About Canyon View Capital

Frequently Asked Questions

FAQS

An accredited investor is a person or entity that can deal with securities not registered with financial authorities by satisfying one of the requirements regarding income, net worth, asset size, governance status or professional experience. The term is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings. Accredited investors include natural individuals, banks, insurance companies, brokers and trusts.

Accredited Investors will meet at least one of the following requirements: Current and expected income equals or exceeds $200,000 per year if single or $300,000 per year if married

-Or-

Current net worth exceeds $1 Million, excluding the value of your primary home.

Click HERE to determine if you are accredited or not.

For more information specific to investing with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

SEC regulations prohibit us from publishing earnings on a public site. We welcome your questions and encourage you to call us at 831.480.6335.

An investor must meet the minimum requirements and be a good fit for the investment. One minimum requirement is investors must be accredited for the funds that are currently open for investment. An accredited investor is a person or entity that can deal with securities not registered with financial authorities by satisfying one of the requirements regarding income, net worth, asset size, governance status or professional experience. The term is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings. Accredited investors include natural individuals, banks, insurance companies, brokers and trusts.

Click HERE to determine if you are accredited or not.

Canyon View Capital partners with Strata Trust Company as Trustee/Custodian to transfer your IRA(s) into our CVC Income Fund. For more information specific to investing with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335

An investor must meet the minimum requirements and be a good fit for the investment. One minimum requirement is investors must be accredited for the funds that are currently open for investment. An accredited investor is a person or entity that can deal with securities not registered with financial authorities by satisfying one of the requirements regarding income, net worth, asset size, governance status or professional experience. The term is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings. Accredited investors include natural individuals, banks, insurance companies, brokers and trusts. Click HERE to determine if you are accredited or not.

The minimum investment for either fund is $250,000. This may be in the form of a cash investment or an IRA/SEP/ROTH rollover. For more information specific to investing with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

Our CVC Balance Fund (B Shares) is a tax-deferred fund and offers passive losses to offset passive income and available for cash investments only. Click here to learn more. The CVC Income Fund (A Shares) is a fully taxable fund (as portfolio income) and is available for both IRA/SEP/ROTH rollovers and cash investment. Click here to learn more

CVC’s founder and CEO, Robert (Bob) Davidson, started investing in real estate with his partners in the early 1980s. In 2001, we were incorporated as MyRetirementAssets, then rebranded under the current name of Canyon View Capital in 2012. For more information and inquiries regarding Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

No, but they are generally available. We will make every effort to work with you and create a good two-way communication on this complex process. There are windows for naming and closing a 1031 exchange that must be adhered to qualify for the 1031 tax deferred advantages. To discuss your individual situation with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

Counter to a “buy-and-flip” acquisition philosophy that is quite common in the West and East coasts, CVC’s investment strategy is, instead, rooted in a “buy-and-hold” philosophy proven to deliver steady, attractive returns over the long term for our investors. We invest in America’s heartland—the Midwest and Midsouth regions of the US—and apply our value-investing philosophy with each of our acquisitions. For more information regarding our overall strategy and earnings, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

Yes. We are happy to email this and other specific information specific to investing with Canyon View Capital, please email investorrelations@canyonviewcapital.com or call us at 831.480.6335.

Why Choose Canyon

View Capital

Stability

Tax Savings

Stock Market Alternative

Schedule a Consultation With One of Our Team Members Today

Our Latest News

So — you’ve decided to seize the opportunity and enjoy the benefits of a 1031 exchange! Or maybe you’re still gathering information before making that leap. After all, why wouldn’t you take advantage of a tax break that lets you defer capital gains taxes, potentially into perpetuity?

While 1031 exchanges are a great way to keep money in your pocket — legally — and out of the IRS’s grip, like any tax break they come with important stipulations to which you must adhere to ensure you can actually use them.

One such requirement to which all 1031 exchanges must adhere is what is known as the 1031 exchange holding period. Luckily for you, we’ve got the 411 on what you need to know about this little wrinkle in the 1031 exchange process. Keep reading to learn more about 1031 exchange benefits, the ins and outs of the 1031 exchange holding period, and how to make the most of this powerful tax strategy.

Understanding 1031 Exchanges

Perhaps you’re already familiar with the basic function of a 1031 exchange, but for the uninitiated or less familiar, we’ll lay out a basic understanding. A 1031 exchange, named for Section 1031 of the Internal Revenue Code, describes a specific series of transactions that basically results in a tax break when you sell your rental property. It enables you to defer the capital gains taxes you would normally owe the IRS from the sale of an investment property.

Instead of paying Uncle Sam 15-25% of the sale proceeds, you can “exchange” the original property for another “like-kind” property, hence the name. To be considered a like-kind property, the new property must be of equal or greater value and also be used for investment purposes.

So, while you can’t swap out your apartment building for a fancy new pad for yourself, you can avoid paying taxes on the sale of the property by upgrading to a more lucrative investment property.

The sweetest part of a 1031 exchange is that you can swap out investment properties indefinitely, so long as the rules of a 1031 exchange are closely followed. That means you can continually upgrade the properties you manage without paying taxes from their sales.

One of the rules that investors must follow when executing a 1031 exchange is the 1031 exchange holding period.

|

Key Takeaways |

|

What is the 1031 Exchange Holding Period?

One of the most common concerns with 1031 exchanges is determining how long the owner must hold on to a property before it can be exchanged for another property. This is often referred to as the 1031 exchange holding period.

Figuring out the exact timeframe for this holding period is a bit tricky, as the IRS does not explicitly state how long you must hold a property before you can sell it in exchange for another. However, there are some precedents that lend a bit of insight into what the IRS likes to see from investors who wish to exchange properties for this tax break.

One key thing the IRS wants to see is that the investment property is being held for “productive use in a trade or for business or for investment.” This means you can’t simply acquire a random property to defer taxes and then sell that property — you actually have to use it for your own business or investment advantage.

While the IRS has not stated a specific amount of time that defines this holding period, many CPAs, tax experts, and legal advisors generally agree upon a minimum 1-2 year window for holding property. This guidance is based on past proposals from Congress for a 12-month holding period, although the proposal was never codified. In addition, because the property will show up on your annual tax returns, holding it for 1-2 years helps establish good faith with the IRS for a successful future exchange.

To help you understand, I’ll provide a couple of examples that illustrate why this holding period matters.

|

The 1031 Exchange Holding Period |

|

|

Ex. 1: |

Ex. 2 |

|

|

The 1031 exchange holding period is crucial for a successful 1031 exchange. However, due to the ambiguous nature of the guidance surrounding it, investors should not attempt 1031 exchanges on their own and should seek professional advice to ensure they don’t find themselves disqualified from a 1031 exchange in the middle of the process.

Let Canyon View Capital Experts Help With Your 1031 Exchange

For property investors, 1031 exchanges can be an excellent way to sell properties and defer capital gains taxes into perpetuity. However, investors must abide by many prerequisites and rules, like the 1031 exchange holding period, to execute this transaction successfully.

For 40+ years, CVC professionals have managed, owned, and operated various types of real estate. Now, we co-own and manage a portfolio of multifamily properties valued at over $1 billion1. That’s why we understand the benefits and nuances of 1031 exchanges better than most, and we work closely with our investors to guide them carefully through this complicated process to completion.

Completing a 1031 exchange often means helming murky waters, which makes it easy to get lost along the way. With CVC experts at your side, you’ll have a reliable navigator to lend clarity on 1031 exchanges, along with a full crew of experts who can offer advice on taxes, accounting, and any other lingering financial concerns so you become a more seasoned investor.

Still hazy on the details of a 1031 Exchange Holding Period?

Canyon View Capital can show you the way! We will walk you through every step of your 1031 exchange, and our in-house professionals will always answer your questions honestly, completely, and promptly. CVC will help you cut through the red tape, no matter how sticky it gets. Contact Canyon View Capital.

Verified accreditation status required.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.

As an investor, it’s natural to worry about what might happen to your assets over time. While familiar options, like stocks, bonds, and 401(k)s are popular choices for investing in the future, many people ignore the potential of real estate investments because they assume they don’t have the available funds to get started.

If this sounds familiar, one avenue you might consider exploring is using a self-directed IRA to invest in real estate. For funds in a self-directed IRA, investors usually have more flexibility in deciding how to invest their savings when compared to traditional 401(k)s, which can include options like real estate. This approach can help diversify your portfolio, offer a hedge against inflation via rental income1, and spread your risk to protect your nest egg2 from volatile market forces.

In this article, I’m going to delve into the benefits of using a self-directed IRA for real estate investing to help both new and experienced investors learn to build diversified portfolios in the hopes of to getting you closer to your financial goals. You can use the links below to skip ahead to different topics in the article.

| Discussion Topics | |

What is a Self-Directed IRA?

Before we get into the nitty-gritty of using a self-directed IRA for real estate investing, we’ll want to make sure you have a baseline understanding of how self-directed IRAs work vs. other financial savings vehicles, like traditional IRAs.

Traditional IRA

An IRA refers to an Individual Retirement Account, hence the acronym. These accounts allow people to contribute pre-tax income toward retirement savings, up to a specified annual amount.

These funds grow tax-deferred in your account until you withdraw them in retirement. Your IRA contributions are typically invested but are usually limited to stocks, bonds, and mutual funds. These investment decisions are normally made by the custodian or trustee of the account, usually a bank, brokerage firm, or another financial institution.

Self-Directed IRAs

When it comes to IRAs, many people think of traditional IRAs as the go-to option. However, another type called a self-directed IRA, offers investors more control over their investment choices. Unlike traditional IRAs, self-directed IRAs do not require that decisions on investing capital go through third-party custodians, which gives account holders greater flexibility.

Self-directed IRAs allow investors to invest in a wider range of assets than traditional IRAs, including real estate, precious metals, and private equity. This article focuses on real estate investing with funds from a self-directed IRA.

To open a self-directed IRA, investors need to select a custodian or trustee that specializes in self-directed accounts. Unlike traditional IRAs, custodians of self-directed IRAs are not responsible for deciding where funds are invested. Instead, they hold and manage the assets in the account and ensure that all transactions comply with IRS rules and regulations.

Some custodians also offer investment management services, such as financial planning and portfolio analysis, for investors who want to make use of them.

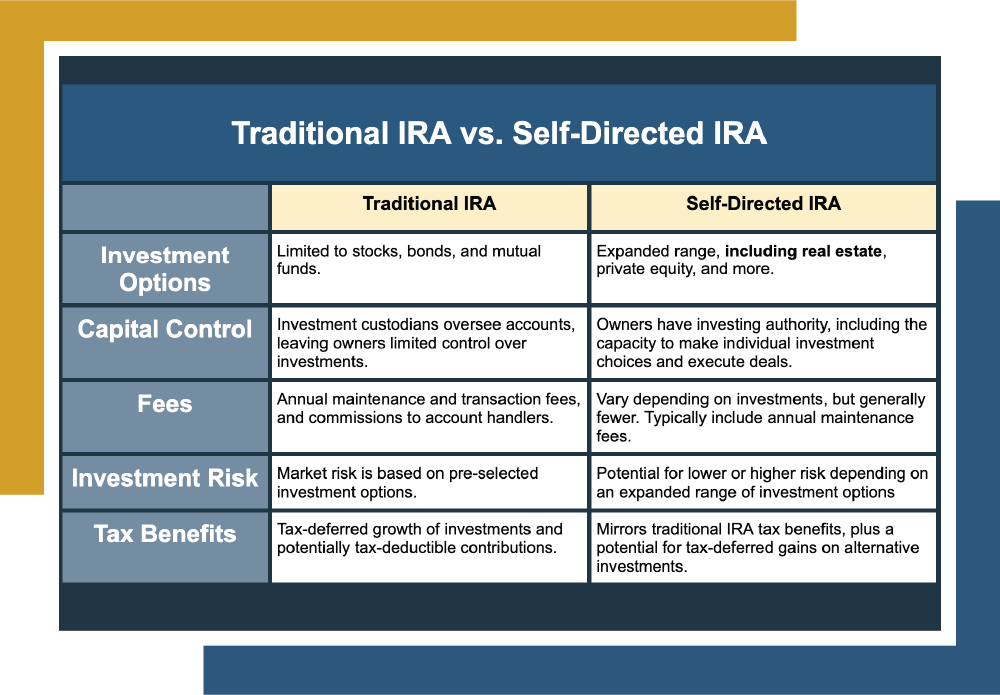

Traditional IRA vs. Self-Directed IRA | ||

Traditional IRA | Self-Directed IRA | |

Investment Options | Limited to stocks, bonds, and mutual funds. | Expanded range, including real estate, private equity, and more. |

Capital Control | Investment custodians oversee accounts, leaving owners limited control over investments. | Owners have investing authority, including the capacity to make individual investment choices and execute deals. |

Fees | Annual maintenance and transaction fees, and commissions to account handlers. | Vary depending on investments, but generally fewer. Typically include annual maintenance fees. |

Investment Risk | Market risk is based on pre-selected investment options. | Potential for lower or higher risk depending on an expanded range of investment options |

Tax Benefits | Tax-deferred growth of investments and potentially tax-deductible contributions. | Mirrors traditional IRA tax benefits, plus a potential for tax-deferred gains on alternative investments. |

Using a Self-Directed IRA for Real Estate Investing

Now that you understand the difference between traditional IRAs and self-directed IRAs, we can get into the details of using a self-directed IRA for real estate investing. “But Eric,” you ask, “why would I want to invest specifically in real estate, instead of all the other options available out there for self-directed IRAs?” Great question!

It’s impossible to overemphasize how distinctly each investment behaves, even though all share a potential for extremely variable performance, depending on conditions. And while piloting the realm of investment property requires careful consideration of all available options, the CVC team believes real estate can offer a few benefits to supplement your investment portfolio, depending on your financial objectives. Some of them include:

Diversification. Adding real estate to your portfolio can help spread your risk. When you put your money in multiple investment avenues, it can have the effect of minimizing risk. In other words, you’re making sure your eggs aren’t all in the same basket.

Diversification. Adding real estate to your portfolio can help spread your risk. When you put your money in multiple investment avenues, it can have the effect of minimizing risk. In other words, you’re making sure your eggs aren’t all in the same basket.- Potential for long-term growth. Historically, real estate has proven to be an avenue where investors can find value appreciation over time because real estate values move slowly. Thus, as home prices rise over time2, the value of your investment may also increase.

- Income generation. Investing in real estate can provide an investor with passive income via rent payments.

- Tangible asset. Unlike many other investment options, real estate is a physical asset you can see and touch, which may offer a sense of security to some investors.

- Inflation hedge. Real estate can help protect your portfolio from inflation, as property values and the rents you collect tend to increase alongside inflation3.

How to Use a Self-Directed IRA for Direct Real Estate Investment

So how do you actually use a self-directed IRA for real estate? There are a few IRS rules and regulations you must follow to avoid penalties or potential account disqualifications.

But broadly, the process follows these steps:

| |

|

|

|

|

| |

|

|

As you can see, using funds from a self-directed IRA to invest in real estate comes with plenty of benefits that could make it an exciting opportunity for investors of all experience levels. However, as with all major investment decisions, investing in real estate requires due diligence and a discussion with your advisors to ensure the risk and return is appropriate for you.

Direct investment in real estate comes with the responsibility of ensuring all transactions comply with IRS regulations, in addition to the physical effort required to manage the property itself. Newer investors might find these daily tasks demand a level of patience, stamina, and expertise that they may not yet have acquired.

That’s where we come in. Canyon View Capital’s investment offerings can help you enjoy some of the potential benefits of real estate investing without the responsibilities of property management.

Canyon View Capital Can Help You Start Your Real Estate Journey

Are you interested in using your self-directed IRA for real estate investing? Canyon View Capital has the know-how you need to get started, and we’re eager to share it with you. Our team can guide you through the intricacies of real estate investing to make the process as easy as possible.

CVC takes on the heavy lifting of property management so you can enjoy the benefits of real estate investing without the daily hassles. Our professionals are here to help you invest in real estate and support your financial goals.

Ready to get started on Your Real Estate Journey?

For over 40 years, principals at CVC have managed, owned, and operated real estate now valued at over $1B3. Our buy-and-hold strategy, concentrated in America’s heartland, is designed to provide consistent investment returns.

New to real estate, but want to learn more about using a self-directed IRA for real estate investing?

Citations

1Grimes, Patrick. “Why Income-Generating Real Estate Is the Best Hedge Against Inflation,” Forbes.com, April 14, 2022. Accessed May 19, 2023.

2Case-Shiller U.S. National Home Price Index. Federal Reserve of Economic Data of St. Louis. FRED.stlouisfed.org. Accessed April 28, 2023.

3Real Estate Can Be a Haven From Market Volatility,” RealtyMogul.com. Accessed May 22, 2023.

4Which Asset Classes Provide Inflation Hedges? National Bureau of Economic Research. NBER.org. Accessed April 29, 2023.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.

Real estate investors and property managers understand the appeal of passive income and the possibility of long-term wealth accumulation that can come with real estate investments. However, when it’s time to sell an investment property, the burden of capital gains taxes can put a damper on your finances, potentially depriving you of as much as 30% of your profits.

But fear not! Within the realm of real estate tax planning, there exists a powerful tool to protect your money: the 1031 exchange. Embedded in the Internal Revenue Code, this rule acts like a shield, mitigating the impact of capital gains taxes, ensuring more money stays in your pocket, and unlocking a multitude of benefits.

This article ventures into the thorny hedge of tax liabilities that surrounds the sale of investment properties to explore the intricacies of 1031 exchanges. We will reveal how 1031 exchange tax benefits could be the solution you’ve been seeking to help secure your treasure — or optimize your financial gains.

| Discussion Topics |

Liabilities of Selling Investment Property

When selling an investment property, it’s crucial to understand the various tax liabilities involved. Before we discuss 1031 exchange tax benefits, we want to ensure that you have a strong grasp of these tax codes that could have a significant impact on your financial outcomes.

Some of the key tax liabilities you need to know about include:

- Capital Gains Taxes. One of the primary liabilities associated with property sales is capital gains taxes. When you sell property for a profit, you must pay taxes on the capital gains—or the difference between a property’s sale price and its adjusted basis (typically the original purchase price plus any qualified improvements or minus depreciation). Federal Income tax rates for capital gains taxes typically land somewhere between 15-20%, with a 3.8% surcharge added for higher-income individuals, detailed below. That’s a lot of money!

- Depreciation Recapture. If you’ve claimed depreciation deductions on the property in previous years, you may also be liable for depreciation recapture taxes. This refers to the portion of a property’s depreciation that’s subject to ordinary income tax rates rather than the lower capital gains tax rates.

- Net Investment Income Tax (NIIT). Depending on your income level, you might be subject to the Net Investment Income Tax, which is an additional tax of 3.8% on certain types of investment income, including capital gains, for higher income thresholds.

- State and Local Taxes. In addition to federal taxes, you may also be liable for state and local taxes on the sale of investment property. Tax rates and regulations vary by jurisdiction, but can easily surpass 10% in high tax states.This is why it’s essential to consult with a tax professional who’s familiar with the rules specific to your area.

- Mortgage and Loan Liabilities. If you have an outstanding mortgage or loan on the property you’re selling, you’ll need to consider the potential tax implications for the loan payoff as well as any possible mortgage-related fees.

As you can see, while selling an investment property can be lucrative, it also comes with a multitude of caveats that you need to consider. For example, capital gains taxes can add up to a significant amount when you sell for a profit. Below is an example how just how hefty the tax responsibility can be.

Capital gains taxes, illustrated | ||||||

|

|

|

| |||

|

$1M |

| ||||

| 13.3% – CA 23.8% – US |

$92,700 | ||||

It’s important to note that tax laws and regulations can change, so it’s advisable to consult with a qualified tax professional or an accountant who can provide personalized guidance based on your specific situation.

What Is a 1031 Exchange?

Now that you have a better understanding of the various forms of tax liability associated with selling investment property — and the potential impact on your profits — it’s time to explore a powerful strategy to help you retain more of your profits: the 1031 exchange.

Delving deeper into the intricacies of the 1031 exchange can help you unlock valuable insights about effectively mitigating your tax burden and enhancing your financial outcomes. Let’s look at the details of this powerful tool to discover how it could preserve your hard-earned funds during property transactions.

How It Works

Here’s how it works in a nutshell: When you sell an investment property, instead of immediately paying capital gains taxes on the profits, you can reinvest the proceeds into another “like-kind” property without incurring immediate tax liabilities. To qualify as “like-kind,” the property must be of equal or greater value and used for intended investment purposes.

This enables you to defer taxes, in perpetuity, and optimize the power of your own capital to generate potentially higher returns. It’s a savvy move for those seeking to maximize their investment potential.

Rules and Guidelines

Let’s slow down a minute to note some of the crucial rules and regulations you need to follow, in accordance with strict timelines. For instance, within 45 days of the initial sale, you must identify a replacement property and the entire exchange must be completed within 180 days. These timelines run concurrently, making time management essential.

There is also a holding period of about two years that limits how quickly you can perform a 1031 exchange on a property after purchasing it. And, it’s essential that a qualified intermediary holds the proceeds from the original sale, not the seller. Failure to comply with this requirement would void the 1031 exchange.

To summarize, the key points to remember about 1031 exchanges are listed below.

- 1031 exchanges allow investors to defer capital gains taxes on the sale of a property to purchase a “like-kind” property.

- “Like-kind” properties must be of a similar asset type and be used for investment purposes.

- Within 45 days of the initial property sale, you must identify a replacement property.

- The entire 1031 exchange process must be completed within 180 days of the initial sale.

- The 45-day identification period and the 180-day exchange period run concurrently.

- The seller cannot retain any proceeds from the original sale; an intermediary must handle them.

By understanding and complying with these rules, you can access the full potential of a 1031 exchange and enjoy the tax benefits it offers.

1031 Exchange Tax Benefits You Need to Know

Congratulations on acquiring a solid understanding of tax liabilities and the requirements for the 1031 exchange process! Now, let’s examine the tax benefits more closely to see how they could enhance some financial outcomes for your real estate transactions.

Leveraging the power of a 1031 exchange offers a number of benefits to complement and strengthen your overall financial strategy. Let’s explore these benefits in greater detail and uncover how they might propel your real estate investments to new heights.

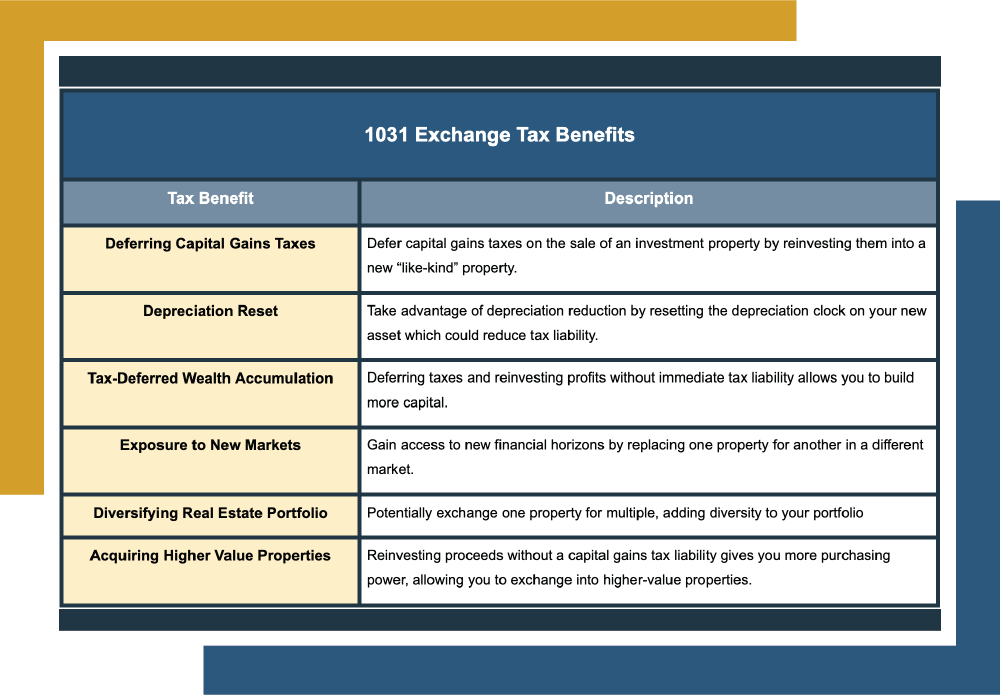

- Deferring Capital Gains Taxes. As we mentioned earlier, one of the primary benefits of a 1031 exchange is the deferral of capital gains taxes. By reinvesting the proceeds from the sale of your investment property into a like-kind property, as defined by the IRS, you can defer paying capital gains taxes until a later date. Instead, those funds continue to work for you, potentially bolstering your purchasing power for the replacement property.

- Depreciation Reset. Through a 1031 exchange, you can also reset the depreciation schedule on the new property. When you acquire a replacement property, the depreciation clock starts anew on the additional asset value purchased. This can be advantageous as it allows you to continue taking advantage of depreciation deductions and potentially reduce your overall tax liability in the long run.

- Tax-Deferred Wealth Accumulation. When selling one investment property and acquiring another, using a 1031 exchange allows you to defer taxes continually. This creates a tax-efficient way to grow your real estate portfolio over time because you can reinvest your profits without immediate tax consequences. Tax deferral gives you more available capital for reinvestment.

- Exposure to New Markets. Successful real estate investing often demands adaptability — investors must be able to seize opportunities in emerging markets. By deferring your taxes with a 1031 exchange, you retain more capital, facilitating the transition to new properties in potentially higher-growth markets. It allows you to explore fresh investment horizons and tap into the potential of evolving real estate landscapes.

- Diversifying Your Real Estate Investment Portfolio. Using 1031 exchanges allows you to exchange one property for multiple properties, thanks to the 1031 exchange 200 Rule. This diversification strategy helps spread risk, has the potential to enhance cash flow, and broadens your investment opportunities.

- Acquiring Higher-Value Properties. As your investment goals evolve, upgrading your portfolio with higher-value properties becomes a more achievable goal. Deferring capital gains taxes with a 1031 exchange can help offset the costs associated with acquiring more expensive properties. In turn, these higher-quality assets can increase your potential for greater returns and portfolio growth.

So how do these benefits match up directly with specific liabilities? Below is a chart that explains how each benefit can offset or eliminate a tax liability from the sale of an investment property.

Investment Property Sales Tax Liabilities vs. 1031 Exchange Tax Benefits | ||

Tax Liability | WITHOUT 1031 | WITH 1031 Exchange |

Capital Gains Taxes | Remit payment of capital gains taxes | Defer capital gains taxes to a later date |

Depreciation Recapture | Subject to recapture tax | Reset the depreciation schedule on the new property |

Net Investment Income Tax (NIIT) | Potential NIIT liability | Potential NIIT deferral |

State and Local Taxes | Remit payment for state and local taxes | Potential reduction or deferral of state and local taxes |

Mortgage and Loan Liabilities | Remit payment of outstanding loan(s) | Potential to carry loan over to the replacement property |

When done correctly, a 1031 exchange can limit your capital gains tax liability as well as your responsibility for other taxes. In fact, some strategies that employ successive 1031 exchanges whenever selling property could result in pushing back capital gains taxes indefinitely.

However, while 1031 exchanges offer remarkable tax benefits, they come with complexities and strict requirements. That’s why it’s recommended that even experienced investors consult with a qualified real estate expert or investment professional. That’s where Canyon View Capital comes in.

Canyon View Capital Simplifies 1031 Exchanges

Now that you have a comprehensive understanding of 1031 exchange tax benefits, it’s essential to partner with someone who genuinely understands the intricacies of the process and cares about your success. Canyon View Capital professionals aim to be that reliable companion for your journey.

With a real estate portfolio now valued at an aggregated $1 billion, our team is passionate about sharing our wealth of knowledge to help investors like you fully realize the advantages of a 1031 exchange.

1031 exchanges require precision to navigate their complexities successfully and adhere to their strict guidelines. Our seasoned investment managers will walk you through every step, helping you avoid costly mistakes so you can make the most of incredible tax advantages.

At CVC, our commitment goes beyond facilitating your 1031 exchange. We genuinely care about your understanding and success and are eager to answer any additional questions you may have, providing you with the support and guidance you need throughout the process. Our goal is to empower you with the knowledge and confidence to make informed decisions and achieve your investment objectives to facilitate a bright future.

Still hazy on the details of 1031 exchange tax benefits?

Canyon View Capital can show you the way! We will walk you through your 1031 exchange and our team members will always answer your questions honestly, completely, and promptly. CVC can help you cut through the red tape, no matter how sticky it gets.

For a successful exchange, contact Canyon View Capital.

Verified accreditation status required.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.

Whether you’re a seasoned investor or a newcomer testing the waters, you’re probably already aware of some of the benefits the real estate market can offer. It’s not uncommon for real estate investors to start out with Single Family Rentals that bring passive returns. But what about another option?

Multifamily real estate offers an exciting opportunity for investors of all backgrounds to diversify their investment portfolios. Moreover, factors such as population growth1, migration to urban2 areas, and consistently rising rents3 make multifamily investing an ideal option for many investors looking to stay ahead of some trends for 2023 and beyond.

In this article, I’ll give you a quick overview about multifamily investing in 2023. We’ll explore how many factors are shaping the way investors approach this sector of real estate investing. With this handy guide as a starting point, you’ll be equipped with the knowledge to start a discussion with your investment advisor about whether or not multifamily investing makes sense for you and your investment goals!

What Is Multifamily Investing?

Imagine owning a property that houses multiple rental units that all work together as a part of a cohesive whole to generate stable rental income streams. This is what we call multifamily investing and it stands in stark contrast to single-family investing, which involves properties that house a single unit’s worth of tenants.

Essentially, multifamily investing is a strategy that involves acquiring properties made up of two or more residential units, including apartment buildings, duplexes, condominiums, and 2-4 unit properties, as opposed to Single Family Rentals (SFR). Instead of relying on a single occupant to generate rental income, investors can have multiple income streams — all from units housed within a single location.

When compared to single-family investing, multifamily investing comes with a slew of potential benefits, including:

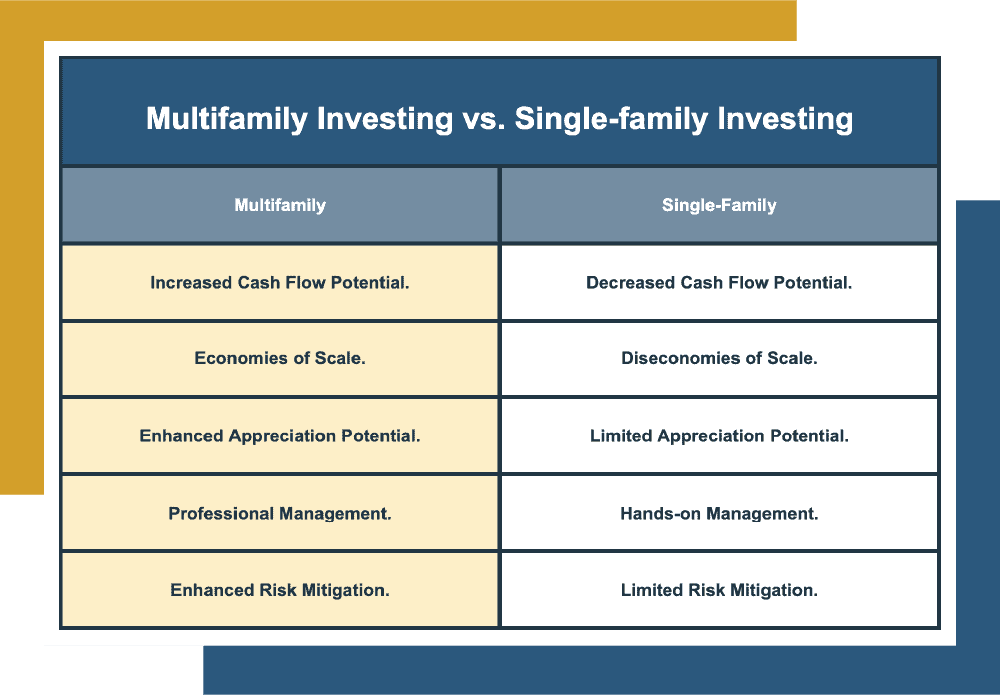

Multifamily Investing vs. Single-family Investing | |

Multifamily | Single-Family |

Increased Cash Flow Potential. | Decreased Cash Flow Potential. |

Economies of Scale. | Diseconomies of Scale. |

Enhanced Appreciation Potential.Multifamily investments offer a high potential for property appreciation. Factors like desirable locations, growing demand, and economies of scale contribute to accelerated appreciation rates in multifamily properties. | Limited Appreciation Potential.Single-family investments may have slower appreciation rates compared to other types of investments. Factors like market conditions, neighborhood growth, and being at the mercy of comparable homes in neighborhoods can result in limited appreciation potential for single-family properties. |

Professional Management. | Hands-on Management. |

Enhanced Risk Mitigation. | Limited Risk Mitigation. |

Perhaps one of the best features of multifamily investing is the potential for added diversification to your real estate portfolio. Even if you’re managing single-family properties, you can add multifamily investing to your investment strategy to hedge against the potential pitfalls of Single Family Rentals — while simultaneously enjoying the advantages of both. These benefits should analyzed on a case by case basis and should always be discussed with your investment advisor before committing funds.

As the demand for housing continues to rise, multifamily investing can help boost rental income and appreciation, offering investors a double win.

Multifamily Investing 2023: What You Need to Know

Now that you have a solid understanding of multifamily investing, you’ll need to be aware of some of the current trends for multifamily investing and some that may pose a challenge for those looking to get into multifamily investing in 2023.

- Rising Rents. Rents have been steadily increasing year-over-year, with a 4% growth projected nationally for 2023. Even with multifamily rent increases expected to slow to around 1% growth in 2024 because of high interest rates, rent prices are continuing an upward trajectory.

- Population Growth and Urbanization Increase Rental Demands. The US has been on a path of rapid urbanization over the last decade, with a 6.4% increase in the nation’s urban population from 2010 to 2020. Urbanization shows no signs of slowing down with some estimating that 83% of the US population will live in urban areas by 2050. Multifamily housing is a popular option for urban renters: about 67% of all multifamily development occurs in large metro areas and 27% in smaller metro areas.

- Interest Rates Are Expected to Keep Rising. While some experts expected interest rates to decrease through 2023, the US economy has had other plans. Mortgage rates continue to rise, even after a short period of marginal decline in the first half of 2023. This indicates a stable demand for rental properties like multifamily units as interest rates continue to negatively impact home affordability.

- Debt Market Difficulties. Current interest rates are high, which has the potential to really diminish investment opportunities, especially in areas that are heavily reliant on the massive rent growth over the last few years. This has made it difficult to buy real estate in some markets and with investments that rely heavily on value-add or opportunistic upside. However, in areas less reliant on massive growth or value-add and opportunistic upside, many investors have the potential to obtain debt terms that still make investments feasible.

- Rapidly Increasing Multifamily Supply. Many of the aforementioned factors, like urbanization and high interest rates, offer no relief from barriers to home ownership. Because of this, builders are putting up hundreds of thousands of multifamily units nationwide, with some forecasting more than 700,000 new units to be completed over the next two years. Such construction is occurring in areas that have seen the most significant post-COVID population growth — as those relocating need access to housing and multifamily units are filling that role.

.

Although current economic headwinds, like inflation, rising interest rates, and slowing rental growth rates are causing nationwide challenges, there are still ways for investors to work around these challenges and use certain economic aspects to their advantage.

For example, while now may not be the best time to purchase new real estate, multifamily investors can work to improve or renovate properties they already own. Such improvements can increase the cash flow from existing investments rather than purchasing new ones. By making such capital expenditures, investors don’t have to pay for new properties with high cap rates that could also be saddled with high debt costs.

Another way investors can still reap the benefits of multifamily investing in 2023 is to use a real estate investment firm as a passive investment vehicle instead of taking the burden of property management on themselves. Firms like Canyon View Capital are well-equipped to overcome the current economic hurdles because we offer multifamily investment properties in growing and stable markets that we acquired before interest rates skyrocketed. When development projects are complete, the new buildings could cost less than buying an existing building but still offer investors the advantage of rising rents and increases in wages with the potential for less cost of debt.

Moreover, investing in multifamily real estate through a professional third party means you won’t need to worry about the logistics of property management but may still earn passive returns.

Canyon View Capital Makes Multifamily Investing Easy

When making an investment decision, it’s important to consider all of your options before committing to one. Even with some of the hurdles we’ve seen this year, multifamily investing in 2023 is still an excellent option for many investors looking to diversify their investment portfolios. At CVC, our professionals have been managing multifamily properties for over 40 years.

That experience gives our team members a comprehensive understanding of the ebb and flow of the rental market — and we’re eager to pass on those benefits to investors that partner with us. Our multifamily investment options offer investors a path toward the same passive returns they can expect from managing rental properties in stable markets without having to worry about the time, resources, and energy required to keep them running.

All it takes is a conversation with one of our professionals to help you decide if our multifamily investment options are right for you.

Ready to learn more about multifamily investing in 2023?

For over 40 years, CVC has managed, owned, and operated real estate now valued at over $1B4 (based on aggregate value). Our buy-and-hold strategy, focused on America’s heartland, is designed to provide consistent investment returns. If you’re new to real estate investing but keen to get started, CVC’s portfolio provides an easy on-ramp.

Citations

1U.S. Urban Population 1960-2023. https://www.macrotrends.net/countries/USA/united-states/urban-population. Datasource: World Bank datatopics.worldbank.org/world-development-indicators/ Retrieved 2023-05-25.

2Barrett, Kristina.”Nation’s Urban and Rural Populations Shift Following 2020 Census.” https://www.census.gov/newsroom/press-releases/2022/urban-rural-populations.html. Updated 3/10/23. Accessed May 26, 2023.

3U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: Rent of Primary Residence in U.S. City Average [CUUR0000SEHA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CUUR0000SEHA, May 26, 2023.

4$1B figure based on the aggregate value of all CVC-managed real estate investments as valued on March 31, 2023.

Eric Fisher, Chief of Staff

Eric joined Canyon View Capital in August 2021 with 15 years of hotel management experience grounded evenly between Property & Corporate Operations, and Business Development & Acquisitions. After $500M+ in hotel acquisitions, Eric uses his nuanced understanding of the acquisitions and transitions processes to support CVC real estate investments. His professional versatility makes Eric an invaluable resource for the President and Executive Team in all business functions, including Investments, Operations, and Strategy.

If you’re reading this, chances are you’re already investing in real estate. It makes sense; real estate investing can bring many benefits to investment portfolios. However, you might be ready to move on from a specific investment property—maybe you’re tired of dealing with a problematic property, or perhaps you want to invest in other regions.

Regardless of the reason, investors can almost always expect to pay capital gains taxes on the sale of their investment property.

I say almost always because savvier investors are becoming more aware of a tax deferral tool called the 1031 exchange. But what exactly is a 1031 exchange, how does it work, and who is it suitable for?

In this article, we’ll explore 1031 exchanges before delving into the pros and cons of a 1031 exchange so you can figure out if this tax deferral strategy is the tool you need to keep money in your pocket.

| Discussion Topics |

Understanding 1031 Exchanges

Usually, when you sell an investment property, you are expected to pay capital gains taxes on the profits from the sale. This amount can range from 15-20% of your earnings (and some states impose a 3.8% surtax on high-income investors) paid as taxes to the Internal Revenue Ser. This can significantly cut into your profits.

For example, if you sold a property in California for a $250,000 profit, you’d likely be liable for more than $73,000 in taxes, or almost 30% of the entire profit from the sale.

1031 exchanges, outlined in section 1031 of the Internal Revenue Code (IRC), allow investors to defer paying capital gains taxes by reinvesting the money they make on the sale of an investment property into a new, “like-kind” property of equal or greater value (i.e., another investment property).

However, there are a few factors that you need to be aware of:

- The requirements and timelines for 1031 exchanges are stringent and must be followed closely.

- Besides being a “like-kind” property, 1031 exchanges must be executed within a 180-day window of selling the initial property.

- Additionally, the replacement property must be identified within a 45-day window of the sale of the initial property.

- These two windows run concurrently.

This is a very abridged summary of the 1031 exchange process. You can explore the 1031 exchange process more deeply by clicking here.

What Are the Pros and Cons of a 1031 Exchange?

Below, I discuss some pros and cons of a 1031 exchange.

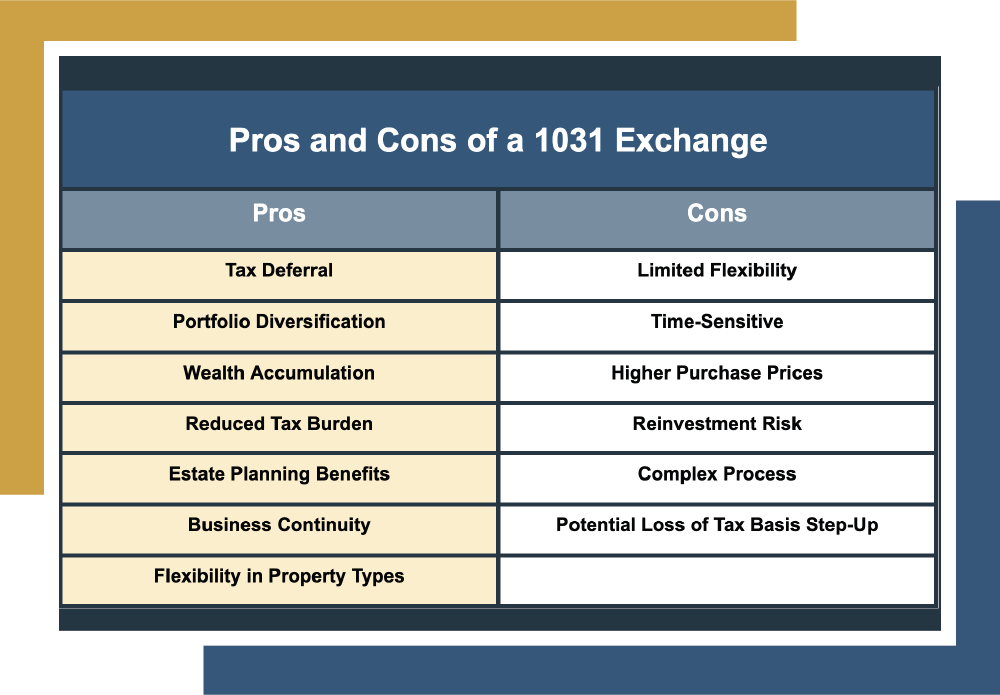

Pros and Cons of a 1031 Exchange | |

Pros | Cons |

|

|

1031 exchanges provide many benefits to investors. They keep the money you earned from selling an investment property out of the hands of the IRS and inside your investment portfolio instead.

With a lower tax burden, you have more money to reinvest in other properties. Moreover, 1031 exchanges can be done to perpetuity when done correctly. For example, if you sell a property that you used a 1031 exchange on, you’ll likely be able to do it again for another property.

Also, you can “swap ‘til you drop,” meaning you can continue exchanging properties and deferring your capital gains taxes for the entirety of your life. Furthermore, you can leave these properties to your heirs, and they won’t be required to pay the total accumulation of deferred taxes because they inherit the properties as assets.

However, there are also a few challenges and stipulations to consider. A 1031 exchange is an often convoluted process with multiple requirements and guidelines that must be met for a 1031 exchange to succeed within extremely tight windows.

This is why you should always consult with a professional, even if you’re a seasoned real estate investor.

Canyon View Capital Takes the Hassle Out of 1031 Exchanges

At Canyon View Capital, we understand the pros and cons of a 1031 exchange better than most. We also know that every investor’s situation is unique. That’s why we want to use our expertise to help you figure out if a 1031 exchange is the right option for you.

If it is, we want to make your 1031 exchange easy by simplifying the process while ensuring you meet the requirements. Our principals have been managing multifamily real estate for more than 40 years, and we’ll use that experience to help you enjoy the benefits of a successful 1031 exchange without the hassle.

At CVC, we are committed to being your guide through the process of a 1031 exchange while answering any questions you may have.

Still Hazy on the Pros and Cons of a 1031 Exchange?

Canyon View Capital Can Show You the Way! We will walk you through every step of your investment when using your 1031 exchange as a vehicle, and our staff will always answer your questions honestly, completely, and promptly. CVC will help you cut through the red tape, no matter how sticky it gets. For more on how you can invest using a 1031 exchange, contact Canyon View Capital.

LEARN MORE about our 1031 Exchange Program.

Verified accreditation status required.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.

Suppose you’re one of the many wise investors looking to commence or have already engaged in a 1031 exchange. If that’s the case, you’ve already made the first step toward reinvesting some serious cash from your investment property sale.

Whether it’s to upgrade a property, spread risk by diversifying their real estate portfolio, or move on from a problematic property, many investors are becoming hip to the benefits of 1031 exchanges. This powerful tool outlined in section 1031 of the Internal Revenue Code allows investors like you to take the proceeds from an investment property sale and reinvest them into a new “like-kind” property while deferring their capital gains taxes from the sale.

But you already knew that, didn’t you? You also probably know how stringent the requirements and deadlines are for a successful 1031 exchange, and if you’re reading this, you are likely wondering if you can get an extension on a 1031 exchange.

Luckily, the IRS has extended deadlines for some residents of California. In this article, I’ll break down the 1031 exchange windows and lay out the eligibility for those who may qualify for an extension on their 1031 exchange.

1031 Exchange Windows Explained

1031 exchanges bring a swath of benefits to investors. They also have strict timelines and deadlines that must be followed throughout the process.

The two main restrictions are the identification period and the exchange period.

- Identification Period: The identification period is the timeframe during which investors must identify the replacement property(s) for the exchange. This is called the 45-day rule, as the investor must identify the replacement property(s) within 45 calendar days from the sale date of the relinquished property. There are a few guidelines within this requirement.

- The investor can identify any number of replacement properties as long as their aggregated fair market value does not exceed 200% of the fair market value of the relinquished property.

- The investor can identify up to three potential replacement properties of any value as potential replacements for the relinquished property.

- These identifications must be made in writing and delivered to a qualified intermediary or designated party.

- Exchange Period: The exchange period is a timeframe in which the investor is required to complete the 1031 exchange process. This is often referred to as the 180-day rule, as the investor has 180 calendar days from the day the relinquished property is sold. There are also a few guidelines that must be followed during this period.

It is crucial to understand that under normal circumstances, these timelines are rigid and inflexible, meaning that investors are required to adhere to them. Failing to do so will result in a nullified 1031 exchange and the investor will be responsible for paying capital gains taxes on the property sale.

However, there are certain circumstances where investors can extend 1031 exchange timelines and windows.

Is There Any Way to Get an Extension on a 1031 Exchange?

I know what you’re probably thinking: “You said 1031 exchanges have a strict window and uncompromising guidelines, but now you say there’s a way to get an extension on a 1031 exchange?”

The truth is that while the general rule is that NO, you cannot extend a 1031 exchange, sometimes there are specific circumstances in which the IRS will provide extensions. One such circumstance is the winter storms that affected many counties in California during 2023.

As a result of winter storms, mudslides, and flooding that occurred from Jan. 8, 2023 to Jan. 10. 2023, the IRS issued an initial extension of the 45- and 180-day deadlines for 1031 exchanges in affected counties. On Feb. 24, 2023, the IRS extended these deadlines to Oct. 16, 2023, allowing investors more time to identify replacement properties and complete their 1031 exchange.

Who is Eligible?

The extensions on 1031 exchanges apply to investors that reside in the following counties:

Alameda, Alpine, Amador, Butte, Colusa, Contra Costa, Del Norte, El Dorado, Fresno, Glenn, Humboldt, Inyo, Kings, Lake, Los Angeles, Madera, Marin, Mariposa, Mendocino, Merced, Mono, Monterey, Napa, Nevada, Orange, Placer, Riverside, Sacramento, San Benito, San Bernardino, San Diego, San Francisco, San Joaquin, San Luis Obispo, San Mateo, Santa Barbara, Santa Clara, Santa Cruz, Siskiyou, Solano, Sonoma, Stanislaus, Sutter, Tehama, Trinity, Tulare, Tuolumne, Ventura, Yolo, and Yuba.

This eligibility applies to investors who qualify as an “affect taxpayer,” which means they fit one of the following:

- Their principal residence is located in one of the aforementioned disaster areas

- Their business or sole proprietorship has its principal place of business located in one of the aforementioned disaster areas

- They are a relief worker assisting in one of the aforementioned the disaster areas

- Their records are held within a location in one of the aforementioned disaster areas

The eligibility also applies to those “having difficulty” meeting deadlines. To qualify, they must prove one of the following reasons:

- The original property or replacement property(s) is located within one of the disaster areas

- The principal place of business of any party of the transaction is located in one of the disaster areas

- One of the reasons listed in Revenue Procedure 2018-58

In addition, these extensions are available to investors who began their 1031 exchange transaction(s) between the dates of Nov. 24, 2022, and Jan. 8, 2023 to extend their 45-day identification period to Oct. 16, 2023 or 120 days from the original 45-day deadline, whichever is later.

They also extend the 180-day deadline for those who initiated their 1031 exchange between the dates of July 12, 2022 and Jan. 8, 2023 to Oct. 16, 2023 or 120 days after the initial 180-day deadline, whichever is later.

What are the Extended Deadlines?

The extended deadlines are as follows:

45-day Deadline: Oct. 16, 2023 or 120 days after the initial deadline for investors who began their 1031 exchange between Nov. 24, 2022 and Jan. 8, 2023, whichever is later.

180-day Deadline: Oct. 16 or 120 days from after the initial deadline for investors who began their 1031 exchange between July 12, 2022 and Jan. 8, 2023.

As stated earlier, the IRS is ordinarily unwavering in its requirements for 1031 exchanges. However, these deadline extensions offer investors an unprecedented opportunity because they allow qualified investors more time to prepare and complete their 1031 exchange.

Those looking to initiate a 1031 exchange or are in the process of one should still consult with a qualified tax or 1031 exchange professional to ensure that their 1031 exchange process fulfills all the requirements and take advantage of any exceptions, such as an extension on a 1031 exchange.

Please consult your tax advisor and 1031 Exchange accommodator to confirm the timelines/deadlines for your particular situation. Every exchange is different and has its own nuances and you need to check with your team to be sure what rules apply to your situation.

Make Your 1031 Exchange as Easy as Pie with Canyon View Capital

At Canyon View Capital, we have a thorough understanding of the ins and outs of 1031 exchanges. That’s because our professionals have managed multifamily real estate for over 40 years. We’re passionate about real estate and enjoy sharing our knowledge with investors.

We understand that 1031 exchanges can be a rigid and time-consuming process. That’s why we want to help investors like you enjoy the tax deferral benefits of 1031 exchanges without the headaches. Whether you’re looking for an extension on a 1031 exchange or simply starting a new one, CVC has your back and is ready to answer any of your questions.

Still Hazy on Extensions on a 1031 Exchange?

Canyon View Capital can show you the way! We will walk you through your 1031 exchange investment, and our experts will always answer your questions honestly, completely, and promptly. CVC will help you cut through the red tape, no matter how sticky it gets. For more information, contact Canyon View Capital.

Gary Rauscher, President

When Gary joined CVC in 2007, he brought more than a decade of in-depth accounting and tax experience, first as a CPA, and later as the CFO for a venture capital fund. As President, Gary manages all property refinances, acquisitions, and dispositions. He works directly with banks, brokers, attorneys, and lenders to ensure a successful close for each CVC property. His knowledge of our funds’ complexity makes him a respected executive sounding board and an invaluable financial advisor.