About Canyon View Capital

Frequently Asked Questions

FAQS

An accredited investor is a person or entity that can deal with securities not registered with financial authorities by satisfying one of the requirements regarding income, net worth, asset size, governance status or professional experience. The term is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings. Accredited investors include natural individuals, banks, insurance companies, brokers and trusts.

Accredited Investors will meet at least one of the following requirements: Current and expected income equals or exceeds $200,000 per year if single or $300,000 per year if married

-Or-

Current net worth exceeds $1 Million, excluding the value of your primary home.

Click HERE to determine if you are accredited or not.

For more information specific to investing with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

SEC regulations prohibit us from publishing earnings on a public site. We welcome your questions and encourage you to call us at 831.480.6335.

An investor must meet the minimum requirements and be a good fit for the investment. One minimum requirement is investors must be accredited for the funds that are currently open for investment. An accredited investor is a person or entity that can deal with securities not registered with financial authorities by satisfying one of the requirements regarding income, net worth, asset size, governance status or professional experience. The term is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings. Accredited investors include natural individuals, banks, insurance companies, brokers and trusts.

Click HERE to determine if you are accredited or not.

Canyon View Capital partners with Strata Trust Company as Trustee/Custodian to transfer your IRA(s) into our CVC Income Fund. For more information specific to investing with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335

An investor must meet the minimum requirements and be a good fit for the investment. One minimum requirement is investors must be accredited for the funds that are currently open for investment. An accredited investor is a person or entity that can deal with securities not registered with financial authorities by satisfying one of the requirements regarding income, net worth, asset size, governance status or professional experience. The term is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings. Accredited investors include natural individuals, banks, insurance companies, brokers and trusts. Click HERE to determine if you are accredited or not.

The minimum investment for either fund is $250,000. This may be in the form of a cash investment or an IRA/SEP/ROTH rollover. For more information specific to investing with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

Our CVC Balance Fund (B Shares) is a tax-deferred fund and offers passive losses to offset passive income and available for cash investments only. Click here to learn more. The CVC Income Fund (A Shares) is a fully taxable fund (as portfolio income) and is available for both IRA/SEP/ROTH rollovers and cash investment. Click here to learn more

CVC’s founder and CEO, Robert (Bob) Davidson, started investing in real estate with his partners in the early 1980s. In 2001, we were incorporated as MyRetirementAssets, then rebranded under the current name of Canyon View Capital in 2012. For more information and inquiries regarding Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

No, but they are generally available. We will make every effort to work with you and create a good two-way communication on this complex process. There are windows for naming and closing a 1031 exchange that must be adhered to qualify for the 1031 tax deferred advantages. To discuss your individual situation with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

Counter to a “buy-and-flip” acquisition philosophy that is quite common in the West and East coasts, CVC’s investment strategy is, instead, rooted in a “buy-and-hold” philosophy proven to deliver steady, attractive returns over the long term for our investors. We invest in America’s heartland—the Midwest and Midsouth regions of the US—and apply our value-investing philosophy with each of our acquisitions. For more information regarding our overall strategy and earnings, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

Yes. We are happy to email this and other specific information specific to investing with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

Why Choose Canyon

View Capital

Stability

Tax Savings

Stock Market Alternative

Schedule a Consultation With One of Our Team Members Today

Our Latest News

Anyone who has managed or sold real estate properties is keenly aware of at least one of life’s few guarantees: taxes. Whether you make a record-breaking return or a modest profit, the Internal Revenue Service inevitably appears to collect the government’s cut.

Some savvy property owners use a 1031 exchange to delay capital gains taxes, typically restricted to investment properties. However, some wonder if a 1031 exchange can apply to a primary residence.

The IRS explicitly says “no,” but Section 1031 of the tax code has exceptions that may allow for a 1031 exchange on a primary residence. Below, I’ll explain the process and how it could be possible to use this fantastic tax deferral tool.

Using a 1031 Exchange on a Primary Residence

Usually, the IRS does not allow 1031 exchanges for primary residences. This factor is because 1031 exchanges are meant to be used on investment properties or properties held for business purposes, and primary residences are used as your shelter.

However, as with many things in the Internal Revenue Code, there are exceptions to the rule and ways to use a 1031 exchange for a primary residence.

Converting a Primary Residence Into an Investment Property

How often has someone mentioned they’ve decided to buy a new home and rent the old one to tenants? Perhaps you’ve even done this yourself, as it’s a typical entry path to real estate investing for many Americans.

One way you can conduct a 1031 exchange on your primary residence is by converting it into an investment property.

There are a couple of stipulations, of course:

- The IRS does not explicitly state how long a property must be held for rental purposes to be used for a 1031 exchange. A general rule of thumb, upon which many CPAs agree, is that you should rent the property out at fair market rates for at least two years.

- You cannot reside at your property in any capacity while it’s being used as a rental. It must be explicitly used for investment purposes.

|

How to Convert a Primary Residence into an Investment Property for a 1031 Exchange |

|

|---|---|

| 1. Move Out of the Primary Residence |

First, you must vacate the premises and stop using it as a primary residence. |

| 2. List the Property for Rent |

You will then need to rent out the property (at fair market value). This step is crucial because it establishes that the property is being used for investment purposes and no longer serves as your primary residence. |

| 3. Rent the Property for at Least Two Years |

While the IRS doesn’t set a specific timeframe, it’s widely recommended that the property be rented for at least two years to clearly establish it as an investment property for tax purposes. |

| 4. Do Not Reside in the Property |

While the property is being rented, you cannot live in it. The property must be used exclusively for investment purposes. |

| 5. Document Rental Income and Expenses |

Keep accurate records of all rental income and expenses, such as maintenance, repairs, and property management. Doing so will support the conversion in case of an IRS audit. |

| 6. Conduct a 1031 Exchange |

After holding the property for investment purposes, you may now be eligible to use a 1031 exchange to defer capital gains taxes when selling the property and purchasing another investment property. |

Here’s a hypothetical example of this process. John lived in his home for 10 years but decided to rent it out when he moved to a new house. After renting it at fair market value for two years, he converted it into an investment property.

By following IRS guidelines, he was able to use a 1031 exchange on his former primary residence, deferring capital gains taxes and rolling the proceeds into a new investment property.

Section 121 Exclusion

Another option for saving taxes is to exclude part of the capital gain using a Section 121 exclusion. While not quite the same as a 1031 exchange, Section 121 exclusions can give you additional elbow room for capital gains taxes on primary residences.

Instead of being a method of tax deferral, it allows you to exclude gains on the sale of a primary residence of up to $250,000 for single filers and $500,000 for joint filers. To use Section 121, you must have resided on the property for at least two of the previous five years, although it doesn’t have to be a continuous period.

There is one huge caveat with Section 121 exclusions. Homeowners can only claim this exclusion once every two years.

|

Section 121 Breakdown |

|

|---|---|

| 1. Understand Section 121 Exclusions |

Section 121 allows homeowners to exclude up to $250,000 (single filer) or $500,000 (joint filer) of capital gains on the sale of a primary residence. |

| 2. Meet Residency Requirements |

You must have lived in the home as your primary residence for at least two of the five years before the sale. These two years do not need to be consecutive. |

| 3. Claim the Exclusion |

Homeowners can claim the exclusion once every two years, meaning they can use it repeatedly so long as the conditions are met. |

| 4. Mixed-Use Properties |

If the property was partly used as a primary residence and partly for investment, you may still qualify for a partial exclusion based on the percentage of time that it served as a primary residence. |

| 5. Consider Special Circumstances |

Exceptions exist for special situations, such as unforeseen circumstances (job change, health reasons), which may allow for a partial exclusion even if the residency requirement isn’t fully met. |

It should be noted that any tax strategy involves adherence to rigid guidelines to ensure validity. Always consult with a tax professional or financial advisor before making any decisions regarding your property.

Canyon View Capital Makes 1031 Exchanges Easy

Now that you know more about using a 1031 exchange on a primary residence, you’ll be looking for options to use a 1031 exchange. If you’re one of the many investors who no longer want to carry the burden of property management or simply want an easier way to receive real estate income. CVC may have a great solution.

We manage a portfolio of multifamily properties across the Midsouth and Midwest valued at over $1 billion1, and we want to help you get a slice of that pie. By exchanging into one or more of our properties as Tenants in Common, you’ll be able to enjoy passive real estate income and potential tax benefits without lifting a finger.

Need more information on using a 1031 exchange on a primary residence?

Canyon View Capital can show you the way! We will walk you through every step of your 1031 exchange, and our in-house professionals will always answer your questions honestly, completely, and promptly. CVC will help you cut through the red tape, no matter how sticky it gets. Contact Canyon View Capital TODAY!

Verified accreditation status required.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.

While investing can be a rewarding experience, venturing into new financial waters can bring on feelings of anxiety. Despite the learning curve, most investors still want some kind of reassurance that they’re making the best moves — especially when you have so many options.

Another concern of financial ventures is the fact that at some point, Uncle Sam will come for his share. Taxes are typically as unavoidable as, well, — death and taxes, when it comes to real estate investments.

If you’re a landlord or property manager, you’re probably already aware of this fact because all the net income your property generates counts as taxable income. This small — but vital — detail can add to an already lengthy list of nagging deadlines. On top of all the duties, responsibilities, and expenditures of managing real estate property, paying taxes on it may feel like an added insult when you finally have an opportunity to sell.

This is why the tax break from a 1031 exchange has become an increasingly attractive option for new investors and real estate managers. If you’re a California resident who wants to explore real estate opportunities in other states, you may be wondering if a 1031 exchange from California to another state is even possible. The short answer is that it is.

Below, we’ll answer that question in greater detail — and we’ll offer a baseline explanation of a 1031 exchange, including some guidelines and restrictions.

1031 Exchange in a Nutshell

If you’ve ever sold an investment property, you know you’re responsible for paying capital gains taxes on any profit you make from the sale. But did you know there’s a way to defer those taxes?

If you’ve ever sold an investment property, you know you’re responsible for paying capital gains taxes on any profit you make from the sale. But did you know there’s a way to defer those taxes?

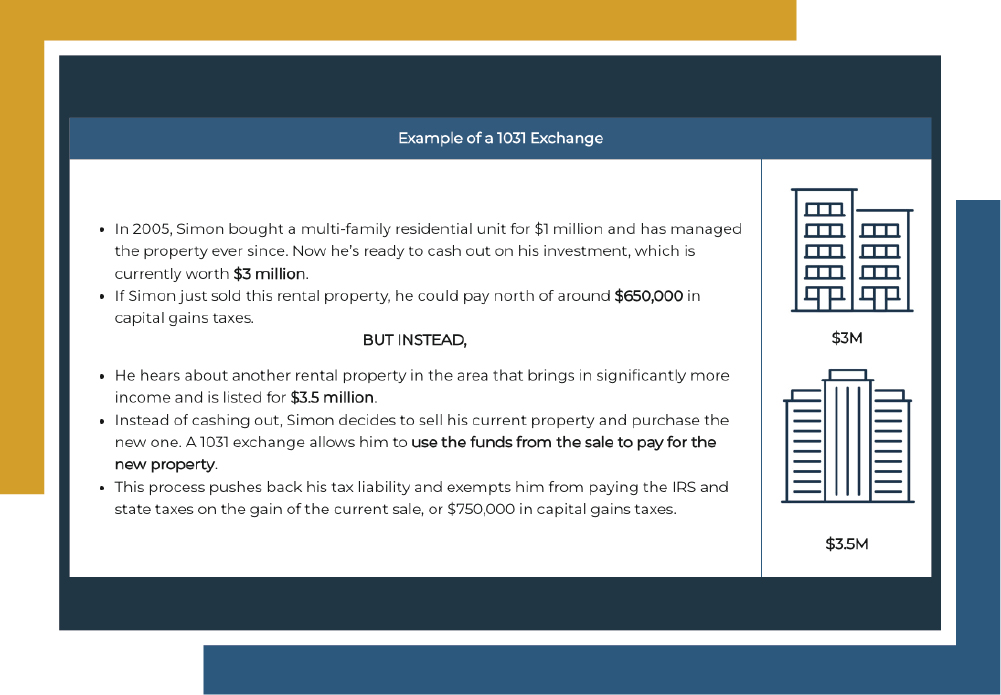

A 1031 exchange, named for Section 1031 of the Internal Revenue Code (IRC), refers to the practice of swapping one real estate property for another to delay (or “defer”) the required payment of capital gains taxes.

This tax break applies when you sell a property that’s used explicitly for investment purposes and purchase another, “like-kind” investment property of equal or greater value. This transaction essentially negates your need to pay taxes on capital gains for your transaction.

For example, if you purchased an investment property for $150,000 and sold it for $300,000 five years later, you may be on the hook for around $50,000+ in federal/state capital gains taxes — that’s nearly a third of the profits you made.

| Example of a 1031 Exchange | |

BUT INSTEAD,

|

$3.5M |

You can see how skipping this last step of the property sales process might seem attractive to investors. And, when done correctly, this practice can be used in perpetuity. While 1031 exchanges are a great way to defer capital gains taxes, you should know about some of the guidelines and strict timelines that apply.

1031 Exchange Rules

One of the most important things to note concerning a 1031 exchange is that proceeds from the sale cannot be received by the seller. That means that when you sell your property, the funds must be handled by an accommodator (sometimes called an intermediary) or the 1031 exchange will be null.

Also, when engaging in a 1031 exchange, there is a rather tight window during which the process must be completed.

- 45-Day Rule: When the sale of your property is complete, you need to designate the replacement property and communicate it in writing to the accommodator within 45 days.

- 180 Day-Rule: Once you have decided on your property and notified the intermediary you intend to close on it, you must complete the transaction within 180 days of the sale of your previous property.

It is also crucial to understand that these two time periods run synchronously. That means if you notify an intermediary of your new property 30 days after your first sale, you now have 150 days to close on that property (180 minus 30).

How a 1031 Exchange from California to Another State Works

For those living in California, the prospect of selling high-priced West Coast real estate and purchasing something in an entirely different state may sound enticing. There are many reasons to consider this strategy.

For instance, the value of California homes is usually much higher than properties in a more central state like Arkansasor Missouri. That means if you exchange a California property, you could potentially get a lot more bang for your buck and end up with more units, or higher-end properties in more centralized (stable) real estate markets.

A common concern regarding 1031 exchanges is whether or not they can be done state-to-state. It’s understandable, given that each state has its own laws for retail and property sales.

Thankfully, there are no such laws that prevent exchanging property from California for property in another state. Under IRC Section 1031, real estate in the US is like-kind to real estate located in another state and you can exchange from one to another. As part of the federal tax code, it applies to all states. However, there are some nuances in play for California and some other states:

- California requires investors to file return information within the same year the out-of-state change occurs, as well as every proceeding year.

- Whenever an investor sells without an exchange, taxes are typically due to the state in which the final property is sold (apart from some specific exceptions).

If you want more detail on these points, make sure to consult with your own tax expert or financial advisor for clarification.

In essence, 1031 exchanges offer shrewd real estate investors to enhance their wealth-building capabilities by deferring capital gains taxes. However, 1031 exchanges can be just as complex as they are beneficial. They must be executed correctly — and on time — so you can enjoy their rewards. That’s why even seasoned investors should enlist the help of professionals who understand the deep financial and tax-specific intricacies of 1031 exchanges.

Canyon View Capital Helps You Upgrade Your Portfolio

At Canyon View Capital, our principals have spent the better part of the last four decades managing real estate that has amassed over $1 billion1 in value. Early company leaders have handed down their wisdom, and now our team is eager to share that expertise with you: our investors.

Now you know the basics: 1031 exchanges have great benefits, but only if you can complete the requirements within a narrow window of execution. CVC can help simplify the process and accommodate your needs accurately and swiftly. We’ve helped plenty of investors roll their sales into one of our multifamily properties located in America’s Heartland, which is just one kind of opportunity we offer.

This allows you to enjoy steady benefits from rental units that tend to be that tend to be higher-yielding, less volatile, and more cost-efficient than what you find in California. We are committed to guiding you through your 1031 exchange and working with you to make sure you have a thorough understanding of the process. We’ll even answer your additional questions about taxes or accounting. All of us at CVC are eager to share our expertise.

Can you do a 1031 exchange from California to another state? Absolutely! Give us a call and we’ll show you how.

Still hazy on the details of a 1031 Exchange from California to another state?

Canyon View Capital can show you the way! We will walk you through every step of your 1031 exchange, and our team members will always answer your questions honestly, completely, and promptly. CVC can help you cut through the red tape, no matter how sticky it gets. For a successful exchange, contact Canyon View Capital.

Verified accreditation status required.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.

Most Americans state that building wealth for the future is a major career goal. This ethos of “working to live” instead of “living to work” prompts many folks to start setting capital aside for a comfortable retirement. While not many want to work forever, most people do look forward to living well, especially in their golden years. That’s why this blog discusses using a 401(k) for investment property.

It should come as no surprise that investment properties offer enormous potential value to investors because they add another avenue for stable returns to their portfolios. What may surprise you is that eligible investors may be able to invest in real property by using funds currently held in a 401(k).

It should come as no surprise that investment properties offer enormous potential value to investors because they add another avenue for stable returns to their portfolios. What may surprise you is that eligible investors may be able to invest in real property by using funds currently held in a 401(k).

If you’re looking for ways to diversify your portfolio, I’ve got the details you need to know to use money in a 401(k) to purchase real estate investments.

401(k)s Explained

![]() For decades, 401(k)s have replaced traditional pensions as the most common financial vehicle for retirement savings. Recent factors like market volatility, inflation, withdrawal limits, and accompanying taxes, however, have started raising questions about whether investments held in a 401(k) alone can sustain a suitable quality of retired life.

For decades, 401(k)s have replaced traditional pensions as the most common financial vehicle for retirement savings. Recent factors like market volatility, inflation, withdrawal limits, and accompanying taxes, however, have started raising questions about whether investments held in a 401(k) alone can sustain a suitable quality of retired life.

Definition

Typically employer-sponsored, 401(k)s are tax-advantaged retirement plans through which companies often match a certain percentage of employee contributions. Employees can choose a flat dollar amount or percentage of their gross salary to contribute from every paycheck. All contributions are tax-deductible, but withdrawals are subject to taxes.

This readily accessible option gives even the least financially savvy individual an opportunity to invest in funds with limited hands-on involvement. With a standard 401(k), you can just set it and forget it!

Limitations

You might notice some drawbacks in the details, however, that could make a 401(k) less enticing as a singular retirement option.

Chief among them is the limit of options you have over how to invest your money after it’s contributed. The capital in your 401(k) is essentially locked in place — usually 401(k) participants must select from a pre-set portfolio of stocks, bonds, and mutual funds — until you make a withdrawal. That means even if you have hundreds of thousands of dollars invested, you have little choice about which individual funds your money goes into.

In addition, it could take years before you are vested in your employer’s contributions. Though the length of time varies with individual plans, most employees are fully vested within either 3 or 6 years, maximum. You may risk forfeiting any employer contributions if you leave a company before you’re vested. If this occurs, it could significantly impact your account balances and funds invested to date.

Moreover, as market forces continue to shift in extremes and inflation reaches decades-high levels, your current 401(k) investments may simply not be enough to provide the life you’ve imagined when it’s time to retire and reap the rewards of your hard work.

In short, while 401(k)s do allow you to contribute easily to a retirement savings account without worrying about closely managing the funds, they do have some shortcomings, which can include:

- Limited options for investment once the funds have been contributed.

- Possible delay of several years before you become vested.

- IRS limits on yearly contributions.

- Tax penalties upon early withdrawal.

.

There are ways to transfer your money out of its current 401(k) vehicle to explore more options to invest your money. It all starts with what is known as a 401(k) rollover.

Rolling Over a 401(k)

A 401(k) rollover involves a direct transfer of the funds from your current 401(k) plan to an individual retirement account (IRA). There are some intricacies here that we recommend you speak to your investment advisor about. If a rollover is right for you, funds placed in a self-directed IRA may be eligible for various alternative investments, including real estate.

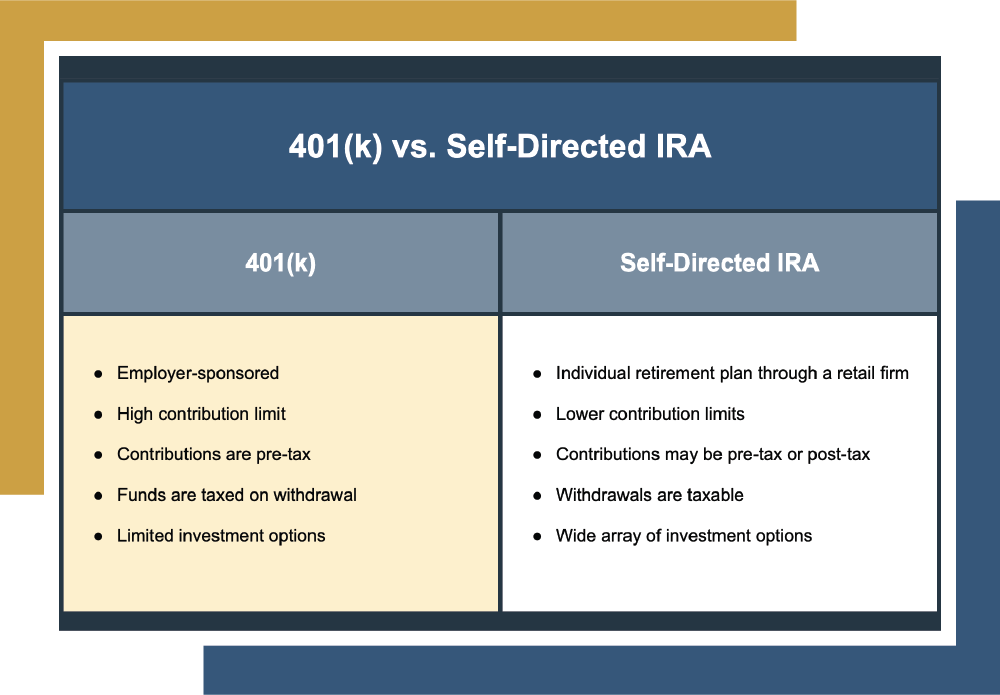

The table below lists some of the key differences between a 401(k) and a self-directed IRA.

401(k) vs. Self-Directed IRA | ||

401(k) |

| |

Self-Directed IRA |

| |

The key factor when comparing 401(k)s with self-directed IRAs regarding investments is that you have a lot more options with a self-directed IRA because you generally have access and can control what you do with the funds.

This article and the grid above contain only summary information about 401(k)s and self-directed IRAs. Be sure to talk to your financial advisor and your tax professional to ensure you understand these investment vehicles, rules, and the limitations that may apply.

How to Use 401(k) Assets for an Investment Property

Earlier in this article, we mentioned real estate investing options, but we had to save discussing the nuts and bolts until after the 401(k)-vs.-self-directed-IRA explanation. That’s because while you generally will not have the ability to invest 401(k) funds for direct real estate investing, you can gain this ability by using a self-directed IRA.

So, you’ve set aside funds from your 401(k) and rolled them into a self-directed IRA. Now your money isn’t restricted to traditional investments like bonds or stocks and—subject to certain limitations—you can fund a variety of alternative investments, like real estate.

But what are the mechanics of this process, you ask? While the process is a bit involved, we can distill it into a handful of main steps, listed below.

- Open your self-directed IRA.

- Roll your funds from your 401(k) into the IRA.

- Locate your potential investment property.

- Make an Earnest Money Deposit.

- Prepare for the escrow process with the title company.

- Close the purchase of the property.

- Begin managing the property.

.

Now that you have the basic dance steps, there are a few guidelines and caveats you should know about before beginning this process:

- The property must be used solely as an investment property. It cannot be used as a second home, an office for your business, or a home for family members.

- Any revenue generated from the property, like rental income, must be declared as taxable income.

.

Armed with all this knowledge, your next step is to use it to start diversifying your investment portfolio. It’s worth noting that taking on an investment property is a huge responsibility, especially for those who are new to the whole real estate investment strategy. As the property manager, you’ll be responsible not only for ensuring the tenants are happy and that the property satisfies legal requirements, but you’ll also manage the taxes and fees that come with your new source of income.

If it sounds like you’re trading away the convenience of “setting and forgetting” your automatic 401(k) contributions, that’s not necessarily the case.

For example, instead of managing a property directly, you could put your money into a real estate investment that’s managed by another party. This allows you to enjoy the benefits of real estate investing without the extra responsibilities of property management. You could give Canyon View Capital a ring to find out what kinds of options we have that will accommodate your self-directed IRA. All it takes is a phone call.

Canyon View Capital Makes Real Estate Investing Simpler

Here at Canyon View Capital, real estate investing is our bread and butter. CVC principals have over 40 years of experience, and now our team manages over $1 billion (aggregated) in real estate properties located across middle America. Our offerings have similarities to other real estate investments but without the burden of property management.

Whether you’re new to real estate investing or an old pro, the CVC team is ready to make real estate investing as easy for you as possible. We can also leverage a depth of pooled knowledge from principals with a broad scope of professional experience.

New to real estate investing, but want to learn more about 401k real estate investment options?

CVC’s investment management professionals are eager to share our strategies. Give us a call, so we can discuss which options are right for you.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.

A common concern for many Americans progressing through their careers is how to prepare for the transition from actively working to “retired” — emotionally and financially. If you’re one of the millions of people with an employer-sponsored retirement plan, you’re probably wondering if you’ve saved enough — and may be curious about the returns you’re getting on those savings.

A recent Investment Company Institute report on the $37 trillion US retirement market indicates 401(k)s make up just over $7 trillion, or roughly one-fifth of the total assets. The rest includes individual retirement accounts (IRAs), pensions, and annuities for private and public sectors.

Aside from increasingly rare pension funds, 401(k)s considered a “simpler” approach to investing because contributions come out of your paycheck automatically. Such regular deposits in investment options can offer many people a sense of security — especially when compared to other savings vehicles, like certificates of deposit (CDs), bonds, or keeping it under your mattress. While recent market downturns, higher fees, and periods of recession could deflate the perceived stability of 401(k)s, a bigger issue is how much flexibility such savings allow.

But there is another way—if you have money in a 401(k), that doesn’t necessarily mean it’s completely tied up! If you’re reading this post, you’ve probably got a solid start on your retirement savings, and now you want it to work for you. If you’re looking for ways to diversify your investment portfolio with alternative options like real estate, this discussion on 401(k) real estate investment rules can help you get started. Use the links below to jump ahead to different sections.

| Discussion Topics | |||||||

Why Investing for the Future Matters

Almost everybody wants to enjoy a relaxing, stable retirement — barring a few special exceptions. When it’s time to move on to the chapter beyond your career, how much you manage to save until that point can strongly influence the quality of your retirement.

Your dreams don’t end just because you retire. When you’ve successfully invested in your future, you want the ability to realize those aspirations, along with new goals developed along the way. More importantly, you want to maintain financial independence long after stepping away from an active career. For a lot of people, such independence comes from a retirement fund, the most commonbeing 401(k)s and IRAs.

401(k)s Explained

401(k)s are defined contribution plans typically used by US employers as retirement funds. These funds offer tax advantages for employees, who can designate a pre-tax amount of each paycheck for deposit. In some cases, employers can opt to match employee contributions.

As an example, if an employee elects to deposit 5% of every paycheck into a 401(k), their employer can choose to match that dollar amount. If an employee’s contribution amounts to $500 per paycheck and their employer opts to match it, another $500 is deposited in the employee’s retirement account.

Depending on the plan, it can take some time before you are fully vested in your employer’s contributions, meaning that you own them outright. If you leave a job before you’re vested, you could forfeit some or all matching contributions to your 401(k).

Deposited funds are typically invested in a number of different savings vehicles that, together, make up the entire 401(k). With some 401(k) funds, you can choose how to allocate your savings from a list of stocks, bonds, mutual funds, and CDs.

Because traditional pre-tax retirement contributions are deducted from an employee’s gross income, the deposited amount reduces taxable income. And, as no taxes are due until the money is withdrawn, these savings can grow tax-deferred.

ROTH 401(k)s

The ROTH 401(k) is another type of retirement fund, but with one key difference from traditional models: this species of savings uses post-tax deductions. The deposits are deducted from net income (unlike traditional 401(k)s), but there are no taxes due for withdrawals after age 59 ½.

Regardless of the type, all 401(k)s have limits on the maximum amount of annual contributions (for 2023, the max amount is $22,500).

401(k) Types | ||||

Name | Summary | Withdrawal Rules | Contribution Taxes | Withdrawal Taxes |

Traditional 401(k) | Standard pre-tax employee savings plan. A percentage of each paycheck (gross earnings) is deposited in investments. | Earnings are taxed when withdrawn. Withdrawals before age 59 ½ are penalized unless they meet an IRS exception. | Pre-tax contributions reduce taxable income. | Withdrawals are taxed as ordinary income. |

ROTH | Post-tax employee savings plan. Similar to traditional 401(k)s but deposits are made as post-tax contributions (from net income). | No tax on withdrawn earnings meeting the following requirements:

| Post-tax contributions lower your weekly paycheck. | Withdrawals are not taxed if they meet IRS stipulations. |

401(k) Real Estate Investment Rules You Should Know

Now that you have a better understanding of 401(k)s, you’ll likely want more information about managing the funds you’ve contributed. There are some individual plan guidelines that determine what you can and can’t do with the money once it leaves your paycheck and is deposited in retirement savings. There are also a few 401(k) real estate investment rules that must be followed when moving that money into real estate.

Often, when you start contributing to a 401(k), you’ll be allowed to choose how the money is invested or if it will just sit in a money market account. In general, 401(k)s tend to have rigid guidelines on how funds are invested. Some of those rules specify:

- You cannot invest in individual companies.

- You may select one or more mutual funds or exchange-traded funds (ETFs) that invest in sectors or in a variety of companies.

- You cannot pull money out of a 401(k) before age 59 ½ for traditional 401(k)s without meeting one of the IRS exceptions — or from ROTH 401(k)s before age 59 ½ unless you become disabled — without suffering a penalty.

- When you leave one job for another, there is a 60-day window wherein the IRS allows you to move your money from a 401(k) into an IRA.

.

The last rule is crucial to giving you greater investing flexibility with your 401(k) funds. That’s because unless you want to pay a steep 10% fee on funds you withdraw (unless you meet an exception), it’s the only leeway the IRS gives you.

IRAs are another kind of pre-tax retirement savings account but they differ from 401(k)s in that they have no employer sponsors. As indicated by the name, “individual account,” investors have more agency in deciding where the money goes.

If, for instance, you wanted to take money out of your IRA and invest it in a wider universe of investment options, including real estate, you can do so! IRAs do come with a few caveats, compared to 401(k)s. They have lower contribution limits and are not eligible for matching employer contributions.

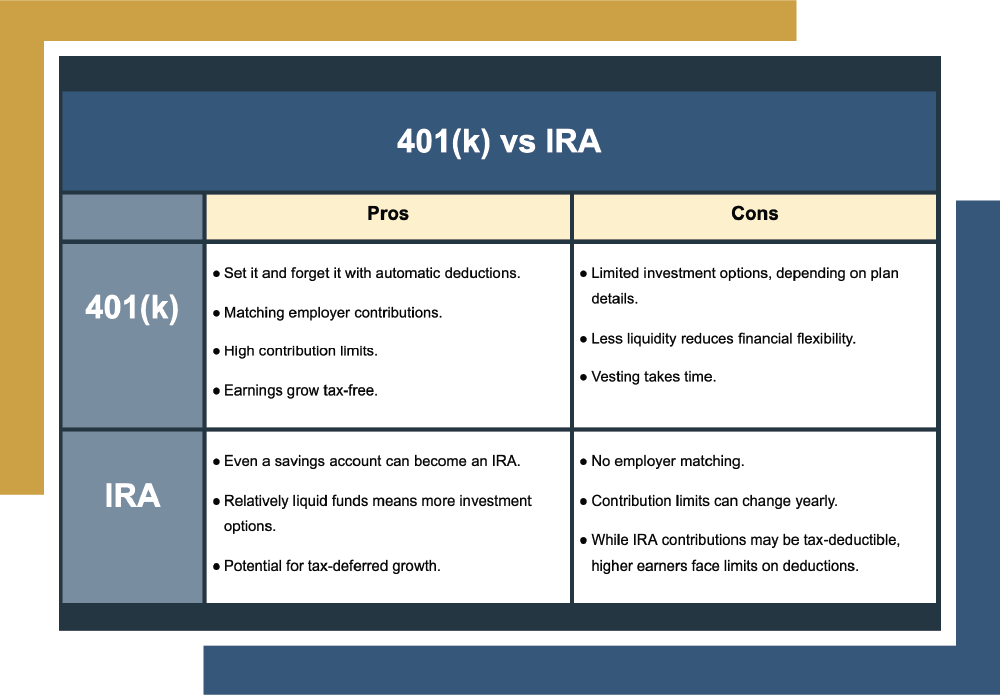

401(k) vs IRA | |||

Type | Summary | Pros | Cons |

401(k) | Standard employee savings plan. Accessible option to deposit a percentage of each paycheck. Employers may match contributions. |

|

|

IRA | Pre-tax savings plans available to anyone. Similar to 401k, but lower contribution limits. More flexible option offered by banks, brokerages, or investment firms. |

|

|

Despite some limitations, IRAs are a valuable tool to have in your retirement planning toolkit because you can invest money from an IRA directly into real estate. Conversely, a crucial 401(k) real estate investment rule to remember is that you cannot invest money from a 401(k) directly into real estate.

Instead, you must roll your 401(k) funds over into a self-directed IRA. Using the 60-day window allotted by the IRS to move money from a 401(k) to an IRA is called a rollover. This strategy can be used to free up money that may otherwise be “stuck” in the more restricted investment opportunities that 401(k)s offer.

There is also a standard process that you must follow.

By taking advantage of a self-directed IRA, you can explore a wider range of investment options like real estate that may not be available through your 401(k). This can be especially useful if you’re concerned that external factors may impact your 401(k) and want to try and further diversify your portfolio to better protect your retirement savings.

If the thought of mixing up your investments alternatives like real estate options piques your interest, you might be wondering about the next steps you can take. That’s where Canyon View Capital comes in. A phone call is all it takes for us to provide you with expert assistance.

Canyon View Capital Offers Options for Real Estate Investment

Congratulations, you’ve taken the first step toward a clearer financial future! Now you’ll want to partner with experts that are not only focused on bringing investors like you financial strategies that could be a good fit for your investment strategy.

At CVC, we eat, sleep, and breathe real estate investing. With decades of experience under our belt and investments throughout the Midwest and Midsouth, we’re here to offer you funds that make your money work for you without worrying about getting caught up in the confusing details.

If you’re new to real-estate investing, but keen to get started?

For 40+ years, CVC professionals have managed, owned, and operated various types of real estate. Now, we co-own and manage a portfolio of multifamily properties valued at over $1 billion1. Our buy-and-hold strategy rooted in America’s heartland is designed to give investors consistent returns. Contact CVC today—it just takes a phone call!

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.

When it comes to real estate investing, navigating a path to financial growth requires a broad understanding of the diverse tools and strategies at your disposal. Among these, the 1031 exchange stands out as a game-changing tax deferment strategy that could amplify your profitability when selling an investment property.

Imagine this: you’re considering selling an investment property, but the prospect of surrendering a substantial portion—potentially over 30%—to capital gains taxes is understandably troubling. Thankfully, investment strategies like 1031 exchanges and other alternatives can help you retain those profits and direct them into other lucrative investment avenues.

In this article, we will examine how the benefits of a 1031 exchange compare with alternative investment strategies. This will give you a broad comparison to help you make informed decisions that support your investment goals.

| Discussion Topics | ||||

What Is a 1031 Exchange?

In the dynamic world of real estate investing, shrewd investors are turning their attention to a strategic gem nestled within section 1031 of the Internal Revenue Code (IRC): the 1031 exchange. For those less familiar with the concept, 1031 exchanges allow investors to delay paying capital gains taxes and unlock new financial possibilities.

At its core, a 1031 exchange empowers investors to sidestep the burden of capital gains taxes by reinvesting the proceeds into “like-kind” property. This means exchanging one property for another—of equal or greater value and intended for investment purposes—without triggering an immediate tax liability. The implications of this strategy are far-reaching, with the power to open doors to new financial advantages and opportunities.

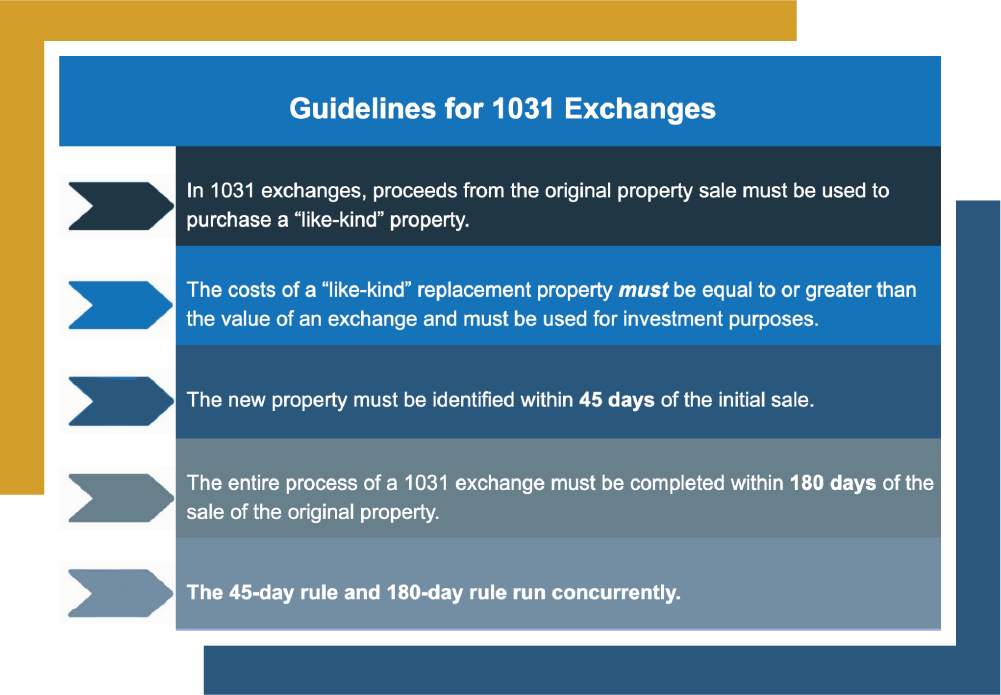

Sound good? That’s because it is! While the long-term benefits of a 1031 exchange are undeniable, the “catch” is that to be valid, these transactions require strict adherence to Internal Revenue Service (IRS) guidelines and regulations, as listed below.

Guidelines for 1031 Exchanges | |

| In 1031 exchanges, proceeds from the original property sale must be used to purchase a “like-kind” property. |

| The costs of a “like-kind” replacement property must be equal to or greater than the value of an exchange and must be used for investment purposes. |

| The new property must be identified within 45 days of the initial sale. |

| The entire process of a 1031 exchange must be completed within 180 days of the sale of the original property. |

| The 45-day rule and 180-day rule run concurrently. |

| To qualify for a 1031 exchange, sellers cannot hold proceeds from the original property sale; the proceeds must be handled by an intermediary. |

The Best 1031 Exchange Benefits

Ok, so now you know the definition of a 1031 exchange, but what about some actual 1031 exchange benefits? While the overall goal of a 1031 exchange is to defer capital gains taxes, this kind of transaction offers many additional benefits. Understanding the details that make up these advantages—like those listed below—is crucial for knowing whether a 1031 exchange is a good fit for your investment strategy.

- Tax Deferral. The most obvious 1031 exchange benefit is the ability to defer costly capital gains taxes. Section 1031 of the IRC makes this possible by reinvesting the proceeds from the sale of an investment property into a “like-kind” property, which allows investors to keep more profits in their pockets.

- Increased Buying Power. Deferring capital gains taxes gives investors more available capital for reinvestment. This increased buying power enables them to acquire higher-value properties, which could, in turn, facilitate portfolio growth.

- Portfolio Diversification. An increase in buying power also supports portfolio diversification. Adding properties from different markets and asset classes can help to spread a portfolio’s risk and provide potential access to markets with higher rents.

- Wealth Accumulation. Larger, more diverse investment properties may allow investors the potential to generate more income and build net worth faster. Leaning into this kind of “snowball effect” is but one way to grow wealth.

- Enhanced Flexibility. As their wealth accumulates, an increase in financial agility allows investors to respond swiftly to changing market conditions and investment goals. This kind of adaptability empowers them to reconfigure real estate investment portfolios, seize emerging market opportunities, or consolidate properties to align with changing investment strategies.

- Potential Cash Flow Enhancement. With underperforming properties, 1031 exchanges enable investors to trade them for properties with better income-generating potential. This, in turn, could lead to increased rental income and improved cash flow.

- Geographic Expansion. Participating in a 1031 exchange could encourage investors to explore real estate opportunities in different regions. They can exchange properties from one state, like California, to another that may have market dynamics, economic growth, stability, or other specific incentives offered by different geographic locations.

- Risk Mitigation. Diversifying real estate investments via a 1031 exchange allows investors to spread their risk across different types of properties, locations, or market segments. This strategy offers their portfolios better protection than the potential forces of a single property or market.

How Do 1031 Exchange Alternatives Stack Up?

- Opportunity Zones.

Opportunity Zones, created under the Tax Cuts and Jobs Act to spur job creation and economic growth, present unique tax-advantaged investment opportunities in economically distressed areas. Such zones incentivize investors to support revitalization efforts with funds allocated from previous investments and offer the potential to defer or (in some cases) eliminate capital gains taxes on investment profits.The downside is that Opportunity Zones are limited to pre-designated areas within a city/county, which could require time-consuming research into the area. They can also leave investors vulnerable to potential market uncertainties in economically distressed areas.

- Delaware Statutory Trusts (DSTs).

DSTs offer a collaborative approach to real estate investing, allowing multiple investors to pool their funds and collectively invest in larger commercial properties. This provides individual investors access to properties they may not have been able to afford on their own, while also enjoying the potential tax advantages of this investment structure.However, the collaborative nature of DSTs limits individual control over property decisions and a required long-term commitment to the trusts typically limits liquidity.

- Installment Sales.

Opting for an installment sale allows property owners to sell a property in multiple payments over time, rather than receiving a lump sum upfront. This approach spreads out the tax liability over an extended period, potentially reducing the overall amount of taxes owed and providing greater flexibility for managing tax obligations.The main drawback to installment sales is that they rely on the buyer’s ability to make installment payments, which can expose investors to risk should a buyer default.

- Paying Capital Gains Taxes.

While not as appealing to some investors, simply paying capital gains taxes on the sale of property remains a viable alternative. This option may suit investors who want to fully cash out of an investment and transition into other opportunities without the complexities or restrictions of alternative strategies.Although paying your capital gains taxes is always an option, it eliminates the ability to take advantage of any potential tax benefits or deferral strategies.

- 721 Exchanges.

A 721 exchange allows property owners to exchange property for shares in an umbrella partnership real estate investment trust, or UPREIT. This allows investors to diversify their investments while enjoying potential tax benefits associated with the structure of the partnership.With 721 exchanges, however, the potential remains for investors to lose control over their contributed property, and said contribution is integral to obtaining UPREIT shares.

Each of these alternatives to 1031 exchanges offers potential advantages, disadvantages, and considerations. Understanding the intricacies of each and how they compare to 1031 exchanges is crucial to making informed decisions that align with the scope of your real estate investment objectives.

1031 Exchange Benefits vs. Alternatives | ||

Strategy | Alternative Investments | 1031 Exchanges |

Opportunity Zones |

|

|

DSTs |

|

|

Installment Sales |

|

|

Pay Capital Gains Taxes |

|

|

721 Exchanges |

|

|

Navigating the world of investment property sales requires careful consideration of all available options. Although 1031 exchange tax benefits may seem like the clear winner, it’s essential to explore alternative strategies that align with your specific needs. The complexity of 1031 exchanges and other strategies may seem daunting, making it crucial for even experienced investors to seek professional guidance. That’s where Canyon View Capital comes in.

CVC Makes Real Estate Investing Make Sense

At Canyon View Capital, we understand the intricacies of real estate investment, 1031 exchange tax benefits, and the importance of tailored solutions. Our team of seasoned professionals is dedicated to helping you make informed decisions that align with your investment objectives. With 1031 exchanges, we provide the expertise and personalized guidance to navigate the path toward your financial goals.

But we don’t stop there. At CVC, we strive to help our investors understand the language of investing by sharing the knowledge and experience that we’ve gathered over four decades of owning and managing real estate now valued at over $1 billion1.

Don’t let the complexity of 1031 exchanges deter you from making the best decision for your investments. Contact Canyon View Capital today to unlock the full potential of your portfolio and ensure your 1031 exchange process is as seamless as possible.

Still Hazy on the Details of 1031 Exchange Benefits?

Canyon View Capital Can Show You the Way! We will walk you through your 1031 exchange, and our professionals will always answer your questions honestly, completely, and promptly. CVC will help you cut through the red tape, no matter how sticky it gets. Contact Canyon View Capital today!

Verified accreditation status required.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.

Many property managers who invest in real estate have come to realize the numerous benefits it offers. However, certain circumstances, like shifting investment goals, property upgrades, or a need to limit liability may prompt them to sell their property. Regardless of the reason, this decision is often accompanied by the daunting realization they have to pay capital gains taxes. This amount can range anywhere from 15-20% of the sale price, with an additional surtax of up to 3.8% some states impose on higher-income earners.

Fortunately, more and more property managers are taking advantage of a 1031 exchange, which allows them to defer capital gains taxes on the sale. While a 1031 exchange might seem like an ideal choice, there are some other options that may be worth considering.

In this article, I will simplify and present to you the available alternatives to 1031 exchanges, with the hope that it provides you with the necessary information to make an informed decision about the best option for your investment needs.

Discussion Topics | |

What Is a 1031 Exchange?

Perhaps you are already aware of how 1031 exchanges work — if so, feel free to skip ahead using the bookmarked links above. For those yet uninitiated or less familiar, 1031 exchanges (tax-deferred exchanges) are outlined by Section 1031 of the Internal Revenue Code (IRC) as a transaction that allows investors to defer paying capital gains taxes on the sale of investment property by reinvesting the proceeds of the sale into another “like-kind” property. This means that 1031 exchanges cannot typically be done on other property types such as primary or secondary properties.

A “like-kind property” refers to real estate of equal or greater value that is also used for investment purposes. In essence, with a 1031 exchange, the investor can exchange one property for another without incurring immediate tax liability.

A few of the benefits of executing a 1031 exchange include:

Saving money by deferring capital gains taxes.

Diversifying your portfolio with new and/or more properties.

Potentially improving cash flow with rental income from more profitable properties.

Investors must adhere to a specific set of rules for a successful 1031 exchange, which includes completing the exchange within very specific timeframes. For instance, a replacement property must be identified within 45 days of the sale of the original property and the entire exchange must be completed within 180 days. These two windows occur concurrently.

Because some state-specific incentives may align with your investment objectives, it’s also worth noting that 1031 exchanges allow you to exchange property from one state to another. So, while 1031 exchanges can be incredibly beneficial when you decide to sell an investment property, the IRS has set stringent guidelines that must be followed down to a T.

Alternatives to 1031 Exchanges

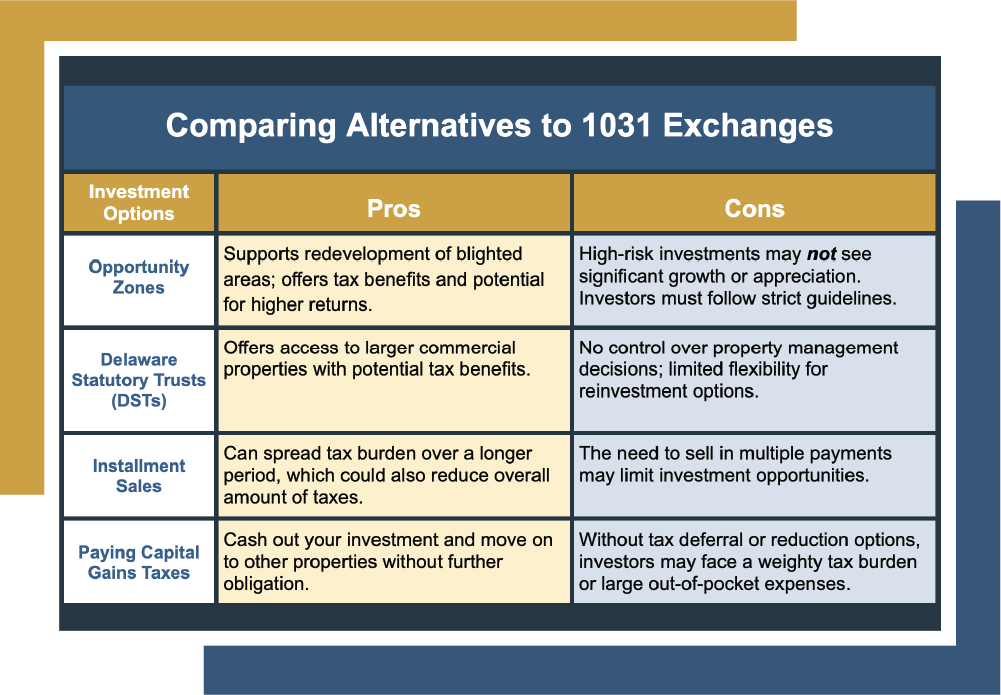

While a 1031 exchange is a popular option for deferring capital gains on the sale of real estate, it’s not the only option available. Here are a few alternatives to 1031 exchanges to consider:

Opportunity Zones. Opportunity Zones are designated as economically distressed areas in which investors can receive tax benefits for real estate investments. By investing in these areas, investors can potentially defer or eliminate capital gains taxes on their profits.

Delaware Statutory Trusts (DSTs). A DST is a type of trust that allows multiple investors to pool their funds and invest in a larger commercial property. This strategy can provide investors access to properties they might not be able to afford on their own, while also offering potential tax benefits.

Installment Sales. An installment sale is when a property owner uses multiple payments over time to sell their property, rather than one lump sum. This can help spread the tax burden over a longer period, potentially reducing the overall amount of taxes due from the owner.

Paying Capital Gains Taxes. While it may not be the most attractive option, simply paying capital gains taxes on the sale of a property remains a viable alternative. This may be a good option for investors who want to cash out of their investment entirely and move on to other opportunities.

721 Exchanges. In a 721 exchange, the owner contributes their property to a partnership with a Real Estate Investment Trust (REIT), and in return, receives operating partnership units (OP units) in the REIT. These OP units can be exchanged for REIT shares at a later time, allowing the property owner to defer capital gains taxes until they are sold.

| Comparing Alternatives to 1031 Exchanges | ||

| Investment Option | Pros | Cons |

| Opportunity Zones | Supports redevelopment of blighted areas; offers tax benefits and potential for higher returns. | High-risk investments may not see significant growth or appreciation. Investors must follow strict guidelines. |

| Delaware Statutory Trusts (DSTs) | Offers access to larger commercial properties with potential tax benefits. | No control over property management decisions; limited flexibility for reinvestment options. |

| Installment Sales | Can spread tax burden over a longer period, which could also reduce overall amount of taxes. | The need to sell in multiple payments may limit investment opportunities. |

| Paying Capital Gains Taxes | Cash out your investment and move on to other properties without further obligation. | Without tax deferral or reduction options, investors may face a weighty tax burden or large out-of-pocket expenses. |

| 1031 Exchanges | Defer taxes on real estate sales to invest in other properties. Untethers the investor from the property and allows them to enhance their portfolio. | Strict guidelines for reinvestment; potential for delayed closings or increased costs if guidelines are not closely followed. |

| 721 Exchanges | Allows investors to exchange shares in a REIT without incurring capital gains taxes. | Extremely limited options for REIT investments. Potential risks: changing interest rates, economic downturns, and volatile real estate markets. |

It’s impossible to overemphasize the distinctive nature of each transaction, which parallels the individual concerns of every investor in terms of goals, risk tolerance, and time constraints. Although 1031 exchanges are an excellent tool for tax deferral, they aren’t the only option at your disposal when you decide to sell an investment property.

If you’re trying to determine whether a 1031 exchange or one of these various alternatives is the best choice for you, it’s critical to consult with an experienced professional. They can help narrow down the investment options that align with your goals, and take your individual circumstances and objectives into account. Don’t make a hasty decision and risk missing the best opportunities – seek advice from the experienced team at Canyon View Capital.

Canyon View Capital Makes Real Estate Investing Make Sense

At Canyon View Capital, we understand that while a 1031 exchange can be a great tool for deferring taxes, it’s important to explore all options available to you, including some alternatives to 1031 exchanges. Our team has over four decades of experience managing real estate that has amassed over $1B1 in aggregated value. We’re eager to share our expertise and help you explore the world of real estate investing.

For all the benefits a 1031 exchange can offer, it also comes with a narrow window for execution and specific requirements that can be difficult to meet, even for experienced investors. At CVC, we can help you understand the process and accommodate your needs accurately and swiftly.

Our commitment to our investors goes beyond just helping with a 1031 exchange. We’re dedicated to guiding you through the entire process and ensuring that you have a thorough understanding of all your options. At CVC, we want to help you make the best investment decisions possible, and we have the experience and expertise to do just that.

Still Hazy on the Details of Your 1031 Exchange?

Canyon View Capital Can Show You the Way! We will walk you through every step of your 1031 exchange, and our experts will always answer your questions honestly, completely, and promptly. CVC will help you cut through the red tape, no matter how sticky it gets.

Verified accreditation status required.

Citation

1$1B figure based on the aggregate value of all CVC-managed real estate investments as valued on March 31, 2023.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.

$3M

$3M