About Canyon View Capital

Frequently Asked Questions

FAQS

An accredited investor is a person or entity that can deal with securities not registered with financial authorities by satisfying one of the requirements regarding income, net worth, asset size, governance status or professional experience. The term is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings. Accredited investors include natural individuals, banks, insurance companies, brokers and trusts.

Accredited Investors will meet at least one of the following requirements: Current and expected income equals or exceeds $200,000 per year if single or $300,000 per year if married

-Or-

Current net worth exceeds $1 Million, excluding the value of your primary home.

Click HERE to determine if you are accredited or not.

For more information specific to investing with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

SEC regulations prohibit us from publishing earnings on a public site. We welcome your questions and encourage you to call us at 831.480.6335.

An investor must meet the minimum requirements and be a good fit for the investment. One minimum requirement is investors must be accredited for the funds that are currently open for investment. An accredited investor is a person or entity that can deal with securities not registered with financial authorities by satisfying one of the requirements regarding income, net worth, asset size, governance status or professional experience. The term is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings. Accredited investors include natural individuals, banks, insurance companies, brokers and trusts.

Click HERE to determine if you are accredited or not.

Canyon View Capital partners with Strata Trust Company as Trustee/Custodian to transfer your IRA(s) into our CVC Income Fund. For more information specific to investing with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335

An investor must meet the minimum requirements and be a good fit for the investment. One minimum requirement is investors must be accredited for the funds that are currently open for investment. An accredited investor is a person or entity that can deal with securities not registered with financial authorities by satisfying one of the requirements regarding income, net worth, asset size, governance status or professional experience. The term is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings. Accredited investors include natural individuals, banks, insurance companies, brokers and trusts. Click HERE to determine if you are accredited or not.

The minimum investment for either fund is $250,000. This may be in the form of a cash investment or an IRA/SEP/ROTH rollover. For more information specific to investing with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

Our CVC Balance Fund (B Shares) is a tax-deferred fund and offers passive losses to offset passive income and available for cash investments only. Click here to learn more. The CVC Income Fund (A Shares) is a fully taxable fund (as portfolio income) and is available for both IRA/SEP/ROTH rollovers and cash investment. Click here to learn more

CVC’s founder and CEO, Robert (Bob) Davidson, started investing in real estate with his partners in the early 1980s. In 2001, we were incorporated as MyRetirementAssets, then rebranded under the current name of Canyon View Capital in 2012. For more information and inquiries regarding Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

No, but they are generally available. We will make every effort to work with you and create a good two-way communication on this complex process. There are windows for naming and closing a 1031 exchange that must be adhered to qualify for the 1031 tax deferred advantages. To discuss your individual situation with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

Counter to a “buy-and-flip” acquisition philosophy that is quite common in the West and East coasts, CVC’s investment strategy is, instead, rooted in a “buy-and-hold” philosophy proven to deliver steady, attractive returns over the long term for our investors. We invest in America’s heartland—the Midwest and Midsouth regions of the US—and apply our value-investing philosophy with each of our acquisitions. For more information regarding our overall strategy and earnings, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

Yes. We are happy to email this and other specific information specific to investing with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

Why Choose Canyon

View Capital

Stability

Tax Savings

Stock Market Alternative

Schedule a Consultation With One of Our Team Members Today

Our Latest News

Savvy investors understand the importance of diversifying their portfolios, exploring new investment avenues to increase their income potentially, and spreading risk across multiple sectors.

One popular investment sector is real estate. However, like any investment, there are various paths investors can take, each with its advantages and disadvantages.

Real estate funds are a favored option for those looking to reap the benefits of real estate investing without extensive hands-on involvement and personal responsibility. But are real estate funds a good investment? Let’s explore this avenue to help you determine if it’s worth considering.

Are Real Estate Funds a Good Investment?

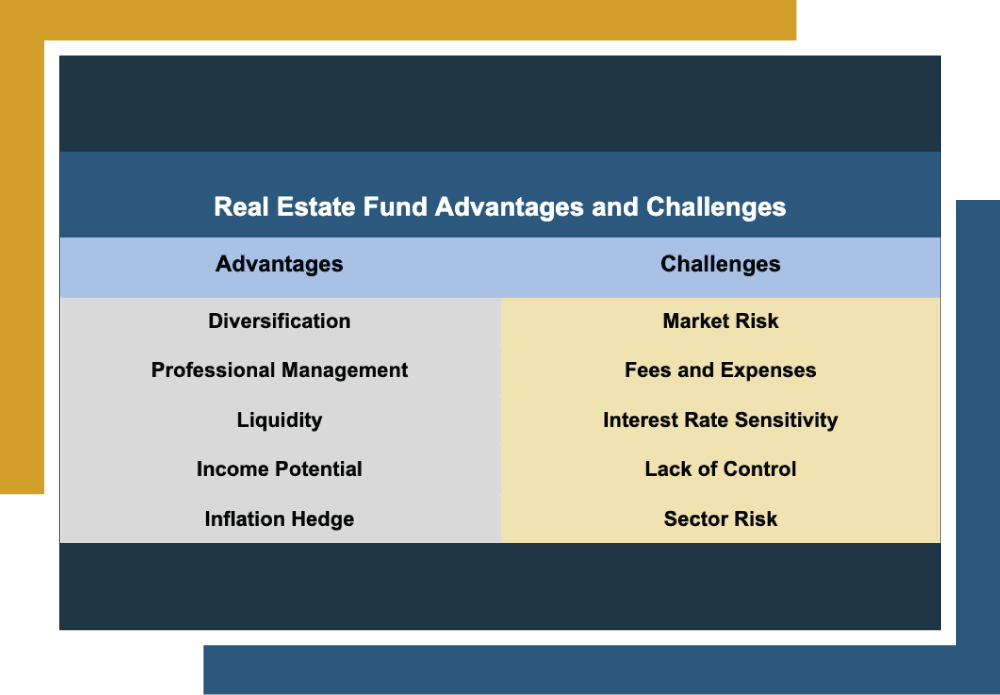

Real estate funds offer a mix of benefits and challenges, making them a valuable investment depending on your circumstances. Factors such as your risk tolerance, financial goals, investment horizon, and preference for hands-on property management will influence whether real estate funds are the right choice for you.

Advantages and Challenges of Real Estate Funds | |

Advantages | Challenges |

Diversification | Market Risk |

Reduces risk by spreading investments across various properties. | Subject to economic downturns and fluctuations in property values. |

Professional Management | Fees and Expenses |

Managed by experts with real estate knowledge and experience. | Potential management fees and other costs can erode returns. |

Liquidity | Interest Rate Sensitivity |

Easier to buy and sell compared to direct property investments. | Sensitive to changes in interest rates, which can impact borrowing costs and property values. |

Income Potential | Lack of Control |

Potential for regular dividend payments from rental income. | Limited control over specific property investments and management decisions. |

Inflation Hedge | Sector Risk |

Property values and rental income generally rise with inflation. | Concentration in specific real estate sectors can increase vulnerability to sector-specific downturns. |

So, are real estate funds a good investment? They can certainly be an excellent choice for investors whose interests align with their benefits.

Who are Real Estate Investment Funds a Good Fit For?

Consider Emily, a 50-year-old professional with a stable income who aims to diversify her investment portfolio. With a moderate risk tolerance, Emily prefers not to handle property management herself due to her busy schedule.

However, she seeks a steady income stream for her approaching retirement. Unlike direct property investments, real estate funds perfectly fit her, offering professional management and the liquidity to buy and sell shares quickly. This approach allows Emily to achieve her financial goals without the hassle of hands-on property management.

It’s also important to understand that real estate investment funds differ by the fund itself, each having unique characteristics such as the type of real estate invested in and the specific investment strategy employed. For instance, CVC offers the Balanced Fund and the Income Fund, each with a distinct focus and benefits.

Let CVC Be Your Real Estate Investment Partner

Are real estate funds a good investment? They can be, depending on your financial goals and risk tolerance. If you think they might be a good fit for your portfolio, consider the expertise of Canyon View Capital. We’re passionate about real estate and manage a portfolio of multifamily properties valued at over $1 billion1.

Partnering with CVC means you benefit from a real estate investment fund with significant tax advantages and income potential. Our fund is fully managed for you and backed by a buy-and-hold strategy that targets conservative returns in stable markets.

If you’re an accredited investor, reach out today to see if Canyon View Capital is the right fit for your investment needs.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.

The trusty 401(k) has long been considered a de facto success route for retirement savings. However, recent economic trends and headwinds have caused many investors to seek alternative options. But what if they have a large amount of most of their retirement savings tied in a 401(k) and want to explore an option such as real estate investment?

Some may wonder if a 401(k) withdrawal for real estate investment is possible, given that 401(k)s don’t allow for direct investing in real estate. The answer is yes, but it involves some specific steps.

The Process of a 401(k) Withdrawal for Real Estate Investment

Yes, it is possible to initiate a 401(k) withdrawal for real estate investment. However, the process involves specific steps and considerations and isn’t straightforward.

While a direct withdrawal is technically possible, it involves a complex process that will typically incur penalties and taxes for early withdrawal. However, alternative methods to access these funds without incurring costs exist.

Methods of 401(k) Withdrawal for Real Estate Investment. | |

401(k) Loan | Self-Directed IRA or 401(k) |

One way to use your 401k for real estate investment is by taking a loan from your 401k.

The IRS allows you to borrow up to 50% of your vested account balance or $50,000, whichever is less.

This method avoids early withdrawal penalties and taxes, but you must repay the loan with interest within a specified period, usually five years. | Another option is to roll your 401k funds into a self-directed IRA or 401(k). A self-directed IRA or self-directed 401(k) gives you more control over your investment choices, including real estate.

By doing this, you avoid the penalties and taxes associated with early 401k withdrawal.

However, managing an SDIRA or SD401(k)requires understanding IRS regulations to avoid prohibited transactions. |

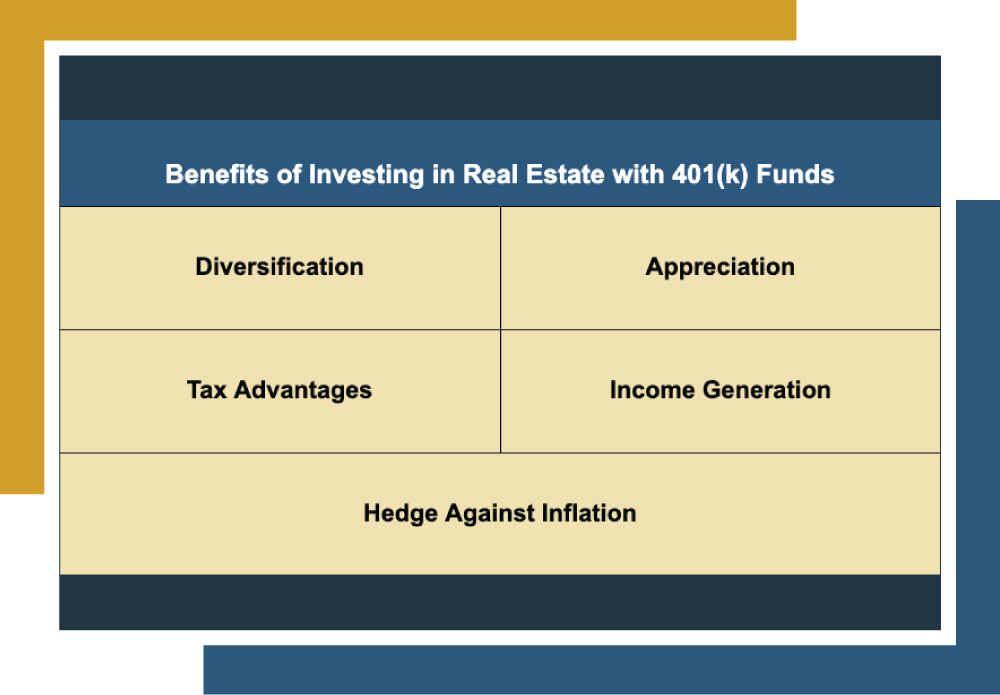

Benefits of Investing in Real Estate with Your 401(k)

Real estate is an investment avenue that offers unique benefits, making it an excellent addition to the portfolios of investors for whom it is a good match. For example, Louis is a 45-year-old investor with a stable career in tech. He has diligently contributed to his 401(k) plan for the past 20 years and has accumulated a solid nest egg.

While he prefers the tax-deferred growth of his 401(k), he is now exploring other investment avenues to diversify his portfolio and generate additional income over long-term growth. He is specifically interested in real estate due to its potential for cash flow and appreciation. If Louis rolls substantial funds from his 401(k) into a self-directed account, he can enjoy these potential benefits:

- Diversification: Real estate can diversify your investment portfolio, reducing overall risk.

- Hedge Against Inflation: Property value and rents usually rise with inflation.

- Appreciation: Over time, real estate can appreciate in value, offering long-term capital gains.

- Tax Advantages: Real estate investments can come with various tax benefits, such as depreciation deductions and 1031 exchanges.

- Income Generation: Real estate investments can provide a steady income stream through rental income.

It’s worth noting that, like any investment, real estate still carries risk and personal responsibility. Always consult your financial advisor or a tax professional before venturing into a new investment.

How Canyon View Capital Can Help

While a 401(k) withdrawal for real estate investment can benefit many investors, there are potential challenges to consider. The stipulations surrounding 401(k) withdrawals can impose limitations, and managing real estate properties requires significant time and effort. For those handling property management themselves, the demands can be burdensome.

However, Canyon View Capital offers a different approach that can provide the same benefits without many of the drawbacks.

When you invest in one of our real estate investment funds with proceeds from your 401(k) loan or self-directed savings account, you will enjoy the following:

- Expert Management and Hassle-Free Investing: We manage a portfolio of multifamily properties on your behalf, handling the heavy lifting while you enjoy truly passive rental income.

- Steady Returns: Our “buy-and-hold” strategy focuses on conservative returns in stable markets, aiming for reliable and consistent returns.

- Compatibility with a 401(k) Loan: The limitations on 401(k) loans make it difficult to purchase real estate. Our threshold means you can still test the waters of real estate while adhering to these limitations.

- Tax Advantages: Our funds are designed to maximize the tax benefits associated with real estate investing.

Partner with CVC and Use Your 401(k) for Real Estate Investing

Now that you understand how to use a 401(k) withdrawal for real estate investment, it’s time to consider your next move. At CVC, we’re passionate about real estate, and our principals have built an extensive multifamily portfolio across the Midsouth and Midwest, now valued at over $1 billion1.

By using savings from your 401(k) to invest in one of our funds, you can enjoy the benefits of rental income through a passive investment vehicle. Our conservative approach ensures that your investment is backed by a robust portfolio, allowing you to reap the tax benefits associated with real estate investing while we handle the complexities for you.

Need more information on a 401(k) withdrawal for real estate investment?

We’re happy to answer your questions! Call CVC today to learn more. Get Started

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.

Many property managers recognize the benefits of real estate investing, but shifting goals, property upgrades, or liability concerns may lead them to sell. Unfortunately, this often means facing 15-20% in capital gains taxes plus a possible 3.8% surtax for high-income earners.

Thankfully, many property owners can turn to 1031 exchanges to defer these taxes and lower their tax liability. While a 1031 exchange is a popular option, other alternatives are worth considering.

In this article, I’ll break down 1031 exchange alternatives to help you make the decision that makes the most sense for your financial strategy.

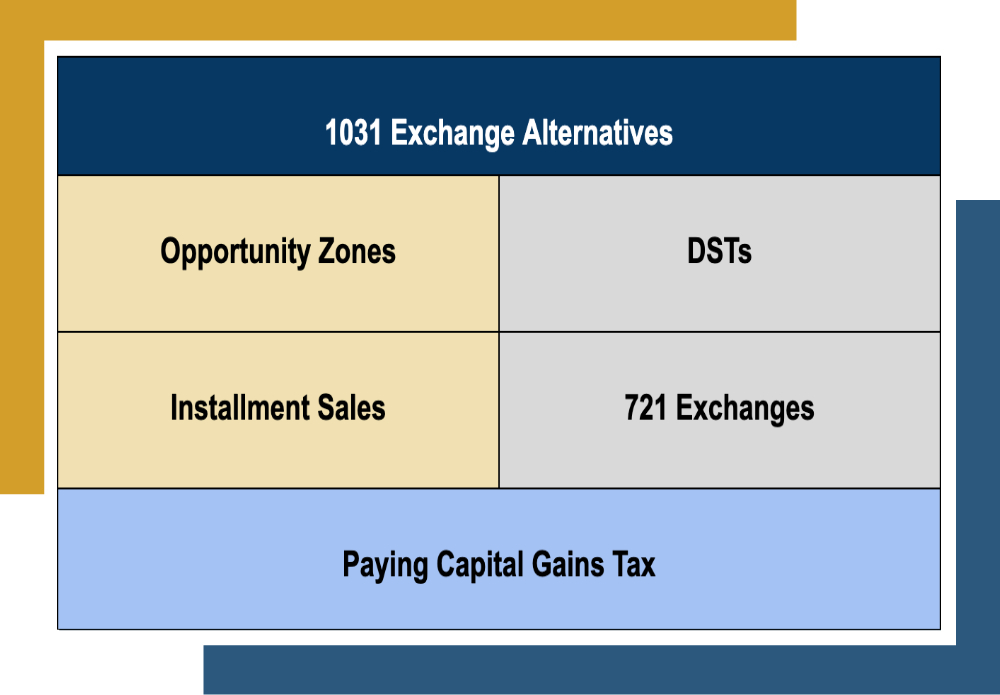

What are 1031 Exchange Alternatives?

While a 1031 exchange is a popular option for deferring capital gains on the sale of real estate, it’s not the only option available. Here are a few 1031 exchange alternatives worth considering:

- Opportunity Zones. Opportunity Zones are designated as economically distressed areas where investors can receive tax benefits for real estate investments. By investing in these areas, investors can potentially defer or eliminate capital gains taxes on their profits.

- Delaware Statutory Trusts (DSTs). A DST is a type of trust that allows multiple investors to pool their funds and invest in a larger commercial property. This strategy can provide investors access to properties they might not be able to afford while offering potential tax benefits.

- Installment Sales. An installment sale is when a property owner sells their property using multiple payments over time rather than one lump sum. This can help spread the tax burden over a longer period, potentially reducing the overall amount of taxes due from the owner.

- Paying Capital Gains Taxes. While it may not be the most attractive option, simply paying capital gains taxes on selling a property remains a viable alternative. This may be a good option for investors who want to cash out of their investment entirely and move on to other opportunities.

- 721 Exchanges. In a 721 exchange, the property owner contributes their property to a partnership with a Real Estate Investment Trust (REIT) and, in return, receives operating partnership units (OP units) in the REIT. These OP units can be exchanged for REIT shares later, allowing the property owner to defer capital gains taxes until the shares are sold.

Pros and Cons of 1031 Exchange Alternatives

Comparing Alternatives to 1031 Exchanges |

||

|---|---|---|

|

Investment Option |

Pros |

Cons |

|

Opportunity Zones |

Supports redevelopment of blighted areas; offers tax benefits and potential for higher returns. |

High-risk investments may not see significant growth or appreciation. Investors must follow strict guidelines. |

|

Delaware Statutory Trusts (DSTs) |

Offers access to larger commercial properties with potential tax benefits. |

No control over property management decisions; limited flexibility for reinvestment options. |

|

Installment Sales |

Spread the tax burden over a longer period could also reduce the overall taxes. |

The need to sell in multiple payments may limit investment opportunities. |

|

Paying Capital |

Cash out your investment and move on to other properties without further obligation. |

Investors may face a weighty tax burden or significant out-of-pocket expenses without tax deferral or reduction options. |

|

1031 Exchanges |

Defer taxes on the sale of real estate to invest in other properties. Untethers the investor from the property and allows them to enhance their portfolio. |

Strict guidelines for reinvestment; potential for delayed closings or increased costs if guidelines are not closely followed. |

|

721 Exchanges |

Allows investors to exchange shares in a REIT without incurring capital gains taxes. |

Extremely limited options for REIT investments. Potential risks include changing interest rates, economic downturns, and volatile real estate markets. |

It’s impossible to overemphasize every transaction’s distinctive nature, which parallels every investor’s individual concerns regarding goals, risk tolerance, and time constraints. Although 1031 exchanges are excellent tools for tax deferral, they aren’t your only option.

It’s crucial to contact an experienced tax professional or financial advisor for assistance when exploring 1031 exchange alternatives. They can help narrow down investment options that align with your goals and ensure that you adhere to regulations.

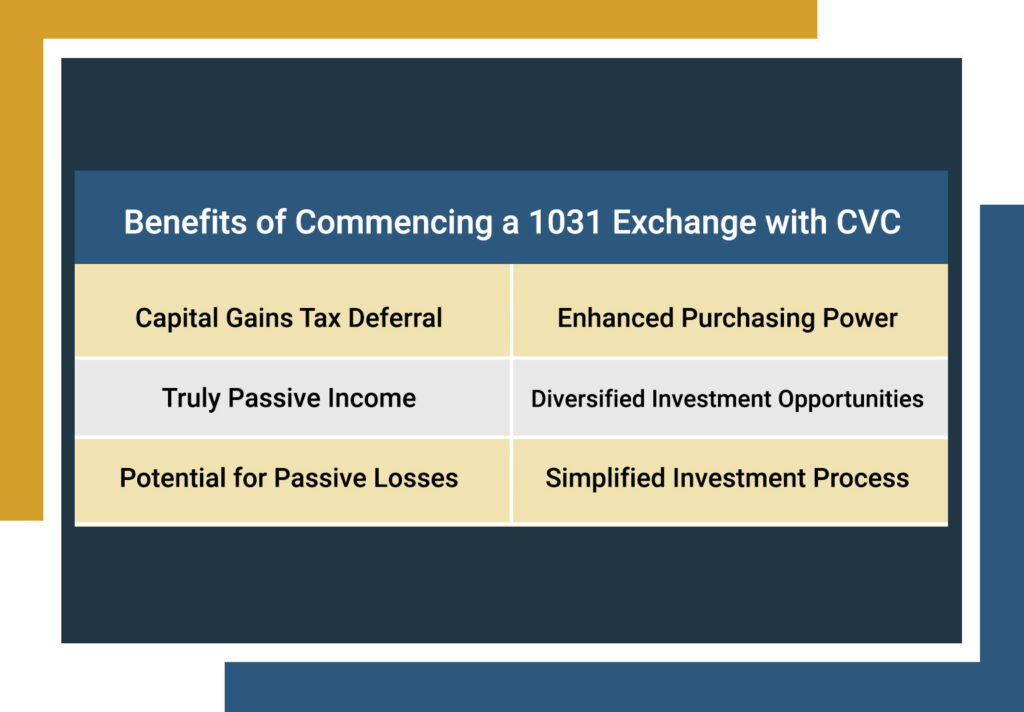

Canyon View Capital Makes Your 1031 Exchange Simpler

At Canyon View Capital, we understand that while a 1031 exchange can be an excellent tool for deferring taxes, it’s essential to explore all options available, including some 1031 exchange alternatives.

Our team comprises principles with over four decades of experience managing real estate that has amassed over $1B1 in aggregated value. We’re eager to share our expertise and help you explore the world of real estate investing.

A 1031 exchange offers excellent benefits but has tight timelines and strict requirements. At CVC, we simplify the process by letting you exchange into our available properties as Tenants in Common, avoiding stressful deadlines while enjoying passive income and additional potential tax benefits.

Need more information on 1031 exchange alternatives?

We’re happy to answer your questions! Call CVC today to learn more. Get Started

Gary Rauscher, President of Canyon View Capital

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.

Welcome to the world of 1031 exchanges! If you’re a real estate investor, you may already know the sting of capital gains taxes when selling an investment property. But with a 1031 exchange, you can defer those taxes and keep more capital working for you. In 2025, the guidelines for 1031 exchanges are as strict as ever, so understanding how they work is critical to reaping the full benefits.

This guide explains 1031 exchange guidelines, offers insights into the 2024 1031 exchange process, and shows how Canyon View Capital can help ease the strain of 1031 exchanges and get the most from your exchange.

Is There a 1031 Exchange 5-Year Rule?

While there are several rules and regulations, investors can rest easy knowing there’s no such thing as a “1031 exchange 5-year rule.” This confusion likely stems from the five-year requirement for capital gains exclusions on primary residences unrelated to 1031 exchanges. However, many investors follow a standard guideline to hold a property for at least one to two years. While it’s not an official rule, this timeframe helps show the IRS that you’re not “flipping” the property and that it was meant for long-term investment, which is critical to qualifying for a 1031 exchange. That said, investors must still be mindful of the many rules governing 1031 exchanges. Despite the significant tax-deferral benefits, it’s essential to understand the process thoroughly before diving in. These exchanges come with strict guidelines, and following them is crucial for taking full advantage of this powerful tax tool.What 1031 Exchange Rules Are There?

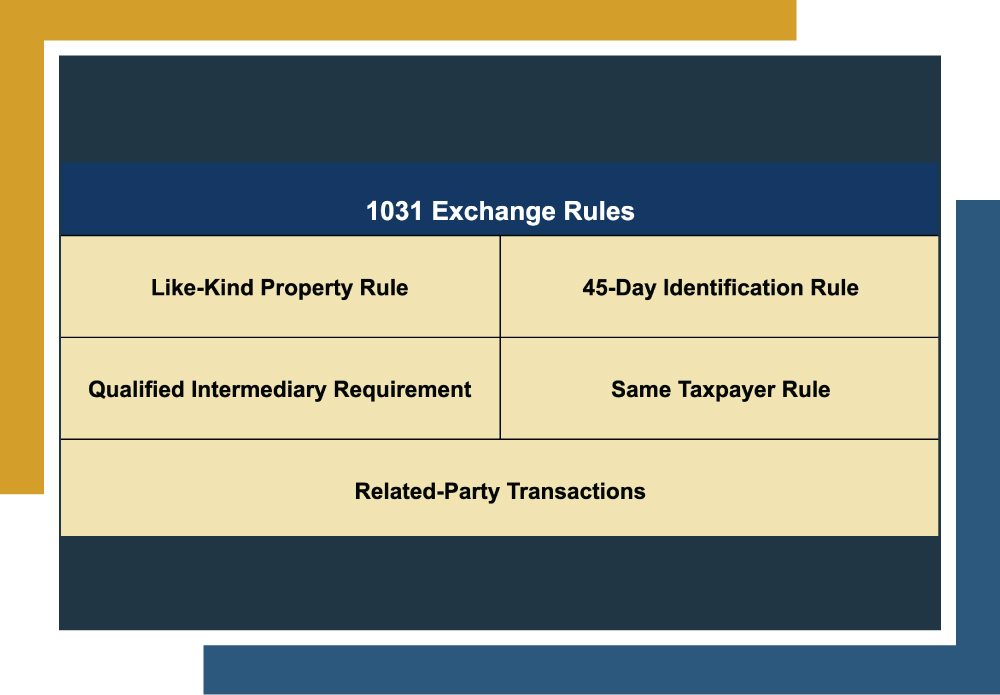

While there is no 5-year rule in a 1031 exchange, several important rules and regulations must be followed to ensure you qualify for the tax deferral. These rules are designed to keep the exchange compliant with IRS requirements. Here are the key rules:Like-Kind Property Rule

The properties involved in the exchange need to be “like-kind.” For real estate, this means both the property you’re selling and the one you’re buying must be for business or investment purposes. The good news? The real estate types can vary, so you could swap an apartment building for raw land if it has similar purposes.45-Day Identification Rule

After selling your property, you have 45 days to identify potential replacement properties. Just submit this list in writing to a qualified intermediary, and you can list up to three properties (or more, depending on certain conditions). This keeps the process moving smoothly.180-Day Exchange Rule

You have 180 days from the sale of your original property to finalize the purchase of your replacement. This includes the 45-day identification period, so the clock starts ticking right after your sale. It’s helpful to keep this timeline in mind as you plan.Qualified Intermediary Requirement

A 1031 exchange requires the help of a third-party intermediary to handle the transaction. You won’t touch the proceeds from your sale; instead, the intermediary holds them safely until you’re ready to purchase your new property. This keeps everything above board with the IRS.Same Taxpayer Rule

The person or entity selling the original property has to be the same one buying the replacement property. This ensures that you’re the one deferring your capital gains tax.Related-Party Transactions

The IRS has stricter rules if you’re exchanging properties with a related party (like family members or a business partner). For example, both parties must hold onto their properties for at least two years. If either party sells within that time, the exchange might not qualify, and taxes could come due. Sticking to these rules will keep your 1031 exchange on track and avoid any hassles later. While many requirements exist, the process doesn’t have to be stressful. Canyon View Capital could help make the whole thing smoother for you, taking some of the worry out of the equation!Canyon View Capital Makes 1031 Exchanges Easy

While there isn’t a 1031 exchange 5-year rule, you now know that there are many requirements that you need to adhere to and consider before taking on a 1031 exchange. These requirements can make 1031 exchanges challenging, especially given the tight identification windows. At CVC, we’re passionate about real estate, and that dedication has helped us build an extensive portfolio of multifamily properties across the Midsouth and Midwest. For accredited investors, we offer an easier path through the 1031 exchange process by allowing you to exchange into one of our available properties as Tenants in Common. This means you can worry less about those strict identification and closing windows. In addition, you’ll enjoy the benefits of passive real estate investing as we handle the property management for you—no effort is needed on your part! For over 40 years, the principals at Canyon View Capital have worked in real estate, with a portfolio currently valued at over $1B1. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.Gary Rauscher, President of Canyon View Capital

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.

Many investors know the frustration of selling an investment property at a profit, only to hand over 20% or more of those gains to the IRS in capital gains taxes. The good news? It doesn’t have to be this way.

Savvy investors are turning to the 1031 exchange, a powerful tax-deferral tool that allows them to reinvest the proceeds from a property sale directly into a new investment property without triggering capital gains tax. However, to reap these benefits, you’ll need to understand 1031 exchange eligibility—because not all assets qualify.

To help you navigate the ins and outs of 1031 exchange eligibility, we’ve created this quick guide to answer common questions and clarify which assets meet the criteria.

1031 Exchange Eligibility: Which Assets Qualify?

Understanding eligibility is critical to maximizing the tax-saving potential of a 1031 exchange. Not every asset makes the cut, and knowing the ins and outs of 1031 exchange eligibility can mean the difference between maximizing your investment and leaving tax benefits on the table.

To help you stay ahead, here’s a breakdown of common questions on eligibility, starting with foreign real estate purchases.

Understanding the “Like-Kind” Requirement for 1031 Exchanges

One of the big rules when it comes to 1031 exchange eligibility is the “like-kind” requirement. This rule means that both the property you’re selling and the one you’re buying need to be similar in nature—but don’t worry, they don’t have to be identical twins.

While there is no formally outlined definition for what constitutes a “like-kind” property, it’s generally accepted that both must be held and used for investment or business purposes.

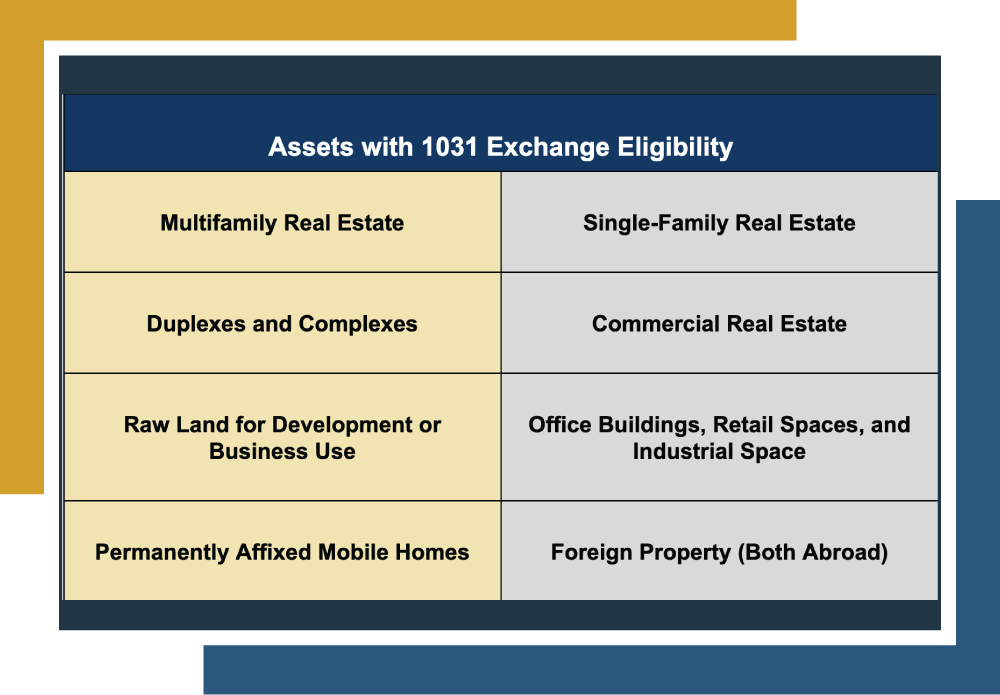

Here are a few examples of what fits under 1031 exchange eligibility:

- Residential Investment Properties: Single-family rentals and multifamily properties such as condominiums, complexes, or duplexes.

- Commercial Properties: Office buildings, retail spaces, and industrial facilities.

- Raw Land: Land held for investment or future development.

When planning a 1031 exchange, remember it’s all about real property investments used for business or held for investment. This keeps the focus on building up your real estate portfolio.

So, as long as both properties check that “like-kind” box, you should be on track for a successful 1031 exchange.

Are Mobile Homes Eligible for a 1031 Exchange?

Mobile homes fall into a bit of a gray area regarding 1031 exchanges because their eligibility depends on their classification. Generally, mobile homes are considered personal property, which makes them ineligible. However, if the mobile home is permanently attached to the land and classified as real property, it might qualify.

Here’s a quick breakdown to clarify:

Mobile Home 1031 Exchange Eligibility | ||

|---|---|---|

Classification | Eligibility | Explanation |

Mobile Home (Not Affixed) | Not Eligible | Classified as personal property because it can be moved with the owner. |

Mobile Home (Permanently Fixed) | Potentially Eligible | Likely eligible if considered real property and part of an investment property |

If you’re considering exchanging a property with a mobile home, double-check its classification with a tax professional. That classification ultimately determines whether it meets the IRS’s “like-kind” requirement.

Are Foreign Real Estate Purchases Eligible for a 1031 Exchange?

Another common question is whether foreign real estate purchases—cross-border properties–qualify for a 1031 exchange.

The answer? Yes—if both the property you’re selling and the one you’re buying are located outside the U.S., you can make it work under 1031 rules. But here’s the catch: both properties must be like-kind and based outside the U.S.

Selling a Property with a 1031 Exchange vs. Without a 1031 Exchange | ||

|---|---|---|

Details | Eligibility | Explanation |

Foreign Real Estate | Eligible | Eligible only if both the relinquished and acquired property are “like-kind” properties not located on U.S. soil. |

U.S.-Based Investment Property | Eligible | Must be “like-kind” real estate property. |

So, while you can’t do a cross-border exchange (meaning you can’t swap a U.S.-based property for an international one or vice versa), you’re good to go if both properties are foreign and are “like-kind.” This setup keeps the tax-deferral benefits within each region, allowing you to reinvest internationally while deferring those capital gains.

Are Stocks Eligible for a 1031 Exchange?

Stocks, bonds, and similar securities aren’t eligible for a 1031 exchange. The IRS keeps 1031 exchanges strictly limited to real property used for investment or business, so if you’re hoping to swap stock investments, 1031 isn’t the tool for you.

The whole idea is to keep capital gains working within the real estate world and not shift into other asset classes.

Quick Recap

Here’s a quick overview of what doesn’t have 1031 exchange eligibility:

- Mobile homes (unless they are permanently affixed and qualify as investment properties).

- Foreign real estate (unless both parties are located abroad and are “like-kind”)

- Stocks, bonds, or securities.

- Primary residences.

While 1031 exchanges can bring substantial potential benefits, as you can see, they also come with their fair share of complications and strict requirements.

That’s where CVC steps in to make things easier—especially for investors ready to skip the property management headaches. With us, you get a smoother 1031 exchange process and the freedom to enjoy passive real estate income without all the hassle.

Turn to CVC for Your Next 1031 Exchange

Now that you’ve got a handle on the basics of 1031 exchange eligibility, you might wonder what’s next. If a 1031 exchange seems the right path, CVC is here to help you make it happen smoothly.

With a $1 billion1 portfolio spread across the Midsouth and Midwest, CVC is about multifamily real estate and helping accredited investors simplify their 1031 exchange processes.

We offer the chance to exchange into one or more of our multifamily properties as Tenants in Common, giving you all the potential benefits of traditional real estate investing—without any property management headaches. It’s a truly passive way to invest in real estate, allowing you to capture the growth potential and income benefits without the hands-on hassle.

For over 40 years, the principals at Canyon View Capital have worked in real estate, with a portfolio currently valued at over $1B1. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

Gary Rauscher, President of Canyon View Capital

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.