How to Become an Accredited Investor

When it comes to investing, access to investment opportunities is not a uniform experience. There are a variety of investments that require investors to be “accredited investors.” This is due to the U.S. Securities and Exchange Commission (SEC)’s restrictions. Some of the investment options that many investors may find enticing, such as private real estate […]

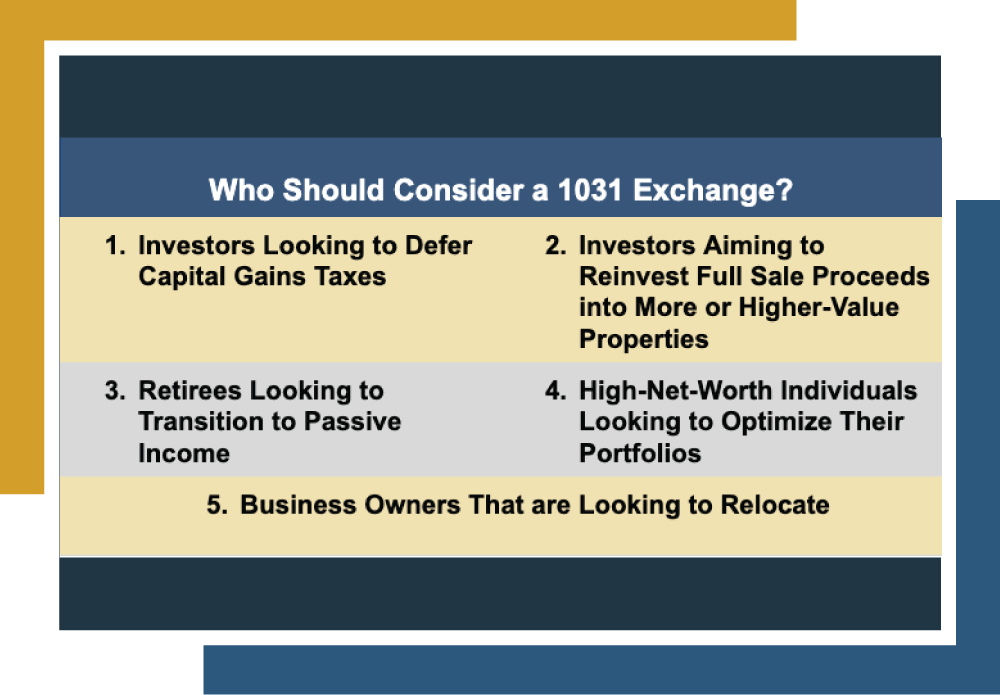

Is a 1031 Exchange Worth It?

If you’ve owned or sold real estate properties, chances are you’re aware of the inevitable capital gains tax liability that awaits you at the end of a transaction. But consider this: What if there were a way to avoid parting with significant funds in the form of capital gains taxes payable to the IRS? That’s […]

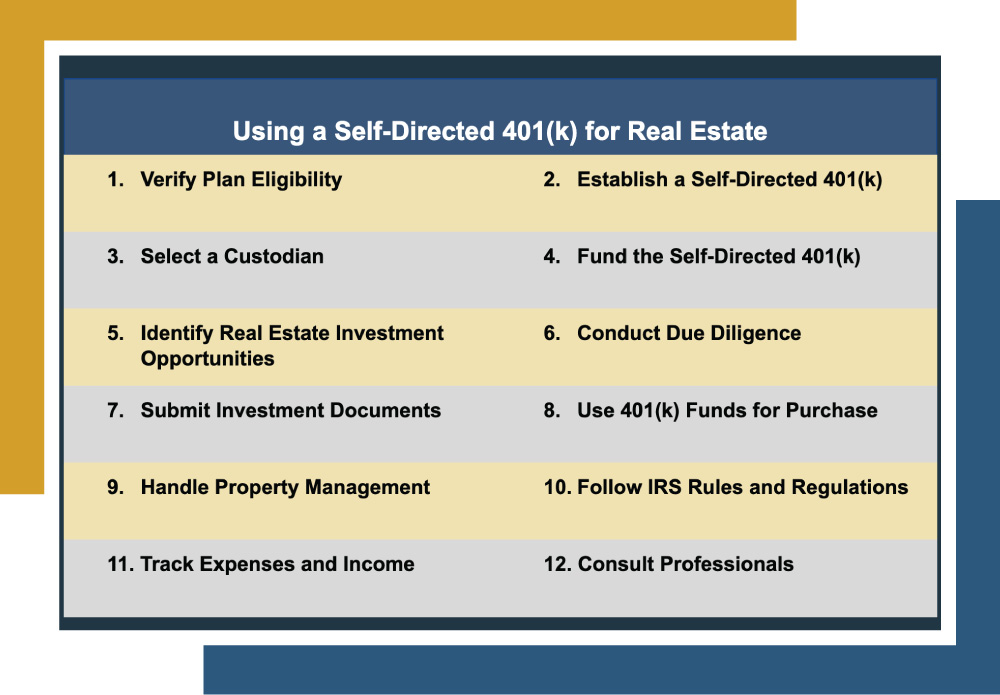

Can I Use 401k to Invest in Real Estate

Many Americans have traditionally leaned on personal retirement savings accounts such as 401(k)s as an investment in their future. However, some concerns are associated with them compared to other investment options, such as: Limited investment control Fees and expenses Market volatility Others are enjoying some of the potential benefits of real estate, such as: Appreciation […]

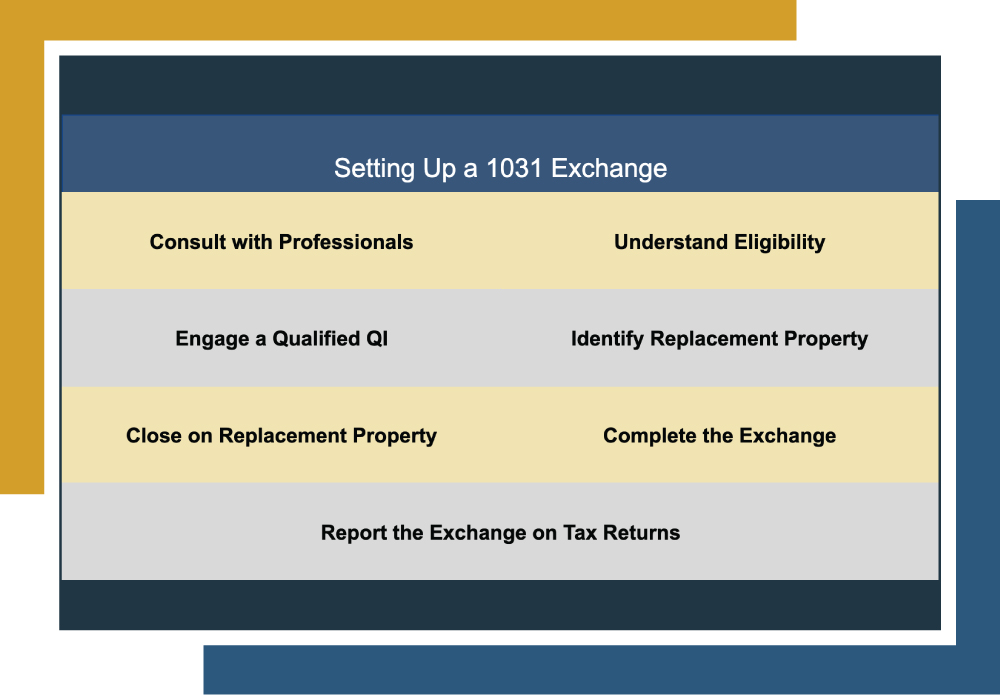

How to Set Up a 1031 Exchange

It’s probably not a controversial statement to say that many investors enjoy having real estate properties in their investment portfolio due to the many potential benefits of this asset class. However, just like any investment vehicle, there are caveats. One of the potential hangups with real estate investing is its potential tax burdens, such as […]

Self-Directed Ira Real Estate Rental Income

Investors have traditionally leaned on personal savings accounts such as 401(k)s and IRAs to save for the future. However, some concerns are associated with them compared to other investment options, such as limited investment control, fees and expenses, and market volatility. That’s why many investors are turning to alternative investment options like real estate to […]

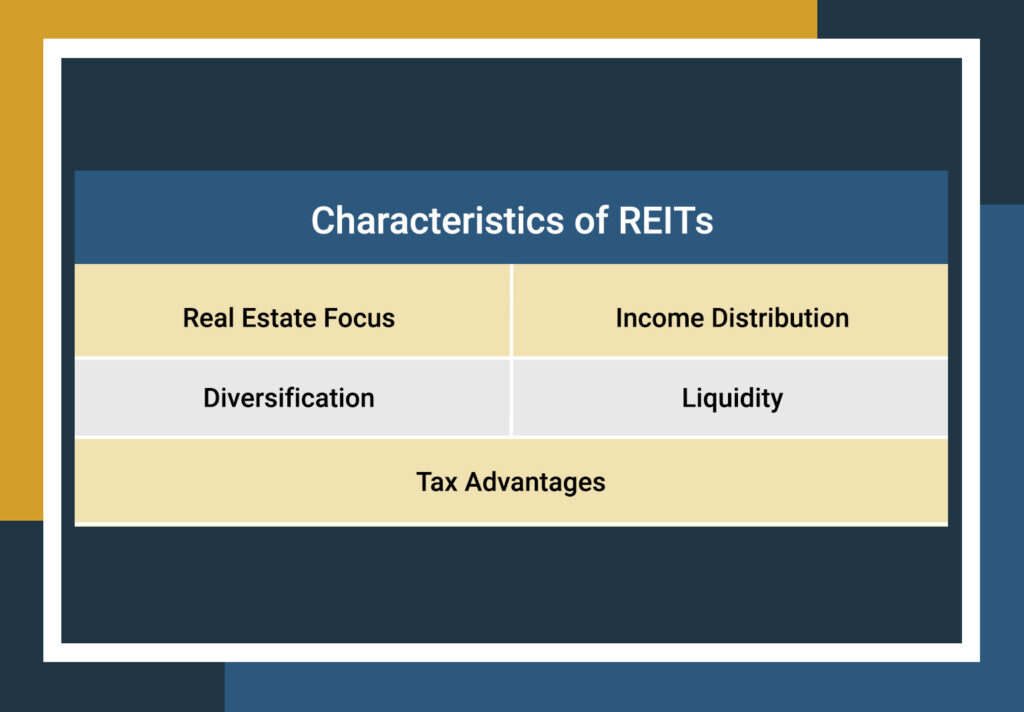

Do REITs Qualify for a 1031 Exchange?

Investors often include real estate in their portfolios for its potential benefits. Real Estate Investment Trusts (REITs) are popular among various real estate investment options. Whether investors choose direct real estate or REITs, many consider using 1031 exchanges to defer capital gains taxes when selling investment properties. Are you considering a 1031 exchange and wondering, […]

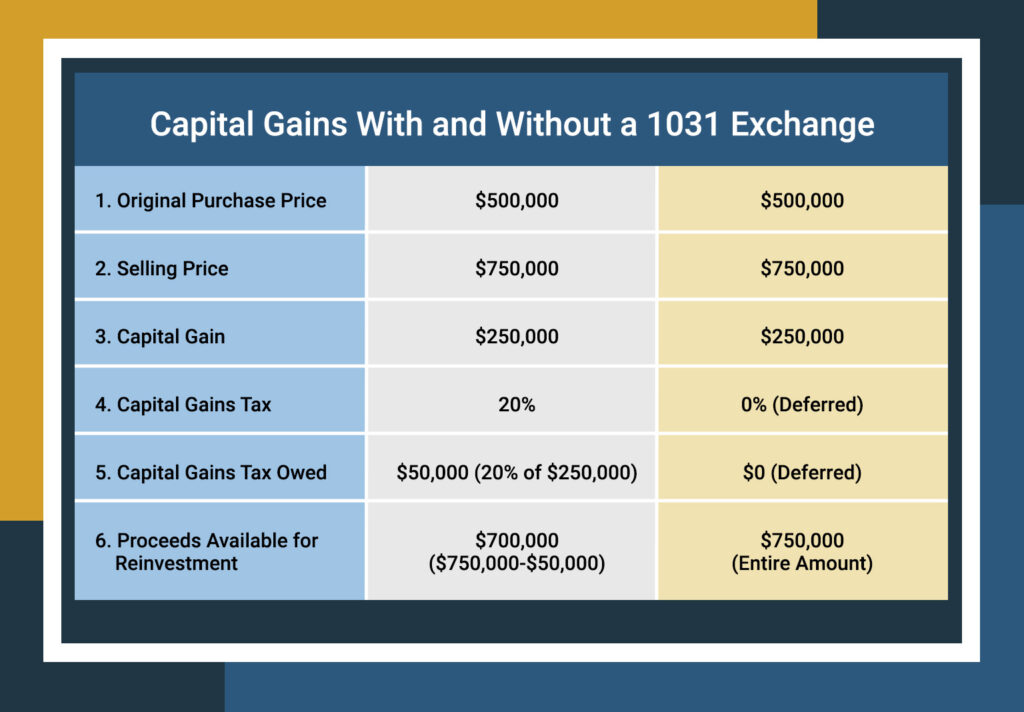

Capital Gains 1031 Exchange

Investors who manage investment real estate know just how much of a nuisance capital gains taxes can be. Should you part ways with an investment property and proceed with its sale, be prepared to owe the IRS a substantial portion, often upwards of 28% of the sale profits—an exorbitant figure by any measure. While you […]

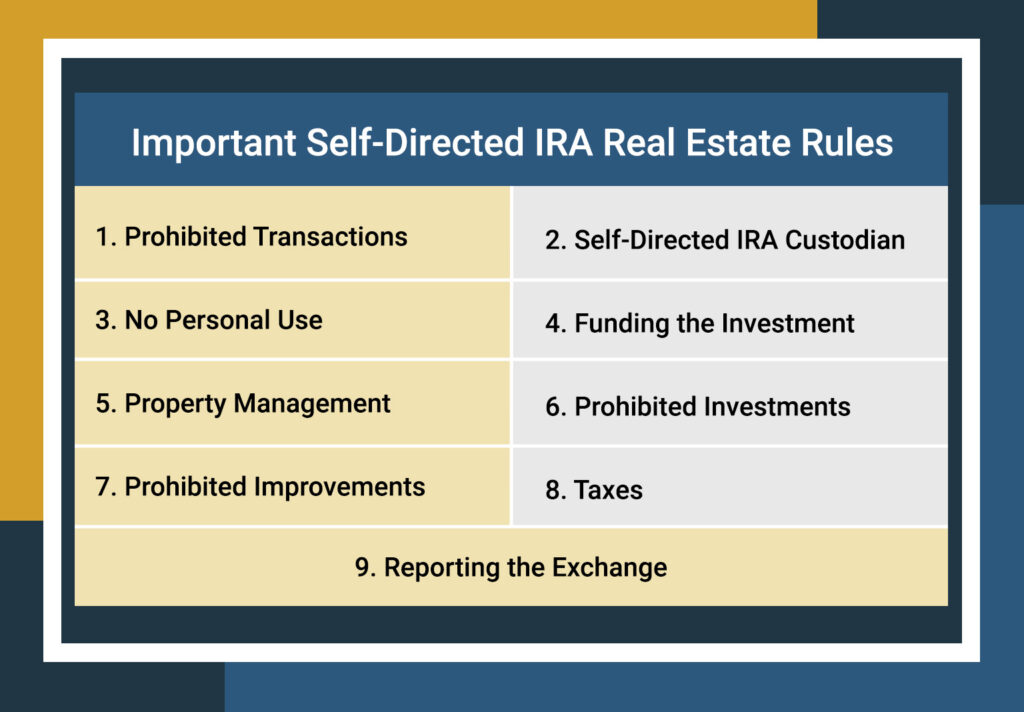

Self-Directed IRA Real Estate Rules

For some, saving money in a retirement account or investing in traditional assets like stocks and bonds has lost its appeal. For these investors, the benefits of alternative investments, such as real estate, may lure them into diversifying their funds in these unconventional avenues. But while Individual Retirement Accounts (IRAs) have many advantages, they come […]

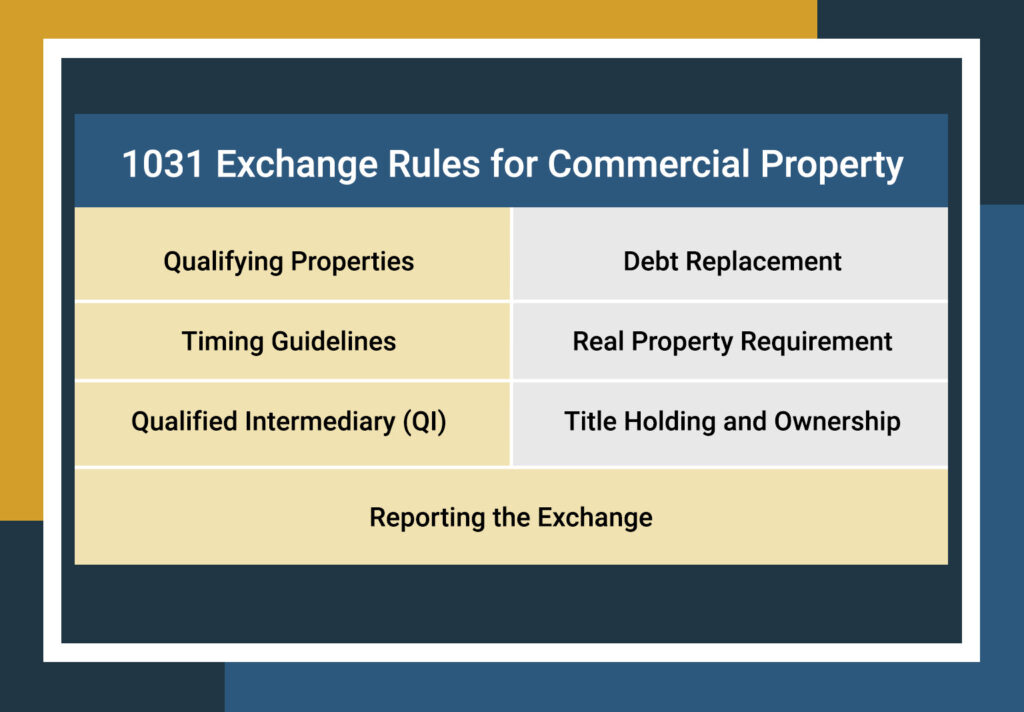

What Are the 1031 Exchange Rules for Commercial Property?

Are you an investor who is considering the sale of a commercial property and seeking strategies to optimize your returns? The 1031 exchange, also known as a like-kind exchange, might be the ideal solution. This tax-deferral tool allows investors to exchange one investment property for another, or even multiple properties, and reinvest the proceeds without […]

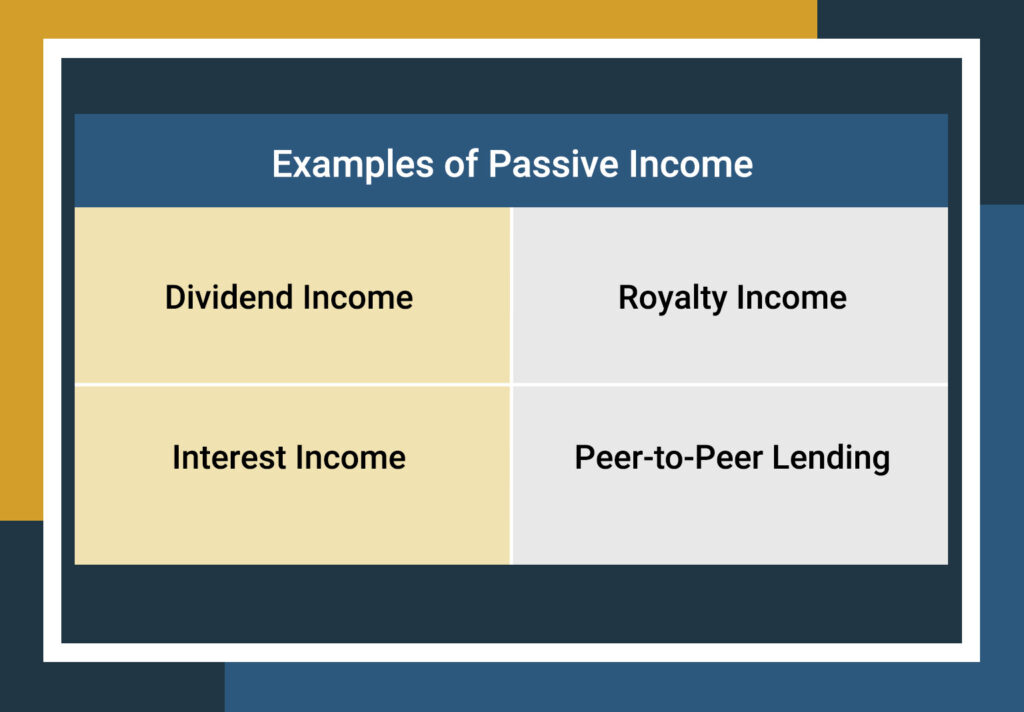

Do You Have to Pay Taxes on Passive Income?

Active investment avenues demand vigilant monitoring, and not everyone has the time or skills for this level of involvement. Investors are keen to diversify their portfolios with real estate, and it is easy to see why: passive income. Learn more about passive income, taxes on passive income, and deductions so that you can choose your […]