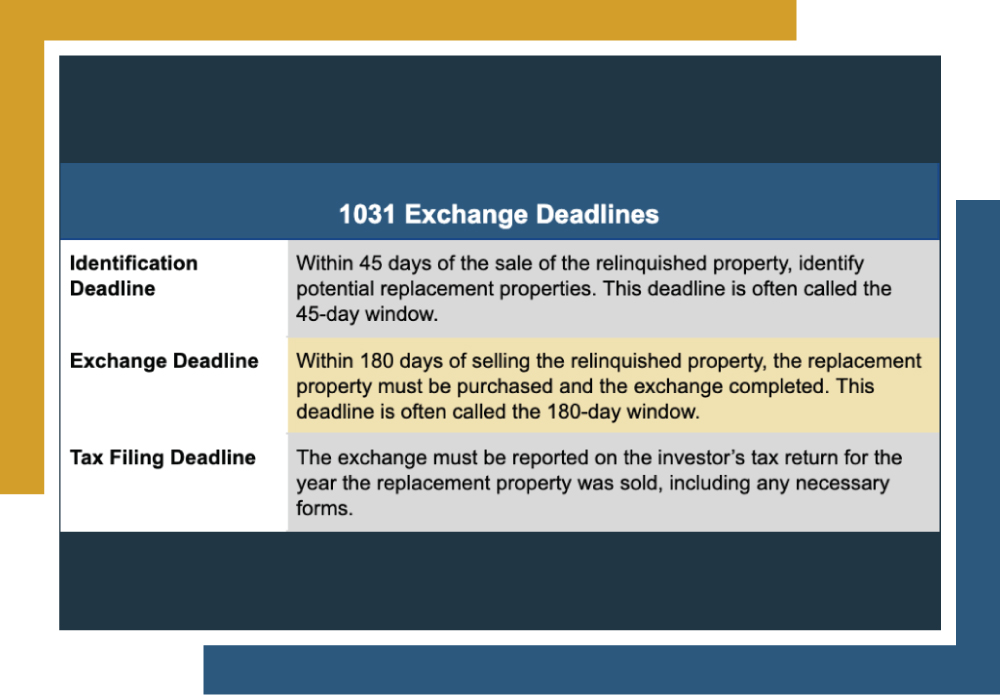

1031 Exchange Deadlines

When it comes to real estate investing, astute investors often seek ways to amplify profits while reducing tax liabilities. When contemplating selling properties to venture into fresh opportunities or alleviate managerial responsibilities, the 1031 exchange is a popular option. This IRS-code section allows the deferral of capital gains taxes, enabling investors to transfer tax basis […]

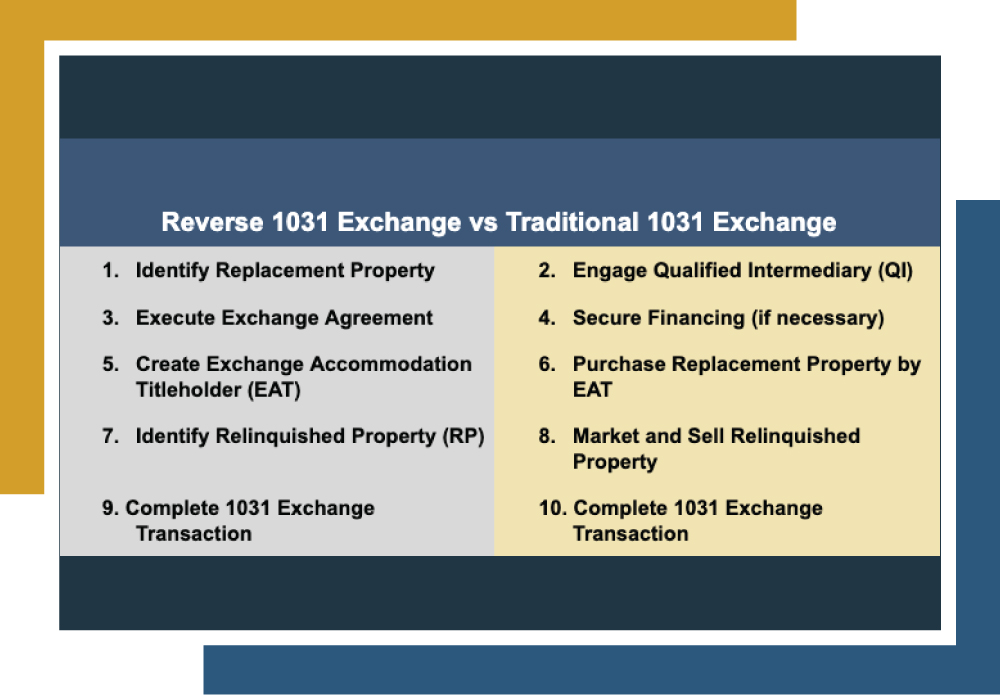

Reverse 1031 Exchange Timeline

1031 exchanges are powerful tax deferral tools that allow investors to negate their capital gains tax liability, letting them keep all the proceeds from the sale of an investment property in their investment portfolio. The rigidity and strict timelines of traditional 1031 exchanges to ensure their validity can pose challenges. However, the reverse 1031 exchange […]

Reverse 1031 Exchange Rules

The old axiom that nothing in life is guaranteed other than “death and taxes” typically rings true. Nevertheless, a growing number of real estate investors are discovering that the certainty of taxes on specific transactions may not be as guaranteed as previously believed. Utilizing the 1031 exchange, investors can defer taxes on investment property sales […]

1031 Exchange TIC: An Overview

In real estate investing, savvy investors seek strategies to maximize returns and minimize taxes. When considering selling properties to explore new opportunities or lighten management burdens, the 1031 exchange stands out. This IRS-code section allows the deferral of capital gains taxes, enabling investors to transfer tax basis and defer gains from one property into another. […]

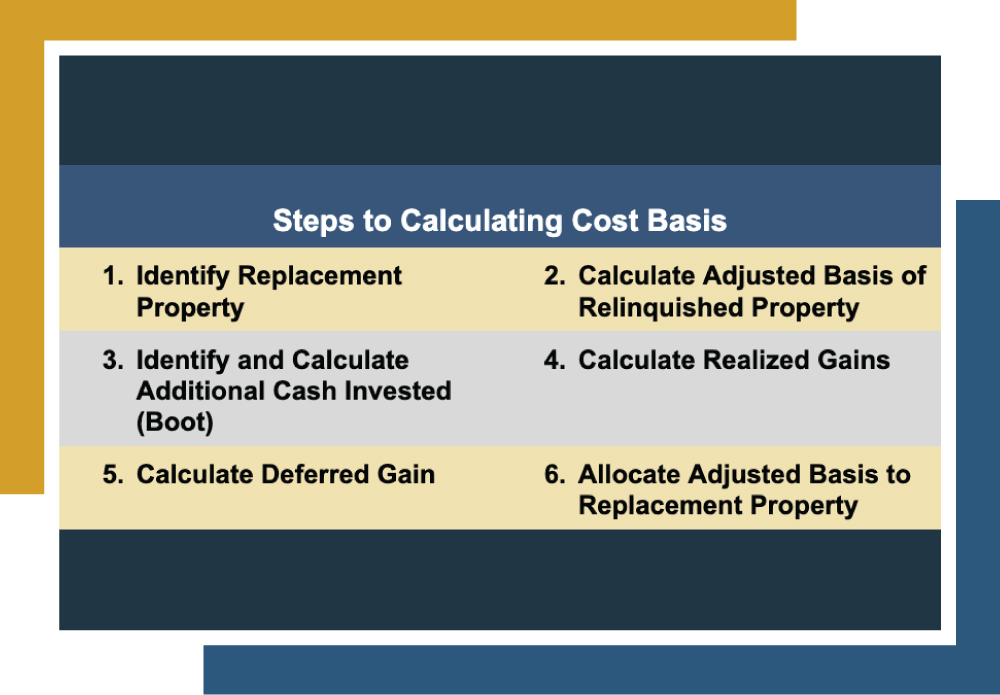

How to Calculate Cost Basis After a 1031 Exchange

Imagine you’ve been overseeing an investment property for a specific duration. Perhaps the property has experienced appreciation, prompting you to consider selling for a profit. Or maybe you’re contemplating a shift to a different investment opportunity for many reasons. Either way, when you sell an investment property, you will typically expect to owe capital gains […]