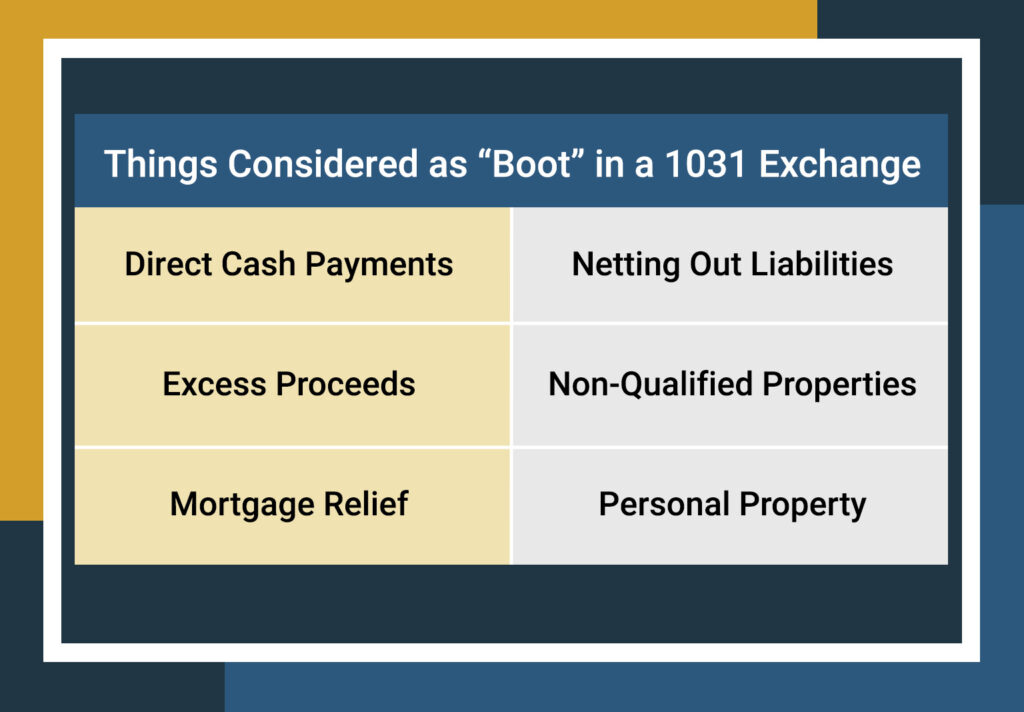

What is a Like-Kind Exchange Boot?

For real estate investors, 1031 exchanges have become a steadfast way to maximize profits and limit their capital gains tax liability. It’s not hard to see the appeal as deferring capital gains taxes on the sale of an investment property increases the investor’s purchasing power. However, 1031 exchanges are complex beasts that the IRS heavily […]

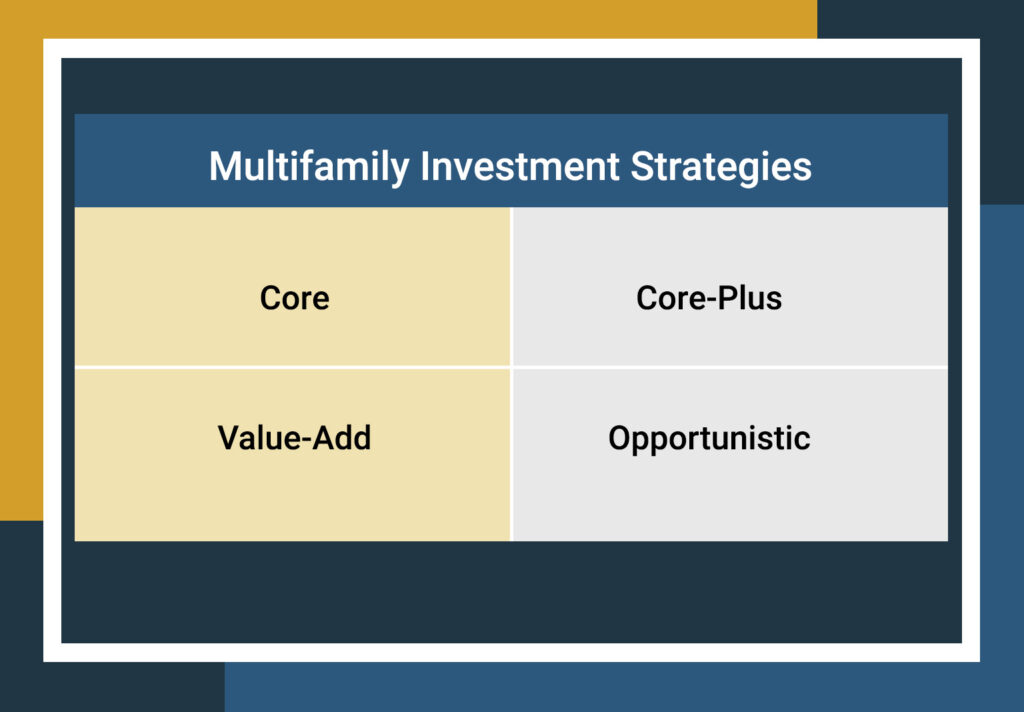

What Is a Good Multifamily Investment Strategy?

Investors are always on the lookout for the next game-changing addition to enhance their investment strategy. On this quest, many explore alternative investment avenues, with real estate often standing out as a compelling choice. Like in any investment landscape, real estate features distinctive sectors, such as multifamily investing, which possess inherent advantages that consistently captivate […]

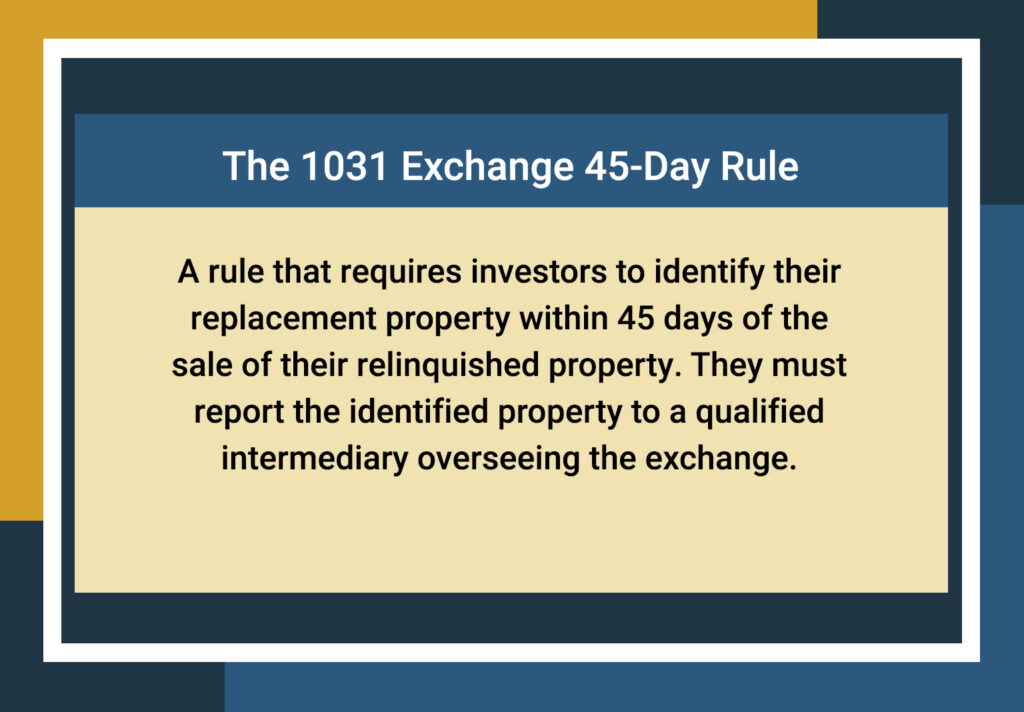

The 1031 Exchange 45-Day Rule Extension

Real estate investors are increasingly leveraging the advantages of 1031 exchanges. A 1031 exchange is a potent tax-deferral strategy that enables investors to postpone capital gains tax obligations following the sale of an investment property by swapping their relinquished asset for a new one. Often, adhering to strict timeframes is challenging during a 1031 exchange. […]

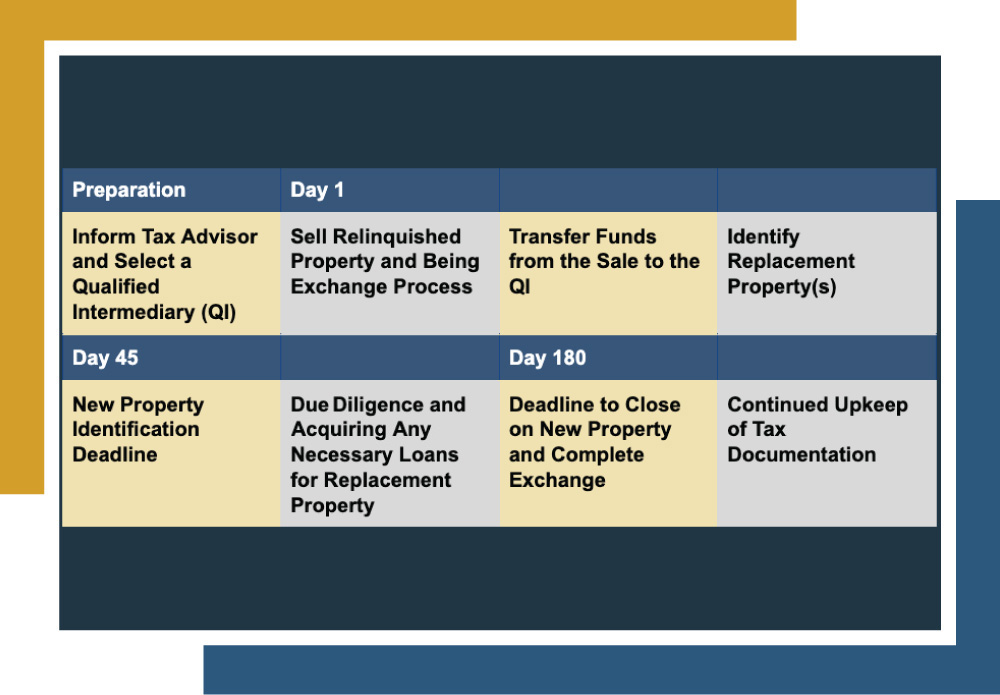

The 1031 Exchange Timeline: A Roadmap for Investors

Real estate investors often contemplate property sales for various reasons, including relocation, upgrading, or divesting underperforming assets while grappling with tax complexities. Investors increasingly recognize the value of 1031 exchanges, a tax-deferral tool. These exchanges enable the sale of investment properties without the burden of capital gains taxes, potentially saving up to 30% of the […]

Self-Directed 401k Real Estate: Benefits of Going Solo

401(k)s have been historically popular options for investors seeking to save for the future. These employer-sponsored retirement plans offer many advantages that have solidified their position as an investment vehicle. However, a potential downside of 401(k)s is their restrictive nature regarding specific investment options. In recent years, some investors have sought alternative investment strategies, such […]

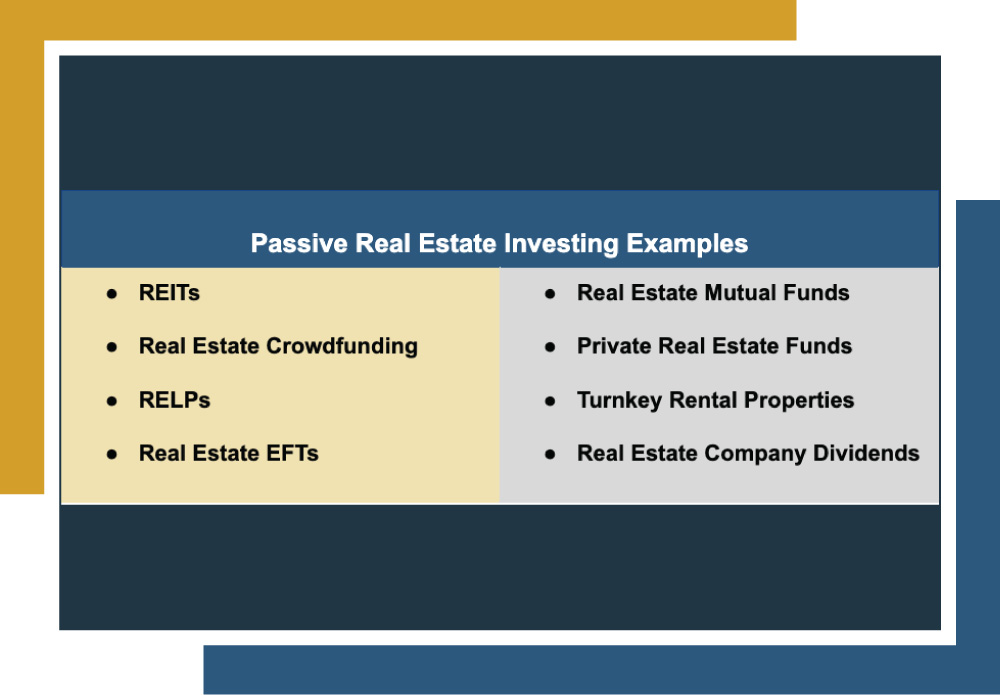

Passive Real Estate Investing Examples: Getting Started

In the ever-evolving landscape of investing, savvy investors constantly look for ways to grow their portfolios while minimizing their hands-on involvement. One path that many investors have become enticed by is real estate investing. However, like any investment, real estate often requires significant hands-on time, and there are many investing strategies to choose from. Also, […]

Investing in Real Estate vs 401k: Considering Your Options

Investors are always looking for ways to strengthen their investment portfolios, whether by diversifying into new investment vehicles or fortifying their current holdings. The overarching aim of investing is to bolster the financial reserves earmarked for the future. While 401(k)s have traditionally served as a tax-advantaged retirement savings option, some investors may find that relying […]

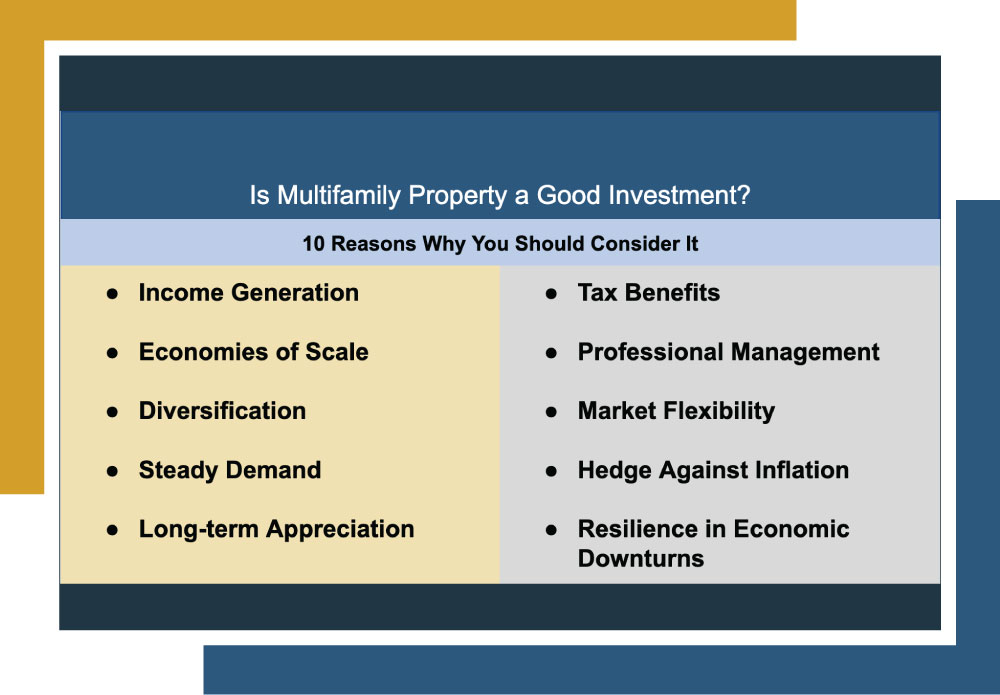

Is Multifamily Property a Good Investment?: 10 Reasons Why You Should Consider It

Real estate is an alternative investment avenue that some investors have turned to for various reasons. Whether it’s property appreciation, a source of consistent cash flow, hedging against inflation, tax advantages, or portfolio diversification, real estate offers many potential benefits for investors of all experience levels. In this article, we’ll discuss multifamily real estate investing, […]

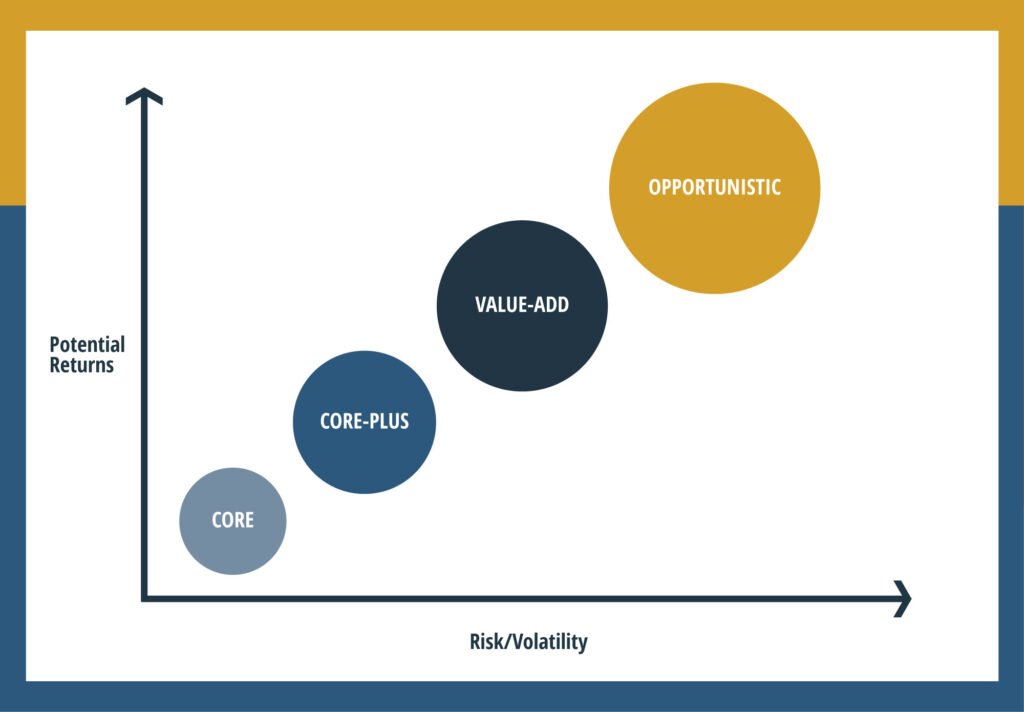

Different Types of Real Estate Investing Strategies

Many savvy investors have become privy to the idea of utilizing real estate as an investment vehicle in their portfolio. Like any investment, it is an ever-evolving landscape of opportunities that requires a nuanced understanding of the various strategies and approaches to investing. In this article, I will delve into the different types of real […]

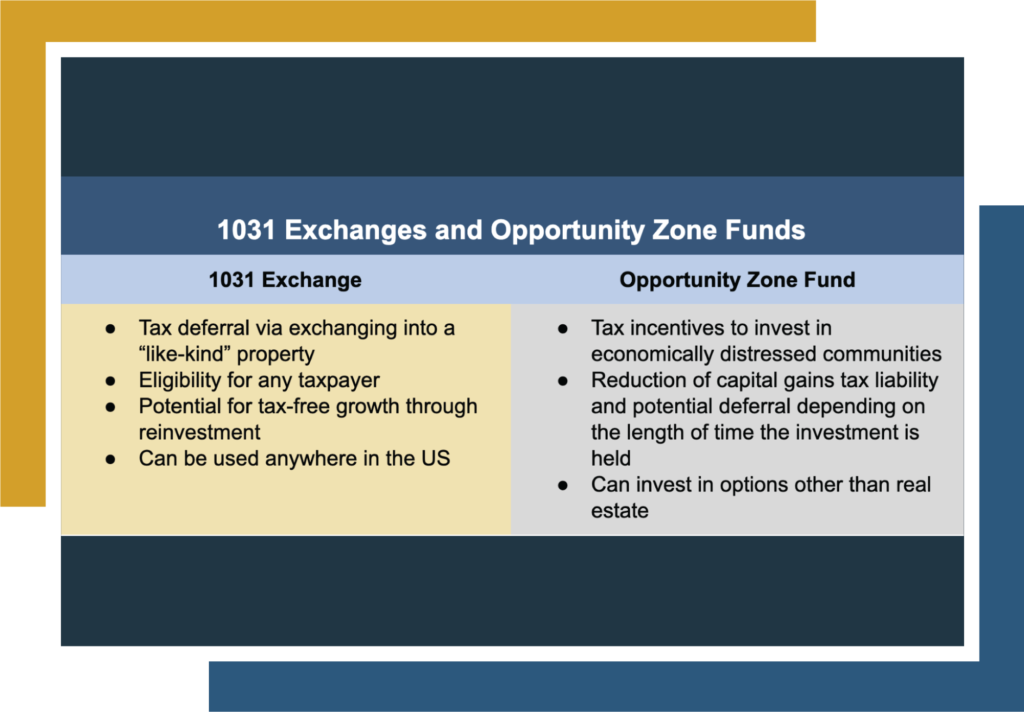

1031 Exchange Into Opportunity Zone

Investors are always looking for ways to get a leg up and enhance their investment strategy, and real estate investors are no different. Fortunately, there are many tools and tactics that real estate investors can utilize to do just that by deferring taxes, mitigating risk, and increasing returns. Two of these strategies are 1031 exchanges […]